Press release

Fraud Detection and Prevention Market is Projected to Grow at a CAGR of 25.6% over the forecast period (2019 – 2027), With Increased Necessity for Mitigating Diverse Risks in Banking and Financial Sector

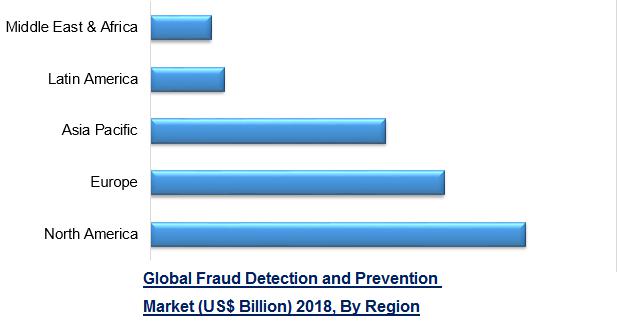

With every fraud occurrence, banks experience direct financial impact and also risk losing customers. When a customer reports a fraudulent transaction, the bank is liable for the transaction cost, it has to refund merchant chargeback fee as well as additional fee. Additionally, frauds erode the trust of banks among customers and it becomes difficult to acquire new customers. Several regulatory bodies also levy fines on financial institutions for frauds. Therefore, the risk of losing customers, financial losses, and increasing incidences of fraud are acting as the primary drivers of fraud detection and prevention market in banking and financial sector. Furthermore, increased number of digital payments has modified the fraud landscape. These payments require complex and large scale monitoring of people, places, systems and events.In terms of revenue, the fraud detection and prevention market stood at US$ 20.70 Bn in 2018, and is expected to grow at a CAGR of 25.6% during the forecast period (2019 – 2027). The study analyzes the market in terms of revenue across all the major regions, which is further bifurcated into countries.

Request a Sample Copy of This Report@ https://www.absolutemarketsinsights.com/request_sample.php?id=198

The solutions offered by vendors in the fraud detection and prevention market are helping banks and financial institutions to decrease risk while adhering to federal regulations. FICO TONBELLER offers banks an integrated anti-fraud solution that detects, assesses and prevents transaction & process alerts in real-time. The alerts generated by this solution are based on customer and transaction data, event patterns and correlations, and on custom user settings. The solution offers initial and continual risk classification for new and existing customers and provides due diligence functionality in the attached research system in addition to the bank's database-founded risk analysis. It also creates clear-structured dashboards to visualize cases of fraud, suspicious activities reports, and detected alerts.

“Two of the biggest challenges that banks and other financial institutions face are mitigating risks and compliance to regulations for which they have to maintain constant vigilance. Moreover, in response to the rising customer demand, banks and financial institutions are investing heavily in enabling digital services through multiple channels. This has expanded the attack surface and created new vulnerabilities in the system. This increasing need to combat the growing risks and to meet compliance requirements is driving the fraud detection and prevention market in banking and financial sector. ”

Inquiry Before Buying This Report@ https://www.absolutemarketsinsights.com/enquiry_before_buying.php?id=198

The detailed research study provides qualitative and quantitative analysis of fraud detection and prevention market. The market has been analyzed from demand as well as supply side. The demand side analysis covers market revenue across regions and further across all the major countries. The supply side analysis covers the major market players and their regional and global presence and strategies. The geographical analysis done emphasizes on each of the major countries across North America, Europe, Asia Pacific, Middle East, Africa and Latin America.

Some of the players operating in the fraud detection and prevention market are ACI Worldwide, Inc., BAE Systems, Cyxtera Technologies, Inc., Dell Inc., Distil, Inc., DXC Technology, Experian Information Solutions, Inc., Fair Isaac Corporation (FICO), First Data Corporation, FIS, Fiserv, Inc., FRISS , Guardian Analytics, IBM Corporation, iovation Inc., Kount Inc., LexisNexis, MaxMind, Inc., NICE, Oracle, SAP SE, SAS Institute Inc., Securonix, Inc., SIMILITY , Software AG, ThreatMetrix and Wirecard AG amongst others.

