Press release

Surety Market Outlook to 2027 - AmTrust Financial Services, Crum & Forster, CNA Financial Corporation, American Financial Group, The Travelers Indemnity Company, Liberty Mutual Insurance Company

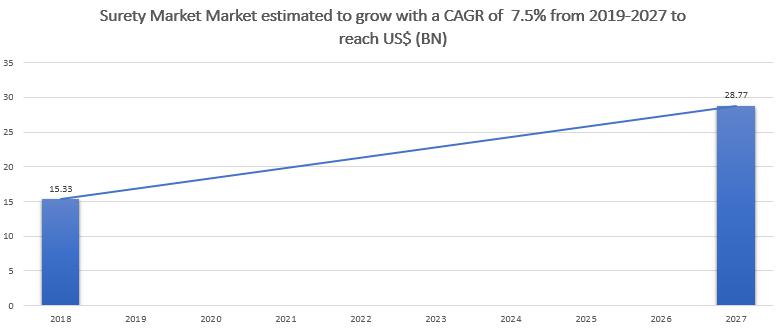

Global surety market is expected to grow from US$ 15.33 Bn in 2018 to US$ 28.77 Bn in 2027 at a CAGR of 7.5% between 2019 and 2027.Surety market is expected to experience significant growth in the coming years due to the increasing demand of commercial bonds. The commercial bonds are gaining popularity in the markets of North America and Europe. Commercial bonds are replacing LOC as they provide a better method for risk management. Some of the big insurance like Crum & Forster, CAN Insurance Group, American Financial Group, Inc., and The Travelers Indemnity Company has a strong focus in providing commercial surety products.

Get PDF sample copy: http://bit.ly/2UPaUKe

Surety market is experiencing good growth across all the geographical regions of the globe, with the increasing demand for infrastructural development as well as residential construction. Furthermore, the rising adoption of public-private partnership model is another factor fueling the growth of the market.

Surety Bonds are obtained by principal parties to protect third parties from a failure to meet contractual obligations. There are four main types of bonds that serve the different purpose namely: contract surety bond, commercial surety bond, fidelity surety bond, and court surety bond. The most common surety bonds are the commercial and contract surety bond and serve the purpose of protecting the public and private interests. The court and fidelity surety bonds protect against the litigation and theft. Surety bonds of all types cost a premium based on the performance of the business and credit score of the business owner, which is between 1-15% of the bond value.

The global surety market for the bond type is fragmented into Contract Surety Bond, Commercial Surety Bond, Fidelity Surety Bond, and Court Surety Bond. Commercial Bonds are general surety bonds that are required by various government agencies state local or federal. Commercial bonds are primarily used by companies or working professionals as per state licensing and permit regulations. Commercial bonds are easy to qualify as they incur low-risk. Commercial bonds protect the general public from that interact with the principal being licensed. The claim is made by someone who faced losses due to the violation of rules and regulations by the bonded principal. The agency checks various parameters before fixing the bond amount such as the number of employees, number of physical locations, and the type of business. Usually, the commercial bonds are annual bonds that are to be renewed every year in some cases bonds are also required for multi-year increments like service tax bond.

Inquire for discount: http://bit.ly/2UNRtl9

Merger and acquisition is expected to be the key growth strategy to be adopted by players for next two-three years. However, this strategy could impact competition, it is also expected to generate new market as well as product opportunities as recently combined companies will thrive to maintain position and profitability. The major companies operating in the market include AmTrust Financial Services, Inc.; Crum & Forster; CNA Financial Corporation; American Financial Group, Inc.; The Travelers Indemnity Company; Liberty Mutual Insurance Company; Hartford Financial Services Group, Inc.; HCC Insurance Holdings; IFIC Surety Group; and Chubb Limited among others.

About Us:

The Insight Partners is a one stop industry research provider of actionable intelligence. We help our clients in getting solutions to their research requirements through our syndicated and consulting research services. We are a specialist in Technology, Healthcare, Manufacturing, Automotive and Defense.

Contact Us:

Call: +1-646-491-9876

Email: sales@theinsightpartners.com

Web: https://www.theinsightpartners.com/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Surety Market Outlook to 2027 - AmTrust Financial Services, Crum & Forster, CNA Financial Corporation, American Financial Group, The Travelers Indemnity Company, Liberty Mutual Insurance Company here

News-ID: 1666189 • Views: …

More Releases from The Insight Partners

Calcium Carbide Industry Advances with Strategic Expansions, Sustainable Innovat …

The Calcium Carbide Industry is experiencing a period of strategic evolution, driven by robust industrial demand, technological innovation, and regulatory shifts shaping production and applications across global markets. As a critical industrial chemical, calcium carbide continues to play an indispensable role in sectors such as metallurgy, chemicals, welding, and infrastructure development, with recent developments underscoring the industry's dynamic growth trajectory.

