Press release

Surety Market at a CAGR of 7.5% between 2019 and 2027 - IFIC Surety Group, Crum & Forster, CNA Financia, American Financial Group, AmTrust Financial Services, The Travelers Indemnity Company, Liberty Mutual Insurance Company, Hartford Financial Serv

The Insight Partner's dedicated research and analysis team consist of experienced professionals with advanced statistical expertise and offer various customization options in the existing study.Surety Market to 2027 – Global Analysis and Forecast by Bond Type. In terms of revenue, the global Surety market accounted for US$ 15.33 Bn in 2018 and is expected to grow at a CAGR of 7.5% over the forecast period 2019–2027, to account for US$ 28.77 Bn in 2027.

Surety Bonds are obtained by principal parties to protect third parties from a failure to meet contractual obligations. There are four main types of bonds that serve the different purpose namely: contract surety bond, commercial surety bond, fidelity surety bond, and court surety bond. The most common surety bonds are the commercial and contract surety bond and serve the purpose of protecting the public and private interests. The court and fidelity surety bonds protect against the litigation and theft. Surety bonds of all types cost a premium based on the performance of the business and credit score of the business owner, which is between 1-15% of the bond value.

Get Sample PDF Brochure of this research @ https://bit.ly/2CIVGOV

Top Leading Market Players:

1. AmTrust Financial Services, Inc.

2. Crum & Forster

3. CNA Financial Corporation

4. American Financial Group, Inc.

5. The Travelers Indemnity Company

6. Liberty Mutual Insurance Company

7. Hartford Financial Services Group, Inc.

8. HCC Insurance Holdings

9. IFIC Surety Group

10. Chubb Limited

The global surety market for the bond type is fragmented into Contract Surety Bond, Commercial Surety Bond, Fidelity Surety Bond, and Court Surety Bond. Commercial Bonds are general surety bonds that are required by various government agencies state local or federal. Commercial bonds are primarily used by companies or working professionals as per state licensing and permit regulations. Commercial bonds are easy to qualify as they incur low-risk. Commercial bonds protect the general public from that interact with the principal being licensed.

The claim is made by someone who faced losses due to the violation of rules and regulations by the bonded principal. The agency checks various parameters before fixing the bond amount such as the number of employees, number of physical locations, and the type of business. Usually, the commercial bonds are annual bonds that are to be renewed every year in some cases bonds are also required for multi-year increments like service tax bond.

Further, surety market is expected to experience significant growth in the coming years due to the increasing demand of commercial bonds. The commercial bonds are gaining popularity in the markets of North America and Europe. Commercial bonds are replacing LOC as they provide a better method for risk management. Some of the big insurance like Crum & Forster, CAN Insurance Group, American Financial Group, Inc., and The Travelers Indemnity Company has a strong focus in providing commercial surety products.

Enquiry for Discount @ http://bit.ly/2G16yKR

The report focuses on an in-depth segmentation of the Surety market based on bond type. The geographic segmentation of the report covers five major regions including; North Americas, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA) and South America (SA).

The Surety Market report is a combination of qualitative as well as quantitative analysis which can be broken down into 40% and 60% respectively. Market estimation and forecasts are presented in the report for the overall global market from 2019 – 2027, considering 2019 as the base year and 2019 – 2027 forecast period. Global estimation is further broken down by segments and geographies such as North America, Europe, Asia-Pacific, Middle East & Africa and South America covering major 18 countries across the mentioned regions. The qualitative contents for geographical analysis will cover market trends in each region and country which includes highlights of the key players operating in the respective region/country, PEST analysis of each region which includes political, economic, social and technological factors influencing the growth of the market.

Browse market data tables and in-depth TOC of the Global Surety Market (2019–2027)

The report segments the Global Surety Market as follows:

Global Surety Market – By Bond Type

• Contract Surety Bond

• Commercial Surety Bond

• Fidelity Surety Bond

• Court Surety Bond

Request for Buy Report @ https://bit.ly/2FXvzY0

What our report offers:

• Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the Global Surety Market.

• Highlights key business priorities in order to assist companies to realign their business strategies.

