Press release

Asia-Pacific Usage Based Insurance Market Comprehensive Analysis By Major Key Players: Allianz, AXA, Progressive Insurance, Allstate, Desjardins, Generali, MAPFRE, Metromile, Aviva, Admiral Group Plc, Allianz Australia, Allianz Asia Pacific, Aviva Asia

In today’s economical market place, businesses take a lot of efforts to seek better solutions in terms of product trends, future products, marketing strategy, future events, actions or behaviours. The Asia-Pacific Usage Based Insurance report has been worked out with the accurate use of tools like SWOT analysis and Porter’s Five Forces analysis methods. A talented team works strictly with their potential capabilities to produce this finest Asia-Pacific Usage Based Insurance market research report. The Asia-Pacific Usage Based Insurance market report considers new product development from beginning to launch by performing detailed market study. Getting thoughtful about competitive landscape is another significant aspect of this market report.As name suggested usage based insurance is calculated by how corresponding vehicle is driven. In other words, usage based insurance is a kind of auto-insurance which totally depends on vehicle used, measured against time, distance, behaviour, place and others. These all usages can be measure using telematics technology; the technology is available in from of mobile application, pre-installed in the car’s network or it can be installed in USB port of the vehicle. Usage based insurance and telematics technology has wide range of benefits such as reverse gear indication, tracking of speeding, seat belt use, harsh braking, acceleration control, driver coaching by voice and others. These all benefits have potential to reduce road accidents.

Asia-Pacific usage based insurance market is expected to reach a healthy CAGR of 20.6% in the forecast period of 2019 to 2026.

Asia-Pacific, led by China, will drive the growth of usage-based insurance

Download FREE | Sample Report at https://databridgemarketresearch.com/request-a-sample/?dbmr=asia-pacific-usage-based-insurance-market

Usage-based insurance (UBI) is a telematics-based insurance service in which premiums are based on driving behavior of consumers. Type of road used, braking, and cornering pattern are amongst the factors according to which the premiums are charged. Usage-based insurance includes different services such as pay-as-you-drive (PAYD), pay-how-you-drive (PHYD), and manage-how-you-drive (MHYD).

Key Competitors: Asia-Pacific usage based insurance market

Allianz, AXA, Progressive Insurance, Allstate, Allstate Canada, Desjardins, Generali, MAPFRE, Metromile, Aviva, Admiral Group Plc,Ageas Group, Octo Telematics, TomTom Telematics, Liberty Mutual Insurance, Intelligent Mechatronic Systems – IMS, Mitsui Sumitomo Insurance Co. (Europe) Ltd, Watchstone Group plc, Allianz Australia, Aviva Canada, Allianz Asia Pacific, AXA Insurance Company, AXA US, Aviva Asia, AXA Italia, AXA UK, Ageas UK, Liberty Mutual Insurance Europe Limited

Recent developments:

In September 2018, Allstate launched a product for life insurance which will pay on monthly basis rather than lump sum amount. This is consumer driven product which will help the company to cover more market share and to aware the people about life insurance.

In October 2018, The Floow launches FlowFleet for the insurer who deals in commercial line. This helped the insurance company to better manage the risk and to provide the optimal premium price to their customer in the high premium rising market.

In June 2018, Allstate launched pay per mile i.e. usage based insurance in New Jersey. This insurance gives more control to customer about their insurance premium and plans.for using telematics services for better management in their insurance segment.

In March 2018, Octo Telematics entered into partnership with Renault finance company to provide data analytics and services to its customer globally. This will increase the global market share of the company.

Get 25 % instant off on this report by inquire about this report at https://databridgemarketresearch.com/inquire-before-buying/?dbmr=asia-pacific-usage-based-insurance-market

Asia-Pacific Usage Based Insurance Market, By Package type (pay-as-you-drive (PAYD), pay-how-you-drive (PHYD), manage-how-you-drive

(MHYD)),vehicle type (light-duty vehicle (LDV), heavy-duty vehicles (HDV)), device offering (company provided, bring your own device

(BYOD)),technology (OBD-II, smartphone, embedded system, black box and others),vehicle age (new vehicles, on-road vehicles),electric and hybrid vehicle (hybrid electric vehicle (HEV), plug-in hybrid vehicle (PHEV), battery electric vehicle (BEV)), Countries (Japan, China, South Korea, India, Singapore, Thailand, Malaysia, Australia, Indonesia and Philippines ) – Industry Trends and Forecast to 2026

About Data Bridge Market Research:

Data Bridge Market Research set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process.