Check valuable insights in the Calcium Carbide Market report. You can…

Cytiva Pioneers Next-Generation Chromatography Resin Advancements for Biopharma …

United States of America - January 09, 2025 - According to The Insight Partners, The Chromatography Resin Market size is expected to reach US$ 4,224 million by 2031. The market is anticipated to register a CAGR of 7.3% during 2025-2031. Cytiva (Danaher Corporation) today announced breakthrough innovations in chromatography resin technology, designed to streamline purification processes for pharmaceutical and biotechnology companies worldwide. This development addresses key challenges in bioprocessing, enhancing…

Cardiopulmonary Exercise Testing Market Poised for Steady Expansion Through 2031 …

United States of America - January 09, 2025 - According to The Insight Partners, The Cardiopulmonary Exercise Testing Market is expected to register a CAGR of 7.33% from 2025 to 2031. The Cardiopulmonary Exercise Testing market continues to gain momentum as healthcare providers worldwide prioritize advanced diagnostic tools for cardiovascular and pulmonary conditions. This non-invasive testing method, often referred to as cardiopulmonary exercise testing (CPET), evaluates heart and lung performance…

Global Medical Robots Market Poised for Transformational Growth Through 2033

The Medical Robots Market continues to redefine modern healthcare delivery, driven by rapid technological advancements, expansion of minimally invasive surgical procedures, and growing adoption of autonomous support systems in clinical settings. As medical robotics technology evolves, the industry is experiencing heightened interest from hospitals, surgical centers, and healthcare innovators seeking to improve precision, reduce errors and transform patient outcomes.

Recent industry developments - including expanded robotics research units and novel product…

More Releases for Surety

Growth Of Digital Payment Services Driving Expansion In The Surety Market: A Key …

The Surety Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Current Surety Market Size and Its Estimated Growth Rate?

The surety market has seen strong growth in recent years. It will grow from $19.62 billion in 2024 to $21 billion in 2025 at…

Top Factor Driving Surety Market Growth in 2025: Growth Of Digital Payment Servi …

Which drivers are expected to have the greatest impact on the over the surety market's growth?

The growing use of digital payment services is expected to fuel the growth of the surety market. Digital payments, facilitated by smartphones and enhanced security features, are transforming how people transact. Surety services provide financial guarantees for businesses, ensuring reliability and protection against risks like fraud or service disruptions. According to the Ministry of Electronics…

Surety Bond Market Future Business Opportunities 2022-2030 | HUB International L …

Global "Surety Bond Market" to grow with an impressive CAGR over the forecast period from 2022-2030. The report on Surety Bond offers the customers with a comprehensive analysis of vital driving factors, customer behavior, growth trends, product application, key player analysis, brand position and price patterns. The statistics on estimating patterns is obtained by studying product prices of key players as well as emerging market players. Additionally, Surety Bond market…

Surety Market Opportunities and Forecast Assessment till 2027

According to a recent research study added to the document repository of ResearchMoz, the Global Surety Market is likely to garner the valuation of XX Mn/Bn at the end of forecast period 2021–2027. Further, the assessment report notes that the market for Surety will expand at extensive CAGR of XX% throughout assessment period.

Surety Market: Overview

Growth avenues, drivers, restraints, demand–supply ratio, and challenges are some of the key factors presented in the new…

Surety Market- Industry Research Report by DeepResearchReport

DeepResearchReports has uploaded a latest report on Surety Industry from its research database. Surety Market is segmented by Regions/Countries. All the key market aspects that influence the Surety Market currently and will have an impact on it have been assessed and propounded in the Surety Market research status and development trends reviewed in the new report.

The new tactics of Surety Industry report offers a comprehensive market breakdown on…

Contract surety bond holding nearly half of the surety market share

The global surety market at US$ 15.33 Bn in 2018 and is expected to grow at a CAGR of 7.5% during the forecast period 2019 – 2027, to account to US$ 28.77 Bn by 2027.

The Surety market penetration rates in North America region is higher than any other markets across the globe. This is attributed to most of U.S. State governments’ laws that mandate surety bonds. Both the U.S. and…