Press release

Peer to Peer (P2P) Lending Market 2019-2025 | Analysis, Technologies, Top Companies are Prosper Marketplace Inc., Common Bond Inc., Circle Back Lending Inc., Upstart Network Inc., Peerform, Social Finance Inc., Funding Circle Limited and Pave, Inc.

Report DescriptionThe peer-to-peer lending market has already witnessed several positive outcomes and also had a huge impact over the finance sector, however, there are no chances that the growth of the market will slow down anytime in coming few years. Moreover, technological developments, uninterrupted innovations as well as supportive guidelines is expected to impel the industry across the globe to unforeseen levels, besides continuously transforming the way we interpret the finance and lending process.

Get Sample Copy of Peer to Peer (P2P) Lending Market Report @ https://www.adroitmarketresearch.com/contacts/request-sample/393

One of the major factor expected to drive peer-to-peer lending market in upcoming years is rising developing markets on account of development in knowledge of lending at marketplace, better transparency for investment as well as reduced rates of interest to consumers.

The global Peer to Peer Lending Market size is anticipated to rise at a CAGR of xx.x % over the forecast period (2018-2025), and reach to $ xxxxxx million by the end of 2025. The global peer to peer lending market has been segmented by different end-user, business model and geography. Further, end-user segment of the market has been bifurcated into small business loans, consumer credit loans, student loans and real estate loans. End-user segment of the peer to peer lending market dominates the global market with significant share because of its small business loans division. Moreover, small business loans sector is expected to grow at a CAGR of xx% over the forecast spell.

Likewise, business model segment of the global peer to peer lending market has been sub-segmented into traditional lending and alternate marketplace lending. Business Model segment of the market especially in emerging economies is led by its traditional lending sector because of lesser availability of modern technologies.

Get access to the complete report on Peer-to-Peer lending market with different major key players available @ https://www.adroitmarketresearch.com/industry-reports/peer-to-peer-p2p-lending-market

Since, peer-to-peer lending market is a small fragment of the financial market that involves several governing restrictions in different regions. The regulations are actually dependent upon the national guidelines, along with original banks as partners in effective business is mostly a major concern. The regulatory process also involves confirmation of debtor’s data by the credit agencies or any other peripheral monitoring bureaus. However, this methodology for the validation as well as documentation varies depending upon the country.

Prosper, a U.S based P2P lending company has more than 2 million members and their total lending is more than $6 billion and Zopa, a UK based P2P lending company has supported a total of more than £1.4 billion of P2P loans and currently has some 60,000 investors lending to its borrowers base which is in lacs. Many companies since Zopa and Prosper have successfully launched their own marketplaces.

Geographical segment of the global market further analyzes across, Europe (Germany, UK, France & Rest of Europe), North America (Canada, U.S. & Mexico), Asia-Pacific (Australia, China & rest of Asia-Pacific) and LAMEA (Middle East, Latin America & Africa). Since past few years, North America led the market with highest peer to peer lending market share. Key factors driving the market of North America are less interest rates in conventional banking, growing reliability over online platforms and consequences of previous financial crisis.

Some of the key players operating in the competitive landscape of the global peer-to-peer lending market include Prosper Marketplace Inc., Common Bond Inc., Circle Back Lending Inc., Upstart Network Inc., Peerform, Social Finance Inc., Funding Circle Limited and Pave, Inc. Prominent players of the market are looking ahead for marking developments to cater the expectations of their customers as well as maintain their position in the market.

Highlights of the key segments in upcoming ‘Global Peer to Peer Lending Market’ report:

End-user Segment

• Small business loans

• Consumer credit loans

• Student loans

• Real estate loans

Business model Segment

• Traditional lending

• Alternate marketplace lending

Geographical Segment

• Europe (Germany, UK, France & Rest of Europe)

• North America (Canada, U.S. & Mexico)

• Asia-Pacific (Australia, China & rest of Asia-Pacific)

• LAMEA (Middle East, Latin America & Africa)

Make an Enquire to Buy This Report @ https://www.adroitmarketresearch.com/researchreport/purchase/393

Analyst Commentary

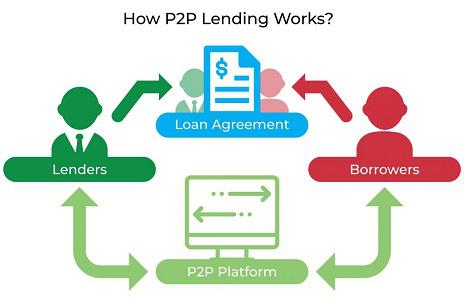

With the rising acceptance of internet communities since last decade a new-fangled method of loan instigation has arrived in the credit market known as peer-to-peer (P2P) lending. Thus, peer to peer lending is also acknowledged as social lending or crowd lending. In such type of lending model the intervention of financial organizations is not mandatory. Moreover, assessment technique of loan instigation is given into the hands of private moneylenders as well as borrowers, also websites such as Prosper.com offers them with a platform in order to involve them with each other. Now, under such platforms borrowers usually describe the purpose of their loan appeal followed by the information related to their existing financial situation, that includes salary and open credit positions, depending upon which the lenders approve the loan.

About Adroit Market Research:

Adroit Market Research provide quantified B2B research on numerous opportunistic markets, and offer customized research reports, consulting services, and syndicate research reports. We assist our clients to strategize business decisions and attain sustainable growth in their respective domain. Additionally, we support them with their revenue planning, marketing strategies, and assist them to make decisions before the competition so that they remain ahead of the curve.

