Press release

Global Bancassurance Market Share, Current Trends, Opportunities, Growth Size & Forecasts 2023

The global bancassurance market is envisaged to witness a healthy growth in the near future due to various favourable factors such as benefits for both insurance companies and banks, increasing awareness about bancassurance, ageing population, rising private banking sector and thriving developing economies.Request for a free sample report: https://www.imarcgroup.com/request?type=report&id=982&flag=B

IMARC Group’s latest report, titled “Bancassurance Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2018-2023”, estimates that the global bancassurance market reached a value of more than US$ 1,100 Billion in 2017, registering a CAGR of 6.4% during 2010-2017. Bancassurance refers to the partnership between a bank and an insurance company, wherein the insurance company is enabled to sell its products by using bank as a distribution channel. This collaboration helps the bank in earning a revenue, apart from the interest, also known as fee-based income. Whereas, the insurance company gets to expand its consumer-base without rising its broker commissions and sales force. With bancassurance, these institutions offer a wide range of banking as well as investment products and services to the consumers, such as health insurance along with mortgage, life insurance, and annuities. These products tend to complement the existing bank products which further leads to additional selling opportunities for both the insurance company and bank.

Browse full report with Table of Content: https://www.imarcgroup.com/bancassurance-market

Market Drivers:

Selling insurance through banks is a cost-effective affair than approaching customers through an agent. Agent’s involvement increases labour cost for the insurance company, thereby decreasing its profit margins. As a result, banking sector has appeared to be a potential distribution channel for insurance products. Further, the adoption of advanced technologies by the private sector banks have resulted in superior customer services for an increasingly sophisticated client base. In addition to this, these banks are continuously revising their policies in order to sustain escalating market competition which is expected to boost the market performance in short and medium terms. Moreover, economic growth, expanding middle-class population and inflating income levels in the emerging economies, such as Asia Pacific and Latin America, have created immense growth prospect for the bancassurance market. Due to the aforementioned forces, the market value is anticipated to reach US$ 1,571 Billion by 2023, exhibiting a CAGR of more than 6% during 2018-2023.

Global Bancassurance Market Segmentation:

Market Breakup by Product:

1. Life Bancassurance

2. Non-Life Bancassurance

The market has been bifurcated on the basis of product type into life and non-life bancassurance. At present, life bancassurance accounts for more than three-fourth of the total market share. This can be attributed to rising awareness about bancassurance among the consumers.

Market Breakup by Bancassurance Models:

1. Pure Distributor

2. Exclusive Partnership

3. Financial Holding

4. Joint Venture

On the basis of type of bancassurance models, the market has been categorised into exclusive partnership, financial holding, pure distributor, joint venture and others. Currently, pure distributor represents the most popular model type of bancassurance as it offers added sales opportunities with minimum investment to both banks and insurance companies.

Market Breakup by Region:

1. Asia Pacific

2. Europe

3. Latin America

4. North America

5. Middle East and Africa

Region-wise, Europe is the largest market for bancassurance, holding a dominant share of the global market. This can be ascribed to favourable tax structure and initiatives undertaken by various governments in the region. Other major regions include Asia Pacific, Latin America, North America, and the Middle East and Africa.

Competitive Landscape:

The competitive landscape of the market has also been analysed in the report with some of the major players being ABN AMRO, ANZ, Banco Bradesco, American Express, Banco Santander, BNP Paribas, ING Group, Wells Fargo, Barclays, Intesa Sanpaolo, Lloyds Bank Group, Citigroup, Crédit Agricole, HSBC, NongHyup Financial Group, Société Générale and Nordea Group.

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact us

IMARC Group

309 2nd St, Brooklyn, NY 11215, USA

Website: https://www.imarcgroup.com

Email: sales@imarcgroup.com

USA: +1-631-791-1145

Follow us on twitter: @imarcglobal

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Bancassurance Market Share, Current Trends, Opportunities, Growth Size & Forecasts 2023 here

News-ID: 1595011 • Views: …

More Releases from IMARC Group

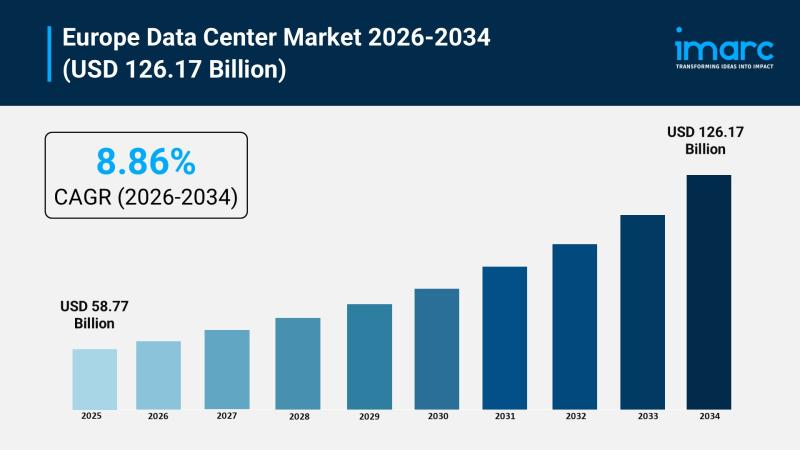

IMARC Group Forecasts 8.86% CAGR for Europe Data Center Market Amidst AI and Clo …

The Europe data center market is experiencing a critical phase of infrastructure evolution, having reached a valuation of USD 58.77 Billion in 2025. Propelled by the accelerating digitalization of the region's economy and sovereign cloud ambitions, the market is projected to reach USD 126.17 Billion by 2034. This growth trajectory represents a solid Compound Annual Growth Rate (CAGR) of 8.86% during the forecast period of 2026-2034.

