Press release

Global Mobile Payment Technology Market

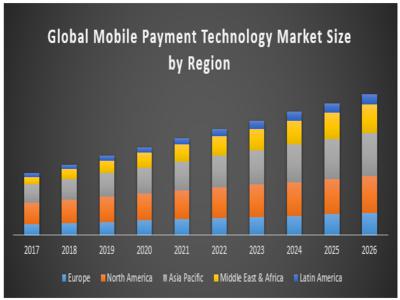

Global Mobile Payment Technology Market – Industry Analysis And Forecast (2017-2026) by Mode of Transaction, Type of Mobile Payment, Application, by Purchase Type, Region.Global mobile payment technology market size is expected to reach US$ 50.56 Bn by 2026, expanding at a CAGR of 39.8% from 2018 to 2026.

Mobile payment can be used for the payment of goods or services and transfer of money through mobiles or smartphones. Growth in E-commerce, introduction of innovative facilities by the key players. However, it has been observed that a number of users are increasing day by day as everything is available online so most efficient way to pay for anything or purchasing things is provided by mobile payment technology. But, network issues or connection failure, power failure will be limiting the growth of the market. Instead of going to stores and purchasing things, it is most convenient for today’s generation to pay online and order whatever you wish to. We can order food online, book hotel rooms, e-banking, e-tickets, there are so many options which requires mobile payment methods. The risks associated in processing mobile payments including financial details of the card owner during the transaction poses a major challenge for the market growth. Government initiatives in promoting digital payment create new opportunities in the mobile payment technology market.

For More Information about Report Visit here

https://www.maximizemarketresearch.com/market-report/global-mobile-payment-technology-market/14988/

NFC segment is anticipated to boost mobile payment technology market on account of NFC enabled smartphones. Various applications pertaining to mobile payment technology are BFSI, retail, healthcare, entertainment, IT and telecom, energy & utilities, hospitality & tourism, and others. Increasing adoption of mobile payments in the banking sector is expected to boost BFSI’s share in the estimated timeframe.

Mobile wallets dominated the mobile payment technology market. Increasing penetration of digitalization. Mobile wallets are a relatively new payment option that can offer some serious benefits. Apple Pay, Samsung Pay and Android Pal works across all major devices. Mobile wallet reduces fraud and reduces content in the wallet. Other popular wallet apps are retailer or brand specific, such as Wal-Mart stores, Walmart pay, capital one financial corporation's (COF) Capital One Wallet and the ubiquitous Starbucks wallet app from Starbucks Corporation (SBUX).

We like our movies and our music the way we like our mail — digitally and when we want to look at it. In the most recent survey from PayPal on digital delivery in the entertainment space, the smartphone reigns supreme, as Melissa O’Malley, director of global initiatives at PayPal, told Karen Webster — even when watching movies. Which means that payment plays a starring role.

Entertainment application segment dominated the market in 2017 and will continue its dominance throughout the forecast period. Digital entertainment is undergoing a revolution. Proliferation of smartphones, rapid product innovations, increased consumer connectivity and the growth of social media have powered the digital entertainment revolution. This has drastically changed the way that customers purchase and consume games, movies and music.

North America held a major share in the global mobile payment technology market in terms of revenue, owing to significant adoption of mobile phones in the U.S. Asia Pacific will exhibit growth at faster pace. In India, “Digital India” initiative by government will be giving major acceleration to the growth Asia Pacific region. While in China contributing factors include the rapid growth of e-commerce, the relatively low adoption of other payment methods such as credit cards, and the availability of mobile payment services. The technology is increasingly being used in BFSI and government sectors, as it offers both security and transparency along with quick payment preprocess.

The objective of the report is to present a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, industry-validated market data and projections with a suitable set of assumptions and methodology. The report also helps in understanding mobile payment technology market dynamics, structure by identifying and analyzing the market segments and project the global market size. Further, the report also focuses on the competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence. The report also provides PEST analysis, PORTER's analysis, SWOT analysis to address questions of shareholders to prioritizing the efforts and investment in the near future to an emerging segment in mobile payment technology market.

Scope of Mobile Payment Technology Market:

Mobile Payment Technology Market by Mode of Transaction:

• SMS

• NFC

• WAP

Mobile Payment Technology Market by Type of Mobile Payment:

• Mobile Wallet

• Bank Cards

• Mobile Money

Mobile Payment Technology by Application:

• Entertainment

• Energy & Utilities

• Healthcare

• Retail

• Hospitality

• Transportation

Mobile Payment Technology by Purchase Type:

• Airtime Transfers & Top-ups

• Money Transfers & Payments

• Merchandise & Coupons

• Travel & Ticketing

Mobile Payment Technology by Region:

• North America

• Europe

• Asia pacific

• Middle East & Africa

• Latin America

Key Players Mobile Payment Technology:

• Orange S.A.

• Vodacom Group Limited

• MasterCard Incorporated

• Bharti Airtel Limited

• MTN Group Limited

• Safaricom Limited

• PayPal Holdings Inc.

• Econet Wireless Zimbabwe Limited

• Millicom International Cellular SA

• Mahindra Comviva

• AT &T’S

• JIO

• Apple Inc.

• Google LLC.

• One97 Communications Limited.

• Venmo.

• Vodafone Group Plc

Maximize Market Research provides B2B and B2C research on 20,000 high growth emerging opportunities & technologies as well as threats to the companies across the Healthcare, Pharmaceuticals, Electronics & Communications, Internet of Things, Food and Beverages, Aerospace and Defense and other manufacturing sectors.

