Press release

Online Loans Market Growing Popularity and Emerging Trends: RateSetter, Canstar & Faircent

A latest study released by HTF MI on Global Online Loans Market covering key business segments and wide scope geographies to get deep dive analysed market data. The study is a perfect balance bridging both qualitative and quantitative information of Online Loans market. The study provides historical data (i.e. Volume** & Value) from 2013 to 2018 and forecasted till 2025*. Some are the key & emerging players that are part of coverage and have being profiled are Upstart, Funding Circle, Prosper, CircleBack Lending, Peerform, Lending Club, Zopa, Daric, Pave, Mintos, Lendix, RateSetter, Canstar & Faircent.Click to get Global Online Loans Market Research Sample PDF Copy Instantly @: https://www.htfmarketreport.com/sample-report/1850770-global-online-loans-market-1

Key highlights that report is going to offer :

• Market Share & Sales Revenue by Key Players & Emerging Regional Players. [Some of the players covered in the study are Upstart, Funding Circle, Prosper, CircleBack Lending, Peerform, Lending Club, Zopa, Daric, Pave, Mintos, Lendix, RateSetter, Canstar & Faircent]

• Gap Analysis by Region. Country Level Break-up will help you dig out Trends and opportunity lying in specific area of your business interest.

• Revenue splits by most promising business segments. [By Type (, On-Premise, Cloud-Based, Industry Segmentation, Individuals, Businesses, Channel (Direct Sales, Distributor) Segmentation, Section 8: 400 USD Trend (2018-2023), Section 9: 300 USD Product Type Detail, Section 10: 700 USD Downstream Consumer, Section 11: 200 USD Cost Structure & Section 12: 500 USD Conclusion), By Application ( ) and any other business Segment if applicable within scope of report]

• A separate chapter on Market Entropy to gain insights on Leaders aggressiveness towards market [Merger & Acquisition / Recent Investment and Key Developments]

• Patent Analysis** No of patents / Trademark filed in recent years.

• Competitive Landscape: Company profile for listed players with SWOT Analysis, Business Overview, Product/Services Specification, Business Headquarter, Downstream Buyers and Upstream Suppliers.

** May vary depending upon availability and feasibility of data with respect to Industry targeted

Market Dynamics:

Set of qualitative information that includes PESTEL Analysis, PORTER Five Forces Model, Value Chain Analysis and Macro Economic factors, Regulatory Framework along with Industry Background and Overview

Buy Full Copy Global Online Loans Report 2018 @ https://www.htfmarketreport.com/buy-now format=1&report=1850770

Competitive Landscape:

Mergers & Acquisitions, Agreements & Collaborations, New Product Developments & Launches, Business overview & Product Specification for each player listed in the study. Players profiled are Upstart, Funding Circle, Prosper, CircleBack Lending, Peerform, Lending Club, Zopa, Daric, Pave, Mintos, Lendix, RateSetter, Canstar & Faircent

Most frequently asked question:

Can we add or profiled new company as per our need

Yes, we can add or profile new company as per client need in the report. Final approval would be provided by research team of HTF MI depending upon the difficulty of survey. Currently list of companies profiled in the study as of now are Upstart, Funding Circle, Prosper, CircleBack Lending, Peerform, Lending Club, Zopa, Daric, Pave, Mintos, Lendix, RateSetter, Canstar & Faircent

** Data availability will be confirmed by research in case of privately held company. Upto 3 players can be added at no added cost.

Segment & geographic Analysis: What Market Data breakdown will be provided by key geographies, Type & Application/End-users

• Online Loans Market Revenue & Growth Rate by Type [, On-Premise, Cloud-Based, Industry Segmentation, Individuals, Businesses, Channel (Direct Sales, Distributor) Segmentation, Section 8: 400 USD Trend (2018-2023), Section 9: 300 USD Product Type Detail, Section 10: 700 USD Downstream Consumer, Section 11: 200 USD Cost Structure & Section 12: 500 USD Conclusion] (Historical & Forecast)

• Online Loans Market Revenue & Growth Rate by Application [ ] (Historical & Forecast)

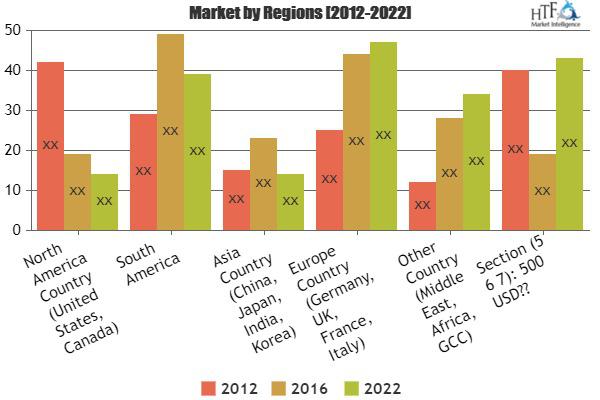

• Online Loans Market Revenue & Growth Rate by Each Region Specified (Historical & Forecast)

• Online Loans Market Volume & Growth Rate by Each Region Specified, Application & Type (Historical & Forecast)

• Online Loans Market Revenue, Volume & Y-O-Y Growth Rate by Players (Base Year)

Enquire for customization in Report @ https://www.htfmarketreport.com/enquiry-before-buy/1850770-global-online-loans-market-1

To comprehend Global Online Loans market dynamics in the world mainly, the worldwide Online Loans market is analyzed across major global regions. HTF MI also provides customized specific regional and country-level reports for the following areas.

• North America: United States, Canada, and Mexico.

• South & Central America: Argentina, Chile, and Brazil.

