Press release

Professional Liability Insurance Market Size to Expand USD 45000 Million globally by 2023 | Analysis by Aon, Chubb (ACE), AIG, Hiscox, Allianz, Tokio Marine Holdings, XL Group, AXA

This report provides in depth study of “Professional Liability Insurance Market” using SWOT analysis i.e. Strength, Weakness, Opportunities and Threat to the organization. The Professional Liability Insurance Market report also provides an in-depth survey of key players in the market organization.Global Professional Liability Insurance Market Synopsis:

The Global “Professional Liability Insurance Market” research 2019 highlights the major details and provides in-depth analysis of the market along with the future growth, prospects and Industry demands analysis explores with the help of complete report with 125 Pages, figures, graphs and table of contents to analyze the situations of global Professional Liability Insurance Market and Assessment to 2023.

Get Sample Study Papers of “Global Professional Liability Insurance Market” @ https://www.businessindustryreports.com/sample-request/152007 .

The Professional Liability Insurance industry has also suffered a certain impact, but still maintained a relatively optimistic growth, the past four years, Professional Liability Insurance market size to maintain the average annual growth rate of 15 from XXX million $ in 2014 to 38500.0 million $ in 2018, Market analysts believe that in the next few years, Professional Liability Insurance market size will be further expanded, we expect that by 2023, The market size of the Professional Liability Insurance will reach 45000.0 million $.

Professional liability insurance, more commonly known as errors and omissions (E&O insurance), is a special type of coverage that protects your company against claims that a professional service you provided caused your client to suffer financial harm due to mistakes on your part (errors) or because you failed to perform some service (omissions).

In the course of the last a few quarters, there has been a consistent positive growth trend for Professional Liability Insurance. According to market study, The Demand for this Type of insurance has spiked because of the expansion in number of professionals in bookkeeping, architecture, engineering, law, medication, and other specific fields. With such huge numbers of business segments encountering development in the present economy, the requirement for professional liability insurance is fantastically high.

Aon plc, the leading global professional services firm providing a broad range of risk, retirement and health solutions, announces an insurance solution designed to meet the changing needs of clients’ intellectual property liability.

Professional Liability Insurance Market Covers the Table of Contents With Segments, Key Players And Region. Based on Product Type, Professional Liability Insurance Market is sub segmented into Medical Liability Insurance, Lawyer Liability Insurance, Construction & Engineering Liability Insurance, Other Liability Insurance. On the Basis of Application, Market is sub segmented into Up to $1 Million, $1 Million to $5 Million, $5 Million to $20 Million, Over $20 Million.

Request a Discount on standard prices of this premium report @ https://www.businessindustryreports.com/check-discount/152007 .

Major Players profiled in the Professional Liability Insurance Market report incorporate: Chubb (ACE), AIG, Hiscox, Allianz, Tokio Marine Holdings, XL Group, AXA, Travelers, Assicurazioni Generali, Doctors Company, Marsh & McLennan, Liberty Mutual, Medical Protective, Aviva, Zurich, Sompo Japan Nipponkoa, Munich Re, Aon, Beazley, Mapfre.

Region segment: This report is segmented into several key regions, with sales, revenue, market share (%) and growth Rate (%) of Professional Liability Insurance in these regions, from 2014 to 2023 (forecast), covering: North America, Europe, Asia Pacific, Middle East & Africa and South America.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

Significant points in table of contents: Market Definition, Market Overview, Business Introduction, Segmentation (Region Level), Segmentation (Type Level), Segmentation (Industry Level), Segmentation (Channel Level), Market Forecast Year, Segmentation Type, Segmentation Industry, Market Cost Analysis, and Conclusion.

Report contents include

1 Analysis of the Professional Liability Insurance Market including revenues, future growth, market outlook

2 Historical data and forecast

3 Regional analysis including growth estimates

4 Analyzes the end user markets including growth estimates.

5 Profiles on Professional Liability Insurance including products, sales/revenues, and market position

6 Market structure, market drivers and restraints.

About us

BusinessindustryReports.com is digital database of comprehensive market reports for global industries. As a market research company, we take pride in equipping our clients with insights and data that holds the power to truly make a difference to their business. Our mission is singular and well-defined – we want to help our clients envisage their business environment so that they are able to make informed, strategic and therefore successful decisions for themselves.