For More Information about Report Visit here

https://www.maximizemarketresearch.com/market-report/global-mobile-payment-technology-market/14988/

Report Published by https://www.maximizemarketresearch.com MAXIMIZE MARKET RESEARCH PVT. LTD.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Mobile Payment Technology Market here

News-ID: 1583207 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

Ready-to-Drink Beverages Market Size to Reach USD 1,227.81 Billion by 2032

Ready-to-Drink Beverages Market is poised for substantial growth over the forecast period, driven by changing consumer lifestyles, rising disposable income, expanding urbanization, and increasing demand for convenient beverage solutions. According to recent industry analysis, the global Ready-to-Drink Beverages Market was valued at USD 766.69 Billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 6.22% from 2025 to 2032, reaching nearly USD 1,227.81 Billion…

Second hand Product Market Set to Surpass USD 1451.34 Billion by 2032, Expanding …

Second hand Product Market was valued at USD 594.45 Billion in 2025 and is projected to grow at a robust CAGR of 13.6% from 2025 to 2032, reaching nearly USD 1451.34 Billion by 2032. The rapid expansion of resale ecosystems, increasing consumer preference for cost-effective purchasing, and rising sustainability awareness are significantly driving the growth of the Second hand Product Market globally.

Market Overview

The Second hand Product Market is undergoing a…

Tungsten Market to Reach USD 10.99 Billion by 2032, Driven by Expanding Aerospac …

The Global Tungsten Market is poised for significant expansion over the coming years, with the market size valued at USD 6.41 Billion in 2025 and projected to grow at a CAGR of 8% from 2025 to 2032, reaching nearly USD 10.99 Billion by 2032. Rising industrial demand, technological advancements in material science, and increasing applications in high-performance sectors are collectively driving this steady growth trajectory.

Tungsten, recognized for its exceptional hardness,…

System-on-Chip (SoC) Market to Reach USD 391.61 Billion by 2032, Driven by 5G, A …

The global System-on-Chip (SoC) Market is poised for significant growth over the forecast period, reflecting the rapid evolution of semiconductor technologies and increasing demand for high-performance, energy-efficient electronic devices. Valued at USD 228.06 Billion in 2025, the market is projected to grow at a CAGR of 8.03% from 2025 to 2032, reaching nearly USD 391.61 Billion by 2032.

♦ Request a Free Sample Copy or View Report Summary:https://www.maximizemarketresearch.com/request-sample/33954/

System-on-Chip (SoC) Market Overview

A…

More Releases for Mobile

Global Mobile Wallet Market, Global Mobile Wallet Industry, Market Revenue, Mark …

The digital wallet is the engine of mobile commerce and also agreements an evolutionary path to decrease the friction in the transaction and optimize consumer satisfaction. The users are interested towards gorgeous cash backs and loyalty coupons suggested by dissimilar mobile wallet corporates. The mobile wallet market in the report denotes to payment services functioned under financial regulation and functioned through a mobile device instead of paying with cheques, cash, or credit cards.…

Asia - Mobile Infrastructure and Mobile Broadband

Bharat Book Bureau Provides the Trending Market Research Report on "Asia - Mobile Infrastructure and Mobile Broadband" under Telecom category. The report offers a collection of superior market research, market analysis, competitive intelligence and industry reports.

Executive Summary

Leading Asian nations prepare for 5G rollouts

Asia’s mobile subscriber market is now witnessing moderate growth in a fast maturing market. Whilst there are still developing markets continuing to grow their mobile subscriber base at…

Mobile Virtual Network Operator (MVNO) Market Analysis by Top Key Players Tracfo …

The mobile virtual network operator (MVNO) is also referred to as the mobile other licensed operator (MOLO), or the virtual network operator (VNO), is the remote service of communication which does not claim the remote network infrastructure on which it gives the customer the services.

Get Sample Copy of this Report @ https://www.bigmarketresearch.com/request-sample/2835705?utm_source=RK&utm_medium=OPR

The MVNO goes into the business agreement with the mobile network operator for acquiring more access to…

Mobile Virtual Network Operator (MVNO) Market Comprehensive Study 2018: Boost Mo …

Global Mobile Virtual Network Operator (MVNO) market report provides a thorough synopsis on the study for market and how it is changing the industry. The data and the information regarding the industry are taken from reliable sources such as websites, annual reports of the companies, journals, and others and were checked and validated by the market experts. Mobile Virtual Network Operator (MVNO) Market report includes historic data, present market trends,…

Asia - Mobile Infrastructure And Mobile Broadband

Asian mobile broadband market continues to grow strongly

With 3.9 billion mobile subscribers and over 50% of the mobile subscribers in the world, spread across a diverse range of markets, the region is already rapidly advancing in the adoption of mobile broadband services. Mobile broadband as a proportion of the total Asian mobile broadband subscriber base, has increased from 2% in 2008 to 18% in 2013, 27% in 2014, 33% in…

Mobile Money Market Trends, Public Demand and Worldwide Strategy - Mobile Commer …

The mobile money market report provides an analysis of the global mobile money market for the period 2014 – 2024, wherein 2015 is the base year and the period from 2016 to 2024 is the forecast period. Data for 2014 has been included as historical information. The report covers all the prevalent trends playing a major role in the growth of the mobile money market over the forecast period. It…