Contact Information:

Ryan Johnson

Account Manager Global

3131 McKinney Ave Ste 600, Dallas,

TX75204, U.S.A.

Phone No.: USA: +1 (214) 884-6068 / +91 9665341414

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Peer to Peer (P2P) Lending Market 2019-2025 | Analysis, Technologies, Top Companies are Prosper Marketplace Inc., Common Bond Inc., Circle Back Lending Inc., Upstart Network Inc., Peerform, Social Finance Inc., Funding Circle Limited and Pave, Inc. here

News-ID: 1586664 • Views: …

More Releases from Adroit Market Research

Electronic Health Records Market Estimated Size Valuation will be USD 47.62 Bill …

The global Electronic Health Records market reached a value of US$ 30.65 Billion in 2023 and is expected to reach US$ 47.62 Billion by 2032, exhibiting a CAGR of 6.01% during the prediction period of 2023 to 2032.

Executive Synopsis:

The last few years have seen a notable increase in the global Electronic Health Records market because of technological breakthroughs, rising demand from a variety of industries, and continuous R&D initiatives to…

Organic Food Market Size to Reach USD 525.65 Billion at a CAGR of 12.09% by 2032 …

The global Organic Food market reached a value of US$ 170.05 Billion in 2023 and is expected to reach US$ 525.65 Billion by 2032, exhibiting a CAGR of 12.09% during the prediction period of 2023 to 2032.

The global Organic Food market report uses methods and major market analysis

To give a thorough picture of the market, the global Organic Food market report uses a range of analytical techniques and frameworks. Market…

Quantum Computing Market Size to Grow Worth USD 888.5 Million at a CAGR of 33.10 …

The global Quantum Computing market reached a value of US$ 888.5 Million in 2023 and is expected to reach US$ 12,622.9 Million by 2032, exhibiting a CAGR of 33.10% during the prediction period of 2023 to 2032.

What is said in the market report for global Quantum Computing

A thorough examination of the market's structure, trends, obstacles, and opportunities is included in the global Quantum Computing market study. A thorough analysis of…

Software as a Service Market Size to grow USD 1,230.81 Billion by 2032 | CAGR of …

The global Software as a Service market reached a value of US$ 275.53 Billion in 2023 and is expected to reach US$ 1,230.81 Billion by 2032, exhibiting a CAGR of 19.5% during the prediction period of 2023 to 2032.

Extensive Assessment of COVID-19's Impact on the Worldwide Software as a Service Industry

The COVID-19 pandemic had a substantial effect on the global Software as a Service market, altering market dynamics through supply…

More Releases for Peer

Peer To Peer Network Patent Enforcement and Industry Consolidation

Peer To Peer Network ($PTOP) formally retained patent infringement counsel to enforce two specific U.S. utility patents, signaling their intent to consolidate control over the projected $300 billion market.

A Pivotal Moment for Digital Networking

The digital business card market, a rapidly growing sector fueled by the global shift to remote and hybrid work, has reached a pivotal moment. The industry is on the cusp of a fundamental transformation, initiated not by…

Evolving Market Trends In The Peer-To-Peer Dining Industry: Affordable And Custo …

The Peer-To-Peer Dining Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Peer-To-Peer Dining Market Size During the Forecast Period?

The peer-to-peer dining market size is expected to grow from $6.36 billion in 2024 to $6.64 billion in 2025 at a CAGR of…

Transforming the Peer-To-Peer Dining Market in 2025: Home Cooking Growth Propels …

What Is the Expected Size and Growth Rate of the Peer-To-Peer Dining Market?

In the past few years, the peer-to-peer dining market size has exhibited consistent growth. The current projection indicates an increase from $6.36 billion in 2024 to $6.64 billion in 2025, maintaining a compound annual growth rate (CAGR) of 4.3%. The expansion during the historic period is believed to stem from factors such as growing internet usage, widespread influence…

What is Peer-to-Peer Networks: Full Guide

In today's fast-paced digital age, the very fabric of how we connect and share information is transforming. At the forefront of this revolution stands peer-to-peer (P2P) technology, a game-changer that offers unprecedented levels of control, security, and efficiency. By enabling devices to communicate directly without a central server, peer-to-peer networks are redefining the way we think about data exchange and resource sharing.

Image: https://revbit.net/wp-content/uploads/2024/11/peer-to-peer-networks-1024x640.png

Understanding Peer-to-Peer Technology

Peer-to-peer technology is redefining connectivity by…

Global Peer-to-peer Network Market Size & Trends

According to a new market research report published by Global Market Estimates, the global peer-to-peer network market is expected to grow at a CAGR of 15.5% from 2023 to 2028.

Global peer-to-peer network market growth is driven by the rise in demand for scalability of the network and efficiency in terms of communication and file sharing.

Browse 147 Market Data Tables and 115 Figures spread through 163 Pages and in-depth TOC on…

CCE’s revolutionary peer-to-peer CAD collaboration technology

FOR IMMEDIATE RELEASE

Debankan Chattopadhyay

+1 (248) 932-5295

debankan@cadcam-e.com

CCE’s revolutionary peer-to-peer CAD collaboration technology

No need to store proprietary data in the cloud/server to view or collaborate

FARMINGTON HILLS, Mich. – (November 10, 2020) – CCE, a leading provider of advanced CAD interoperability technology, will launch Review Room, an exciting update to its EnSuite-Cloud product to enable people working remotely use its unique secure peer-to-peer technology for CAD collaboration.

EnSuite-Cloud is a phenomenally successful…