Press release

Polish cosmetics buyers‘ preferences – findings of a survey

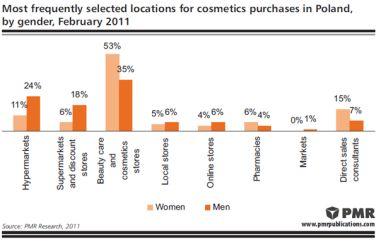

Women choose specialist channels rather than general grocery stores when purchasing cosmetics and are more likely to shop specifically for cosmetics. Men, on the other hand, more often buy such items along with the large weekly shopping for the household. These are some of the findings of a consumer survey included in the latest PMR report “Retail market of cosmetics in Poland 2011. Market analysis and development forecasts for 2011–2013”.The main shopping locations for cosmetics purchases indicated by our respondents are specialist beauty care and cosmetics stores. The development of this category over the past few years has shown that consumers, and female customers in particular, are increasingly inclined to buy more expensive products, to expect a wide range of lines, and, most of all, to expect assistance from staff, which means that the hypermarket offer is no longer adequate. As a result, specialist cosmetics and beauty care stores are becoming more prevalent on the market. A significant factor is their convenient locations (in shopping centres and main streets). In small towns, where there are no supermarkets, a cosmetics store is often the only place at which to buy such products.

According to those we surveyed, 53% of all cosmetics shopping is carried out by women at beauty care and cosmetics stores, and a further 15% with the assistance of cosmetic company consultants. This means that for female respondents shopping for cosmetics is carried out by means of a specialist distribution channel. The situation is different among male consumers. Despite the fact 35% of all shopping done by men takes place at beauty care and cosmetics stores, 42% is done at general grocery stores: hypermarkets (24%) or supermarkets and discount stores (18%). This pattern of shopping locations confirms the theory, verified in other PMR research projects, that men more often than women buy their cosmetics as part of larger purchases: for example, the weekly shopping for the entire household. Women are more likely to buy such products independently, or while doing other shopping at shopping centres. The pattern is also related to the nature of the products – women buy more specialist, and more expensive, cosmetics which are simply not available at general grocery stores.

Among the beauty care and cosmetics stores, the most frequently indicated brands were the Rossmann, Drogerie Natura, Sephora and Super-Pharm chains. Tesco, Real and Carrefour were the most favoured hypermarkets, and Biedronka and Lidl the most popular discount stores.

Selection criteria for shopping locations

The most frequently cited factor pertaining to the choice of store categories in spontaneous responses was the convenience of the location (35% of all indications). Convenient location encompasses ideas such as comfort, proximity, easy reach and easy parking. Another choice criterion was price (22% of indications). Approximately 20% of responses referred to a wide selection of lines. The final factor which exceeded the 10% threshold was product quality (12%), followed by the store brand (5%) and promotional offers (4%).

Preferred methods of promotion

Both men and women opt mainly for the possibility of buying two products for the

price of one. This form of promotional offer was cited by 38% of female and 42% of male respondents. The choice of the “two-for-one” offer is associated with a strong preference for products from a favourite brand. The next most popular form of promotion was reduced price, with 27% and 25% of women and men respectively. Larger containers prompted a similar response among men (23%), but were appreciated less by women (18%). The least popular form was a free gift with a purchase, indicated as a favourite by only 17% of women and 11% of men.

PMR www.pmrcorporate.com is a British-American company providing market information, advice and services to international businesses interested in Central and Eastern European countries as well as other emerging markets. PMR's key areas of operation include business publications (through PMR Publications), consultancy (through PMR Consulting) and market research (through PMR Research). Being present on the market since 1995, employing highly skilled staff, offering high international standards in projects and publications, providing one of most frequently visited and top-ranked websites, PMR is one of the largest companies of its type in the region.

PMR Publications

ul. Dekerta 24, 30-703 Krakow, Poland

tel. /48/ 12 618 90 00, fax /48/ 12 618 90 08

Contact Person: Anna Rojek, marketing@pmrcorporate.com

www.pmrpublications.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Polish cosmetics buyers‘ preferences – findings of a survey here

News-ID: 168021 • Views: …

More Releases from PMR Ltd

60% of Polish SMEs use IT services

Approx. 60% of small and medium sized enterprises use IT services in Poland. Some 30% of SMEs declare to employ people responsible for IT. The number of portable computers used by SMEs has been growing. On average, there are five such computers per one SME. The proportion of companies which use EU funds to finance ICT development has gone down over the last two years.

