Press release

Alliance Group welcomes new GST rates to take effect from March 1, 2019

“Alliance Group, a leading real estate group in Chennai reduces GST rates one month ahead of the deadline announced by the GST council.”Welcoming the GST Council’s major decision of lowering the Goods and Services Tax (GST) rates on residential properties, Mr. Manoj Sai Namburu, CMD, Alliance Group & Urbanrise stated that this will give a great boost to ” the Housing for All scheme” and will benefit the aspiring home buyers at large.

The GST Council slashed tax rates on under-construction regular housing properties to 5% without ITC (Input Tax Credit) from the existing 12%. The council further cut the GST rates on affordable housing to 1% from 8% and expanded the scope of affordable housing to flats costing up to Rs.45 lakh rupees, measuring 60 sq m in metros & 90 sq m in non-metro cities.

Furthermore, Finance Minister, Arun Jaitley said the new tax rates will come into effect from April 1, 2019.

“The Council has expanded the definition of affordable housing so that aspiring people can buy better houses,” Bloomberg Quint quoted Jaitley as saying.

Existing GST:

As of now, properties purchased under Credit-Linked Subsidy Scheme (CLSS) attracted GST rate of 18%, which has been reduced to 12% after deducting the value of land. The concessional rate of 12% was applicable to only on properties under-construction and the following three components of PMAY (Pradhan Mantri Awas Yojana),

1. Redevelopment of existing slums using land as a resource component

2. Affordable housing in partnership with other entities

3. Beneficiary-led individual house construction / enhancement.

The exemption is now extended to properties purchased under Credit-Linked Subsidy Scheme (CLSS) as well.

How lowering GST helps home buyers?

Reducing GST on affordable housing category from 8% to 1% will also make huge difference to aspiring home buyers and is expected to boost the housing market.

The reduction of GST rates is likely to provide the affordable housing sector an opportunity to avail interest subsidy under PMAY scheme at a concessional rate of GST of 1%.

This is a compelling opportunity for all fence-sitting homebuyers to own homes on GST rate cut & uniform taxation of under-construction & ready-to-move homes. All things considered, “a simple and transparent tax applied on the purchase price is the biggest take-away for property buyers”

Alliance Infrastructure Projects Pvt. Ltd. Known as Alliance Group is one of South India’s most establishing real estate developers and construction companies, focused on urban multifamily residential communities, targeting assets in established locality with proven long-term demand drivers.

From luxury residential community to budget friendly individual homes, we’re on a mission to change the way urban residents’ lives, works and plays with dynamic residential, multifamily, and mixed-use developments that provide positive fiscal impacts to neighbourhood communities, while utilizing designs to incorporate green building practices and sustainable materials.

Since 2004 we’ve been developing distinctive residential communities from the ground-up, employing a full-spectrum development approach, managing the investment process throughout all phases of asset acquisition, planning, entitlement, construction, operations and disposition.

Alliance Group

Plot No.'A', No. 36/1, Gandhi Mandapam Road,

Kottur Puram, Chennai - 600 085

Tel: +91-44-4354 6999,

Fax.: +91-44-4354 6888

E-mail: info@alliancein.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Alliance Group welcomes new GST rates to take effect from March 1, 2019 here

