Press release

Future Growth of Retail Banking Service Market: Attractiveness Competitive Landscape and Forecasts to 2024 | Allied Irish Bank, Aldermore Bank, Bank of Ireland, Cybg

“Global Retail Banking Service Market 2019” report gives the most up to date industry information and industry future patterns, enabling you to recognize the items and end clients driving Revenue development and gainfulness. The business report records the main rivals and gives the bits of knowledge vital industry Analysis of the key elements impacting the market.Global Retail Banking Service Market Overview:

The report spread across a 139 pages is an outline of the Global Retail Banking Service Market Report 2019. The Global Retail Banking Service Market is projected to grow at a healthy rate of growth from 2019 to 2024 in keeping with new analysis. The study focuses on market trends, leading players, provide chain trends, technological innovations, key developments, and future methods.

Accessible Exclusive Sample Copy of this Report @ https://www.businessindustryreports.com/sample-request/154110 .

Top Industry News: The Specialty in Retail Banking Service for Services Material base Company, ALDERMORE BANK shut its monetary year with a solid outcome. Recently ALDERMORE BANK, the specialist bank, has announced that Carl D’Ammassa, its Group Managing Director for Business Finance, will leave the Bank after five and a half years. Carl will become the new Chief Executive Officer of White Oak UK later this year.

The Global Retail Banking Service Market report additionally covers segment information, including by Product Type segment, Application: Industry segment, End User, Channel segment, and Regions.

According to Retail Banking Service Market report analysis, the Retail Banking Service Market explore report gives thorough data about the key elements provoking the development of the market. Expanding Internet entrance in many creating nations is likewise a key driver of market development. It likewise extends openings that will indicate wide-going development rate in not so distant future. This report distinguishes that in a quickly developing aggressive condition, the present marketing data is dynamic to checking execution and settling on considerable choices about development and gainfulness.

According to regions, the North American region is estimated to hold the largest market in 2019. The early adoption of technologies and the high focus on innovation in the region are leading to the growth of the market in North America.

Top Leading Key Manufacturers are: Allied Irish Bank, Aldermore Bank, Bank of Ireland, Cybg, The Co-Operative Bank and More.

This investigation answers to the underneath key inquiries:

1 What is the present size of Retail Banking Service market in the world and in different nations?

2 How is Retail Banking Service market divided into different thing sections?

3 How are the general market and particular thing sections creating?

4 How is the market foreseen to make later on?

5 What is the market potential diverged from various nations?

Global Retail Banking Service Market 2019-2024: The target of the examination is to characterize showcase sizes of various segments and nations as of late and to gauge the qualities to the coming four years. The report is planned to join both abstract and quantitative parts of the business inside all of the regions and nations associated with the examination.

Discount your report @ https://www.businessindustryreports.com/check-discount/154110 .

About us

BusinessindustryReports.com is digital database of comprehensive market reports for global industries. As a market research company we take pride in equipping our clients with insights and data that holds the power to truly make a difference to their business. Our mission is singular and well-defined – we want to help our clients envisage their business environment so that they are able to make informed strategic and therefore successful decisions for themselves.

Media Contact

Business Industry Reports

Pune – India

sales@businessindustryreports.com

+19376349940

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Future Growth of Retail Banking Service Market: Attractiveness Competitive Landscape and Forecasts to 2024 | Allied Irish Bank, Aldermore Bank, Bank of Ireland, Cybg here

News-ID: 1736997 • Views: …

More Releases from BIR Markets

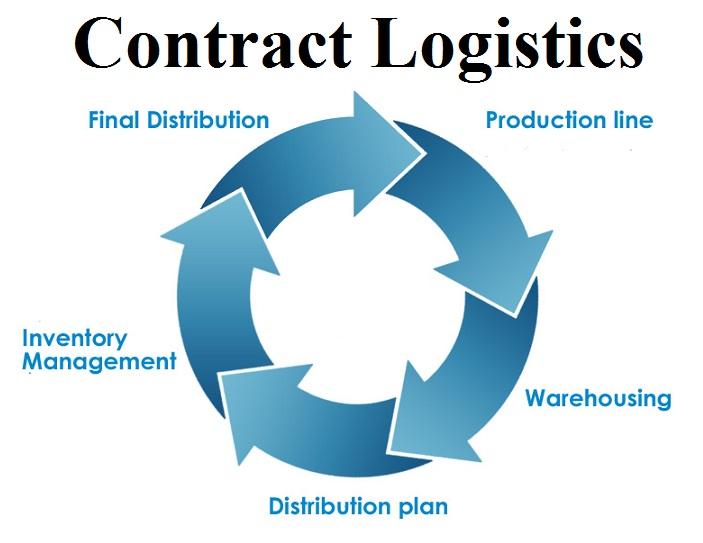

Big boom by Contract Logistics Market 2019 with an impressive double-digit growt …

The demand for Contract Logistics Market 2019 is anticipated to be high for the next few years. By considering this demand we provide latest Contract Logistics Market Report which gives complete industry analysis, market outlook, size, growth and forecast till 2023. This report will assist in analyzing the current and future business trends, sales and revenue forecasts.

Global Contract Logistics Market Overview:

The report spread across 90 pages is an overview of…

Outstanding Growth of Multi-factor Authentication (MFA) Market is estimated to r …

The exclusive research report on the Global Multi-factor Authentication (MFA) Market 2019 examines the market in detail along with focusing on significant market dynamics for the key players operating in the market. Global Multi-factor Authentication (MFA) Industry research report offers granulated yet in-depth analysis of revenue share, market segments, revenue estimates and various regions across the globe.

Global Multi-factor Authentication (MFA) Market Overview:

The Global Multi-factor Authentication (MFA) Market is Valued at…

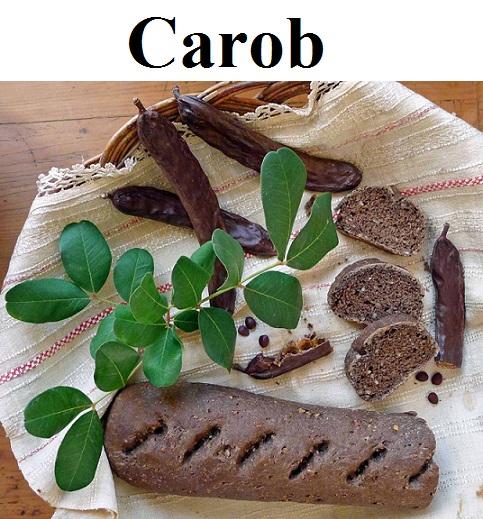

Carob Market Incredible Possibilities, Growth Analysis with Top International Ke …

A market study ”Global Carob Market” examines the performance of the Global Carob Market 2019. It encloses an in-depth Research of the Carob Market state and the competitive landscape globally. This report analyzes the potential of Carob Market in the present and the future prospects from various angles in detail.

Global Carob Market Overview:

This report studies the Global Carob Market over the forecast period of 2019 to 2023. The Global Carob…

Future Scope of Hazardous Waste Management Market 2019: Top Leading Players - Su …

The demand for Hazardous Waste Management Market 2019 is anticipated to be high for the next few years. By considering this demand we provide latest Hazardous Waste Management Market Report which gives complete industry analysis, market outlook, size, growth and forecast till 2025. This report will assist in analyzing the current and future business trends, sales and revenue forecasts.

Global Hazardous Waste Management Market Overview:

The report spread across 120 pages is…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…