Press release

Transaction Banking Market 2019 | Global Forecast 2025 | Major Players Oliver Wyman, ORACLE ,Citi Bank, YES Bank, Deutsche Bank

Transaction Banking Market report delivers data on manufacturers, geographical regions, types, applications, key drivers, challenges, Opportunities, annual growth rate, market share, revenue and the actual process of whole Transaction Banking industry. Transaction Banking Market report delivers information on types, applications and its regional markets including past and expected Opportunities.For Sample Copy of this Report @ https://www.orianresearch.com/request-sample/635743

Some of the key players operating in this market include –

Oliver Wyman

ORACLE

Standard Chartered Bank

Citi Bank

YES Bank

SOCIETE GENERALE

Deutsche Bank

…

Key Benefits of the Report:

* Global, Regional, Country, Insight Type, and Application Market Size and Forecast from 2014-2025

* Detailed market dynamics, industry outlook with market specific PESTEL, Value Chain, Supply Chain, and SWOT Analysis to better understand the market and build strategies

* Identification of key companies that can influence this market on a global and regional scale

* Expert interviews and their insights on market shift, current and future outlook and factors impacting vendors short term and long term strategies

* Detailed insights on emerging regions, Insight Type & Application, and competitive landscape with qualitative and quantitative information and facts

Global Transaction Banking Industry is spread across 121 pages, profiling 07 companies and supported with tables and figures.

Inquire more or share a question if any before the purchase on this report @ https://www.orianresearch.com/enquiry-before-buying/635743 .

Target Audience:

* Transaction Banking providers

* Traders, Importer and Exporter

* Raw material suppliers and distributors

* Research and consulting firms

* Government and research organizations

* Associations and industry bodies

The Global Transaction Banking Market was valued at USD XX million in 2017, and is expected to grow at a CAGR of XX% by 2025. The Transaction Banking market is driven by the growing demand for IT capabilities, business operations and business models.

The Transaction Banking market is mainly driven the smooth functioning of national economies and have a direct influence on the safety and soundness of the global banking system

Transformation from traditional analysis techniques for the analysis of business data is an opportunity for the growth of this market.

Lack of proper governance and mitigating risk are the factors that hamper the market growth.

Geographically, Asia is dominate the market as there is more and more need for sophisticated cash management, cash pooling and treasury management strategies to create end-to-end systems that make oversight easier.

Order a copy of Global Transaction Banking Market Report 2019 @ https://www.orianresearch.com/checkout/635743 .

Research Methodology

The market is derived through extensive use of secondary, primary, in-house research followed by expert validation and third party perspective like analyst report of investment banks. The secondary research forms the base of our study where we conducted extensive data mining, referring to verified data sources such as white papers government and regulatory published materials, technical journals, trade magazines, and paid data sources.

For forecasting, regional demand & supply factor, investment, market dynamics including technical scenario, consumer behavior, and end use industry trends and dynamics, capacity production, spending were taken into consideration.

We have assigned weights to these parameters and quantified their market impacts using the weighted average analysis to derive the expected market growth rate.

The market estimates and forecasts have been verified through exhaustive primary research with the Key Industry Participants (KIPs) which typically include:

* Original Equipment Manufacturer,

* Application Supplier,

* Distributors,

* Government Body & Associations, and

* Research Institute

About Us

Orian Research is one of the most comprehensive collections of market intelligence reports on the World Wide Web. Our reports repository boasts of over 500000+ industry and country research reports from over 100 top publishers. We continuously update our repository so as to provide our clients easy access to the world's most complete and current database of expert insights on global industries, companies, and products. We also specialize in custom research in situations where our syndicate research offerings do not meet the specific requirements of our esteemed clients.

Contact Us:

Ruwin Mendez

Vice President – Global Sales & Partner Relations

Orian Research Consultants

US +1 (415) 830-3727| UK +44 020 8144-71-27

Email: info@orianresearch.com

Website: www.orianresearch.com/

Follow Us on LinkedIn: https://www.linkedin.com/company-beta/13281002/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Transaction Banking Market 2019 | Global Forecast 2025 | Major Players Oliver Wyman, ORACLE ,Citi Bank, YES Bank, Deutsche Bank here

