Press release

Europe Usage Based Insurance Market 2019 Trends and Review by Quantitative Analysis, Comprehensive Landscape and Future Growth by 2026 - key Players are Mitsui Sumitomo Insurance Co. (Europe) Ltd, AXA UK, Ageas UK, Liberty Mutual Insurance Europe Limited

Europe Usage Based Insurance Market is the finest market research report which is the result of proficient team and their potential capabilities. It gives details about market drivers and market restraints which can help businesses in guessing about reducing or increasing the production of particular product. A strong research methodology used here consists of data models that include market overview and guide, vendor positioning grid, market time line analysis, company positioning grid, company market share analysis, standards of measurement, top to bottom analysis and vendor share analysis. Europe Usage Based Insurance Market share analysis and key trend analysis are the two other major success factors in this Europe Usage Based Insurance Market report.Europe usage based insurance market is growing with the healthy CAGR of 18.6% in the forecast period of 2019 to 2026.

Download Free Sample Report Instantly at https://databridgemarketresearch.com/request-a-sample/?dbmr=europe-usage-based-insurance-market

Under market segmentation, research and analysis is done based on application, vertical, deployment model, end user, and geography. Competitive analysis studied in this Europe Usage Based Insurance market report assists to get ideas about the strategies of key players in the market. The key research methodology used here by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Europe Usage Based Insurance market report gives information about company profile, product specifications, capacity, production value, and market shares for each company for the year 2019 to 2019 under the competitive analysis study.

Table of Content: Europe Usage Based Insurance Market

Section 1 Europe Usage Based Insurance Definition

Section 2 Europe Usage Based Insurance Major Player Share and Market Overview

Section 3 Major Player Europe Usage Based Insurance Business Introduction

Section 4 Europe Usage Based Insurance Segmentation

Section 5 Europe Usage Based Insurance Market Segmentation (Type Level)

Section 7 Europe Usage Based Insurance Market Forecast

Section 8 Europe Usage Based Insurance Segmentation Type

Section 9 Europe Usage Based Insurance Segmentation Industry

Section 10 Europe Usage Based Insurance Cost Analysis

Section 11 Conclusion

Major Benefits of usage-based insurance:

Attracting low-risk drivers

Enhancing customer loyalty

Reducing claims costs

Increasing the number of potential touch-points per year

Providing personalized, revenue-generating, value-added services to insurance plans to serve customer interests more effectively

The simplest form of usage-based insurance bases the insurance costs simply on distance driven. However, the general concept of pay as you drive includes any scheme where the insurance costs may depend not just on how much you drive but how, where, and when one drives

Inquire about this report at https://databridgemarketresearch.com/inquire-before-buying/?dbmr=europe-usage-based-insurance-market

Market Segmentation: Europe Usage Based Insurance Market

On the basis of package type, the market is segmented into pay-as-you-drive (PAYD), pay-how-you-drive (PHYD), and manage-how-you-drive (MHYD). In 2019, the pay-as-you-drive (PAYD), market is growing at the CAGR of 18.8% in the forecast period of 2019-2026.

In November 2015, Intelligent Mechatronic Systems (IMS) was awarded for excellence in the innovative. This award made Intelligent Mechatronic Systems (IMS) more popular.

On the basis of vehicle type, the market is segmented into light-duty vehicle (LDV) and heavy-duty vehicles (HDV). In 2018, light-duty vehicle (LDV) market is growing with the highest CAGR of 19.1% in the forecast period of 2019 to 2026.

In March 2016, TrueMotion has acquired The Canary Project. Due to this acquisition, company has application developer for developing telematics application

On the basis of device offering, the market is segmented into company provided and bringyour own device (BYOD). The company provided market is growing at the CAGR of 18.0% in the forecast period of 2019-2026.

In June 2018, Cambridge Mobile Telematics (CMT) was awarded as best auto digital insurance product award from TU-Automotive Detroi for DriveWell. This award made Cambridge Mobile Telematics (CMT) more popular which increases the overall income of the company

On the basis of technology, the market is segmented into OBD-II, smartphone, embedded system, black box and others. In 2018, embedded system market is growing with the highest CAGR of 19.2% in the forecast period of 2019 to 2026.

In August 2017, Cambridge Mobile Telematics (CMT) has launched powerful smartphone telematics program for commercial fleets. This launch has improved employee safety, reduce the number of accidents and claims and increase operational efficiency and performance.

On the basis of vehicle age, the market is segmented into new vehicles and on-road vehicles. In 2018, on-road vehicles market is growing with the highest CAGR of 19.0% in the forecast period of 2019 to 2026.

In September 2017, the company was awarded as the global pioneer in telematics insurance and champion for road safety by UK insurance sector This award made company more popular which further increases the overall sells

On the basis of electric and hybrid vehicle, the market is segmented into hybrid electric vehicle (HEV), plug-in hybrid vehicle (PHEV) and battery electric vehicle (BEV).In 2018 Battery Electric Vehicle (BEV) market is growing with the highest CAGR of 19.3% in the forecast period of 2019 to 2026.

