Press release

Global Enterprise Asset Management Software Market to Grow at a CAGR of +14% During Forecast Period 2019-2025 Including Top Vendors Like IFS AB, Oracle Corporation, SAP SE, IBM, ABB Ltd, CGI Group

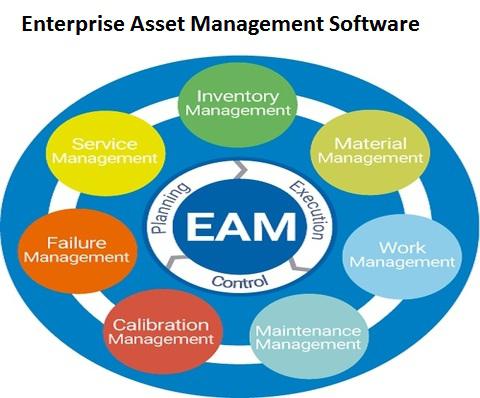

The global enterprise asset management software market which was represented a CAGR of approximately +14% in the midst of the estimate time span of 2019-2025.Enterprise Asset Management Software is a computer software that handles every aspect of running a public works or asset-intensive organization. Enterprise asset management (EAM) software applications include features such as asset life-cycle management, preventive maintenance scheduling, warranty management, integrated mobile wireless handheld options and portal-based software interface. Rapid development and availability of mobile devices also affected EAM software which now often supports Mobile enterprise asset management.

Request A Sample Copy Of Report: Click Here https://www.reportconsultant.com/request_sample.php?id=27620

The report titled, Global Enterprise Asset Management Software Market presents the current scenario of the industry also the factors that are anticipated to impact the futuristic growth is also presented through our in-depth analysis. The overall market growth and revenue generated in the year 2019 is portrayed along with the evaluation of the state of the market by 2025. It also offers quantitative and qualitative analysis of every feature of the market and catches the emerging industry trends. The aim of the Global Enterprise Asset Management Software Market report is to allow the readers to concentrate on the classifications on the basis of product qualifications, standing competitive landscape and the market's incomes with profitability.

Top Key Players:

IFS AB, Oracle Corporation, SAP SE, IBM (International Business Machines) Corporation, ABB Ltd, CGI Group Inc., Schneider Electric, Infor, Vesta Partners LLC, Emaint, Ramco Systems, Dude Solutions Inc.

Segment By Regions/Countries, This Enterprise Asset Management Software Market Report Covers

• United States

• Europe

• China

• Japan

• Southeast Asia

• India

Geographically, the Global Enterprise Asset Management Software Market report discovers the possibility of the extraordinary market development in the regions of North America, Europe, and Southeast Asia as well as in the countries of China, Japan, and India. Currently, North America and Europe serve the maximum claim for the market and are anticipated to have the largest market share of the Global Enterprise Asset Management Software Market during the forecast period, however, emerging economies such as India and China are estimated to turn in to highly profitable country-wide markets in the coming years. These two Asia-Pacific countries are tremendously populated and are among the most talented emerging economies with increasing disposable income in the metropolitan population.

Ask For Discount@ https://www.reportconsultant.com/ask_for_discount.php?id=27620

To understand the competitive landscape of industrialists, the Global

Enterprise Asset Management Software Market Report is crafted based on market share, volume, manufactures, and the average price of some of the leading businesses in 2018 and 2019. It also classifies the top three and top five manufacturers as of 2019 and studies their current planned choices such as fusions and procurements and extension plans. For each of these corporations, the Global Enterprise Asset Management Software Market report appreciates their engineering base, participants, product type, presentation and specification, pricing, and gross margin. For each of the region and country-wide markets, the report discovers the production capability, price, and gross margin, taking historical data from 2019 until 2025.

Enterprise Asset Management Software Market Segment By Type

• Linear Assets

• Non-Linear Assets

• Field Service Management (FSM)

• Assets Maintenance, Repair, and Operations (MRO)

Enterprise Asset Management Software Market Segment By Application, Split Into

• Government

• Oil and Gas

• Healthcare

• Transportation and Logistics

• Manufacturing

• Energy and Utilities

• Others

In This Study, The Years Considered To Estimate The Market Size Of Enterprise Asset Management Software Are As Follows:

• History Year: 2015-2018

• Base Year: 2018

• Estimated Year: 2019

• Forecast Year 2019 to 2025

For More Information: Click Here https://www.reportconsultant.com/enquiry_before_buying.php?id=27620

Table Of Content:

The Global Enterprise Asset Management Software Market Report Contains:

1. Global market overview

2. Global market competition by manufacturers, type and application

3. USA/China/Japan/Europe/India and Southeast Asia are the regional analysis of enterprise asset management software (volume, value and sales price)

4. Analysis of global market by manufacturer

5. Enterprise asset management software manufacturing cost analysis

6. Industrial chain, sourcing strategy and downstream buyers

7. Marketing strategy analysis, distributors/traders

8. Market effect factors analysis

9. Global market forecast (2019-2025)

10. Conclusion of the global enterprise asset management software market

11. Appendix

About Us:

Report Consultant - A worldwide pacesetter in analytics, research and advisory that can assist you to renovate your business and modify your approach. With us, you will learn to take decisions intrepidly by taking calculative risks leading to lucrative businesses in the ever-changing market. We make sense of drawbacks, opportunities, circumstances, estimations and information using our experienced skills and verified methodologies.

