Press release

Business Strategy of Shadow Banking Market in Global Industry 2019 to 2023 |Analysis by Top Key Vendors - Barclays, Bank of America Merrill Lynch, HSBC, Credit Suisse, Citibank, Deutsche Bank

The exclusive research report on the Global Shadow Banking Market 2019 examines the market in detail along with focusing on significant market dynamics for the key players operating in the market. Global Shadow Banking Industry research report offers granulated yet in-depth analysis of revenue share, market segments, revenue estimates and various regions across the globe.Global Shadow Banking Market Overview:

The report spread across 125 pages is an overview of the Global Shadow Banking Market Report 2019. The Global Shadow Banking Market is projected to grow at a healthy growth rate from 2019 to 2023 according to new research. The study focuses on market trends, leading players, supply chain trends, technological innovations, key developments, and future strategies.

This report studies the Global Shadow Banking Market over the forecast period of 2019 to 2023. The Global Shadow Banking Market is expected to grow at an impressive Compound Annual Growth Rate (CAGR) from 2019 to 2023.

Available Exclusive Sample Copy of this Report @ https://www.businessindustryreports.com/sample-request/147111 .

According to the market research report, Shadow Banking is the group of financial intermediaries facilitating the creation of credit across the global financial system but whose members are not subject to regulatory oversight. Shadow banking also refers to unregulated activities by regulated institutions. Examples of intermediaries not subject to regulation include hedge funds, unlisted derivatives and other unlisted instruments, while examples of unregulated activities by regulated institutions include credit default swaps.

The Global Shadow Banking Market is segmented on the basis of Type, Application and Region. On the basis of Application, the Global Shadow Banking Market is sub-segmented into Banks, Finance, and others.

Industry News:

Barclays (12 April 2019) – Jes Staley opens new Per Scholas site in New Jersey – Barclays Connect with Work programme partner Per Scholas – a nationwide US non-profit organisation that helps people in overlooked communities to overcome the ‘’systemic roadblocks” to careers in technology – opened its doors to a new facility in Newark earlier this week. We report on the launch.

Barclays Group CEO Jes Staley was in Newark, New Jersey, on Tuesday to open a new branch of Per Scholas – the nationwide US non-profit that helps people in overlooked communities to access careers in technology.

Using standard analytical tools such as SWOT analysis, the report presents the strengths, weakness, opportunities, and threats of the market until the end of the forecast period in 2023. The report also covers an analysis impact of macro and micro factors on the growth of the market, which is essential for existing market players as well as new entities that are interested in participating in the market. Thus, the report analysis helps in formulating informed business decisions by receiving detailed insights into the development of the key market segments.

Purchase this report online with 125 Pages, List of Tables & Figures and in-depth Table of Contents on “Global Shadow Banking Market Report 2019” @ https://www.businessindustryreports.com/buy-now/147111/single .

Top Leading Key Manufacturers are: Bank of America Merrill Lynch, Barclays, HSBC, Credit Suisse, Citibank, Deutsche Bank, Goldman Sachs, Morgan Stanley and others. New product launches and continuous technological innovations are the key strategies adopted by the major players.

Region segment: This report is segmented into several key regions, with sales, revenue, market share (%) and growth Rate (%) of Shadow Banking in these regions, from 2013 to 2023 (forecast), covering: North America, Europe, Asia Pacific, Middle East & Africa and South America

With the presence of a large pool of participants, the Global Shadow Banking Market is displaying a highly competitive business landscape, finds a new research report by Business Industry Reports (BIR). Bank of America Merrill Lynch, Barclays, HSBC, Credit Suisse, Citibank, Deutsche Bank, Goldman Sachs, Morgan Stanley, etc. are some of the key vendors of Shadow Banking across the world. These players across Shadow Banking Market are focusing aggressively on innovation, as well as on including advanced technologies in their existing products.

Grab Your Report at an Impressive Discount @ https://www.businessindustryreports.com/check-discount/147111 .

Major Points in Table of Contents:

Global Shadow Banking Market Report 2019

1 Shadow Banking Definition

2 Global Shadow Banking Market Major Player Share and Market Overview

2.1 Global Major Player Shadow Banking Business Revenue

2.2 Global Shadow Banking Market Overview

3 Major Player Shadow Banking Business Introduction

3.1 Bank of America Merrill Lynch Shadow Banking Business Introduction

3.1.1 Bank of America Merrill Lynch Shadow Banking Revenue, Growth Rate and Gross profit 2014-2018

3.1.2 Bank of America Merrill Lynch Shadow Banking Business Distribution by Region

3.1.3 Bank of America Merrill Lynch Interview Record

3.1.4 Bank of America Merrill Lynch Shadow Banking Business Profile

3.1.5 Bank of America Merrill Lynch Shadow Banking Specification

3.2 Barclays Shadow Banking Business Introduction

………………. Request free sample to get a complete Table of Content

About us

BusinessindustryReports.com is digital database of comprehensive market reports for global industries. As a market research company, we take pride in equipping our clients with insights and data that holds the power to truly make a difference to their business. Our mission is singular and well-defined – we want to help our clients envisage their business environment so that they are able to make informed, strategic and therefore successful decisions for themselves.