In September 2017, the Progressive Company has introduced ELD Usage-Based Insurance Program for Commercial Truck Drivers. This launch extended the company’s service portfolio

Key Competitors: Europe Usage Based Insurance

Allianz, AXA, Progressive Insurance, Allstate, Allstate Canada, Desjardins, Generali, MAPFRE, Metromile, Aviva, Admiral Group Plc, Ageas Group, Octo Telematics, TomTom Telematics, Liberty Mutual Insurance, Intelligent Mechatronic Systems – IMS, Mitsui Sumitomo Insurance Co. (Europe) Ltd, Watchstone Group plc, Allianz Australia, Aviva Canada, Allianz Asia Pacific, AXA Insurance Company, AXA US, Aviva Asia, AXA Italia, AXA UK, Ageas UK, Liberty Mutual Insurance Europe Limited

Customization of the Report:

This report can be customized to meet the client’s requirements. Please connect with our sales team (sopan.gedam@databridgemarketresearch.com), who will ensure that you get a report that suits your needs.

About Data Bridge Market Research:

Data Bridge Market Research set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process.

Contact:

Data Bridge Market Research

Tel: +1-888-387-2818

Email: sopan.gedam@databridgemarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Europe Usage Based Insurance Market 2019 Trends and Review by Quantitative Analysis, Comprehensive Landscape and Future Growth by 2026 - key Players are Mitsui Sumitomo Insurance Co. (Europe) Ltd, AXA UK, Ageas UK, Liberty Mutual Insurance Europe Limited here

News-ID: 1715351 • Views: …

More Releases from Data Bridge Market Research

Scented Candle Market Shows Strong Growth Driven by Wellness and Home Décor Tr …

The global scented candle market is on track for significant expansion, increasing from an estimated USD 3.60 billion in 2024 to USD 6.00 billion by 2032, registering a strong CAGR of 6.60%. Rising consumer interest in home ambiance, wellness, and premium lifestyle products continues to drive market demand.

Get More Detail: https://www.databridgemarketresearch.com/reports/global-scented-candle-market

Market Growth Drivers

The scented candle market has evolved beyond being just a decorative item. Key growth factors include:

Home Fragrance &…

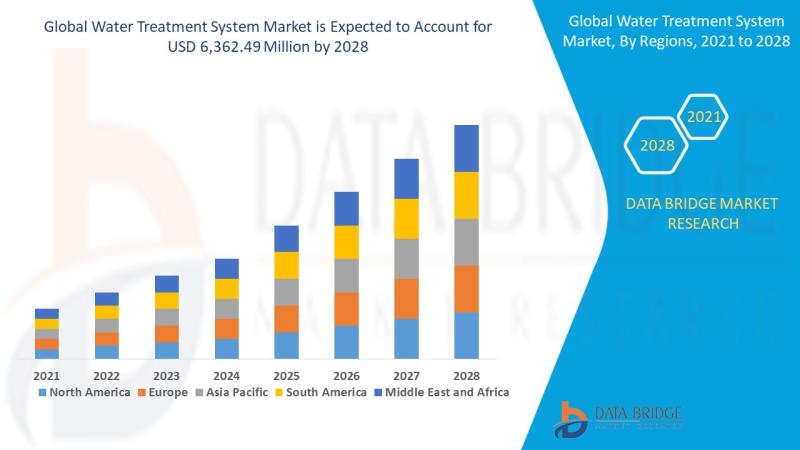

Water Treatment System Market: Sustaining the Future of Clean Water

Introduction

Understanding Water Treatment Systems

Water treatment systems are designed to purify and disinfect water for various uses-drinking, industrial processes, irrigation, and wastewater reuse. These systems eliminate contaminants such as bacteria, viruses, heavy metals, chemicals, and particulates, making water safe and sustainable for consumption and use.

Importance in Global Sustainability

Clean water is essential to life and industrial progress. With growing water demand and pollution, water treatment systems are now critical infrastructure across the…

Veterinary X-Ray Market Size, Analysis, Scope, Demand, Opportunities, Statistics

According to Data Bridge Market Research The global Veterinary X-Ray market size was valued at USD 915.19 million in 2024 and is projected to reach USD 1576.00 million by 2032, with a CAGR of 7.03 % during the forecast period of 2025 to 2032.

With increasing globalization and digital disruption, the Equine X-Ray Solutions Market is expanding across multiple industries, . Market research data indicates that businesses in the Companion Animal…

Veterinary X-Ray Market Size, Analysis, Scope, Demand, Opportunities, Statistics

According to Data Bridge Market Research The global Veterinary X-Ray market size was valued at USD 915.19 million in 2024 and is projected to reach USD 1576.00 million by 2032, with a CAGR of 7.03 % during the forecast period of 2025 to 2032.

With increasing globalization and digital disruption, the Equine X-Ray Solutions Market is expanding across multiple industries, . Market research data indicates that businesses in the Companion Animal…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…