Key Market Trends &…

Hot Sauce Manufacturing Plant DPR & Unit Setup - 2026: Demand Analysis and Proje …

Setting up a hot sauce manufacturing plant positions investors within one of the fastest-growing and flavor-driven segments of the global condiment industry, fueled by rising consumer appetite for spicy, bold, and ethnic flavors, increasing demand for clean-label and premium condiment products, and expanding utilization of hot sauce across food service, retail, and food processing applications. Made primarily from chili peppers, vinegar, salt, and complementary flavoring ingredients, hot sauce is recognized…

Glyoxylic Acid Prices Q4 2025: US Stable While Europe Remains High Price Trend

The Glyoxylic Acid Price Trend Analysis indicates dynamic shifts in global supply-demand balance, feedstock volatility, and regional trade flows. In 2026, Glyoxylic Acid Prices are reflecting fluctuations in raw material costs and downstream demand from pharmaceuticals, cosmetics, and agrochemicals. Market participants closely track the Glyoxylic Acid price index and forecast data to understand pricing momentum, risk exposure, and procurement strategies across key global regions.

Glyoxylic Acid Current Glyoxylic Acid Price Movements:

Recent…

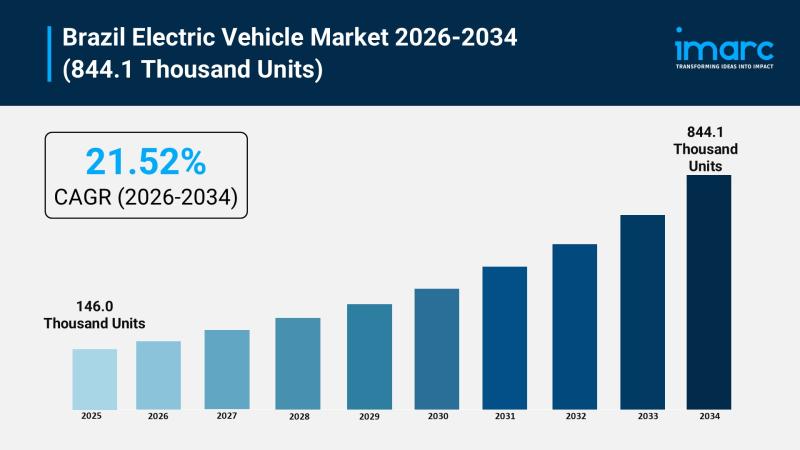

IMARC Group Forecasts 21.52% CAGR for Brazil EV Market as BYD and GWM Ramp Up Lo …

The Brazil electric vehicle (EV) market is currently witnessing an unprecedented surge, having reached a volume of 146.0 Thousand Units in 2025. Fueled by a combination of stringent environmental policies and a strategic shift toward domestic production by global automakers, the market is projected to reach 844.1 Thousand Units by 2034. This rapid expansion represents a robust Compound Annual Growth Rate (CAGR) of 21.52% during the forecast period of 2026-2034.

Key…

More Releases for Bancassurance

Bancassurance Market Dynamics: Innovation and Automation Driving 5.52% CAGR

The Bancassurance market was valued at USD 1.6 trillion in 2024 and is projected to reach USD 2.2 trillion by 2030, growing at a steady CAGR of 4.6% during the forecast period from 2024 to 2030.

Driven by the seamless integration of financial services, the bancassurance model-where insurance products are sold through banking channels-is redefining the customer experience. By leveraging existing bank-customer trust and massive distribution networks, financial institutions are successfully…

Investment Outlook: Analyzing Europe Bancassurance Market Trajectory by 2033

Market Overview

The Europe bancassurance market was valued at USD 646.79 Billion in 2024 and is forecast to reach USD 971.75 Billion by 2033, growing at a CAGR of 4.40% during 2025-2033. Digital transformation and enhanced financial literacy are primary growth drivers. Partnerships between banks and insurers create integrated service offerings, expanding customer access to insurance.

Download a sample copy of the report: https://www.imarcgroup.com/europe-bancassurance-market/requestsample

Study Assumption Years

Base Year: 2024

Historical Years: 2019-2024

Forecast Period: 2025-2033

Europe…

Bancassurance Market: An Extensive Analysis Predicts Significant Future Growth

According to USD Analytics the Global Bancassurance Market is projected to register a high CAGR from 2025 to 2034.

The latest study released on the Global Bancassurance Market by USD Analytics Market evaluates market size, trend, and forecast to 2034. The Bancassurance market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study…

GCC Bancassurance Market 2024: Trends, Growth Drivers, and Opportunities

The Business Research Company recently released a comprehensive report on the Global Food Inclusions Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

According to The Business Research Company's, The food inclusions market size…

Bancassurance Market Growth, Size, Trends,Share Analysis 2024-2033

"The Business Research Company recently released a comprehensive report on the Global Bancassurance Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample of…

Global Bancassurance Market Professional 2027-

Global Bancassurance Market Size Is Projected To Reach US$ 2291.7 Million By 2027, From US$ 2008.8 Million In 2020, At A CAGR Of 1.9% During 2021-2027

QY Research recently published a research report titled, "Global Bancassurance Market Report, History and Forecast , Breakdown Data by Manufacturers, Key Regions, Types and Application". The research report attempts to give a holistic overview of the Bancassurance market by keeping the information simple, relevant, accurate,…