Media Contact

Business Industry Reports

Pune – India

sales@businessindustryreports.com

+19376349940

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Business Strategy of Shadow Banking Market in Global Industry 2019 to 2023 |Analysis by Top Key Vendors - Barclays, Bank of America Merrill Lynch, HSBC, Credit Suisse, Citibank, Deutsche Bank here

News-ID: 1703720 • Views: …

More Releases from Business Industry Reports

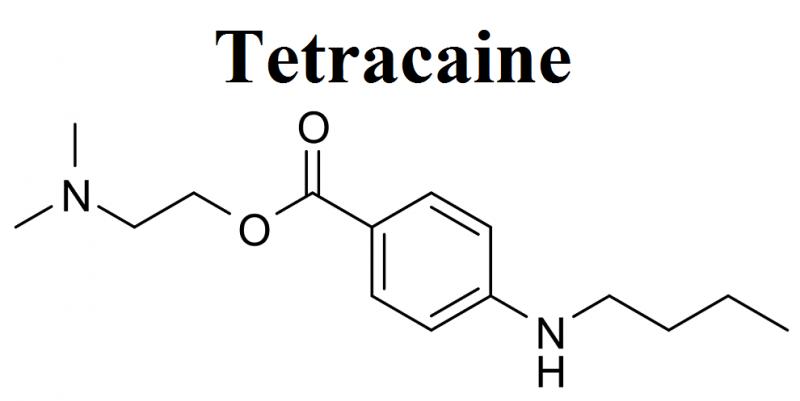

Tetracaine Market Exhibits a Lucrative Growth Potential during 2021-2025 | Endo …

BusinessIndustryReports has recently broadcasted a new study to its broad research portfolio, which is titled as “Global Tetracaine Market” Research Report 2021 provides an in-depth analysis of the Tetracaine with the forecast of market size and growth. The analysis includes addressable market, market by volume, market share by business type and by segment (external and in-house). The research study examines the Tetracaine on the basis of a number of criteria,…

Cyber Warfare Market Evenly Poised To Reach A Market Value of US$ By Share, Size …

Overview of Global Cyber Warfare Market:

This report provides in-depth study of “Global Cyber Warfare Market 2021” using SWOT analysis i.e. Strength, Weakness, Opportunities, and Threat to the organization. The Cyber Warfare Market report also provides an in-depth survey of key players in the market organization.

According to the market research study, the Cyber Warfare is virtual conflict between state, organization, or country by the use of computer technology to disrupt activities…

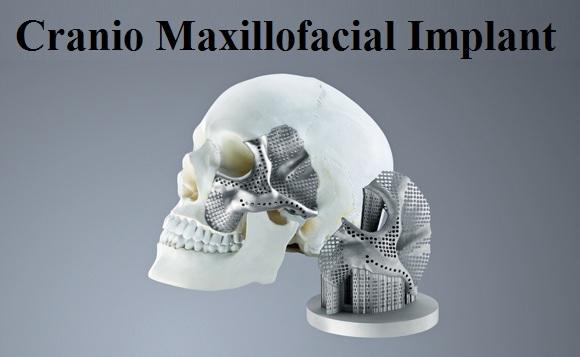

Covid-19 Impact on Cranio Maxillofacial Implant Market 2021-2025: Business Growt …

Overview of Global Cranio Maxillofacial Implant Market:

This report provides in-depth study of “Global Cranio Maxillofacial Implant Market 2021” using SWOT analysis i.e. Strength, Weakness, Opportunities, and Threat to the organization. The Cranio Maxillofacial Implant Market report also provides an in-depth survey of key players in the market organization.

According to the market research study, Craniomaxillofacial Implants are medical implants used in surgeries of maxillofacial region such as, head, face, neck, oral,…

Beginning of the bloom: The Rise of the Biohacking Market 2021-2025 | Global Key …

Global Biohacking Market Synopsis:

The report covers a forecast and an analysis of the Biohacking Market on a global and regional level. The study provides historical data for 2015, 2016, 2017 and 2018 along with a forecast from 2020 to 2025 based on revenue (USD Million) and volume (Kilotons). The study includes drivers and restraints of the Biohacking Market along with the impact they have on the demand over the forecast…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…