Press release

New Profitable Report on The Consumer Banking Service Market by 2019 - 2023: Top Key Players Allied Irish Bank, Aldermore, Bank Of Ireland UK, Close Brothers, The Co-Operative Bank, Cybg, TSB

Consumer Banking Service Market research report 2019 - 2023 provides the newest industry data and industry future trends, allowing you to identify the products and end users driving Revenue growth and profitability.Global Consumer Banking Service Market Synopsis:

The Global “Consumer Banking Service Market” research 2019 highlights the major details and provides in-depth analysis of the market along with the future growth, prospects and Industry demands analysis explores with the help of complete report with 125 Pages, figures, graphs and table of contents to analyze the situations of global Consumer Banking Service Market and Assessment to 2023.

Get Sample Study Papers of “Global Consumer Banking Service Market” @ https://www.businessindustryreports.com/sample-request/153901 .

This report studies the Consumer Banking Service Market over the forecast amount of 2019 to 2023. The Consumer Banking Service Market is anticipated to grow at a powerful Compound Annual rate of growth (CAGR) from 2019 to 2023.

This report studies the Consumer Banking Service market size by players, regions, product types and end industries, history data 2014-2018 and forecast data 2019-2023; This report also studies the global market competition landscape, market drivers and trends, opportunities and challenges, risks and entry barriers, sales channels, distributors and Porter's Five Forces Analysis.

Consumer banking is the typical mass-market banking in which individual customers use local branches of larger commercial banks. Consumer Banking Service aims to be the one-stop shop for as many financial services as possible on behalf of individual retail clients. Consumers expect a range of basic services from retail banks, such as checking accounts, savings accounts, personal loans, lines of credit, mortgages, debit cards, credit cards and CDs.

Industry News: TSB has won the Consumer NZ People’s Choice award for Banking for the third year in a row, following the results of the 2018 Consumer NZ bank survey. To achieve the People’s Choice award, a brand must stand out in terms of customer satisfaction. TSB had the highest customer satisfaction result at 87% and is the first bank to receive this award for three consecutive years. It also scored above average on four of Consumer NZ’s five core performance measures.

Consumer Banking Service Market Covers the Table of Contents With Segments, Key Players And Region. On the Basis of Product Type, Consumer Banking Service Market is sub segmented into Traditional and Digital Led. Based on Industry, Market is sub segmented into Transactional Accounts, Savings Accounts, Debit Cards, Credit Cards, Loans, Others.

Request a Discount on standard prices of this premium report @ https://www.businessindustryreports.com/check-discount/153901 .

Major players profiled in the Consumer Banking Service Market report incorporate: Allied Irish Bank (UK), Aldermore Bank, Bank Of Ireland UK, Close Brothers, The Co-Operative Bank, Cybg, First Direct, Handelsbanken, Masthaven Bank, Metro Bank, Onesavings Bank, Paragon Bank, Secure Trust Bank, Shawbrook Bank, TSB, Virgin Money.

Region segment: This report is segmented into several key regions, with sales, revenue, market share (%) and growth Rate (%) of Consumer Banking Service in these regions, from 2014 to 2023 (forecast), covering: North America, Europe, Asia Pacific, Middle East & Africa and South America.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

Noteworthy focuses in chapter by chapter guide: Market Definition, Market Overview, Business Introduction, Segmentation (Region Level), Segmentation (Type Level), Segmentation (Industry Level), Segmentation (Channel Level), Market Forecast Year, Segmentation Type, Segmentation Industry, Market Cost Analysis, and Conclusion.

Report contents include

1 Analysis of the Consumer Banking Service Market including revenues, future growth, market outlook

2 Historical data and forecast

3 Regional analysis including growth estimates

4 Analyzes the end user markets including growth estimates.

5 Profiles on Consumer Banking Service including products, sales/revenues, and market position

6 Market structure, market drivers and restraints.

About us

BusinessindustryReports.com is digital database of comprehensive market reports for global industries. As a market research company, we take pride in equipping our clients with insights and data that holds the power to truly make a difference to their business. Our mission is singular and well-defined – we want to help our clients envisage their business environment so that they are able to make informed, strategic and therefore successful decisions for themselves.