• Middle East & Africa: Saudi Arabia, UAE, Turkey, Egypt and South Africa.

• Europe: UK, France, Italy, Germany, Spain, and Russia.

• Asia-Pacific: India, China, Japan, South Korea, Indonesia, Singapore, and Australia.

Actual Numbers & In-Depth Analysis, Business opportunities, Market Size Estimation Available in Full Report.

Browse for Full Report at @: https://www.htfmarketreport.com/reports/1850770-global-online-loans-market-1

Thanks for reading this article, you can also get individual chapter wise section or region wise report version like North America, Europe or Asia.

About Author:

HTF Market Report is a wholly owned brand of HTF market Intelligence Consulting Private Limited. HTF Market Report global research and market intelligence consulting organization is uniquely positioned to not only identify growth opportunities but to also empower and inspire you to create visionary growth strategies for futures, enabled by our extraordinary depth and breadth of thought leadership, research, tools, events and experience that assist you for making goals into a reality. Our understanding of the interplay between industry convergence, Mega Trends, technologies and market trends provides our clients with new business models and expansion opportunities. We are focused on identifying the “Accurate Forecast” in every industry we cover so our clients can reap the benefits of being early market entrants and can accomplish their “Goals & Objectives”.

Contact US :

Craig Francis (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Unit No. 429, Parsonage Road Edison, NJ

New Jersey USA – 08837

Phone: +1 (206) 317 1218

sales@htfmarketreport.com

Connect with us at

https://www.linkedin.com/company/13388569/

https://www.facebook.com/htfmarketintelligence/

https://twitter.com/htfmarketreport

https://plus.google.com/u/0/+NidhiBhawsar-SEO_Expert rel=author

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Online Loans Market Growing Popularity and Emerging Trends: RateSetter, Canstar & Faircent here

News-ID: 1741407 • Views: …

More Releases from HTF Market Intelligence Consulting Pvt. Ltd.

Artisanal Waste Market Is Booming Worldwide | EnviroServ , TerraCycle

The latest study released on the Global Artisanal Waste Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Artisanal Waste study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analysed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider how these…

Digital Biomarkers Market Hits New High|Major Giants Biofourmis , Evidation Heal …

The latest study released on the Global Digital Biomarkers Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Digital Biomarkers study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analysed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider how these…

Private And Public Cloud In Financial Services Market Next Big Thing | Major Gia …

The latest study released on the Global Private And Public Cloud In Financial Services Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Private And Public Cloud In Financial Services study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analysed study to help understand market trends, growth drivers,…

Luxury Art Logistics Market Is Booming Worldwide | Major Giants Crozier Fine Art …

The latest analysis of the worldwide luxury art logistics market by HTF MI Research evaluates the market's size, trends, and forecasts through 2033. The Luxury Art Logistics market study includes extensive research data and proofs to give managers, analysts, industry experts, and other key personnel a ready-to-access, self-analyzed study to help understand market trends, growth drivers, opportunities, and upcoming challenges, as well as competitors.

Key Players in This Report Include:

Crozier Fine…

More Releases for Loans

Online Payday Loans Texas & USA | Online Installment Loans for Bad Credit | Loom …

https://www.loomloans.com

Loom Loans: Your Gateway to Financial Flexibility Across the United States

Have you been searching for $255 payday loans online same day, online payday loans Texas, or maybe even online installment loans for bad credit? Look no further; Loom Loans can help! Understanding that time is often of the essence when it comes to financial needs, our service specializes in linking applicants to available loans, allowing you to find the right…

Syndicated Loans Market : Surge in Demand for Large Loans | 2031

According to the report published by Allied Market Research, the global real estate investment market generated $11,444.7 billion in 2021, and is projected to reach $30,575.5 billion by 2031, growing at a CAGR of 10.7% from 2022 to 2031. The report offers a detailed analysis of the top winning strategies, evolving market trends, market size and estimations, value chain, key investment pockets, drivers & opportunities, competitive landscape and regional landscape.…

Syndicated Loans Market : Surge in Demand for Large Loans | 2031

According to the report published by Allied Market Research, the global real estate investment market generated $11,444.7 billion in 2021, and is projected to reach $30,575.5 billion by 2031, growing at a CAGR of 10.7% from 2022 to 2031. The report offers a detailed analysis of the top winning strategies, evolving market trends, market size and estimations, value chain, key investment pockets, drivers & opportunities, competitive landscape and regional landscape.…

Online Loans at GoodCheddar Make Comparing Loans Easier in Canada

GoodCheddar offers a personal finance solution that is about helping consumers find the answers they need when it comes to personal loans. Expanding its reach in the consumer marketplace, GoodCheddar.com aims to lower the barriers of borrowing by making options more accessible to Canadians.

When a consumer needs a personal loan, it can be a big financial decision. GoodCheddar empowers consumers in their decisions and helps them make smart financial…

Loans Now Website Educates Consumers on Bad Credit Loans

JACKSONVILLE, FL – MAY 6, 2019–Bad credit can make people feel hopeless when they face issues out of their control like car crashes and medical emergencies. Personal loan provider Loans Now educates consumers so that they can get the help they need.

Loans Now’s website serves as an extensive resource meant to inform potential borrowers about how to borrow money responsibly. Its representatives work with borrowers to find the loan that’s…

Guaranteed Personal Loans: Instant Approval Loans

Real-personal-loans.com is today devoted to offering instant approval loan for people with low income to see to it that they kind out their financial conditions soon after they harass. This is a very convenient solution compared with the old times where system for the financial loan was a very frustrating process and people could spend days to get the cash. Application will only require a few clicks and the creditors…