Press release

Blockchain in Insurance Market is projected to Grow at a CAGR of 65.9% over the Forecast Years (2019 – 2027), Owing to the Benefits of Blockchain in Smart Contracts, With the says Absolute Markets Insights

Public blockchain technology has proved to be a catalyst for smart contracts. A smart contract formalizes the relationships between people, institutions and the assets they own. These rights and obligations established in the smart contract can be automatically executed by a computer or a network of computers as soon as the parties have come to an agreement and met the conditions of the agreement (enforcement). This is expected to boost the blockchain in insurance market. An insurance company can easily differentiate itself from its competitors by offering autonomous claim payout system using smart contracts. This eliminates the intermediary that must monitor the machine, calling the suppliers and replenishing itself, eliminating time and money expenses in that process and further simplifying the task.Request a Sample Copy of This Report@ https://www.absolutemarketsinsights.com/request_sample.php?id=179

In addition to claims processing solutions, companies are collaborating for innovative applications of smart contracts in the blockchain in insurance market. Signaturit, in collaboration with DAS Spain, has developed a service based on smart contracts, which allows non-payment policies of rent to be carried out in an automated and simplified way. The solution offered through this collaboration automates and facilitates the payment of policies, sending of notifications and renewal of contracts. As this solution is blockchain based, all the actions carried out from the entry into force of a contract until its completion can be traced. Ethereum platform allows developers to program their own smart contracts, or ‘autonomous agents’. The language is ‘Turing-complete’, meaning it supports a broader set of computational instructions. Insurra, developed by Sofocle Technologies (OPC) Pvt Ltd., creates a smart contract of the insurance agreement made between the insurer and the insured. The smart contract facilitated insurance processing is automated and can act as a complement or substitute for legal contracts.

Inquiry Before Buying This Report@ https://www.absolutemarketsinsights.com/enquiry_before_buying.php?id=179

“Smart contracts can be applied to several pain points of the insurance industry which is expected to propel the blockchain in insurance market. They can minimize paper work by allowing the insured to upload the documents via app installed on smartphones or their personal computers. As these are coded to get executed autonomously, a claim is processed automatically if pre-defined condition(s) are met. Insurance companies can drastically reduce the operational cost involved in collecting & storing documents and processing claims. Not only this will benefit the companies but will improve the customer experience to great extents.”

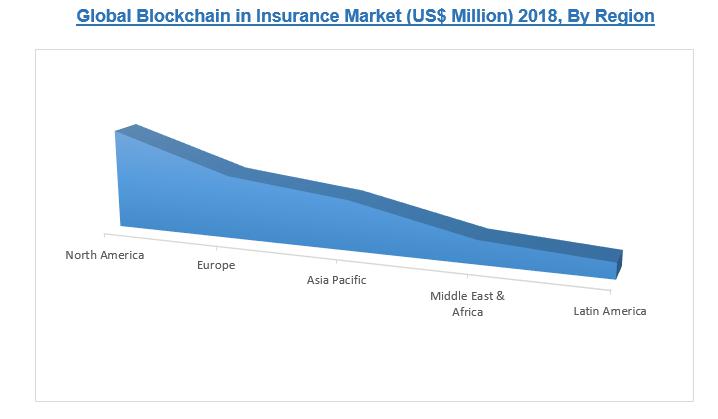

The detailed research study provides qualitative and quantitative analysis of Blockchain in Insurance market. The market has been analyzed from demand as well as supply side. The demand side analysis covers market revenue across regions and further across all the major countries. The supply side analysis covers the major market players and their regional and global presence and strategies. The geographical analysis done emphasizes on each of the major countries across North America, Europe, Asia Pacific, Middle East, Africa and Latin America.

Request for Customized Report@ https://www.absolutemarketsinsights.com/request_for_customization.php?id=179

Some of the players operating in the blockchain in insurance market are Amazon Web Services, Inc., AUXESIS GROUP, Bitfury Group Limited, Boston Consulting Group, BTL Group Ltd, ChainThat, Circle Internet Financial Limited, CONSENSUS SYSTEMS (Consensys), Deloitte Touche Tohmatsu Limited, Digital Asset Holdings, LLC, Everledger Ltd, Etherparty Inc, Factom, Guardtime, IBM Corporation, iXLedger, KPMG International Cooperative, Microsoft, Oracle, SafeShare, Symbiont.io and Willis Towers Watson amongst others.