Media Contact

Business Industry Reports

Pune – India

sales@businessindustryreports.com

+19376349940

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release New Profitable Report on The Consumer Banking Service Market by 2019 - 2023: Top Key Players Allied Irish Bank, Aldermore, Bank Of Ireland UK, Close Brothers, The Co-Operative Bank, Cybg, TSB here

News-ID: 1731303 • Views: …

More Releases from Business Industry Reports

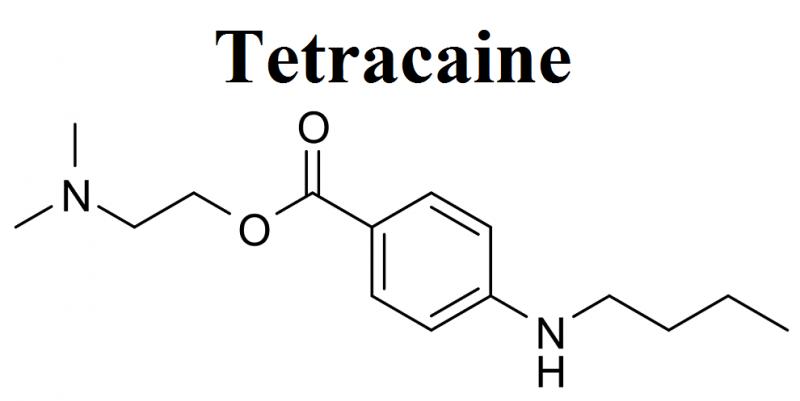

Tetracaine Market Exhibits a Lucrative Growth Potential during 2021-2025 | Endo …

BusinessIndustryReports has recently broadcasted a new study to its broad research portfolio, which is titled as “Global Tetracaine Market” Research Report 2021 provides an in-depth analysis of the Tetracaine with the forecast of market size and growth. The analysis includes addressable market, market by volume, market share by business type and by segment (external and in-house). The research study examines the Tetracaine on the basis of a number of criteria,…

Cyber Warfare Market Evenly Poised To Reach A Market Value of US$ By Share, Size …

Overview of Global Cyber Warfare Market:

This report provides in-depth study of “Global Cyber Warfare Market 2021” using SWOT analysis i.e. Strength, Weakness, Opportunities, and Threat to the organization. The Cyber Warfare Market report also provides an in-depth survey of key players in the market organization.

According to the market research study, the Cyber Warfare is virtual conflict between state, organization, or country by the use of computer technology to disrupt activities…

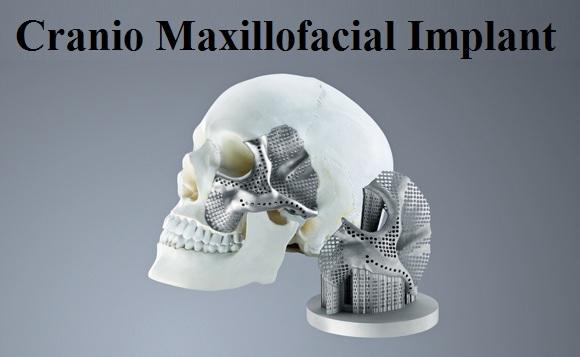

Covid-19 Impact on Cranio Maxillofacial Implant Market 2021-2025: Business Growt …

Overview of Global Cranio Maxillofacial Implant Market:

This report provides in-depth study of “Global Cranio Maxillofacial Implant Market 2021” using SWOT analysis i.e. Strength, Weakness, Opportunities, and Threat to the organization. The Cranio Maxillofacial Implant Market report also provides an in-depth survey of key players in the market organization.

According to the market research study, Craniomaxillofacial Implants are medical implants used in surgeries of maxillofacial region such as, head, face, neck, oral,…

Beginning of the bloom: The Rise of the Biohacking Market 2021-2025 | Global Key …

Global Biohacking Market Synopsis:

The report covers a forecast and an analysis of the Biohacking Market on a global and regional level. The study provides historical data for 2015, 2016, 2017 and 2018 along with a forecast from 2020 to 2025 based on revenue (USD Million) and volume (Kilotons). The study includes drivers and restraints of the Biohacking Market along with the impact they have on the demand over the forecast…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…