News-ID: 1623997 • Views: …

More Releases from Orian Research

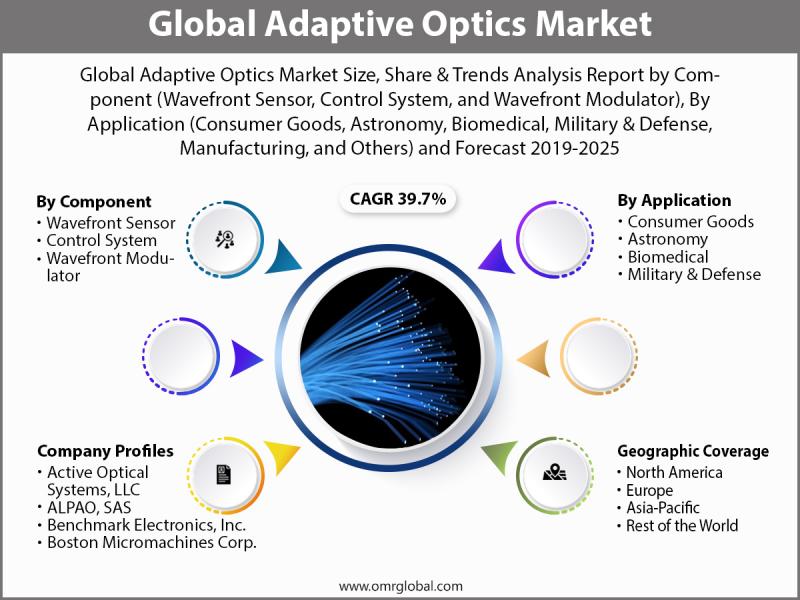

Adaptive Optics Market Size, Competitive Analysis, Share, Forecast- 2019-2025

The global adaptive optics market is projected to grow at a significant CAGR of 39.7% during the forecast period owing to the increasing application of adaptive optics in retinal imaging and ophthalmology to reduce the optical aberrations. The integration of adaptive optics converts an ophthalmoscope into a microscope, allowing visualization of and optical access to individual retinal cells in living human eyes.

To learn more about this report request a…

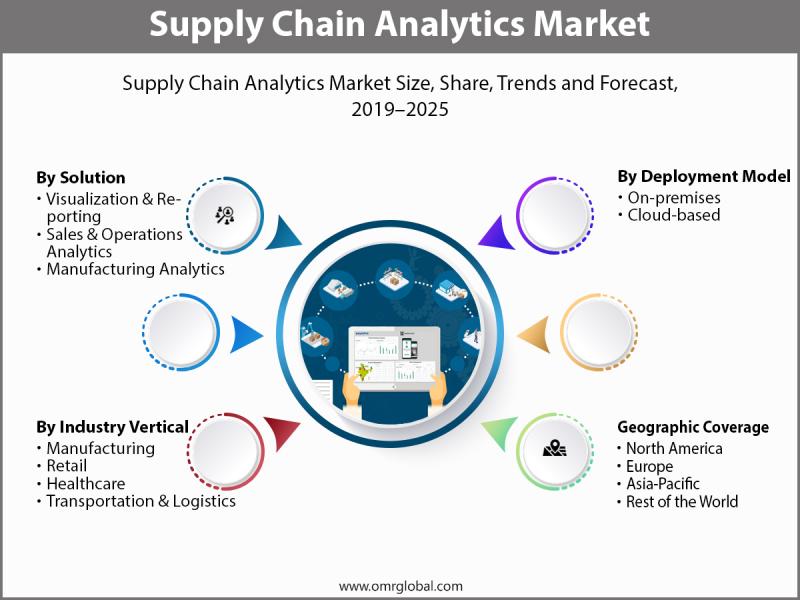

Supply Chain Analytics Market Size, Competitive Analysis, Share, Forecast- 2019- …

The Global Supply Chain Analytics Market is estimated to grow at a significant CAGR during the forecast period 2019- 2025. The impact of e-commerce on retailers and manufacturers is driving a revolution in many sectors and business organization. This has led to the introduction of supply chain analytics solution, which offers mathematics, statistics, predictive modeling and machine-learning techniques to find meaningful patterns and knowledge regarding order, shipment and transactional data.…

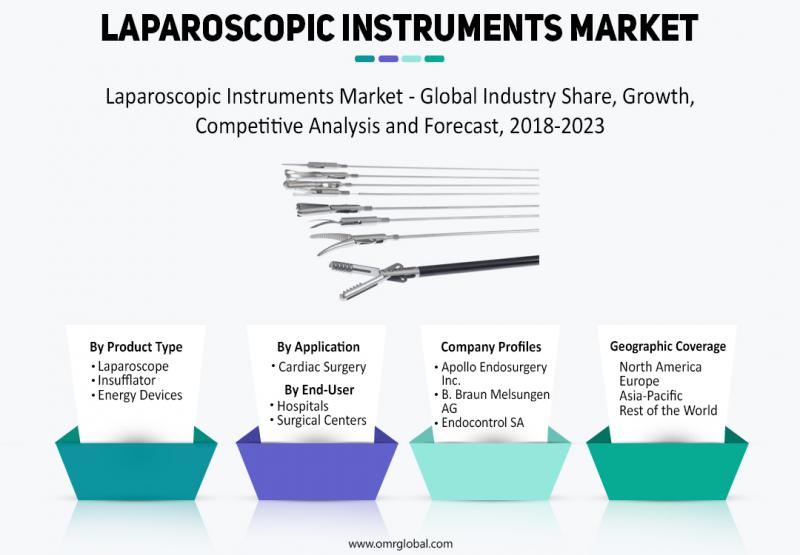

Laparoscopic Instruments Market Size, Competitive Analysis, Share, Forecast- 201 …

The laparoscopic or minimally invasive surgery uses a special surgical instrument known as laparoscope to look inside the body and carry out certain procedures. The laparoscopic instruments market is projected to witness a steady growth rate during the forecast period 2018-2023. The rise in preference of minimal invasive method over invasive surgeries, the high prevalence of lifestyle-oriented diseases, high global expenditure on the laparoscopic market, increasing healthcare market in emerging…

Fertility Drug Market Size, Competitive Analysis, Share, Forecast- 2018-2023

Infertility is one of the major issue now a day due to change in life style & cultural shift. There are various fertility drugs available in market for infertility related problems. Fertility drugs enhance the reproductive ability by improving quality of egg or sperms by increasing the levels of certain hormones in human body. The major factors that are responsible for the growth of fertility drug market are Change in…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…