Press release

TradeFinex Launches An Updated Website Supporting Financial Instruments

The TradeFinex (https://www.tradefinex.org/) website has recently undergone some significant changes. The redesigned site highlights; achieving liquidity and interoperability of financial instruments as the main objective. With the updated TradeFinex site, the entities can mitigate counter-party risks by making their digital bonds and invoices; liquid and interoperable.Digital Bonds

Based on XinFin Hybrid Blockchain, TradeFinex will simplify and streamline the entire corporate bond lifecycle. TradeFinex will create a global bond standard by connecting traditional bond market with digital bond technology. Built-in KYC/AML regulations and standard features like profile creation for both organization and individual; makes TradeFinex, a real-life bond creation, and exchange platform. A blockchain-powered platform, TradeFinex is fully secure and transparent and will always avoid the risk of single point of failure for its users. Not only will it make creating, managing, and liquidating bond instruments seamlessly easy but will also enable hassle-free automatic, instant, and efficient bond settlements for its users. Another major benefit would be the enhancement of secondary market liquidity by bringing brokers, dealers, and licensed entities on one single platform.

Interested institutions looking to conduct a PoC, please click at https://www.tradefinex.org/publicv/bond_create.

Explore more about Digital Bonds at https://www.tradefinex.org/publicv/digital_bond.

Invoices

TradeFinex leverages the power of blockchain to help users get more financing options to their unpaid invoices. InFactor is a platform for factoring trade instruments, mainly invoices. Designed on a global framework, XDC-I11 messaging and transaction ISO20022 standard using XinFin Hybrid Blockchain technology, InFactor (http://infactor.io/) will convert unpaid invoices to instant cash. Built-in XDC Wallet and smart contracts will make invoice factoring easier, transparent, and secure for its users. Open ‘plug-and-play’ API access will enable easy and fast integration allowing users to create interoperable platforms and get access to a wider financial ecosystem. The underlying smart contracts will facilitate automatic repayment and settlement of invoices. Hence, companies receive cash instantly, customers live by friendly payment terms and investors earn profits in the form of factoring fees.

Interested institutions looking to conduct a PoC, please click at https://docs.xinfin.org/docs/dapp/infactor.io/conduct-a-poc.

Read more about Invoice Factoring/InFactor at https://www.tradefinex.org/publicv/infactor.

Coming Soon on The TradeFinex Site

R3 Corda Bridge

Another counter-party risk mitigation feature pending release on the TradeFinex website is R3 Corda Bridge. TradeFinex will enable users to connect R3 Corda Bridge State with Public Network by deploying Corda smart contracts to XinFin Network smart contracts using a relayer bridge. R3 Corda and XinFin Bridge connectivity will facilitate atomic swap which will completely revolutionize the money transfer system in the crypto world.

Explore more about R3 Corda Bridge at https://www.tradefinex.org/publicv/corda_bridge .

The TradeFinex Consortium

The TradeFinex team has initiated a consortium with open invitations to address peer-to-peer trade finance and asset tokenization of real-world assets. TradeFinex invites Global Public Investors (GPIs), regulators, fintech companies, and financial & government institutions to be a part of the ecosystem who will introduce the right financial instruments, their standardization and will closely work with regulators for holistic business development.

To be a part of this change as a consortium founding member, please click at https://www.tradefinex.org/publicv/consortium.

Click at http://events.tradefinex.org/ to know more about the consortium event scheduled in June this year.

Click at https://www.linkedin.com/groups/10436249/ to know more about the TradeFinex LinkedIn Group. Membership with invitation only.

About XinFin

XinFin is an open source enterprise-ready Hybrid Blockchain for Global Trade and Finance. It combines the power of Public and Private Blockchains with interoperable smart contracts. XinFin is fully EVM compatible. For more information on XinFin, please visit www.xinfin.org or learn more about XinFin in this video https://www.youtube.com/watch?v=K-tHZkV6zAs.

Interested Institutions looking to setup KYC enforced Masternodes (TestNet), please click at https://www.xinfin.org/setup-masternode.php.

Follow XinFin on: Twitter: ( @ ) XinFin_Official

LinkedIn: https://www.linkedin.com/company/xinfin/

Telegram:https://t.me/xinfintalk

#3-37, Block 30,

Temasek Poly Launchpad-SIT,

29B Tampines Ave 1

Singapore 528694

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release TradeFinex Launches An Updated Website Supporting Financial Instruments here

News-ID: 1684630 • Views: …

More Releases from XinFin Fintech Pte. Ltd.

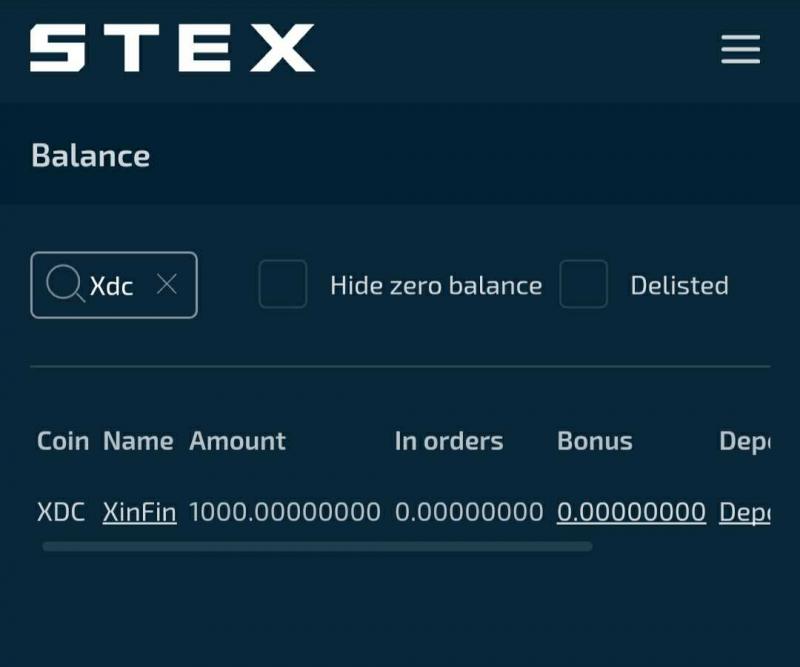

XinFin's Native Coin XDC to List on STEX.