Our research reports will give you the most realistic and incomparable experience of revolutionary market solutions. We have effectively steered businesses all over the world through our market research reports with our predictive nature and are exceptionally positioned to lead digital transformations. Thus, we craft greater value for clients by presenting progressive opportunities in the global futuristic market.

Contact us:

Rebecca Parker

(Report Consultant)

Akasaka biz tower,

5-3-1 akasaka minato-ku,

Tokyo, Japan

Contact No: +81-368444299

sales@reportconsultant.com

www.reportconsultant.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Enterprise Asset Management Software Market to Grow at a CAGR of +14% During Forecast Period 2019-2025 Including Top Vendors Like IFS AB, Oracle Corporation, SAP SE, IBM, ABB Ltd, CGI Group here

News-ID: 1697853 • Views: …

More Releases from Report Consultant

Biopsy Needle Market- Increasing Demand with Industry Professionals: Ethicon End …

A new market study report by Report Consultant on the Biopsy Needle Market has been released with reliable information and accurate forecasts for a better understanding of the current and future market scenarios. The report offers an in-depth analysis of the global market, including qualitative and quantitative insights, historical data, and estimated projections about the market size and share in the forecast period. The forecasts mentioned in the report have…

Serverless Architecture Market Giants Spending Is Going to Boom With Alibaba Gro …

Global Serverless Architecture Market is a latest research study released by Report Consultant evaluating the market risk side analysis, highlighting opportunities and leveraged with strategic and tactical decision-making support. The report provides crucial statistics on the market status of the leading Serverless Architecture market players and offers information on market trends and development, growth drivers, technologies, and the changing investment structure of the Global Serverless Architecture Market. The report uses…

Remittance Market Growth, Developments Analysis and Precise Outlook 2023 to 2030 …

Global Remittance Market Research Report initially provides a basic overview of the industry that covers definition, applications and technology, post which the report explores into the international players in the market. The report profiles the key players in the industry, along with a detailed analysis of their individual positions against the global landscape. The study conducts SWOT analysis to evaluate strengths and weaknesses of the key players in the market.…

Consumer IoT Market 2023 is Booming Globally with Top Key Players- Cisco Systems …

Global Consumer IoT Market Report is a compilation of comprehensive research studies on various aspects of the Consumer IoT Market. With accurate data and highly authentic information, it makes a brilliant attempt to provide a real, transparent picture of current and future situations of the global Consumer IoT Market. Market participants can use this powerful tool when creating effective business plans or making important changes to their strategies. The report…

More Releases for Asset

Klydex Global Inc Expands Asset Coverage with New Multi-Asset Listing Framework

The new listing structure accelerates asset onboarding and improves market diversification.

Colorado, United States, 1st Dec 2025 - Klydex Global, Inc introduced an expanded multi-asset listing framework that accelerates the onboarding of high-quality digital assets. The new structure enhances screening procedures, technical integration, and market-readiness evaluation to support global asset diversification.

Klydex Global, Inc announced the launch of its enhanced multi-asset listing framework, representing a significant step toward diversifying asset choices for…

Asset Performance Management Market Is Driven By Asset Performance Management In …

Asset Performance Management (APM) has emerged as a critical solution for industries aiming to enhance the performance, reliability, and efficiency of their assets. APM systems utilize data analytics, predictive maintenance, and monitoring technologies to optimize asset performance, minimize downtime, and maximize operational efficiency. The global Asset Performance Management market is characterized by key drivers and notable trends that are reshaping how industries manage and maintain their critical assets.

Download Free PDF…

Asset Management Software

In today's dynamic business landscape, efficient asset management is more critical than ever. Sunsmart Asset Management Software is designed to empower organizations of all sizes and industries to streamline their asset-related processes, enhance control, and maximize the value of their assets.

Key Features and Benefits:

Comprehensive Asset Tracking: Our software provides a centralized platform to track and manage assets, offering real-time visibility into asset location, condition, and history, reducing the risk of…

Asset Evaluation Service Market 2023-2030 Comprehensive Research Study and Stron …

Infinity Business Insights published a new research publication on Asset Evaluation Service Market Insights, to 2030 with 113+ pages and enriched with self-explained Tables and charts in presentable format. The worldwide Asset Evaluation Service market is expected to grow at a booming CAGR during 2023-2030. It also shows the importance of the Asset Evaluation Service market main players in the sector, including their business overviews, financial summaries, and SWOT assessments.

The…

Big Boom in Asset Recovery Software Market 2020-2027 |HPE , Terrapin Systems , C …

According to a report on Asset Recovery Software Market, recently added to the vast repository of Research N Reports, the global market is likely to gain significant impetus in the near future. The report, titled “Global Asset Recovery Software Market Research Report 2020,” further explains the major drivers manipulating industry, the possibility of development, and the challenges going up against the administrations and industrialists in the market. This research study…

Crypto Asset Management Market | Digital Asset Custody Company, Crypto Finance A …

Global Crypto Asset Management Market: Snapshot

The demand within the global market for crypto asset management has been rising on account of advancements in the field of crypto currency. The past years have been an era of advancements in the global digital industry and have paved way for several new technologies. In this stampede of digital transformations, crypto currency has emerged as a matter of discussion and recourse. Hence, the global…