• The key findings and recommendations highlight crucial progressive industry trends in the Surety, thereby allowing players to develop effective long term strategies.

• Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

• Scrutinize in-depth global market trends and outlook coupled with the factors driving the market, as well as those hindering it.

• Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to products, segmentation and industry verticals.

About Us:

The Insight Partners is a one stop industry research provider of actionable intelligence. We help our clients in getting solutions to their research requirements through our syndicated and consulting research services. We are a specialist in Technology, Healthcare, Manufacturing, Automotive and Defense.

Contact Us:

The Insight partners,

Phone: +1-646-491-9876

Email: sales@theinsightpartners.com

Website: www.theinsightpartners.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Surety Market at a CAGR of 7.5% between 2019 and 2027 - IFIC Surety Group, Crum & Forster, CNA Financia, American Financial Group, AmTrust Financial Services, The Travelers Indemnity Company, Liberty Mutual Insurance Company, Hartford Financial Serv here

News-ID: 1691146 • Views: …

More Releases from The Insight Partners

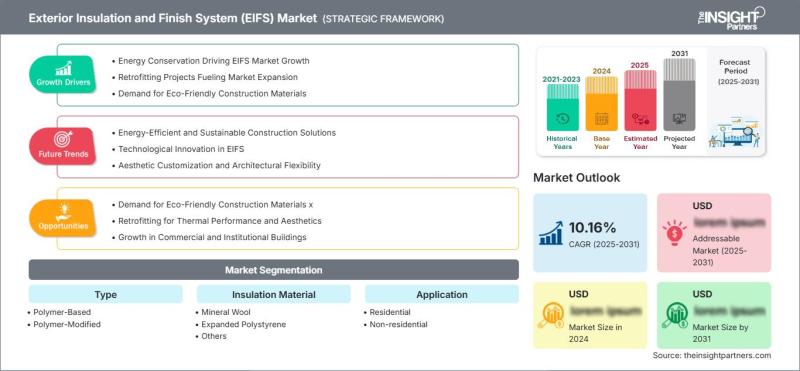

Exterior Insulation and Finish System (EIFS) Market: Key Drivers, Trends, and Op …

The Exterior Insulation and Finish System (EIFS) market continues to gain momentum as builders and homeowners prioritize energy-saving building solutions that also enhance visual appeal. Recent developments highlight a shift toward sustainable materials and innovative applications, drawing from ongoing construction demands worldwide.

The Exterior Insulation and Finish System (EIFS) Market is expected to register a CAGR of 10.16% from 2025 to 2031.

Download PDF Sample Copy @ https://www.theinsightpartners.com/sample/TIPRE00007470/?utm_source=OpenPR&utm_medium=10813

Key Drivers

Growing focus on energy…

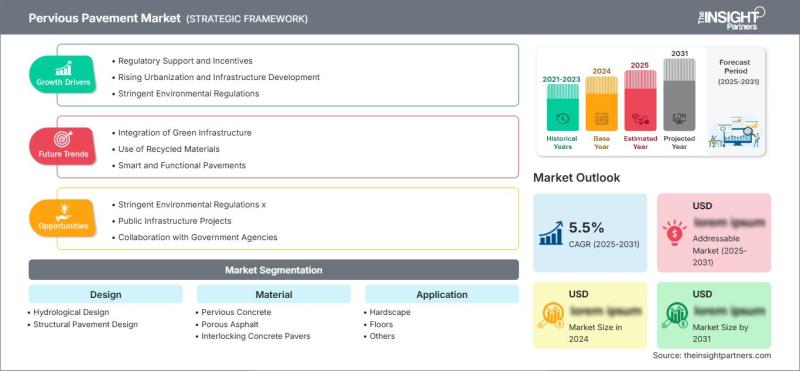

Pervious Pavement Market Size, Share, Drivers and Trends by Forecast by 2031

The pervious pavement market continues to gain momentum as cities worldwide prioritize sustainable infrastructure solutions that address stormwater challenges effectively. This innovative paving approach allows water to infiltrate through surfaces, supporting environmental goals in urban development.

