Press release

Surety Market to Witness an Outstanding Growth by 2027 - Lead by IFIC Surety Group, Crum & Forster, CNA Financia, American Financial Group, AmTrust Financial Services, The Travelers Indemnity Company, Liberty Mutual Insurance Company and Hartford Financia

Worldwide Surety Market Analysis to 2027 is a specialized and in-depth study of the Surety Industry with a focus on the global market trend. The report aims to provide an overview of global Surety Market with detailed market segmentation by product/application and geography. The global Surety Market is expected to witness high growth during the forecast period. The report provides key statistics on the Market status of the Surety players and offers key trends and opportunities in the market.Surety market accounted for US$ 15.33 Bn in 2018 and is expected to grow at a CAGR of 7.5% over the forecast period 2019–2027, to account for US$ 28.77 Bn in 2027.

Surety Bonds are obtained by principal parties to protect third parties from a failure to meet contractual obligations. There are four main types of bonds that serve the different purpose namely: contract surety bond, commercial surety bond, fidelity surety bond, and court surety bond. The most common surety bonds are the commercial and contract surety bond and serve the purpose of protecting the public and private interests.

The court and fidelity surety bonds protect against the litigation and theft. Surety bonds of all types cost a premium based on the performance of the business and credit score of the business owner, which is between 1-15% of the bond value.

Get Sample PDF Brochure of this research @ https://bit.ly/2CIVGOV

Top Dominating Key Players:

1. AmTrust Financial Services, Inc.

2. Crum & Forster

3. CNA Financial Corporation

4. American Financial Group, Inc.

5. The Travelers Indemnity Company

6. Liberty Mutual Insurance Company

7. Hartford Financial Services Group, Inc.

8. HCC Insurance Holdings

9. IFIC Surety Group

10. Chubb Limited

The global surety market for the bond type is fragmented into Contract Surety Bond, Commercial Surety Bond, Fidelity Surety Bond, and Court Surety Bond. Commercial Bonds are general surety bonds that are required by various government agencies state local or federal. Commercial bonds are primarily used by companies or working professionals as per state licensing and permit regulations. Commercial bonds are easy to qualify as they incur low-risk. Commercial bonds protect the general public from that interact with the principal being licensed.

The claim is made by someone who faced losses due to the violation of rules and regulations by the bonded principal. The agency checks various parameters before fixing the bond amount such as the number of employees, number of physical locations, and the type of business. Usually, the commercial bonds are annual bonds that are to be renewed every year in some cases bonds are also required for multi-year increments like service tax bond.

Further, surety market is expected to experience significant growth in the coming years due to the increasing demand of commercial bonds. The commercial bonds are gaining popularity in the markets of North America and Europe. Commercial bonds are replacing LOC as they provide a better method for risk management. Some of the big insurance like Crum & Forster, CAN Insurance Group, American Financial Group, Inc., and The Travelers Indemnity Company has a strong focus in providing commercial surety products.

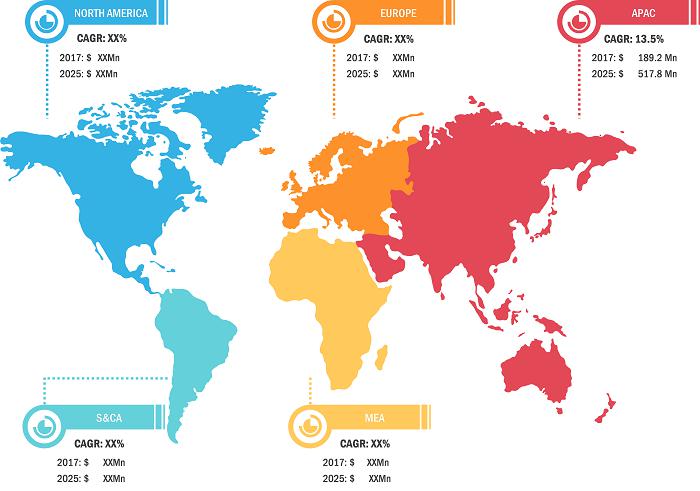

The report focuses on an in-depth segmentation of the Surety market based on bond type. The geographic segmentation of the report covers five major regions including; North Americas, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA) and South America (SA).

Browse market data tables and in-depth TOC of the Global Surety Market (2019–2027)

The report segments the Global Surety Market as follows:

Global Surety Market – By Bond Type

• Contract Surety Bond

• Commercial Surety Bond

• Fidelity Surety Bond

• Court Surety Bond

Enquiry for Discount @ https://bit.ly/2G16yKR

What our report offers:

• Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the Global Surety Market.

• Highlights key business priorities in order to assist companies to realign their business strategies.

• The key findings and recommendations highlight crucial progressive industry trends in the Surety, thereby allowing players to develop effective long term strategies.

• Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

• Scrutinize in-depth global market trends and outlook coupled with the factors driving the market, as well as those hindering it.

• Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to products, segmentation and industry verticals.

About Us:

The Insight Partners is a one stop industry research provider of actionable intelligence. We help our clients in getting solutions to their research requirements through our syndicated and consulting research services. We are a specialist in Technology, Healthcare, Manufacturing, Automotive and Defense.

