Press release

Anti-money Laundering Software Solution Market is anticipated to grow over 1600 Million USD by 2023 | Top Key Players - Nice Actimize, Oracle, Thomson Reuters, Fiserv, SAS, SunGard, Experian, ACI Worldwide, Verafin, EastNets

A market study ”Global Anti-money Laundering Software Solution Market” examines the performance of the Global Anti-money Laundering Software Solution Market 2019. It encloses an in-depth Research of the Anti-money Laundering Software Solution Market state and the competitive landscape globally. This report analyzes the potential of Anti-money Laundering Software Solution Market in the present and the future prospects from various angles in detail.Global Anti-money Laundering Software Solution Market Overview:

The Global Anti-money Laundering Software Solution Market size was 960 Million US$ in 2018 and it is expected to reach 1600 Million US$ by the end of 2023, with a healthy CAGR during the forecast period (2019 - 2023).

As per the market report analysis, the Anti-money Laundering (AML) Solution is software used in the finance and legal industries to meet the legal requirements for financial institutions and other regulated entities to prevent or report money laundering activities. Anti-money Laundering (AML) Solution allows financial institutions and other enterprises to detect suspicious transactions and analyze customer data. Its ability to provide real-time alerts and tools to report suspicious events to maximize security and operational efficiency will foster its adoption during the forecast period.

Available Exclusive Sample Copy of this Report @ https://www.businessindustryreports.com/sample-request/148995 .

One of the most important factor drives the growth of the Global Anti-money Laundering Software Solution Market is increasing regulatory compliance requirements, which compels financial institutions to adopt AML software. The growing utilization of predictive analytics to reduce false results and to decrease the compliance cost of AML software is a trend that will impel market growth until the end of 2023. Europe to be the largest market for AML software during the forecast period. Though Europe accounts for the largest market share, the APAC region is envisaged to witness the fastest growth during the predicted period. US will still play an important role which cannot be ignored. Any changes from United States might affect the development trend of Anti-money Laundering Software.

The Global Anti-money Laundering Software Solution Market is segmented based on Type, Deployment, Application and Region. On the basis of Type, the market is sub-segmented into Transaction Monitoring Systems, Currency Transaction Reporting, Customer Identity Management Systems and Compliance Management Software. Based on the Deployment, the market is divided into On-Premise and Cloud. On the basis of Application, the market is sub-segmented into IT & Telecommunications, Healthcare, BFSI, Transportation & Logistics, Manufacturing, Defense & Government, Retail, Energy & Utilities, and others.

In terms of the geographic analysis, the Anti-money Laundering Software Solution Market is currently dominated by North America due to the technological advancements in this region. APAC Anti-money Laundering Software Solution Market is expected to have the highest growth rate during the forecast period (2019 - 2023).

Latest Industry Updates:

NICE Actimize (April 22, 2019) –NICE Actimize Enhances Intelligent eComms Surveillance Solution with Next Generation Machine Learning and Investigative Tools – NICE Actimize’s market-leading intelligent analytics dramatically improve detection accuracy and reduce false positives by up to 93%, while reducing compliance costs – As the volume and variety of regulated communications increase, the supervision challenges and risks for financial services organizations (FSOs) only become more complex.

To address this, NICE Actimize, a NICE business and the leader in Autonomous Financial Crime Management, has enhanced its Intelligent eCommunications Surveillance solution with next generation machine learning capabilities, intelligent analytics and investigative tools to strengthen surveillance detection and case management, reduce false alerts, and drive down compliance costs.

Top Leading Key Manufacturers are: Oracle, Thomson Reuters, Fiserv, SAS, SunGard, Experian, ACI Worldwide, Tonbeller, Banker's Toolbox, Nice Actimize, CS&S, Ascent Technology Consulting, Targens, Verafin, EastNets and others. New product launches and continuous technological innovations are the key strategies adopted by the major players.