The Pervious Pavement Market is expected to register a CAGR of 5.5% from 2025 to 2031.

Download PDF Sample Copy @ https://www.theinsightpartners.com/sample/TIPRE00008435/?utm_source=OpenPR&utm_medium=10813

Key Market Drivers

Growing concerns over stormwater runoff in densely populated areas drive demand for pervious…

Marine Engines Market Continues Steady Expansion Amid Global Trade Surge

The Marine Engines Market size is expected to reach US$ 14.73 billion by 2031. The market is anticipated to register a CAGR of 3.8% during 2025-2031.

Download PDF Sample Copy @ https://www.theinsightpartners.com/sample/TIPRE00004338/?utm_source=OpenPR&utm_medium=10813

Key Market Drivers

Rising global trade activities fuel demand for reliable propulsion in cargo vessels, container ships, and tankers, boosted by e-commerce growth and logistics needs. Advances in ship design, including automation, digital tools like 3D printing, and lighter materials, enhance…

Tunable Lasers Market Poised for Significant Growth Amid Rising Demand for Preci …

The tunable lasers market size is projected to reach US$ 32.49 billion by 2031 from US$ 15.89 billion in 2023. The market is expected to register a CAGR of 9.3% during 2023-2031, the industry is witnessing a surge in demand for versatile and high-performance laser solutions.

Get the sample request - https://www.theinsightpartners.com/sample/TIPRE00008783?utmsource=Openpr&utm_medium=10865

Market Overview

Tunable lasers are optical devices that allow for the adjustment of their output wavelength, providing flexibility for a wide…

More Releases for Surety

Growth Of Digital Payment Services Driving Expansion In The Surety Market: A Key …

The Surety Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Current Surety Market Size and Its Estimated Growth Rate?

The surety market has seen strong growth in recent years. It will grow from $19.62 billion in 2024 to $21 billion in 2025 at…

Top Factor Driving Surety Market Growth in 2025: Growth Of Digital Payment Servi …

Which drivers are expected to have the greatest impact on the over the surety market's growth?

The growing use of digital payment services is expected to fuel the growth of the surety market. Digital payments, facilitated by smartphones and enhanced security features, are transforming how people transact. Surety services provide financial guarantees for businesses, ensuring reliability and protection against risks like fraud or service disruptions. According to the Ministry of Electronics…

Surety Bond Market Future Business Opportunities 2022-2030 | HUB International L …

Global "Surety Bond Market" to grow with an impressive CAGR over the forecast period from 2022-2030. The report on Surety Bond offers the customers with a comprehensive analysis of vital driving factors, customer behavior, growth trends, product application, key player analysis, brand position and price patterns. The statistics on estimating patterns is obtained by studying product prices of key players as well as emerging market players. Additionally, Surety Bond market…

Surety Market Opportunities and Forecast Assessment till 2027

According to a recent research study added to the document repository of ResearchMoz, the Global Surety Market is likely to garner the valuation of XX Mn/Bn at the end of forecast period 2021–2027. Further, the assessment report notes that the market for Surety will expand at extensive CAGR of XX% throughout assessment period.

Surety Market: Overview

Growth avenues, drivers, restraints, demand–supply ratio, and challenges are some of the key factors presented in the new…

Surety Market- Industry Research Report by DeepResearchReport

DeepResearchReports has uploaded a latest report on Surety Industry from its research database. Surety Market is segmented by Regions/Countries. All the key market aspects that influence the Surety Market currently and will have an impact on it have been assessed and propounded in the Surety Market research status and development trends reviewed in the new report.

The new tactics of Surety Industry report offers a comprehensive market breakdown on…

Contract surety bond holding nearly half of the surety market share

The global surety market at US$ 15.33 Bn in 2018 and is expected to grow at a CAGR of 7.5% during the forecast period 2019 – 2027, to account to US$ 28.77 Bn by 2027.

The Surety market penetration rates in North America region is higher than any other markets across the globe. This is attributed to most of U.S. State governments’ laws that mandate surety bonds. Both the U.S. and…