Press release

Current and Future Scope of Risk Capital Investment Market with an impressive double-digit growth rate by 2023 | Global Key Players - Accel, Benchmark Capital, First Round Capital, Lowercase Capital, Sequoia Capital

This report provides in depth study of “Risk Capital Investment Market” using SWOT analysis i.e. Strength, Weakness, Opportunities and Threat to the organization. The Risk Capital Investment Market report also provides an in-depth survey of key players in the market organization.Global Risk Capital Investment Market Synopsis:

The Global “Risk Capital Investment Market” research 2019 highlights the major details and provides in-depth analysis of the market along with the future growth, prospects and Industry demands analysis explores with the help of complete report with 125 Pages, figures, graphs and table of contents to analyze the situations of global Risk Capital Investment Market and Assessment to 2023.

Get Sample Study Papers of “Global Risk Capital Investment Market” @ https://www.businessindustryreports.com/sample-request/148931 .

This report studies the Global Risk Capital Investment Market over the forecast period of 2019 to 2023. The Global Risk Capital Investment Market is expected to grow at an impressive Compound Annual Growth Rate (CAGR) from 2019 to 2023.

The Global Risk Capital Investment Market research report is the study prepared by analysts, which contain a detailed analysis of drivers, restraints, and opportunities along with their impact on the Risk Capital Investment Market growth (2019 - 2023).

Risk Capital Investment is a private or institutional investment made into early-stage / start-up companies (new ventures). As defined, ventures involve risk (having uncertain outcome) in the expectation of a sizeable gain. Venture Capital is money invested in businesses that are small; or exist only as an initiative, but have huge potential to grow. The people who invest this money are called venture capitalists (VCs). The venture capital investment is made when a venture capitalist buys shares of such a company and becomes a financial partner in the business.

Risk capital should be funds that are expendable in exchange for the opportunity to generate outsized gains. It is money that can afford to be lost. Investors must be willing to lose some or all of their risk capital. It should account for 10% or less of an investor's portfolio equity and should be offset with more stable diversified investments.

Risk capital is commonly utilized with speculative investments and activities. If the risk is more than proportionate to the reward, then risk capital may be considered. Investors and traders should try to accurately assess the risk prior to any investment or trade. Risk capital is often used for speculative investments in penny stocks, angel investing, lending, private equity, initial public offerings, real estate, day trading and swing trading of stocks, futures, options and commodities.

Risk Capital Investment Market Covers Table of Contents With Segments, Key Players And Region. On the Basis of Product Type, Risk Capital Investment Market is sub segmented into Early Stage Financing, Expansion Financing, Acquisition or Buyout Financing. Based on Industry, Market is sub segmented into High Technology Industries and Innovative Technology Company.

Key players profiled in the report include Accel, Benchmark Capital, First Round Capital, Lowercase Capital, Sequoia Capital, UNION SQUARE VENTURES, Andreessen Horowitz, Bessemer Venture Partners, Greylock Partners, Kleiner Perkins Caufield & Byers, Baseline Ventures, Breyer Capital, Founders Fund, Index Ventures, New Enterprise Associates.

Region segment: This report is segmented into several key regions, with sales, revenue, market share (%) and growth Rate (%) of Risk Capital Investment in these regions, from 2013 to 2023 (forecast), covering: North America, Europe, Asia Pacific, Middle East & Africa and South America.

Request a Discount on standard prices of this premium report @ https://www.businessindustryreports.com/check-discount/148931 .

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

Report contents include

1 Analysis of the Risk Capital Investment Market including revenues, future growth, market outlook

2 Historical data and forecast

3 Regional analysis including growth estimates

4 Analyzes the end user markets including growth estimates.

5 Profiles on Risk Capital Investment including products, sales/revenues, and market position

6 Market structure, market drivers and restraints.

About us

BusinessindustryReports.com is digital database of comprehensive market reports for global industries. As a market research company, we take pride in equipping our clients with insights and data that holds the power to truly make a difference to their business. Our mission is singular and well-defined – we want to help our clients envisage their business environment so that they are able to make informed, strategic and therefore successful decisions for themselves.

Media Contact

Business Industry Reports

Pune – India

sales@businessindustryreports.com

+19376349940

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Current and Future Scope of Risk Capital Investment Market with an impressive double-digit growth rate by 2023 | Global Key Players - Accel, Benchmark Capital, First Round Capital, Lowercase Capital, Sequoia Capital here

News-ID: 1712532 • Views: …

More Releases from Business Industry Reports

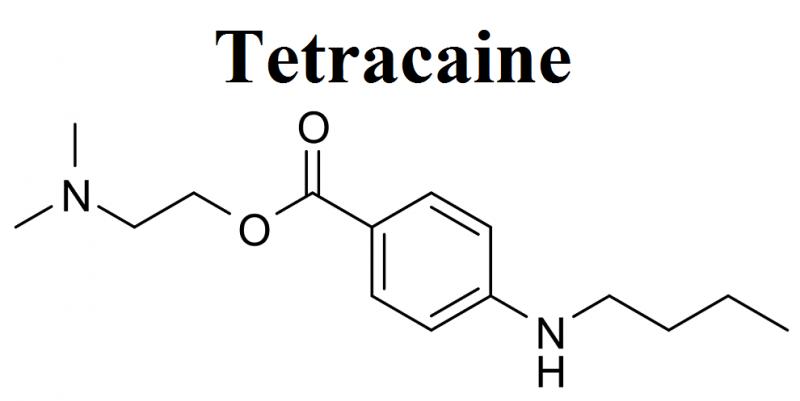

Tetracaine Market Exhibits a Lucrative Growth Potential during 2021-2025 | Endo …

