Press release

Mobile Banking Industry 2019 Technology Advancement and Market Demand 2025(ICICI Bank Mobile Banking, CCB, SBI, ICBC Bank, MBS, HSBC Mobile Banking, Barclays, U.S. Bank, Santander Mobile Banking)

Mobile Banking Industry 2019 research report presents critical information and factual data about the Mobile Banking market. It also provides an overall statistical information market on the basis of market drivers, limitations, outlook and its future prospects. The prevalent Mobile Banking trends and opportunities are also taken into consideration in Mobile Banking Industry Report.Get Sample Copy of this Report - https://www.orianresearch.com/request-sample/953605

The Global Mobile Banking market 2019 research provides a basic overview of the industry including definitions, classifications, applications and industry chain structure. The Global Mobile Banking market analysis is provided for the international markets including development trends, competitive landscape analysis, and key regions development status. Development policies and plans are discussed as well as manufacturing processes and cost structures are also analyzed. This report also states import/export consumption, supply and demand Figures, cost, price, revenue and gross margins.

Global Mobile Banking Industry 2019 Market Research Report is spread across 125 pages and provides exclusive vital statistics, data, information, trends and competitive landscape details in this niche sector.

Inquire more or share questions if any before the purchase on this report @ https://www.orianresearch.com/enquiry-before-buying/953605

Global Mobile Banking market competition by top manufacturers, with production, price, revenue (value) and market share for each manufacturer; the TOP PLAYERS including

• ICICI Bank Mobile Banking

• CCB

• SBI

• ICBC Bank

• MBS

• HSBC Mobile Banking

• Barclays

• …

The report provides insights on the following pointers:

Product Analysis and Development: Detailed insights on upcoming technologies, research and development activities, and new product launches in the global Mobile Banking market.

Market Development: Comprehensive information about lucrative emerging markets is provided. The report also analyzes the markets for Mobile Banking across various regions, exploits new distribution channels, new clientele base, and different pricing policies.

Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investment decisions in the global Mobile Banking market. Detailed description regarding the related and unrelated diversification pertaining to this market is also provided.

Competitive Assessment: An in-depth assessment of market shares and company share analysis of the key players, which is forecast till 2025 is provided. The business strategies and manufacturing capabilities of leading players are offered for the major companies in the Mobile Banking market.

Order a copy of Global Mobile Banking Market Report 2019 @ https://www.orianresearch.com/checkout/953605

Most important types of Mobile Banking products covered in this report are:

IOS

Android

Most widely used downstream fields of Mobile Banking market covered in this report are:

Account information

Transaction

Investments

Support

Content services

Scope of the Report:

• To analyze global Mobile Banking status, future forecast, growth opportunity, key market and key players.

• To present the Mobile Banking development in United States, Europe and China.

• To strategically profile the key players and comprehensively analyze their development plan and strategies.

• To define, describe and forecast the market by product type, market and key regions.

About Us:

Orian Research is one of the most comprehensive collections of market intelligence reports on the World Wide Web. Our reports repository boasts of over 500000+ industry and country research reports from over 100 top publishers. We continuously update our repository so as to provide our clients easy access to the world's most complete and current database of expert insights on global industries, companies, and products. We also specialize in custom research in situations where our syndicate research offerings do not meet the specific requirements of our esteemed clients.

Contact Us:

Ruwin Mendez

Vice President – Global Sales & Partner Relations

Orian Research Consultants

US: +1 (415) 830-3727 | UK: +44 020 8144-71-27

Email: info@orianresearch.com

Website: www.orianresearch.com/

Follow Us on LinkedIn: https://www.linkedin.com/company-beta/13281002/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mobile Banking Industry 2019 Technology Advancement and Market Demand 2025(ICICI Bank Mobile Banking, CCB, SBI, ICBC Bank, MBS, HSBC Mobile Banking, Barclays, U.S. Bank, Santander Mobile Banking) here