News-ID: 1624894 • Views: …

More Releases from Alliance Group

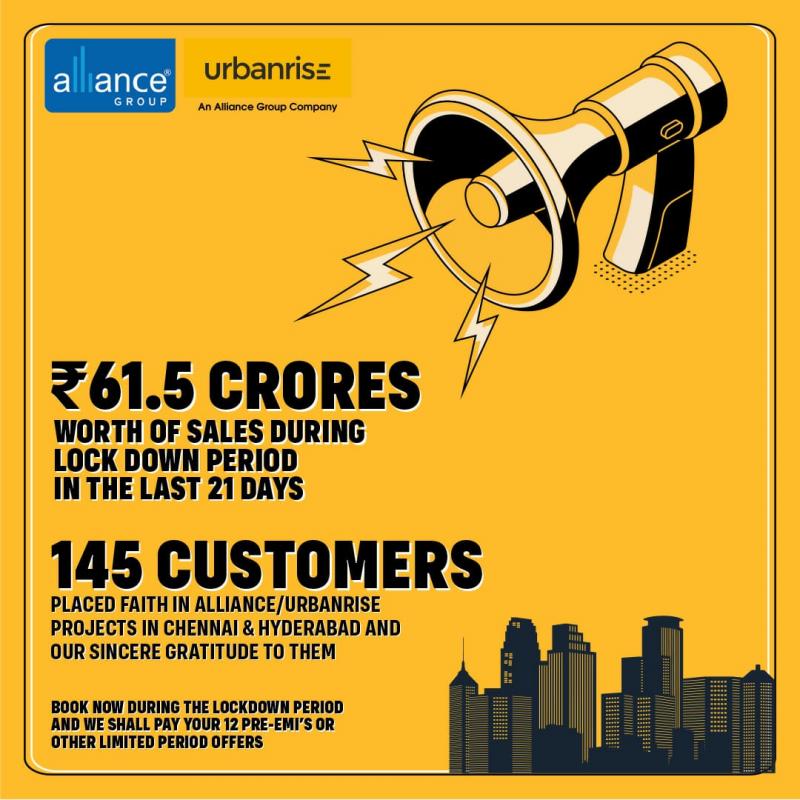

Alliance Setting New Standards in Real Estate this Lockdown Season

The Alliance Group and its flagship Urbanrise brand, have created a record of sorts by achieving a sales target of Rs. 61.5 Crore, during the 3 weeks of the nationwide Lockdown imposed due to COVID-19.

Transforming Odds to Opportunities

While most real estate companies and their operations have come to a standstill due to this lockdown since March 22, Alliance took this challenge head-on by implementing its "Business Continuity" plan for its…

More Releases for GST

Smart GST Calc Unveils New and Improved Australian GST Calculator

Smart GST Calc Unveils New and Improved Australian GST Calculator

[Karachi, Sindh, 23.11.2024] - Smart GST Calc, a trusted name in simplifying tax calculations for businesses and individuals, is excited to announce the release of the latest version of its Australian GST Calculator. The enhanced tool, available at SmartGSTCalc.com, delivers unparalleled accuracy, speed, and ease of use, making GST calculations simpler than ever before.

With the evolving demands of modern businesses and…

The Impact of GST on Small Businesses

With the motive of 'One Nation, One Taxation', the Government of India introduced the Goods and Service Tax (GST) on 01 July 2017. It was a revolutionary move that transformed India's indirect taxation system by providing a unified approach to taxation for businesses. Since small and medium enterprises (SMEs) contribute to around 50% of industrial production and 45% of total exports, GST has had a mixed impact on these…

GST Loans for MSMEs: Eligibility and Process

MSMEs are big contributors to the Indian economy, they contribute over 45% of the total manufacturing output and 35% of India's GDP. Needless to say, their impact on the Indian economy is very significant and supporting the MSME sector is going to help India's overall development. The Indian Government, especially after the COVID-19 pandemic, initiated various schemes that will help ease the financial burden on these micro, small and medium…

LLP Registration | Trademark Registration | GST Registration

legalsalah.com provides online services for LLP Registration, Income-Tax Filing, Registration for Private Limited Company, GST Registration and others in Short time. Legal Salah is pioneer in providing best legal and lawyer advice since last 5 years.

he company aims for excluding the mediators from between the disadvantaged and the professional and saving the time of former whilst the procedure. The Company came up with the idea of Legal Salah-…

eZee Hospitality Solutions Get GST Ready For India

As the Indian government rolls out the held up GST bill, the hospitality industry buckles up for new regulations and tax reforms, making way towards a better economy.

Earlier this month, India became one of the 160 countries in the world to have implemented Goods and Service Tax bill. Effective from 1st of July, the single indirect tax will subsume almost all the current indirect taxes in India.

With a…

Seminar on “Implementation of GST in Insurance Industry”

The Goods and Services Tax (GST) is a ground-breaking reform for the Indian economy's indirect tax regime. GST will change the tax architecture between the state and the centre.

The Goods and Services Tax(GST) is a value added tax that will replace all the indirect taxes levied on goods and services by the government, both central and states, once it is implemented.

The basic idea of this taxation reform is to create…