BusinessIndustryReports has recently broadcasted a new study to its broad research portfolio, which is titled as “Global Tetracaine Market” Research Report 2021 provides an in-depth analysis of the Tetracaine with the forecast of market size and growth. The analysis includes addressable market, market by volume, market share by business type and by segment (external and in-house). The research study examines the Tetracaine on the basis of a number of criteria,…

Cyber Warfare Market Evenly Poised To Reach A Market Value of US$ By Share, Size …

Overview of Global Cyber Warfare Market:

This report provides in-depth study of “Global Cyber Warfare Market 2021” using SWOT analysis i.e. Strength, Weakness, Opportunities, and Threat to the organization. The Cyber Warfare Market report also provides an in-depth survey of key players in the market organization.

According to the market research study, the Cyber Warfare is virtual conflict between state, organization, or country by the use of computer technology to disrupt activities…

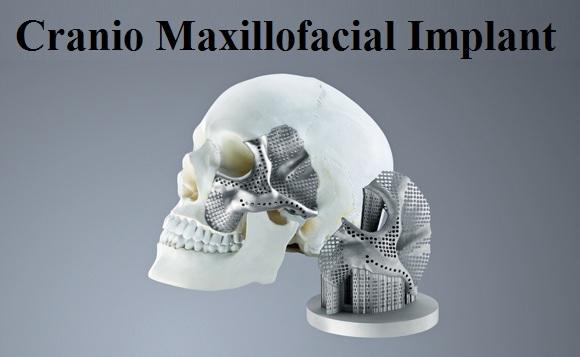

Covid-19 Impact on Cranio Maxillofacial Implant Market 2021-2025: Business Growt …

Overview of Global Cranio Maxillofacial Implant Market:

This report provides in-depth study of “Global Cranio Maxillofacial Implant Market 2021” using SWOT analysis i.e. Strength, Weakness, Opportunities, and Threat to the organization. The Cranio Maxillofacial Implant Market report also provides an in-depth survey of key players in the market organization.

According to the market research study, Craniomaxillofacial Implants are medical implants used in surgeries of maxillofacial region such as, head, face, neck, oral,…

Beginning of the bloom: The Rise of the Biohacking Market 2021-2025 | Global Key …

Global Biohacking Market Synopsis:

The report covers a forecast and an analysis of the Biohacking Market on a global and regional level. The study provides historical data for 2015, 2016, 2017 and 2018 along with a forecast from 2020 to 2025 based on revenue (USD Million) and volume (Kilotons). The study includes drivers and restraints of the Biohacking Market along with the impact they have on the demand over the forecast…

More Releases for Capital

Venture Capital Investment Market Is Booming Worldwide | Accel, Benchmark Cap …

Venture Capital Investment Market: The extensive research on Venture Capital Investment Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Venture Capital Investment Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the market, such as…

Venture Capital & Private Equity Firms Market is Going to Boom | TPG Capital, GG …

The latest independent research document on Venture Capital & Private Equity Firms examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Venture Capital & Private Equity Firms study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth,…

Venture Capital Investment Market 2021 Is Booming Worldwide | Accel, Benchmark C …

Venture Capital Investment Market describes an in-depth evaluation and Covid19 Outbreak study on the present and future state of the Venture Capital Investment market across the globe, including valuable facts and figures. Venture Capital Investment Market provides information regarding the emerging opportunities in the market & the market drivers, trends & upcoming technologies that will boost these growth trends. The report provides a comprehensive overview including Definitions, Scope, Application, Production…

Risk Capital Investment Market Business Development Strategies 2020-2026 by Majo …

Risk Capital Investment Market - Global Analysis is an expert compiled study which provides a holistic view of the market covering current trends and future scope with respect to product/service, the report also covers competitive analysis to understand the presence of key vendors in the companies by analyzing their product/services, key financial facts, details SWOT analysis and key development in last three years. Further chapter such as industry landscape and…

Global Venture Capital Investment Market, Top key players are Accel, Benchmark C …

Global Venture Capital Investment Market Report 2019 - History, Present and Future

The global market size of Venture Capital Investment is $XX million in 2018 with XX CAGR from 2014 to 2018, and it is expected to reach $XX million by the end of 2024 with a CAGR of XX% from 2019 to 2024.

Global Venture Capital Investment Market Report 2019 - Market Size, Share, Price, Trend and Forecast is a professional…

Venture Capital Investment Market 2019 Trending Technologies, Developments, Key …

Fintech solutions provide alternative finance firms with a platform for investors to directly come across companies and individuals looking for equity financing and debt. The technology has enabled new players to take faster decisions, engage with customers more precisely, and run operations at low cost-to-income ratios compared with traditional banks

This report studies the Venture Capital Investment market status and outlook of Global and major regions, from angles of players,…