Request for Customized Report@ https://www.absolutemarketsinsights.com/request_for_customization.php?id=198

Fraud Detection and Prevention Market:

• By Deployment

o On Cloud

o On Premise

• By Organization Size

o SMEs

o Large Enterprise

• By Component

o Solutions

Fraud Analytics

Authentication

Single-Factor Authentication

Multifactor Authentication

Others

o Services

Professional Service

Managed Service

• By Application

o Identity Theft

o Payment Frauds

Electronic Payment Fraud

Mobile Payment Fraud

Credit and Debit Card Fraud

o Money Laundering

o Others (Banking Transactions, Fund Transfers etc.)

• By Industry Vertical:

o Banking, Financial Services and Insurance (BFSI)

o Energy and Power

o Government/Public Sector

o Healthcare

o Manufacturing

o Real Estate

o Retail

o Telecommunication

o Others (Travel and Transportation, Media and Entertainment, etc.)

• By Geography

o North America

U.S.

Canada

Mexico

Rest of North America

o Europe

France

The UK

Spain

Germany

Italy

Nordic Countries

Denmark

Finland

Iceland

Sweden

Norway

Benelux Union

Belgium

The Netherlands

Luxembourg

Rest of Europe

o Asia Pacific

China

Japan

India

New Zealand

Australia

South Korea

Southeast Asia

Indonesia

Thailand

Malaysia

Singapore

Rest of Southeast Asia

Rest of Asia Pacific

o Middle East and Africa

Saudi Arabia

UAE

Egypt

Kuwait

South Africa

Rest of Middle East & Africa

o Latin America

Brazil

Argentina

Rest of Latin America

Purchase Full Analysis Report@ https://www.absolutemarketsinsights.com/checkout?id=198

Related Reports:

https://www.absolutemarketsinsights.com/reports/Global-Cyber-Security-Market-2019-2027

https://www.absolutemarketsinsights.com/reports/Managed-Security-Services-Market-2019-2027

https://www.absolutemarketsinsights.com/reports/SaaS-Security-Market-2018-2026

https://www.absolutemarketsinsights.com/reports/Threat-Intelligence-Security-Market-2018-2026

About Us:

Absolute Markets Insights assists in providing accurate and latest trends related to consumer demand, consumer behavior, sales, and growth opportunities, for the better understanding of the market, thus helping in product designing, featuring, and demanding forecasts. Our experts provide you the end-products that can provide transparency, actionable data, cross-channel deployment program, performance, accurate testing capabilities and the ability to promote ongoing optimization.

From the in-depth analysis and segregation, we serve our clients to fulfill their immediate as well as ongoing research requirements. Minute analysis impact large decisions and thereby the source of business intelligence (BI) plays an important role, which keeps us upgraded with current and upcoming market scenarios.

Contact Us:

Company: Absolute Markets Insights

Email Id: sales@absolutemarketsinsights.com

Phone: +91-740-024-2424

Contact Name: Shreyas Tanna

Website: https://www.absolutemarketsinsights.com/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Fraud Detection and Prevention Market is Projected to Grow at a CAGR of 25.6% over the forecast period (2019 – 2027), With Increased Necessity for Mitigating Diverse Risks in Banking and Financial Sector here

News-ID: 1651369 • Views: …

More Releases from Absolute Markets Insights

Gesture Recognition Market Present Scenario and Growth Prospects 2023-2031| Goog …

The latest report, Global Gesture Recognition Market by Absolute Markets Insights is analyzed and researched on the basis of the comprehensive analysis of the global market. The report focuses on key market-related aspects including market segmentation, geographic segmentation, dynamics, and other market growth factors. The report contains detailed analysis of the distinct industrial growth strategies, which helps to determine the dominant segments and to know about different factors. The scope…

Blockchain Identity Management Market to Reach a Valuation of USD 60 million by …

Global Blockchain Identity Management Market Report is a compilation of comprehensive research studies on various aspects of the Blockchain Identity Management Market. With accurate data and highly authentic information, it makes a brilliant attempt to provide a real, transparent picture of current and future situations of the global Blockchain Identity Management Market. Market participants can use this powerful tool when creating effective business plans or making important changes to their…

Payment Software Market Size Revenue to Cross USD 510 million by 2031: Absolute …

Global Payment Software Market was valued at USD 240 million in 2023 and is anticipated to exceed USD 510 million by 2031.

