Press release

Online Loans Market 2019 Global Industry Types, Future Demand, segments and Prominent Key Players- Upstart, Funding Circle, Prosper, CircleBack Lending, Peerform, Lending Club, Zopa, Daric, Pave, Mintos

Online Loans Market report presents an in-depth assessment of the including enabling technologies, key trends, market drivers, challenges, standardization, regulatory landscape, deployment models, operator case studies, opportunities, future roadmap, value chain, ecosystem player profiles, and strategies. The report also presents forecasts for Online Loans investments from 2019 till 2025.Get Sample Copy @https://www.orianresearch.com/request-sample/794764

The report includes Different parts, dealing with:

• Basic information

• Online Loans industry analysis

• Market entry and investment feasibility analysis

• Report conclusion.

The Major Key Players Coverage (Sales data, Main Products & Services etc.):

• Upstart

• Funding Circle

• Prosper

• CircleBack Lending

• Peerform

• Lending Club

• Zopa

• Daric

• Pave

• Mintos

• …

Global Online Loans Industry is spread across 94 pages supported with tables and figures.

Inquire more or share a question if any before the purchase on this report @https://www.orianresearch.com/enquiry-before-buying/794764.

Product Type Coverage (Market Size & Forecast, Major Business of Product Type etc.):

• On-Premise

• Cloud-Based

Product Applications (Industry Size & Forecast, Consumer Distribution):

• Individuals

• Businesses

Online Loans is a user interface or dashboard that connects a person to a machine, system, or device. While the term can technically be applied to any screen that allows a user to interact with a device, HMI is most commonly used in the context of an industrial process.

Order a copy of Global Online Loans Market Report 2019 @https://www.orianresearch.com/checkout/794764.

This report focuses on the Online Loans in global market, especially in North America, Europe and Asia-Pacific, South America, Middle East and Africa. This report categorizes the market based on manufacturers, regions, type and application.

In 2018, the global Online Loans market size was xx million US$ and it is expected to reach xx million US$ by the end of 2025, with a CAGR of xx% during 2019-2025.

Online Loans Market Report covers the comprehensive market, vendor landscape, present scenario, and the growth prospects of the Sensing Online Loans Market for 2019-2024. A report, consists of various factors such as definitions, applications, and classifications. Global Sales Volume, Sales Price and Sales Revenue Analysis are also covered in the Sensing Online Loans Market research report. This report provides valuable information for companies like manufacturers, suppliers, distributors, traders, customers, investors and individuals who have interests in this industry.

The study objectives of this report are:

To analyze global Online Loans status, future forecast, growth opportunity, key market and key players.

To present the Online Loans development in United States, Europe and China.

To strategically profile the key players and comprehensively analyze their development plan and strategies.

To define, describe and forecast the market by product type, market and key regions.

In this study, the years considered to estimate the market size of Online Loans are as follows:

History Year: 2014-2018

Base Year: 2018

Estimated Year: 2019

Forecast Year 2019 to 2025

About Us:

Orian Research is one of the most comprehensive collections of market intelligence reports on the World Wide Web. Our reports repository boasts of over 500000+ industry and country research reports from over 100 top publishers. We continuously update our repository so as to provide our clients easy access to the world's most complete and current database of expert insights on global industries, companies, and products. We also specialize in custom research in situations where our syndicate research offerings do not meet the specific requirements of our esteemed clients.

Contact Us:

Ruwin Mendez

Vice President – Global Sales & Partner Relations

Orian Research Consultants

US +1 (415) 830-3727| UK +44 020 8144-71-27

Email: info@orianresearch.com

Website: www.orianresearch.com/

Follow Us on LinkedIn: https://www.linkedin.com/company-beta/13281002/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Online Loans Market 2019 Global Industry Types, Future Demand, segments and Prominent Key Players- Upstart, Funding Circle, Prosper, CircleBack Lending, Peerform, Lending Club, Zopa, Daric, Pave, Mintos here

