Press release

Industry Prospects of Global Mobile Banking Market 2018 | ICICI Bank Mobile Banking,Santander Mobile Banking,SBI,CCB,ICBC Bank

Global Mobile Banking Market report offers the latest industry trends, technological innovations and forecast market data. A deep-dive view of Global Mobile Banking industry based on market size, Mobile Banking growth, development plans, and opportunities is offered by this report. The forecast market information, SWOT analysis, Mobile Banking barriers, and feasibility study are the vital aspects analyzed in this report.Get FREE Sample Report Copy @ https://bit.ly/2uxrIK9

Mobile Banking market segmentation by Players:

ICICI Bank Mobile Banking

Santander Mobile Banking

SBI

CCB

ICBC Bank

HSBC Mobile Banking

Barclays

TSB Bank

U.S. Bank

MBS

Global Mobile Banking Market report studies the present state of the industry to analyze the future growth opportunities and risk factors. Mobile Banking report aims at providing a 360-degree market scenario. Initially, the report offers Mobile Banking introduction, fundamental overview, objectives, market definition, Mobile Banking scope, and market size estimation.

Global Mobile Banking Market report helps the readers in understanding the growth factors, industry plans, policies and development strategies implemented by leading Mobile Banking players. All the terminologies of this market are covered in the report. The report analyses facts and figures to derive the global Mobile Banking Industry revenue. A detailed explanation of Mobile Banking market values, potential consumers and the future scope are presented in this report.

Inquiry Here For Detail Report @ https://bit.ly/2JL2a6G

Global Mobile Banking Market segmentation by Type:

IOS

Android

Global Mobile Banking Market segmentation by Application:

Account information

Transaction

Investments

Support

Content services

Leaders in Global Mobile Banking market share, product portfolio and company profile are covered in this report. Key market participants are analyzed based on yield, gross margin, market value and price structure. Mobile Banking Competitive market scenarios among players will help you plan your industry strategy. The metrics provided in this report will be a helpful guide to shaping your business growth.

Market segmentation

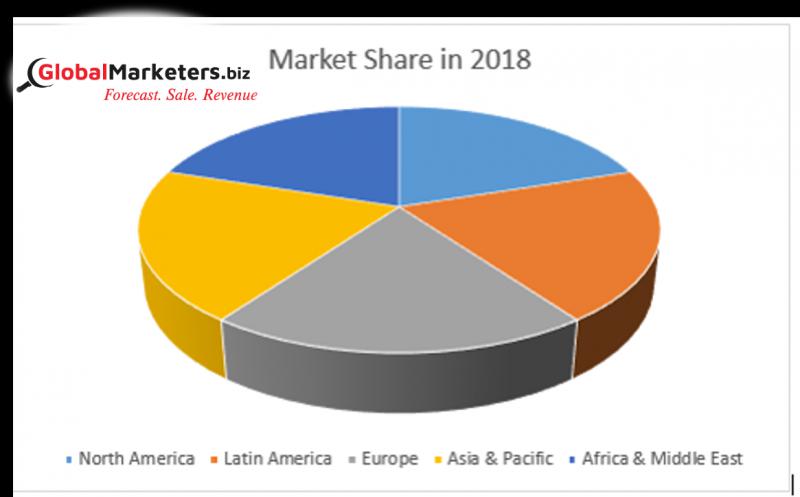

On global level Mobile Banking, industry is segmented by product type, diverse applications, and research regions. Regional Global Mobile Banking Market segmentation analyses the market presence across North America, Europe, Japan, India, China, Middle East & Africa, South America. The regional analysis presented the Global Mobile Banking Industry production volume and growth rate from 2013-2018

In the next section, market dynamics, Global Mobile Banking Industry growth drivers, emerging market segments and the growth curve is presented based on past, present and futuristic market status. Mobile Banking revenue on global and regional level and applications is conducted. The analysis of downstream buyers, sales channel, raw materials, and industry verticals is offered in this report. The Global Mobile Banking industry chain study covers the upstream raw material suppliers analysis, top industry players, manufacturing capacity of each player, cost of raw material and labor cost.