Contact Us:

The Insight partners,

Phone: +1-646-491-9876

Email: sales@theinsightpartners.com

Website: www.theinsightpartners.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Surety Market to Witness an Outstanding Growth by 2027 - Lead by IFIC Surety Group, Crum & Forster, CNA Financia, American Financial Group, AmTrust Financial Services, The Travelers Indemnity Company, Liberty Mutual Insurance Company and Hartford Financia here

News-ID: 1709948 • Views: …

More Releases from The Insight Partners

Plastic Healthcare Packaging Market Expands with Advancements in Smart and Susta …

The Plastic Healthcare Packaging Market is projected to experience steady expansion from 2026 to 2034, with market valuation growing from its 2025 baseline and continuing through the end of the forecast period. This positive outlook is driven by evolving healthcare industry requirements, increasing demand for safe and reliable packaging, and continuous technological advancements in materials and design.

Download PDF Sample: https://www.theinsightpartners.com/sample/TIPRE00017624/?utm_source=OpenPR&utm_medium=10914

The report categorizes the market by Industry (Medical Device, Pharmaceutical) and…

Rising Security and Autonomous Vehicle Adoption Driving Digital Radar Market Gro …

The Digital Radar Market is projected to witness strong growth during the forecast period, with the market size expanding from US$ XX million in 2024 to US$ XX Million by 2031.

The report is segmented by Type (Active and Passive), Dimension (2D, 3D and 4D), Application (Safety, Security and Surveillance), and Vertical (Automotive, Aerospace, Military and Defense). The global analysis is further broken down at the regional level and across major…

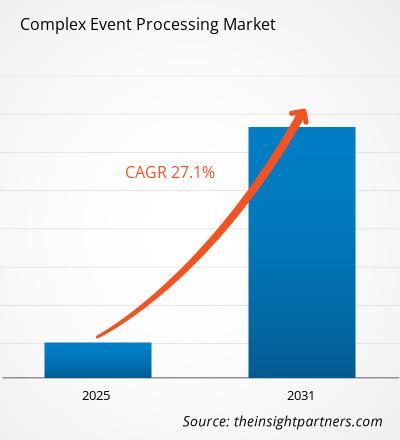

Real-Time Analytics Driving Strong Growth in the Complex Event Processing Market

The report is segmented by Deployment Mode (Cloud, On-Premise); Service Type (Consulting, Installation and Maintenance, Training and Support, Managed Services); Application (Algorithmic Trading, Electronic Transaction Monitoring, Dynamic Pre-Trade Analytics, Data Enrichment, Fraud Detection, Governance, Risk and Compliance, Asset Management and Predictive Scheduling, Geo-fencing and Geospatial Analysis, Others).

The global analysis is further broken down at the regional level and across major countries. The report offers the market value in USD for…

![A Complete Guide to Air Purification Industry [PDF E-Book]](https://cdn.open-pr.com/L/1/L115168461_g.jpg)

A Complete Guide to Air Purification Industry [PDF E-Book]

The increase in airborne diseases owing to the rise in air pollution is a key factor attributed to the market's growth. Furthermore, growing awareness among the consumer about using air purifiers, a rise in disposable income, and an improved standard of living are the prominent factors boosting the market growth. The growing trend toward adopting portable and smart air purifiers is further propelling the market dynamics over the forecast period.…

More Releases for Surety

Growth Of Digital Payment Services Driving Expansion In The Surety Market: A Key …

The Surety Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Current Surety Market Size and Its Estimated Growth Rate?

The surety market has seen strong growth in recent years. It will grow from $19.62 billion in 2024 to $21 billion in 2025 at…

Top Factor Driving Surety Market Growth in 2025: Growth Of Digital Payment Servi …

Which drivers are expected to have the greatest impact on the over the surety market's growth?

The growing use of digital payment services is expected to fuel the growth of the surety market. Digital payments, facilitated by smartphones and enhanced security features, are transforming how people transact. Surety services provide financial guarantees for businesses, ensuring reliability and protection against risks like fraud or service disruptions. According to the Ministry of Electronics…

Surety Bond Market Future Business Opportunities 2022-2030 | HUB International L …

Global "Surety Bond Market" to grow with an impressive CAGR over the forecast period from 2022-2030. The report on Surety Bond offers the customers with a comprehensive analysis of vital driving factors, customer behavior, growth trends, product application, key player analysis, brand position and price patterns. The statistics on estimating patterns is obtained by studying product prices of key players as well as emerging market players. Additionally, Surety Bond market…

Surety Market Opportunities and Forecast Assessment till 2027

According to a recent research study added to the document repository of ResearchMoz, the Global Surety Market is likely to garner the valuation of XX Mn/Bn at the end of forecast period 2021–2027. Further, the assessment report notes that the market for Surety will expand at extensive CAGR of XX% throughout assessment period.

Surety Market: Overview

Growth avenues, drivers, restraints, demand–supply ratio, and challenges are some of the key factors presented in the new…

Surety Market- Industry Research Report by DeepResearchReport

DeepResearchReports has uploaded a latest report on Surety Industry from its research database. Surety Market is segmented by Regions/Countries. All the key market aspects that influence the Surety Market currently and will have an impact on it have been assessed and propounded in the Surety Market research status and development trends reviewed in the new report.

The new tactics of Surety Industry report offers a comprehensive market breakdown on…

Contract surety bond holding nearly half of the surety market share

The global surety market at US$ 15.33 Bn in 2018 and is expected to grow at a CAGR of 7.5% during the forecast period 2019 – 2027, to account to US$ 28.77 Bn by 2027.

The Surety market penetration rates in North America region is higher than any other markets across the globe. This is attributed to most of U.S. State governments’ laws that mandate surety bonds. Both the U.S. and…