Blockchain in Insurance Market:

• By Offerings

o Solutions

Applications and Platforms

Middleware

Infrastructure and Protocols

o Services

Professional

Managed

• By Application

o Identity Management and Fraud Detection

o Claims Management

o Distribution and Payment Models

o Others (GRC Management etc.)

• By Organization Size

o Large Enterprises

o Small and Medium-Sized Enterprises

• By Insurance Type

o Life Insurance

o Health Insurance

o Property and Casualty Insurance

o Reinsurance

o Others (Travel Insurance, Vehicle Insurance etc.)

• By Geography

o North America

U.S.

Canada

Mexico

Rest of North America

o Europe

France

The UK

Spain

Germany

Italy

Nordic Countries

Denmark

Finland

Iceland

Sweden

Norway

Benelux Union

Belgium

The Netherlands

Luxembourg

Rest of Europe

o Asia Pacific

China

Japan

India

New Zealand

Australia

South Korea

Southeast Asia

Indonesia

Thailand

Malaysia

Singapore

Rest of South Asia

Rest of Asia Pacific

o Middle East and Africa

Saudi Arabia

UAE

Egypt

Kuwait

South Africa

Rest of Middle East & Africa

o Latin America

Brazil

Argentina

Rest of Latin America

You Can Get Full Report@ https://www.absolutemarketsinsights.com/reports/Blockchain-in-Insurance-Market-2019-2027-179

About Us:

Absolute Markets Insights assists in providing accurate and latest trends related to consumer demand, consumer behavior, sales, and growth opportunities, for the better understanding of the market, thus helping in product designing, featuring, and demanding forecasts. Our experts provide you the end-products that can provide transparency, actionable data, cross-channel deployment program, performance, accurate testing capabilities and the ability to promote ongoing optimization.

From the in-depth analysis and segregation, we serve our clients to fulfill their immediate as well as ongoing research requirements. Minute analysis impact large decisions and thereby the source of business intelligence (BI) plays an important role, which keeps us upgraded with current and upcoming market scenarios.

Contact Us:

Company: Absolute Markets Insights

Email id: sales@absolutemarketsinsights.com

Phone: +91-740-024-2424

Contact Name: Shreyas Tanna

The Work Lab,

Model Colony, Shivajinagar, Pune, MH, 411016

Website: https://www.absolutemarketsinsights.com/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Blockchain in Insurance Market is projected to Grow at a CAGR of 65.9% over the Forecast Years (2019 – 2027), Owing to the Benefits of Blockchain in Smart Contracts, With the says Absolute Markets Insights here

News-ID: 1640050 • Views: …

More Releases from Absolute Markets Insights

Gesture Recognition Market Present Scenario and Growth Prospects 2023-2031| Goog …

The latest report, Global Gesture Recognition Market by Absolute Markets Insights is analyzed and researched on the basis of the comprehensive analysis of the global market. The report focuses on key market-related aspects including market segmentation, geographic segmentation, dynamics, and other market growth factors. The report contains detailed analysis of the distinct industrial growth strategies, which helps to determine the dominant segments and to know about different factors. The scope…

Blockchain Identity Management Market to Reach a Valuation of USD 60 million by …

Global Blockchain Identity Management Market Report is a compilation of comprehensive research studies on various aspects of the Blockchain Identity Management Market. With accurate data and highly authentic information, it makes a brilliant attempt to provide a real, transparent picture of current and future situations of the global Blockchain Identity Management Market. Market participants can use this powerful tool when creating effective business plans or making important changes to their…

Payment Software Market Size Revenue to Cross USD 510 million by 2031: Absolute …

Global Payment Software Market was valued at USD 240 million in 2023 and is anticipated to exceed USD 510 million by 2031.

The Global Payment Software Market Report studies extensive evaluation of the market growth predictions and restrictions. The strategies range from new product launches, expansions, agreements, joint ventures, partnerships, to acquisitions. This report comprises of a deep knowledge and information on what the market's definition, classifications, applications, and engagements and…

Artificial Intelligence in Healthcare Market Size Worth USD 5,310.31 Million By …

A New Market study by Absolute Markets Insights on the Global Artificial Intelligence in Healthcare Market has been released with reliable information and accurate forecasts for a better understanding of the current and future market scenarios. The report offers an in-depth analysis of the global market, including qualitative and quantitative insights, historical data, and estimated projections about the market size and share in the forecast period. The forecasts mentioned in…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…