Contact:

Data Bridge Market Research

Tel: +1-888-387-2818

Email: sopan.gedam@databridgemarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Asia-Pacific Usage Based Insurance Market Comprehensive Analysis By Major Key Players: Allianz, AXA, Progressive Insurance, Allstate, Desjardins, Generali, MAPFRE, Metromile, Aviva, Admiral Group Plc, Allianz Australia, Allianz Asia Pacific, Aviva Asia here

News-ID: 1732649 • Views: …

More Releases from Data Bridge Market Research

Scented Candle Market Shows Strong Growth Driven by Wellness and Home Décor Tr …

The global scented candle market is on track for significant expansion, increasing from an estimated USD 3.60 billion in 2024 to USD 6.00 billion by 2032, registering a strong CAGR of 6.60%. Rising consumer interest in home ambiance, wellness, and premium lifestyle products continues to drive market demand.

Get More Detail: https://www.databridgemarketresearch.com/reports/global-scented-candle-market

Market Growth Drivers

The scented candle market has evolved beyond being just a decorative item. Key growth factors include:

Home Fragrance &…

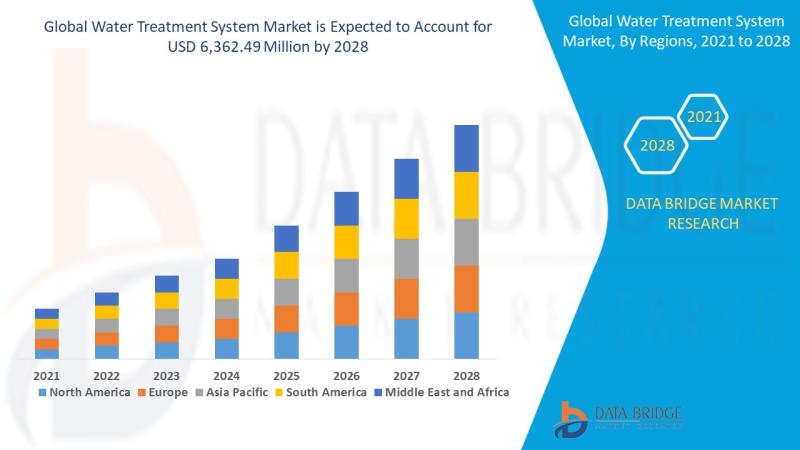

Water Treatment System Market: Sustaining the Future of Clean Water

Introduction

Understanding Water Treatment Systems

Water treatment systems are designed to purify and disinfect water for various uses-drinking, industrial processes, irrigation, and wastewater reuse. These systems eliminate contaminants such as bacteria, viruses, heavy metals, chemicals, and particulates, making water safe and sustainable for consumption and use.

Importance in Global Sustainability

Clean water is essential to life and industrial progress. With growing water demand and pollution, water treatment systems are now critical infrastructure across the…

Veterinary X-Ray Market Size, Analysis, Scope, Demand, Opportunities, Statistics

According to Data Bridge Market Research The global Veterinary X-Ray market size was valued at USD 915.19 million in 2024 and is projected to reach USD 1576.00 million by 2032, with a CAGR of 7.03 % during the forecast period of 2025 to 2032.

With increasing globalization and digital disruption, the Equine X-Ray Solutions Market is expanding across multiple industries, . Market research data indicates that businesses in the Companion Animal…

Veterinary X-Ray Market Size, Analysis, Scope, Demand, Opportunities, Statistics

According to Data Bridge Market Research The global Veterinary X-Ray market size was valued at USD 915.19 million in 2024 and is projected to reach USD 1576.00 million by 2032, with a CAGR of 7.03 % during the forecast period of 2025 to 2032.

With increasing globalization and digital disruption, the Equine X-Ray Solutions Market is expanding across multiple industries, . Market research data indicates that businesses in the Companion Animal…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…