Media Contact

Business Industry Reports

Pune – India

sales@businessindustryreports.com

+19376349940

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Professional Liability Insurance Market Size to Expand USD 45000 Million globally by 2023 | Analysis by Aon, Chubb (ACE), AIG, Hiscox, Allianz, Tokio Marine Holdings, XL Group, AXA here

News-ID: 1738471 • Views: …

More Releases from BIR Markets

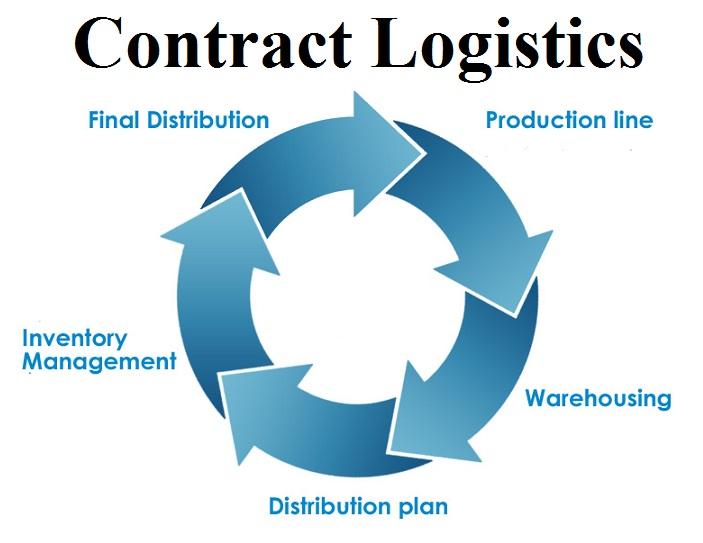

Big boom by Contract Logistics Market 2019 with an impressive double-digit growt …

The demand for Contract Logistics Market 2019 is anticipated to be high for the next few years. By considering this demand we provide latest Contract Logistics Market Report which gives complete industry analysis, market outlook, size, growth and forecast till 2023. This report will assist in analyzing the current and future business trends, sales and revenue forecasts.

Global Contract Logistics Market Overview:

The report spread across 90 pages is an overview of…

Outstanding Growth of Multi-factor Authentication (MFA) Market is estimated to r …

The exclusive research report on the Global Multi-factor Authentication (MFA) Market 2019 examines the market in detail along with focusing on significant market dynamics for the key players operating in the market. Global Multi-factor Authentication (MFA) Industry research report offers granulated yet in-depth analysis of revenue share, market segments, revenue estimates and various regions across the globe.

Global Multi-factor Authentication (MFA) Market Overview:

The Global Multi-factor Authentication (MFA) Market is Valued at…

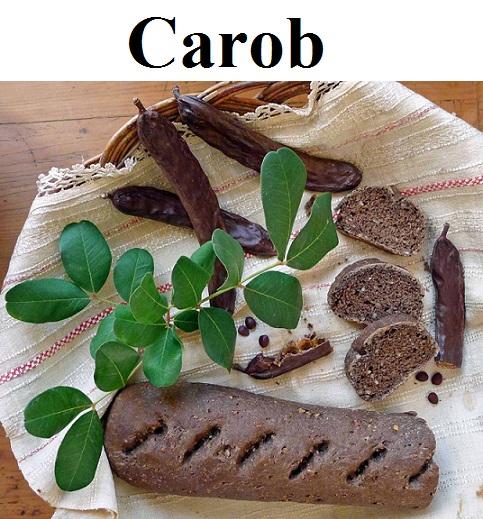

Carob Market Incredible Possibilities, Growth Analysis with Top International Ke …

A market study ”Global Carob Market” examines the performance of the Global Carob Market 2019. It encloses an in-depth Research of the Carob Market state and the competitive landscape globally. This report analyzes the potential of Carob Market in the present and the future prospects from various angles in detail.

