Press release

Credit Insurance Market 2019: Highlights on Growth Opportunities with Top Players: AIG, Euler Hermes, Atradius, Coface, Zurich, Credendo, QBE | Forecast to 2023

Global Credit Insurance Market Report 2019 offers elaborated knowledge on the market parts like size, Key Regions, growth, trends, dominating firms, Major Manufactures. The Credit Insurance report introduces market competition situation among the vendors, revenue, product & services, latest developments and business strategies.Global Credit Insurance Market Overview:

According to market analysts, Global Credit Insurance Market is projected to grow at a high CAGR value from 2019 to 2023.

Sample Copy of “Global Credit Insurance Market” Report Available @ https://www.businessindustryreports.com/sample-request/133984 .

The Global Credit Insurance Market research report is the study prepared by analysts, which contain a detailed analysis of drivers, restraints, and opportunities along with their impact on the Credit Insurance Market growth.

Growth of the credit insurance market is primarily driven by two major factors, unstable macroeconomic factors that are influencing the growth of credit insurance, and improving sales & accounts receivable support benefits to accentuate the demand for credit insurance. Businesses are driven by increasing consumer expectations to stay competitive in the market, whereas the new entrants look to disrupt the traditional businesses and garner market share from incumbent players.

Credit insurance is an insurance policy and a risk management product offered by private insurance companies and governmental export credit agencies to business entities wishing to protect their accounts receivable from loss due to credit risks such as protracted default, insolvency or bankruptcy. Credit insurance product is a type of property and casualty insurance.

The Credit Insurance Market is segmented based on type, industry, and region. On the basis of type, the market is sub-segmented into P to P lending, Microfinance, and Trade credit. By industry, it is categorized into Domestic Trade, and Export Trade.

Regionally, China’s policy stimulus for credit insurance, the increased role for export credit insurance and the liberalized export credit market in conjunction with an increasing SME involvement, have been the primary driving factors for the credit insurance market in the Asia Pacific.

Some of the major key players functioning in the Credit Insurance Market Report includes: AIG, Euler Hermes, Atradius, Coface, Zurich, Credendo Group, QBE Insurance, CESCE, China Export & Credit Insurance Corporation, ECGC Limited, Lloyds Banking Group, XL Group, Sompo Holdings, VHV Group, Zurich Insurance Group.

Grab Your Report at an Impressive Discount @ https://www.businessindustryreports.com/check-discount/133984 .

Key Regions:

1 North America Country (United States, Canada)

2 South America

3 Asia Country (China, Japan, India, Korea)

4 Europe Country (Germany, UK, France, Italy)

5 Other Country (Middle East, Africa, GCC)

The report offers clear guidelines for players to cement a position of strength in the global Credit Insurance market. It prepares them to face future challenges and take advantage of lucrative opportunities by providing a broad analysis of market conditions. It also helps them to set new business goals with changes in customer preferences, customer needs, and the vendor landscape of the global Credit Insurance market.

Points Covered in in table of contents: Market Definition, Market Overview, Business Introduction, Segmentation (Region Level), Segmentation (Type Level), Segmentation (Industry Level), Segmentation (Channel Level), Market Forecast Year, Segmentation Type, Segmentation Industry, Market Cost Analysis, and Conclusion.

About us:

BusinessindustryReports.com is digital database of comprehensive market reports for global industries. As a market research company, we take pride in equipping our clients with insights and data that holds the power to truly make a difference to their business. Our mission is singular and well-defined – we want to help our clients envisage their business environment so that they are able to make informed, strategic and therefore successful decisions for themselves.

Media Contact

Business Industry Reports

Pune – India

sales@businessindustryreports.com

+19376349940

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Credit Insurance Market 2019: Highlights on Growth Opportunities with Top Players: AIG, Euler Hermes, Atradius, Coface, Zurich, Credendo, QBE | Forecast to 2023 here

News-ID: 1710794 • Views: …

More Releases from Business Industry Reports

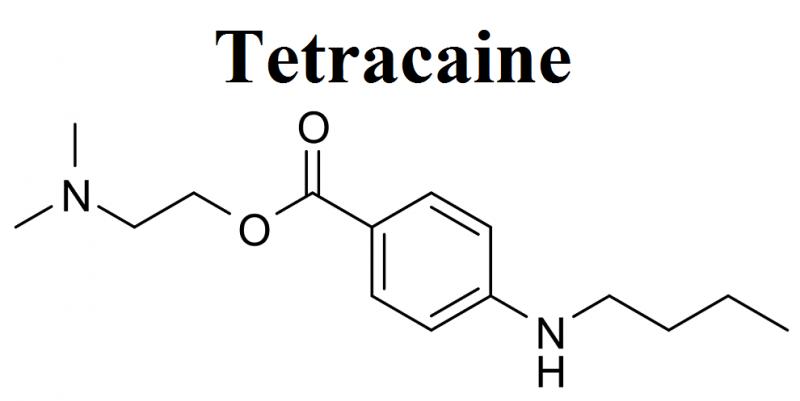

Tetracaine Market Exhibits a Lucrative Growth Potential during 2021-2025 | Endo …

