Press release

Financial Services Application Market 2019 Ongoing Trend with Accenture Plc, Fis Corporation, Fiserv, IBM Corporation, Infosys Ltd, Misys, Oracle Corporation

The global financial services application market was valued at USD 74.35 billion in 2017, and it is projected to reach a value of USD 117.1 billion by the end of 2023, at a CAGR of 7.86% during the forecast period, 2018-2023. With the use of technology, the banking and financial sector has incorporated risks into the mainstream decision-making, promoting a culture that incorporates risk management, consistently monitoring performance, providing relevant market intelligence, and delivering business and profitability insights. The global financial crisis brought the financial services industry into the limelight, questioning the data quality and the industry’s direction and decision-making. In the current scenario, financial services institutions need a potent and reliable business intelligence solution, to meet their enterprise needs. Due to the increasing number of financial institutions, there is a need for such financial services. These services are also found to enrich consumer experience, along with optimizing the workforce. On, the contrary, high deployment costs restrict the widespread use of such services. High number of regulatory issues also hamper the growth of the market.Detailed Sample Copy of Updated Analysis @ https://marketprognosis.com/sample-request/16141

BI & Analytics is Expected to be one of the Leading Financial Service Application Software

One of the most recent trends witnessed in the market is the increased adoption of self-service analytics tools, wherein, end users can gain insight, with minimal technical knowledge. A recent survey conducted on the effectiveness of BI tools, served as a word of caution for new firms, as more than two-third of the BI projects failed, due to lack of co-ordination between the IT, business, and management teams. One of the root causes of this issue is that BI is an engineering problem, rather than a business one. Therefore, there always exists a risk of a communication breakdown between different teams, due to such difficulties, the market for financial service applications is expected to continue to grow. Big data analytics are considered very integral applications to business intelligence, in the industry. 87% of the enterprises believe that analytics will redefine the competitive landscape of their industries.

Key Developments in the Market

January 2018: Baidu, a Chinese search engine giant, launched blockchain as a service. This platform offers financial analysis as a part of the services offered, which enable better decision making. This platform enables the first of its kind asset-backed securities exchange products using blockchain technology, capable of transforming the payment infrastructure in the country.

Major Players:

ACCENTURE PLC, FIS CORPORATION, FISERV INC., IBM CORPORATION, INFOSYS LTD, MISYS, ORACLE CORPORATION, SAP SE, TCS LTD, TEMENOS GROUP AG

Request Discount on this report @ https://marketprognosis.com/discount-request/16141

North America is Expected to hold a High Market Share in the Financial Services Applications Market

Many banks in the United States have adopted latest technologies, such as artificial intelligence (AI) to provide more personalized services. The adoption of financial service applications has increased the sophistication of decisions being taken, which provides an increased level of reassurance to stakeholders. United States is one of the largest market for financial technologies adoption, primarily due to the country being a pioneer in the field of FinTech, further buoyed by the presence of major financial giants in the region. Many institutions, such as the Office of the Comptroller of the Currency, in the United States has taken necessary measures to achieve uniform and national set of standards for financial technology institutions, which is further expected to augment the market for such technologies.

Reasons to Purchase this Report

• Technological Advancements changing the market scenario for Financial Services Application

• Analyzing various perspectives of the market, with the help of Porter’s five forces analysis

• The vertical expected to dominate the market

• The regions expected to witness the fastest growth rates during the forecast period

• Identify the latest developments, market shares, and strategies that are employed by the major market players

• 3 months analyst support, along with the Market Estimate sheet (in excel)

Enquiry Before Buying@ https://marketprognosis.com/enquiry/16141

About Market Prognosis

We at Market Prognosis believe in giving a crystal clear view of market dynamics for achieving success in today’s complex and competitive marketplace through our quantitative & qualitative research methods.

We help our clients identify the best market insights and analysis required for their business thus enabling them to take strategic and intelligent decision.

We believe in delivering actionable insights for your business growth and success.

Contact us:

ProgMarkPvt Ltd,

Thane - 421501

India.

Contact No:+1 973 241 5193

Email: sales@marketprognosis.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Financial Services Application Market 2019 Ongoing Trend with Accenture Plc, Fis Corporation, Fiserv, IBM Corporation, Infosys Ltd, Misys, Oracle Corporation here