Global Mobile Banking market share and market value are analyzed for each product type of this market. The pricing analysis is provided from 2013-2018. Mobile Banking consumption statistics, downstream buyers, and the growth trend for each application is analyzed from 2013 to 2018. Global Mobile Banking Market import, export scenario, SWOT analysis, and utilization ratio is presented on a global and regional scale.

The graphical and tabular view of Global Mobile Banking market will provide ease of understanding to the readers.

Major points from Table of Contents for Global Mobile Banking Industry 2018 Market Research Report include:

1 Global Mobile Banking Market Overview

2 Global Mobile Banking Competition by Manufacturers

3 Global Mobile Banking Industry Capacity, Production, Revenue (Value) by Region (2018-2023)

4 Global Mobile Banking Industry Supply (Production), Consumption, Export, Import by Region (2018-2023)

5 Global Mobile Banking Production, Revenue (Value), Price Trend by Type

6 Global Mobile Banking Industry Analysis by Application

7 Global Mobile Banking Manufacturers Profiles/Analysis

8 Mobile Banking Manufacturing Cost Analysis

9 Industrial Chain, Sourcing Strategy and Downstream Buyers

10 Marketing Strategy Analysis, Distributors/Traders

11 Market Effect Factors Analysis

12 Global Mobile Banking Industry Forecast (2018-2023)

13 Research Findings and Conclusion

14 Appendix

Explore Full Report With Detailed TOC Here @ https://bit.ly/2U2v3jL

Global Marketers is a research hub to meet the syndicate, custom and consulting research needs. Our company excels in catering to the research requirements of commercial, industrial and all other business enterprises.

Global Marketers is the trusted brand when it comes to satisfying the research needs of any industry vertical located across the globe.

Contact Us:

Company Name: Globalmarketers.biz

Contact Person: Alex White

Email: inquiry@globalmarketers.biz

Phone: +1(617)2752538

Website: www.globalmarketers.biz

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Industry Prospects of Global Mobile Banking Market 2018 | ICICI Bank Mobile Banking,Santander Mobile Banking,SBI,CCB,ICBC Bank here

News-ID: 1676445 • Views: …

More Releases from Globalmarketers.biz

Global Bicycle Market 2019 | Giant Bicycles, Hero Cycles, TI Cycles, Trek, Shang …

Global Bicycle Market Report presents a competitive scenario of key Bicycle Industry players with their market share, sales, revenue and growth prospects. The comprehensive information on present and forecast Bicycle industry status is presented in the report. The reliable Global Bicycle market statistics are provided by segmenting the Global Bicycle Industry based on product type, applications and regional presence.

The vital factors which are Compound Annual Growth Rate (CAGR) value for…

Know More About Global Light Commercial Vehicle Market 2019 | PSA Group, Renault …

Global Light Commercial Vehicle Market Report presents a competitive scenario of key Light Commercial Vehicle Industry players with their market share, sales, revenue and growth prospects. The comprehensive information on present and forecast Light Commercial Vehicle industry status is presented in the report. The reliable Global Light Commercial Vehicle market statistics are provided by segmenting the Global Light Commercial Vehicle Industry based on product type, applications and regional presence.

The vital…

Global Corrugated Boxes Market 2019 | International Paper, WestRock (RockTenn), …

Global Corrugated Boxes Market Report presents a competitive scenario of key Corrugated Boxes Industry players with their market share, sales, revenue and growth prospects. The comprehensive information on present and forecast Corrugated Boxes industry status is presented in the report. The reliable Global Corrugated Boxes market statistics are provided by segmenting the Global Corrugated Boxes Industry based on product type, applications and regional presence.

The vital factors which are Compound Annual…

Industry Prospects of Global Dissolving Pulp Market 2019 | Sappi, Rayonier, Brac …

Global Dissolving Pulp Market Report presents a competitive scenario of key Dissolving Pulp Industry players with their market share, sales, revenue and growth prospects. The comprehensive information on present and forecast Dissolving Pulp industry status is presented in the report. The reliable Global Dissolving Pulp market statistics are provided by segmenting the Global Dissolving Pulp Industry based on product type, applications and regional presence.

The vital factors which are Compound Annual…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…