News-ID: 1719609 • Views: …

More Releases from Orian Research

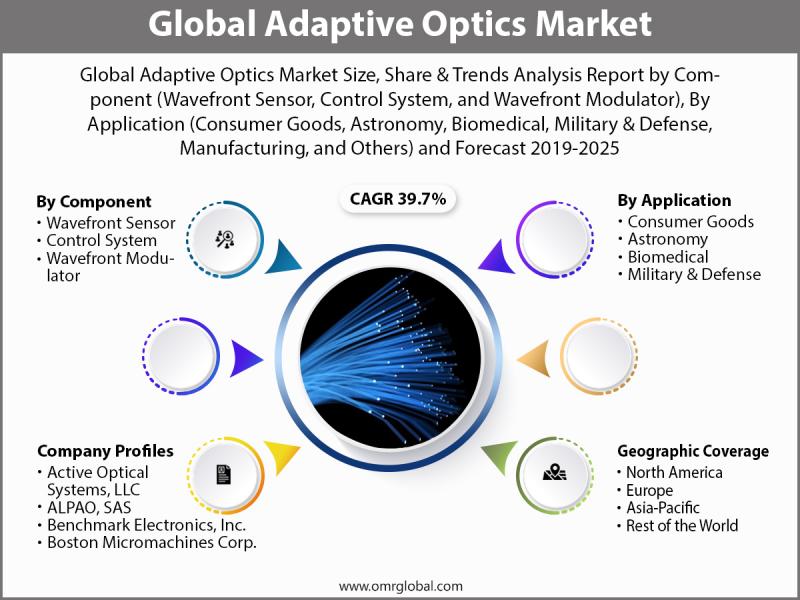

Adaptive Optics Market Size, Competitive Analysis, Share, Forecast- 2019-2025

The global adaptive optics market is projected to grow at a significant CAGR of 39.7% during the forecast period owing to the increasing application of adaptive optics in retinal imaging and ophthalmology to reduce the optical aberrations. The integration of adaptive optics converts an ophthalmoscope into a microscope, allowing visualization of and optical access to individual retinal cells in living human eyes.

To learn more about this report request a…

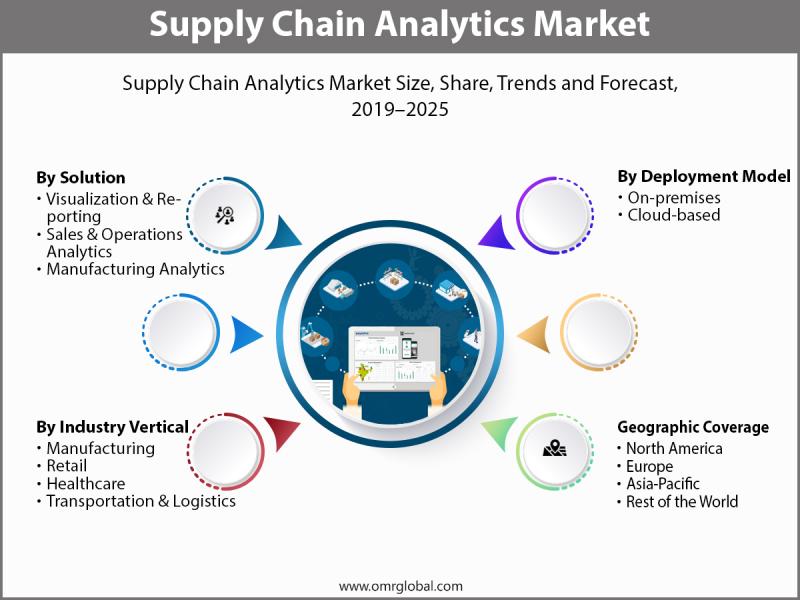

Supply Chain Analytics Market Size, Competitive Analysis, Share, Forecast- 2019- …

The Global Supply Chain Analytics Market is estimated to grow at a significant CAGR during the forecast period 2019- 2025. The impact of e-commerce on retailers and manufacturers is driving a revolution in many sectors and business organization. This has led to the introduction of supply chain analytics solution, which offers mathematics, statistics, predictive modeling and machine-learning techniques to find meaningful patterns and knowledge regarding order, shipment and transactional data.…

Laparoscopic Instruments Market Size, Competitive Analysis, Share, Forecast- 201 …

The laparoscopic or minimally invasive surgery uses a special surgical instrument known as laparoscope to look inside the body and carry out certain procedures. The laparoscopic instruments market is projected to witness a steady growth rate during the forecast period 2018-2023. The rise in preference of minimal invasive method over invasive surgeries, the high prevalence of lifestyle-oriented diseases, high global expenditure on the laparoscopic market, increasing healthcare market in emerging…

Fertility Drug Market Size, Competitive Analysis, Share, Forecast- 2018-2023

Infertility is one of the major issue now a day due to change in life style & cultural shift. There are various fertility drugs available in market for infertility related problems. Fertility drugs enhance the reproductive ability by improving quality of egg or sperms by increasing the levels of certain hormones in human body. The major factors that are responsible for the growth of fertility drug market are Change in…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…