News-ID: 1581281 • Views: …

More Releases from Orian Research

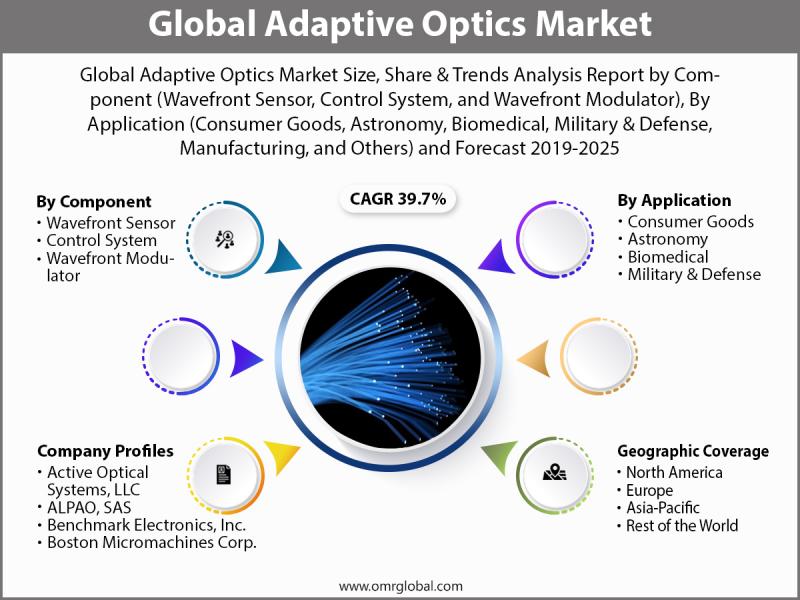

Adaptive Optics Market Size, Competitive Analysis, Share, Forecast- 2019-2025

The global adaptive optics market is projected to grow at a significant CAGR of 39.7% during the forecast period owing to the increasing application of adaptive optics in retinal imaging and ophthalmology to reduce the optical aberrations. The integration of adaptive optics converts an ophthalmoscope into a microscope, allowing visualization of and optical access to individual retinal cells in living human eyes.

To learn more about this report request a…

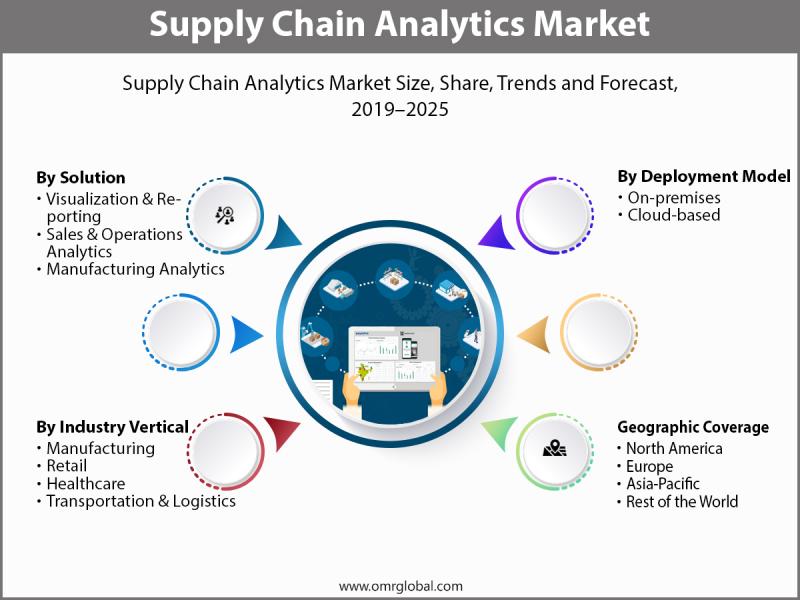

Supply Chain Analytics Market Size, Competitive Analysis, Share, Forecast- 2019- …

The Global Supply Chain Analytics Market is estimated to grow at a significant CAGR during the forecast period 2019- 2025. The impact of e-commerce on retailers and manufacturers is driving a revolution in many sectors and business organization. This has led to the introduction of supply chain analytics solution, which offers mathematics, statistics, predictive modeling and machine-learning techniques to find meaningful patterns and knowledge regarding order, shipment and transactional data.…