XinFin is excited to announce that the XinFin mainnet chain has been listed on an Estonia licensed exchange STEX.com. XDC was initially listed on AlphaEx.net, where it is paired with BTC, ETH, XRP, USDT, USDC and 1:1 swappable with XDCE. STEX is the second exchange to list XinFin mainnet native coin XDC.

STEX is a centralized exchange (CEX) launched in September 2017. It is a licensed exchange located in Tallinn, Estonia…

XinFin Blockchain Network and Trace Financial team up to provide counterparty ri …

Trace Financial, a leading financial messaging and integration provider for major global financial institutions and an integration partner for SWIFT MT-MX messages has signed a partnership agreement with the XinFin Network through its Abu Dhabi Global Markets (ADGM) Sandbox Entity.

As a part of this partnership, TradeFinex Tech Ltd. will offer Trace Financial’s flagship product, Transformer, through XinFin Network Masternodes. Transformer performs financial message mappings using any format including financial standards…

XinFin Partners With AiX, A Leading AI Trading Platform Backed By Major Regulate …

XinFin Network, an open source enterprise-friendly hybrid blockchain platform has partnered with London-based AiX, a leading AI Trading Platform backed by a FINRA-registered Wall Street Brokerage Firm. AiX has a team of experienced inter-dealer brokers holding FINRA Series 7, 63, 55 and 24 designations in the US in addition to FCA registrations in the UK.

As a part of this partnership, XinFin will extend its platform and technology to AiX for…

XinFin Releases New Address Prefix Starting With XDC

XinFin today announced the new address prefix starting with XDC. With this implementation, XinFin Network will become distinguishable from other platforms which are also based on go-ethereum codebase. Developer team at XinFin performed a major change in Ethereum Virtual Machine to achieve the unique XDC address prefix. Developer team also changed the various libraries used for dApp.

Based on Delegated Proof of State Consensus algorithm https://www.xinfin.org/xinfin-consensus.php and go-ethereum codebase https://medium.com/xinfin/xinfin-joins-the-enterprise-ethereum-alliance-a49224324fe8, XinFin…

More Releases for Trade

Trade Intelligence for Global Trade: Benchmarking Competitors with Verified Trad …

In the modern supply chain battlefield, knowledge is not just power-it's leverage. Understanding how your competitors move in the global trade space can make the difference between a strategic win and a costly misstep. Yet, many companies still rely on fragmented or outdated information, missing out on key shifts that trade intelligence platforms can now uncover easily.

The Blind Spot in Traditional Competitive Research

Traditional competitor analysis typically relies on market reports,…

Decoding Chongqing's Cross-Border Trade through the Yumaotong Smart Trade Platfo …

Since its launch on May 13, the New Western International Land - Sea Corridor - Yumaotong Smart Trade Platform (hereinafter referred to as the 'Yumaotong Smart Trade Platform') has welcomed 420 enterprises, including over 100 foreign companies. At the 7th Western China International Fair held in Chongqing on May 22, Deng Ai, head of the platform, said that it offered global businesses a one-stop, full-chain, professional service from capturing trade…

Trade Show Displays: Maximizing Your Trade Show Booth Design

Trade shows are a critical aspect of any business that wants to showcase its products, services, and brand to potential customers, partners, and investors. Trade show displays are one of the most crucial elements in trade show marketing, and they play a significant role in determining the success of a company's presence at a trade show. In this article, we'll explore the different types of displays for trade shows and…

The future of international trade and worldwide network: Global Trade Plaza

The future of international trade and worldwide network: Global Trade Plaza

A radical change to support continuous growth in supply traffic.

Connecting all manufacturers, suppliers, traders, exporters, and importers.

Open the door to the future of safe international trade.

B2B marketplace Global Trade Plaza wants to redefine the supply chain. The growth due to digitalization has touched multiple fields, but couldn't do much for the intercountry supply. We are here with…

US-China trade war shifting cement seaborne trade flows

In 2018, the total number of active cement carriers surpassed 360 units, with the total dead weight tonnage topping 2.7 million, the highest figure recorded since 2010.

According to CW Research’s 2019 update of the World Cement, Clinker & Slag Sea-Based Trade Report, the upward trend was underpinned by a growing demand for cement carriers in key domestic trade markets.

Specialized cement carriers move about 25 million tons of cement per…

Suisse Trade – Holding Trade Seminar in Tokyo in December 2016

Suisse Trade is a full-fledged Forex trading firm that is renowned worldwide for rendering clients with the best assistance in commodity and Forex based trading. The company has been consistently successful in presenting clients with the most formidable instruments to trade in currency and commodities markets. The tasks undertaken by the company also involve spot and cash trades, limited risk options on futures as well as contracts. It has always…