Region segment: This report is segmented into several key regions, with sales, revenue, market share (%) and growth Rate (%) of Anti-money Laundering Software Solution in these regions, from 2013 to 2023 (forecast), covering: North America, Europe, Asia Pacific, Middle East & Africa and South America

Purchase this report online with 125 Pages, List of Tables & Figures and in-depth Table of Contents on “Global Anti-money Laundering Software Solution Market Report 2019” @ https://www.businessindustryreports.com/buy-now/148995/single .

In the end, this report covers data and information on capacity and production overview, production, market share analysis, sales overview, supply, sales, and shortage, import, export and consumption as well as cost, price, revenue and gross margin of Anti-money Laundering Software Solution Market.

About us

BusinessindustryReports.com is digital database of comprehensive market reports for global industries. As a market research company, we take pride in equipping our clients with insights and data that holds the power to truly make a difference to their business. Our mission is singular and well-defined – we want to help our clients envisage their business environment so that they are able to make informed, strategic and therefore successful decisions for themselves.

Media Contact

Business Industry Reports

Pune – India

sales@businessindustryreports.com

+19376349940

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Anti-money Laundering Software Solution Market is anticipated to grow over 1600 Million USD by 2023 | Top Key Players - Nice Actimize, Oracle, Thomson Reuters, Fiserv, SAS, SunGard, Experian, ACI Worldwide, Verafin, EastNets here

News-ID: 1715798 • Views: …

More Releases from Business Industry Reports

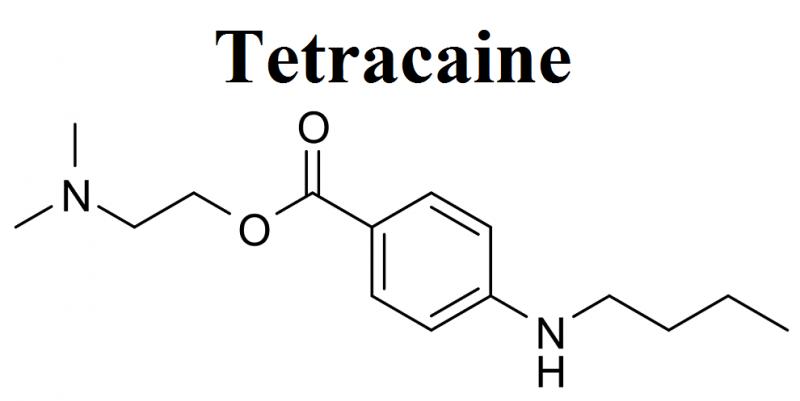

Tetracaine Market Exhibits a Lucrative Growth Potential during 2021-2025 | Endo …

BusinessIndustryReports has recently broadcasted a new study to its broad research portfolio, which is titled as “Global Tetracaine Market” Research Report 2021 provides an in-depth analysis of the Tetracaine with the forecast of market size and growth. The analysis includes addressable market, market by volume, market share by business type and by segment (external and in-house). The research study examines the Tetracaine on the basis of a number of criteria,…

Cyber Warfare Market Evenly Poised To Reach A Market Value of US$ By Share, Size …

Overview of Global Cyber Warfare Market:

This report provides in-depth study of “Global Cyber Warfare Market 2021” using SWOT analysis i.e. Strength, Weakness, Opportunities, and Threat to the organization. The Cyber Warfare Market report also provides an in-depth survey of key players in the market organization.

According to the market research study, the Cyber Warfare is virtual conflict between state, organization, or country by the use of computer technology to disrupt activities…

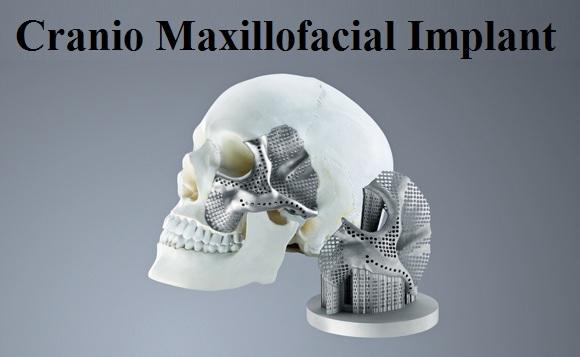

Covid-19 Impact on Cranio Maxillofacial Implant Market 2021-2025: Business Growt …