Global Carob Market Overview:

This report studies the Global Carob Market over the forecast period of 2019 to 2023. The Global Carob…

Future Scope of Hazardous Waste Management Market 2019: Top Leading Players - Su …

The demand for Hazardous Waste Management Market 2019 is anticipated to be high for the next few years. By considering this demand we provide latest Hazardous Waste Management Market Report which gives complete industry analysis, market outlook, size, growth and forecast till 2025. This report will assist in analyzing the current and future business trends, sales and revenue forecasts.

Global Hazardous Waste Management Market Overview:

The report spread across 120 pages is…

More Releases for Liability

Brooklyn Premises Liability Attorney Samantha Kucher Discusses Store Liability f …

Brooklyn premises liability attorney Samantha Kucher (https://www.rrklawgroup.com/is-a-store-liable-for-a-customer-injury-in-new-york/) recently addressed a key concern for shoppers and business owners alike-store liability for customer injuries. Understanding when a store can be held responsible is essential, as these incidents can result in serious harm. Whether caused by a slippery floor, a falling object, or another hazardous condition, the question remains: "Is a store liable for a customer injury?"

Premises liability law establishes that store owners…

Brooklyn Premises Liability Lawyer Samantha Kucher Releases Crucial Article on P …

Brooklyn premises liability lawyer Samantha Kucher (https://www.rrklawgroup.com/premises-liability-and-building-code/) of Kucher Law Group has recently published a comprehensive article titled 'Premises Liability and Building Code'. The article is crucial for property owners, tenants, and legal advisors, providing essential insights into the intricacies of premises liability and the importance of adhering to building codes.

In the insightful piece, the Brooklyn premises liability lawyer explores the complexities of premises liability-a concept that holds property owners…

Brooklyn Premises Liability Lawyer Samantha Kucher Shares Insights on NY Premise …

Samantha Kucher (https://www.rrklawgroup.com/what-are-the-elements-of-a-premises-liability-case-in-ny/), a Brooklyn premises liability lawyer at Kucher Law Group, has recently published an in-depth article titled "What are the Elements of a Premises Liability Case in NY?" The article aims to demystify the various components of premises liability law in New York, providing vital information for those who have suffered injuries on someone else's property due to negligence.

The Brooklyn premises liability lawyer discusses how understanding the legal…

Brooklyn Premises Liability Attorney Samantha Kucher Releases Insightful Article …

Brooklyn premises liability attorney Samantha Kucher (https://www.rrklawgroup.com/is-a-store-liable-for-a-customer-injury-in-new-york/), of Kucher Law Group, has recently published an informative article titled "Is A Store Liable For A Customer Injury?" This comprehensive piece sheds light on the intricate details of premises liability law and the responsibilities of store owners towards maintaining a safe environment for their customers.

In her article, Brooklyn premises liability attorney Samantha Kucher emphasizes the legal obligations that store owners and managers…

Cosmetology Liability Insurance Market Forecast Report on Cosmetology Liability …

The report titled, Global Cosmetology Liability Insurance Market Size, Status and Forecast 2019-2026 has been recently published by Researchmoz.us. The Cosmetology Liability Insurance market has been garnering remarkable momentum in recent years. Demand continues to rise due to increasing purchasing power is projected to bode well for the global market. The insightful research report on the Cosmetology Liability Insurance market includes Porter’s five forces analysis and SWOT analysis to understand the factors…

Liability Insurance Market

Global Liability Insurance Market 2019

Liability insurance is a part of the general insurance system of risk financing to protect the purchaser (the "insured") from the risks of liabilities imposed by lawsuits and similar claims. It protects the insured in the event he or she is sued for claims that come within the coverage of the insurance policy.

Get sample copy of this report: https://bit.ly/2FggjnP

Global Liability Insurance Market…