The Global Payment Software Market Report studies extensive evaluation of the market growth predictions and restrictions. The strategies range from new product launches, expansions, agreements, joint ventures, partnerships, to acquisitions. This report comprises of a deep knowledge and information on what the market's definition, classifications, applications, and engagements and…

Artificial Intelligence in Healthcare Market Size Worth USD 5,310.31 Million By …

A New Market study by Absolute Markets Insights on the Global Artificial Intelligence in Healthcare Market has been released with reliable information and accurate forecasts for a better understanding of the current and future market scenarios. The report offers an in-depth analysis of the global market, including qualitative and quantitative insights, historical data, and estimated projections about the market size and share in the forecast period. The forecasts mentioned in…

More Releases for Fraud

GrayCat PI Joins Global Effort to Spotlight Fraud During International Fraud Awa …

Image: https://www.abnewswire.com/upload/2025/11/dc16cdb8496c72daf00c6802941e27f3.jpg

International Fraud Awareness Week runs November 19-22, 2025 worldwide Oaxaca, Oaxaca, Mexico. $3.1 billion lost to fraud. That figure comes from Occupational Fraud 2024: A Report to the Nations, the latest study from the Association of Certified Fraud Examiners (ACFE), based on 1,921 occupational fraud cases worldwide. The report is available at https://legacy.acfe.com/report-to-the-nations/2024/.

Because fraud remains a persistent and costly threat, GrayCat PI has joined International Fraud Awareness Week [https://graycatpi.com/fraud-week-mexico-2025/],…

New York City Fraud Attorney Russ Kofman Releases Insightful Guide on Welfare Fr …

New York City fraud attorney Russ Kofman (https://www.lebedinkofman.com/are-you-being-investigated-for-welfare-fraud-in-nyc/) of Lebedin Kofman LLP has recently published an enlightening article addressing the complexities surrounding welfare fraud investigations in New York City. The article, aimed at individuals who may be under investigation for welfare fraud, offers crucial legal insight and guidance for navigating this challenging process.

Welfare fraud is no minor offense. It comprises various fraudulent acts to unlawfully obtain public assistance benefits. This…

Fraud Increased by 3% in 2021 - Says Shufti Pro's Global ID Fraud Report

AI-powered digital identity verification solution provider, Shufti Pro, revealed new data in its Global ID Fraud Report 2021 which shows insights from ample research of 11 months of verification. The report highlights the changing fraudulent activities and advanced manipulation techniques that the company faced in 2021. Experts from Shufti Pro have also made fraud predictions that will threaten the corporate sector in 2022.

The ceaseless increase in ID and…

IPTEGO Launching PALLADION Fraud Detection and Prevention for a Real-Time Protec …

IPTEGO presents PALLADION Fraud Detection & Prevention, an innovative protection for CSPs and their customers against toll fraud.

Berlin, Germany, February 08, 2012 -- IPTEGO presents PALLADION Fraud Detection & Prevention, an innovative protection for CSPs and their customers against toll fraud.

With PALLADION Fraud Detection & Prevention, IPTEGO provides an answer to a growing demand for more network security when it comes to toll fraud. Today’s Communication Service Providers (CSPs) are…

Online Fraud Prevention – Sentropi

Are security nightmares causing you sleepless nights? Are you worried about how secure your I.T infrastructure is? Sentropi aims to address these ever present security concerns with its uniquely different identification and tracking solution. Sentropi's innovative technology allows you to identify your users with pinpoint accuracy and lets you track fraudsters on any platform, any browser, any time and any where! Hunt down fraudsters by tracking down their computers rather…

Fight Private Placement Program Fraud - PPP Fraud!

Stand up to private placement program fraud!

To set an undertone for the following summary; logic begets logic. No trading platforms nor programs, whether public or private have the freedom of complete exclusion from regulatory oversight, licensing, and governance.

Our firm has significant interest in a few platforms, as principals. There are indeed private financial offerings which have historically delivered very significant performance using "Institutional Leverage, Traders, Risk Management, Clearing & Execution"…