News-ID: 1639605 • Views: …

More Releases from Market Prognosis

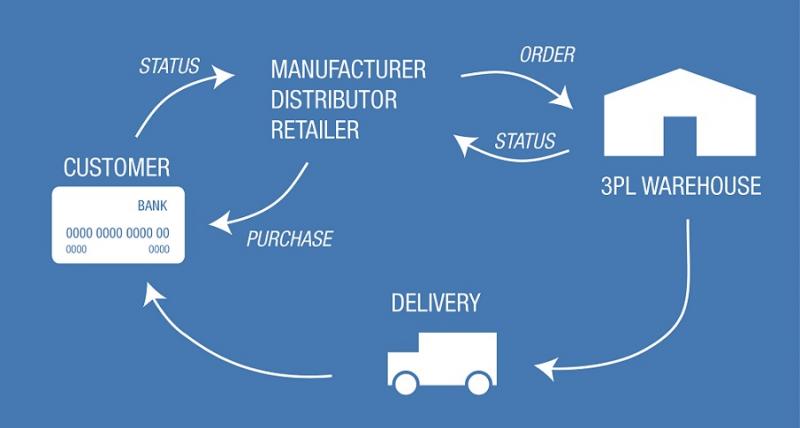

Third-Party Logistics (3PL) Market Latest Study Focuses On Current, Future Innov …

The report covers a forecast and an analysis of the Third-Party Logistics (3PL) Market on a global and regional level. The study provides historical data for 2018, 2019, and 2020 along with a forecast from 2019 to 2026 based on revenue and volume.

Overview of the Global Third-Party Logistics (3PL) Market:

The report spread across 90 pages is an overview of the Global Third-Party Logistics (3PL) Market. These report study based on the Third-Party…

Ride-Hailing Market: An Insight on the Important Factors and Trends Influencing …

The report covers a forecast and an analysis of the Ride-Hailing Market on a global and regional level. The study provides historical data for 2018, 2019, and 2020 along with a forecast from 2019 to 2026 based on revenue and volume.

Overview of the Global Ride-Hailing Market:

The report spread across 90 pages is an overview of the Global Ride-Hailing Market. These report study based on the Ride-Hailing Market. It is a complete overview…

COVID-19 Impact on Professional Indemnity Insurance Market 2021-2026: Industry I …

The report covers a forecast and an analysis of the Professional Indemnity Insurance Market on a global and regional level. The study provides historical data for 2018, 2019, and 2020 along with a forecast from 2019 to 2026 based on revenue and volume.

Overview of the Global Professional Indemnity Insurance Market:

The report spread across 90 pages is an overview of the Global Professional Indemnity Insurance Market. These report study based on the Professional…

Modular Construction Market Future Growth Explored in Latest Research Report by …

The report covers a forecast and an analysis of the Modular Construction Market on a global and regional level. The study provides historical data for 2018, 2019, and 2020 along with a forecast from 2019 to 2026 based on revenue and volume.

Overview of the Global Modular Construction Market:

The report spread across 90 pages is an overview of the Global Modular Construction Market. These report study based on the Modular Construction Market. It…

More Releases for Financial

Financial Leasing Services Market Share, Size, Financial Summaries Analysis from …

Infinity Business Insights has recently released a comprehensive research report titled "Financial Leasing Services Market Insights, Extending to 2031." This publication spans over 110+ pages and offers an engaging presentation with visually appealing tables and charts that are self-explanatory. The worldwide Financial Leasing Services market is expected to grow at a booming CAGR of 6.3% during 2024-2031. It also shows the importance of the Financial Leasing Services market main players…

Global Financial Aid Management Software Market Streamlining Financial Assistanc …

Overview for the report "Financial Aid Management Software Market" Helps in providing scope and definations, Key Findings, Growth Drivers, and Various Dynamics by Infinitybusinessinsights.com. This report will help the viewer in Better Decision Making.

At a predicted CAGR of 10.9% from 2023 to 2028, The Market for Financial Assistance Management Software will increase from USD 1.07 billion in 2022 to USD X.XX billion by 2030. The market's expansion can be attributed…

What will be Driving Growth Financial Leasing Market 2027 | Bank Financial Leasi …

Financial Leasing Market research is an intelligence report with meticulous efforts undertaken to study the right and valuable information. The data which has been looked upon is done considering both, the existing top players and the upcoming competitors. Business strategies of the key players and the new entering market industries are studied in detail. Well explained SWOT analysis, revenue share and contact information are shared in this report analysis.

Ask for…

Financial Leasing Market 2017 Analysis – CDB Leasing, ICBC Financial Leasing C …

A financial lease is a method used by a business for acquisition of equipment with payment structured over time. To give proper definition, it can be expressed as an agreement wherein the lessor receives lease payments for the covering of ownership costs. Moreover, the lessor holds the responsibility of maintenance, taxes, and insurance.

In this report, RRI studies the present scenario (with the base year being 2017) and the growth prospects…

Financial Leasing Market Is Booming | KLC Financial, SMFL Leasing, GM Financial, …

HTF MI recently introduced Global Financial Leasing Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are Sumitomo Mitsui Finance and Leasing, Maldives, HNA Capital, KUKE S.A., KLC…

Financial Analytics Market: Banking & financial sector expected to make most of …

The Financial Analytics Market deals with the development, manufacture and distribution of financial analytics tools for enterprises of all kinds and sizes. Financial data analytics can be described as a set of tools, techniques and processes used to find out answers for various business questions as well as to forecast future scenarios regarding finance and the economy.

The services provided by the Financial Analytics Market are used for analyzing the equity…