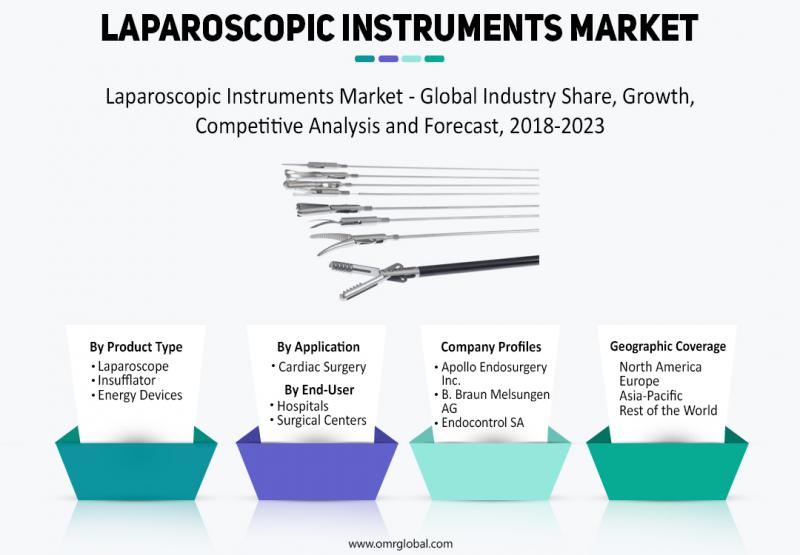

Laparoscopic Instruments Market Size, Competitive Analysis, Share, Forecast- 201 …

The laparoscopic or minimally invasive surgery uses a special surgical instrument known as laparoscope to look inside the body and carry out certain procedures. The laparoscopic instruments market is projected to witness a steady growth rate during the forecast period 2018-2023. The rise in preference of minimal invasive method over invasive surgeries, the high prevalence of lifestyle-oriented diseases, high global expenditure on the laparoscopic market, increasing healthcare market in emerging…

Fertility Drug Market Size, Competitive Analysis, Share, Forecast- 2018-2023

Infertility is one of the major issue now a day due to change in life style & cultural shift. There are various fertility drugs available in market for infertility related problems. Fertility drugs enhance the reproductive ability by improving quality of egg or sperms by increasing the levels of certain hormones in human body. The major factors that are responsible for the growth of fertility drug market are Change in…

More Releases for Loans

Beehive Loans Expands Access to Transparent Online Payday Loans across Utah

Beehive Loans, a trusted local financial provider, has expanded its services to offer broader access to online payday loans across Utah. With an emphasis on clear terms, fast approvals, and no credit check options, Beehive Loans continues its mission to provide responsible short-term financial assistance to individuals throughout the state.

Residents in Salt Lake City, Ogden, Provo, West Jordan and other major Utah cities can now benefit from streamlined applications, same-day…

Online Payday Loans Texas & USA | Online Installment Loans for Bad Credit | Loom …

https://www.loomloans.com

Loom Loans: Your Gateway to Financial Flexibility Across the United States

Have you been searching for $255 payday loans online same day, online payday loans Texas, or maybe even online installment loans for bad credit? Look no further; Loom Loans can help! Understanding that time is often of the essence when it comes to financial needs, our service specializes in linking applicants to available loans, allowing you to find the right…

Syndicated Loans Market : Surge in Demand for Large Loans | 2031

According to the report published by Allied Market Research, the global real estate investment market generated $11,444.7 billion in 2021, and is projected to reach $30,575.5 billion by 2031, growing at a CAGR of 10.7% from 2022 to 2031. The report offers a detailed analysis of the top winning strategies, evolving market trends, market size and estimations, value chain, key investment pockets, drivers & opportunities, competitive landscape and regional landscape.…

Syndicated Loans Market : Surge in Demand for Large Loans | 2031

According to the report published by Allied Market Research, the global real estate investment market generated $11,444.7 billion in 2021, and is projected to reach $30,575.5 billion by 2031, growing at a CAGR of 10.7% from 2022 to 2031. The report offers a detailed analysis of the top winning strategies, evolving market trends, market size and estimations, value chain, key investment pockets, drivers & opportunities, competitive landscape and regional landscape.…

Online Loans at GoodCheddar Make Comparing Loans Easier in Canada

GoodCheddar offers a personal finance solution that is about helping consumers find the answers they need when it comes to personal loans. Expanding its reach in the consumer marketplace, GoodCheddar.com aims to lower the barriers of borrowing by making options more accessible to Canadians.

When a consumer needs a personal loan, it can be a big financial decision. GoodCheddar empowers consumers in their decisions and helps them make smart financial…

Loans Now Website Educates Consumers on Bad Credit Loans

JACKSONVILLE, FL – MAY 6, 2019–Bad credit can make people feel hopeless when they face issues out of their control like car crashes and medical emergencies. Personal loan provider Loans Now educates consumers so that they can get the help they need.

Loans Now’s website serves as an extensive resource meant to inform potential borrowers about how to borrow money responsibly. Its representatives work with borrowers to find the loan that’s…