Use of IT services

According to the…

Ukrainian IT industry to keep on growing in 2012-2013

In the last two years Ukrainian IT market has been recovering after a sharp decline experienced in 2009. The market will continue to record double digit growth rates in 2012-2013. The macroeconomic and political situation will remain of crucial importance in the country.

Current situation and key trends

According to the latest report “IT market in Ukraine 2012. Development forecasts for 2012-2017” published by PMR, a market research company, the total…

Retail grocery market to provide €117bn in 2014 in the CE region

PMR estimates that in 2011 the grocery market in six Central European (CE) countries was worth nearly €107bn, 2.8% more than the previous year when expressed in local currencies. The increase was generated foremost by the discount stores and supermarket segments, and was driven by the skyrocketing prices of foodstuffs. Schwarz Group, which operates the Lidl and Kaufland chains, is a leading grocery player in the CE region – as…

Hungarian construction market to recover in 2013-2014

After a poor 2009-2012 for the Hungarian construction industry, from 2013 a visible market recovery is expected. The growth in 2013-2014 will result from the intense execution of EU co-financed infrastructure investments as well as some revival in building construction, particularly in non-residential buildings.

According to the research company PMR’s latest report, entitled “Construction sector in Hungary 2012 – Development forecasts for 2012-2014”, weak macroeconomic environment, falling investment demand and poor…

More Releases for Poland

Poland Agriculture Market, Poland Agriculture Industry, Agriculture Livestock Ma …

Poland is a significant European and global producer of numerous agricultural products. The agricultural land market in country is divided in two parts: privately owned farms and land owned farms by the State Treasury. Privately owned farm is an enterprise to cultivate various agricultural products under the control of one or more investor. Poland is among the world's primary producers of potatoes, rye, and apples, as well as pork and…

MAUSER Poland Celebrates 5th Anniversary

Bruehl/Germany, June 27, 2017

MAUSER Group, a worldwide leading company in industrial packaging, celebrates the 5th anniversary of its factory in Gliwice, Poland. Ideally located in the industrial heartland of Upper Silesia, and operated by a strong local management team, the plant offers high-quality industrial packaging solutions and services.

MAUSER Poland serves customers with a comprehensive product range of Composite Intermediate Bulk Containers (CIBCs) and plastic tight-head drums. In line with…

Agrochemicals Market in Poland

ReportsWorldwide has announced the addition of a new report title Poland: Agrochemicals: Market Intelligence (2016-2021) to its growing collection of premium market research reports.

The report “Poland: Agrochemicals: Market Intelligence (2016-2021)” provides market intelligence on the different market segments, based on type, active ingredient, formulation, crop, and pest. Market size and forecast (2016-2021) has been provided in terms of both, value (000 USD) and volume (000 KG) in the report. A…

A+ ratings on Poland

Jelenia Gora/Poland, 20.09.2011 - In August 2011 two rating agencies i.e. Standard & Poor's and Moody's Investors Service affirmed their A+ rating on Poland with a stable outlook. Both agencies noted that the Polish economy is competitive and increasingly diversified. Moody's evaluated Poland as relatively well placed to withstand global turmoil with its relatively resilient economy. Both agencies stressed that the Polish economy continued to expand in 2009, in contrast…

IT market in Poland

IT providers in Poland are starting the post-crisis period in actually quite good moods and are already beginning to predict what solutions will be most sought after by their customers during prosperity.

However last year hardware distributors recorded significant reduction in the number of orders placed, especially by business customers, software and IT services providers performed far better. A majority of them had similar sales as in previous periods, while some…

VoIP in Poland

At the end of 2008 the Polish VoIP telephony market was worth PLN 440m, with CaTV operators having generated the largest share of revenue in the segment. In recent years also fixed-line operators have included VoIP services into their offer.

According to research and consulting company PMR Polish VoIP market continues to represent a small share of the fixed-line telecommunications market. In 2008 it accounted for approximately five percent of the…