Overview of Global Cranio Maxillofacial Implant Market:

This report provides in-depth study of “Global Cranio Maxillofacial Implant Market 2021” using SWOT analysis i.e. Strength, Weakness, Opportunities, and Threat to the organization. The Cranio Maxillofacial Implant Market report also provides an in-depth survey of key players in the market organization.

According to the market research study, Craniomaxillofacial Implants are medical implants used in surgeries of maxillofacial region such as, head, face, neck, oral,…

Beginning of the bloom: The Rise of the Biohacking Market 2021-2025 | Global Key …

Global Biohacking Market Synopsis:

The report covers a forecast and an analysis of the Biohacking Market on a global and regional level. The study provides historical data for 2015, 2016, 2017 and 2018 along with a forecast from 2020 to 2025 based on revenue (USD Million) and volume (Kilotons). The study includes drivers and restraints of the Biohacking Market along with the impact they have on the demand over the forecast…

More Releases for Laundering

Surge In Money Laundering Cases Drives Growth Of Anti-Money Laundering Software …

Use code ONLINE20 to get 20% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

Anti-Money Laundering Software Market Size Valuation Forecast: What Will the Market Be Worth by 2025?

The market size for anti-money laundering software has seen swift expansion in the past few years. Its growth is expected to rise from $2.85 billion in 2024 to $3.22 billion in 2025, with a…

Prominent Anti-Money Laundering Market Share Trend for 2025: SaaS Anti-Money Lau …

What industry-specific factors are fueling the growth of the anti-money laundering market?

The increasing emphasis on internet banking and digital transactions is anticipated to drive the anti-money laundering market's expansion in the future. Digital transactions involve money transfer from one payment account to another via a computer, mobile phone, or other digital device. Technologies aimed at preventing money laundering are employed to deter online fraud and mitigate risks associated with digital…

Leading Growth Driver in the Anti-Money Laundering Software Market in 2025: Surg …

Which drivers are expected to have the greatest impact on the over the anti-money laundering software market's growth?

The surge in incidents related to money laundering is anticipated to boost the anti-money laundering software industry. Money laundering typically involves transforming unlawfully obtained capital into lawful funds. The significant growth in money laundering incidents has facilitated the widespread use of anti-money laundering software programs to meet the regulatory demands of organizations seeking…

Anti-Money Laundering: Global Market Outlook

Summary:

Anti-money laundering (AML) comprises laws, policies, and regulations to safeguard financial frauds and illegal activity. Organizations must comply with these regulations even though compliance led financial institutions do have compliance departments and purchase software solutions. As times are changing, organizations are becoming more adaptive to the AML technologies and the end-user industry is reflecting various important trends shaping how they are being utilized. Increasing stringent regulations and compliance obligations for…

Rising Money Laundering Cases To Boost Anti-Money Laundering Market Growth

Factors such as the surging number of money laundering cases and mounting information technology (IT) expenditure will facilitate the anti-money laundering (AML) market growth during the forecast period (2021-2030). According to P&S Intelligence, the market generated a revenue of $2.4 billion revenue in 2020. Moreover, the surging volume of digital payments, rising technological advancements, and mounting internet traffic will also accelerate the market growth in the foreseeable future. Financial institutions…

Increasing Prevalence of Money Laundering Driving Anti-Money Laundering Market G …

The global anti-money laundering market reached a value of $3 billion in 2020 and it is predicted to exhibit huge expansion between 2021 and 2030 (forecast period). The market is being driven by the surging incidence of money laundering cases and the burgeoning demand for monitoring money laundering activities. Additionally, the soaring information technology (IT) expenditure in several countries is also pushing up the requirement for anti-money laundering (AML) solutions…