BusinessIndustryReports has recently broadcasted a new study to its broad research portfolio, which is titled as “Global Tetracaine Market” Research Report 2021 provides an in-depth analysis of the Tetracaine with the forecast of market size and growth. The analysis includes addressable market, market by volume, market share by business type and by segment (external and in-house). The research study examines the Tetracaine on the basis of a number of criteria,…

Cyber Warfare Market Evenly Poised To Reach A Market Value of US$ By Share, Size …

Overview of Global Cyber Warfare Market:

This report provides in-depth study of “Global Cyber Warfare Market 2021” using SWOT analysis i.e. Strength, Weakness, Opportunities, and Threat to the organization. The Cyber Warfare Market report also provides an in-depth survey of key players in the market organization.

According to the market research study, the Cyber Warfare is virtual conflict between state, organization, or country by the use of computer technology to disrupt activities…

Covid-19 Impact on Cranio Maxillofacial Implant Market 2021-2025: Business Growt …

Overview of Global Cranio Maxillofacial Implant Market:

This report provides in-depth study of “Global Cranio Maxillofacial Implant Market 2021” using SWOT analysis i.e. Strength, Weakness, Opportunities, and Threat to the organization. The Cranio Maxillofacial Implant Market report also provides an in-depth survey of key players in the market organization.

According to the market research study, Craniomaxillofacial Implants are medical implants used in surgeries of maxillofacial region such as, head, face, neck, oral,…

Beginning of the bloom: The Rise of the Biohacking Market 2021-2025 | Global Key …

Global Biohacking Market Synopsis:

The report covers a forecast and an analysis of the Biohacking Market on a global and regional level. The study provides historical data for 2015, 2016, 2017 and 2018 along with a forecast from 2020 to 2025 based on revenue (USD Million) and volume (Kilotons). The study includes drivers and restraints of the Biohacking Market along with the impact they have on the demand over the forecast…

More Releases for Credit

Credit Scores, Credit Reports & Credit Check Services Market Set for Explosive G …

Global Credit Scores, Credit Reports & Credit Check Services Market Report from AMA Research highlights deep analysis on market characteristics, sizing, estimates and growth by segmentation, regional breakdowns & country along with competitive landscape, player's market shares, and strategies that are key in the market. The exploration provides a 360° view and insights, highlighting major outcomes of the industry. These insights help the business decision-makers to formulate better business plans…

Credit Repair Service Market Size in 2023 To 2029 | AMB Credit Consultants, Cred …

The Credit Repair Service market report provides a comprehensive analysis of the market-driving factors, major obstacles, and restraining factors that can impede market growth during the forecast period. This information can be particularly useful for existing manufacturers and start-ups as they develop strategies to overcome challenges and capitalize on lucrative opportunities. The report also offers detailed information about prime end-users and annual forecasts during the estimated period. This can help…

Credit Scores, Credit Reports & Credit Check Services Market is Going to Boom | …

Latest Study on Industrial Growth of Global Credit Scores, Credit Reports & Credit Check Services Market 2022-2028. A detailed study accumulated to offer Latest insights about acute features of the Credit Scores, Credit Reports & Credit Check Services market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market,…

Credit Scores, Credit Reports and Credit Check Services Market is Booming Worldw …

Credit Scores, Credit Reports and Credit Check Services Market - Global Outlook and Forecast 2022-2028 is the latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities, and leveraging with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the Credit Scores, Credit Reports and Credit Check Services Market. Some of…

Credit Scores, Credit Reports & Credit Check Services Market is Booming With Str …

The latest study released on the Global Credit Scores, Credit Reports & Credit Check Services Market by AMA Research evaluates market size, trend, and forecast to 2027. The Credit Scores, Credit Reports & Credit Check Services market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends,…

Credit Scores, Credit Reports & Credit Check Services Market May See Big Move | …

Global Credit Scores, Credit Reports & Credit Check Services Market Report 2020 by Key Players, Types, Applications, Countries, Market Size, Forecast to 2026 (Based on 2020 COVID-19 Worldwide Spread) is latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities and leveraged with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure…