Press release

Investment Banking Market 2019 Analysis By Top Key Players | Barclays , JP Morgan , Goldman Sachs , Bank Of America Merrill Lynch , Morgan Stanley

Global Investment Banking Market 2019 report provides key information about the industry, including invaluable facts and figures, expert opinions, and the latest developments across the globe. The Report also calculate the market size, the report considers the revenue generated from the sales of This Report and technologies by various application segments.The investment banking market comprises establishments primarily engaged in undergoing capital risk in the process of underwriting securities. This market excludes companies acting as agents and/or brokers between buyers and sellers of securities and commodities. These establishments primarily involve in underwriting, originating, and/or maintaining markets for issue of securities.

Download Sample PDF copy of this report: https://supplydemandmarketresearch.com/home/contact/119488?ref=Sample-and-Brochure&toccode=SDMRSE119488&utm_source=ss

Investment banks across the globe are moving towards businesses requiring less regulatory capital. In this regard, major investment banks from around the world such as Barclays, Deutsche Bank and Credit Suisse have announced their plans to move from traditional underwriting business to other activities such as mergers and acquisitions advisory and fundraising.

The key players covered in this study

• Barclays

• JP Morgan

• Goldman Sachs

• Bank Of America Merrill Lynch

• Morgan Stanley

• Deutsche Bank

• Credit Suisse

Market segment by Type, the product can be split into

• Mergers And Acquisitions Advisory

• Debt Capital Markets Underwriting

• Equity Capital Markets Underwriting

• Financial Sponsor/ Syndicated Loans

Market segment by Application, split into

• Bank

• Investment Banking Companies

• Securities Company

How helpful this report will be?

Current estimation of the market

User consumption on the basis of geographical divisions

Top and mid level manufacturers

Revenue generation based on production

User application

Sales volume of products

Market segment by Regions/Countries, this report covers

• United States

• Europe

• China

• Japan

• Southeast Asia

• India

• Central & South America

Enquire before purchase@: https://supplydemandmarketresearch.com/home/purchase?code=SDMRSE119488

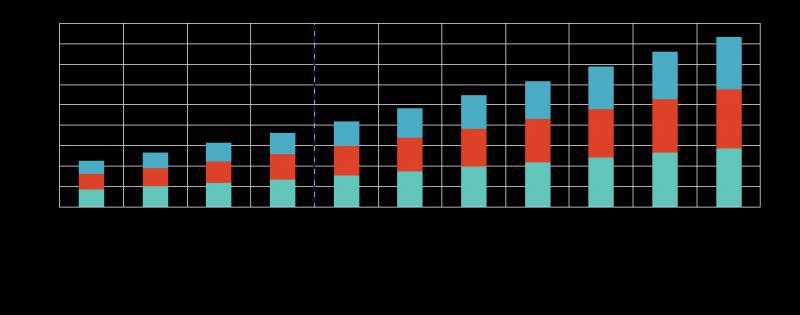

In this study, the years considered to estimate the market size of Investment Banking are as follows:

History Year: 2014-2018

Base Year: 2018

Estimated Year: 2019

Forecast Year 2019 to 2025

For the data information by region, company, type and application, 2018 is considered as the base year. Whenever data information was unavailable for the base year, the prior year has been considered.

Table of contents:

12 International Players Profiles

12.1 Barclays

12.1.1 Barclays Company Details

12.1.2 Company Description and Business Overview

12.1.3 Investment Banking Introduction

12.1.4 Barclays Revenue in Investment Banking Business (2014-2019)

12.1.5 Barclays Recent Development

12.2 JP Morgan

12.2.1 JP Morgan Company Details

12.2.2 Company Description and Business Overview

12.2.3 Investment Banking Introduction

12.2.4 JP Morgan Revenue in Investment Banking Business (2014-2019)

12.2.5 JP Morgan Recent Development

12.3 Goldman Sachs

12.3.1 Goldman Sachs Company Details

12.3.2 Company Description and Business Overview

12.3.3 Investment Banking Introduction

12.3.4 Goldman Sachs Revenue in Investment Banking Business (2014-2019)

12.3.5 Goldman Sachs Recent Development

12.4 Bank Of America Merrill Lynch

12.4.1 Bank Of America Merrill Lynch Company Details

12.4.2 Company Description and Business Overview

12.4.3 Investment Banking Introduction

12.4.4 Bank Of America Merrill Lynch Revenue in Investment Banking Business (2014-2019)

12.4.5 Bank Of America Merrill Lynch Recent Development

12.5 Morgan Stanley

12.5.1 Morgan Stanley Company Details

12.5.2 Company Description and Business Overview

12.5.3 Investment Banking Introduction

12.5.4 Morgan Stanley Revenue in Investment Banking Business (2014-2019)

12.5.5 Morgan Stanley Recent Development

12.6 Deutsche Bank

12.6.1 Deutsche Bank Company Details

12.6.2 Company Description and Business Overview

12.6.3 Investment Banking Introduction

12.6.4 Deutsche Bank Revenue in Investment Banking Business (2014-2019)

12.6.5 Deutsche Bank Recent Development

12.7 Credit Suisse

12.7.1 Credit Suisse Company Details

12.7.2 Company Description and Business Overview

12.7.3 Investment Banking Introduction

12.7.4 Credit Suisse Revenue in Investment Banking Business (2014-2019)

12.7.5 Credit Suisse Recent Development

TOC continued…!

About us

We have a strong network of high powered and experienced global consultants who have about 10+ years of experience in the specific industry to deliver quality research and analysis.

Having such an experienced network, our services not only cater to the client who wants the basic reference of market numbers and related high growth areas in the demand side, but also we provide detailed and granular information using which the client can definitely plan the strategies with respect to both supply and demand side.

Canada Office:

302-20 Misssisauga Valley Blvd, Missisauga, L5A 3S1, Toronto

Contact Us

Email- info@supplydemandmarketresearch.com

Website-http://www.supplydemandmarketresearch.com/

Phone Number: +1-276-477-5910

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Investment Banking Market 2019 Analysis By Top Key Players | Barclays , JP Morgan , Goldman Sachs , Bank Of America Merrill Lynch , Morgan Stanley here

News-ID: 1707818 • Views: …

More Releases from Supply Demand Market Research

Germany Waste Heat Recovery Systems is anticipated to reach USD 2150 Million by …

The Germany Waste Heat Recovery Systems (WHRS) is anticipated to reach USD 2150 million by 2030 growing at a CAGR of 5.7% from 2024-2030. Continued expansion post-2026 aligns with Germany's decarbonization trajectory, as operators increasingly prioritize heat-recovery to reduce fuel consumption and comply with tightening carbon-intensity expectations.

By technology, the exchange waste heat recovery boilers market size is anticipated to reach USD 710 million by 2030. Exchange/WH Boilers and SRC (Steam…

South Korea Flounder Market Anticipated to grow at a CAGR of 8% from 2023-2030

The South Korea flounder is anticipated to grow at a CAGR% of 8.0% from 2022-2030. The factors contributing towards the high growth are flounders such as halibut and turbot high-protein and low-calorie food, helps to re-solve the nutritional imbalance from diet because of its rich minerals, carbohydrates and vitamins despite low-calorie. They also offer medical benefits as liver of halibut contains lots of vitamin B1 and B2, which is effective…

Global Flounder Market Anticipated to reach USD 56 Billion by 2030

The global flounder market is anticipated to reach USD 56 Billion by 2030, growing at a CAGR% of 8.0% from 2022-2030. The factors contributing towards the high growth are flounders such as halibut and turbot high-protein and low-calorie food, helps to re-solve the nutritional imbalance from diet because of its rich minerals, carbohydrates and vitamins despite low-calorie. They also offer medical benefits as liver of halibut contains lots of vitamin…

Global Seafood Market Anticipated to reach USD 730 Billion by 2030

The global seafood market is anticipated to reach USD 730 Billion by 2030, growing at a CAGR% of 8.9% from 2022-2030. The factors contributing towards the high growth are increased disposable income, awareness of fish being used as an ingredient in healthy food is growing. USA the government plans to sanction illegal fishing activities, actively promote fair trade, and promote strategies to promote the fishing industry through detailed strategies such…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…