Press release

Inwara, the leading cryptocurrency data provider is contemplating a Securitized Token Offering (STO) in 2019

Leader in STO, ICO, Blockchain and Cryptocurrency Data, Inwara is trusted, accurate and verified data preferred by capital markets, industry and service providers.New York, January 16, 2019

Established in 2017, Inwara has quickly become the data provider of choice for investors and other market participants in the cryptocurrency space. Inwara offers data and analysis across over 4000 ICOs, almost all STOs launched till date, Private funding rounds, Mergers and Acquisitions, Venture capitalists, Cryptocurrency exchanges, Key management personnel and Service providers.

Hailed as the Morningstar of the cryptocurrency space, Inwara has taken strong strides in terms of client growth, market reach and enriching subscription content. As a part of their ongoing growth strategy, Inwara is contemplating on launching a securitized token offering in 2019.

As the industry is evolving, 2018 witnessed an increasing number of STOs as the there are over 60% STOs that are either active or upcoming. Also, the companies intending to raise funds are starting to realize that the interests of a sophisticated and/or accredited investors and funds are more inclined towards "security" tokens instead of "utility tokens", due to values possessed by the security tokens.

Inwara, has been looking at various token standards such as Ethereum's ERC 20 which is dominating the space with 68% token adoption by STOs. Also under consideration is Polymath, one of the first companies to bolster the notion of STOs takes the next biggest share of 23% with its ST-20 token standard. The company also has been watching closely the evolution of other upcoming tokens such as Securitize.

October 2018 has seen the most number of STOs. Inwara has noticed a shift from ICOs to STOs which is largely driven due to the recent bottoming of the retail market (both Bitcoin and Ethereum) and softening demand from retail investors for ICOs.

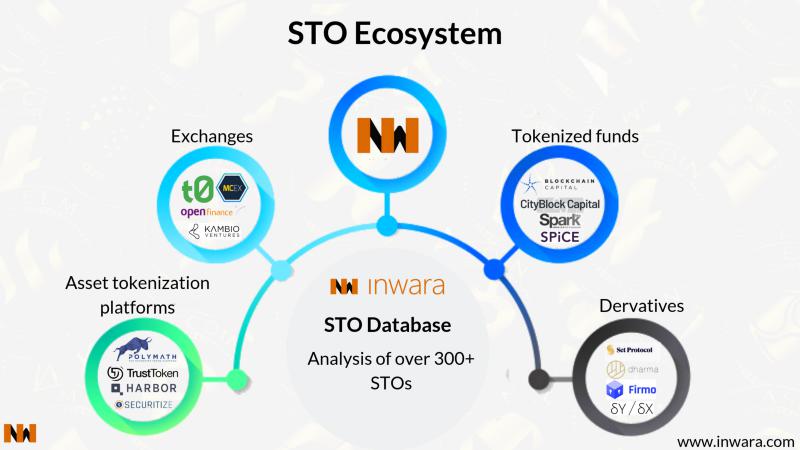

In its latest annual report, Inwara database had covered over 2200 ICO main sales, over 1200 ICO pre sales, 300+ STOs and over 2000 investors. With a comprehensive coverage and thought leadership, Inwara is poised for the next stage of growth in the cryptocurrency space. Though 2018 was a dismal year, 2019 is looking promising. Concerns on practical use cases, adoption, security and transparency are well addressed to. Investors have pumped millions of dollars into projects that support the issuance, exchange, and custody of security tokens. The STO ecosystem has established players across its value chain namely Issuance, Broker-Dealers, Custody & Trust, Legal and Compliance and Listing and Trading.

InWara is a premier database and a one-stop source of fundamental bottom-up research into today's digital currency landscape. InWara provides data and research on companies behind ICOs, their competitors, funding, road maps and management.

InWara does not promote any Cryptocurrency/ICO. InWara provides a database of Cryptocurrencies and their analysis so that an investor can make an uninfluenced decision.

Inwara, 2500 Plaza 5,

25th floor, Harborside Financial Center,

Jersey City, NJ 07311,

United States

contact: info@inwara.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Inwara, the leading cryptocurrency data provider is contemplating a Securitized Token Offering (STO) in 2019 here

News-ID: 1561623 • Views: …

More Releases from InWara Inc

Will 2019 be the year of the STO?

Disclaimer: Article inspired from InWara. This is not financial advice.

STO: Security Token Offering

Security token offering (STO) is a fundraising tool similar to an ICO, but with certain regulations that hold the token issuers accountable for their actions.

The relatively quick success of ICOs has established them as a viable method of crowdfunding. While ICOs have helped a lot of startups raise a great deal of money, the fundraising method also paved…

Is EOS ICO a scam? Once the top fundraiser, now faces collusion allegations

The highest record earning project, EOS is now facing speculations of being a scam since the leaking of a spreadsheet by Shi Feifei, a Huobi employee.

Everything about EOS

EOS is a decentralized project in the blockchain space that aims to radically improve what is already on the market. The decentralized operating system intends to provide an easy alternative for all the developers to design a dApp.

EOS became the talk of the town…

Ripple vs Ethereum

Ripple vs Ethereum

Ripple overtook Ethereum three times in the second half of September 2018 in terms of market capitalization. Although it was for a brief time, Ethereum lost its place as the 2nd largest cryptocurrency. Eventually, Ethereum powered back to re-take its position.

Let's analyze the cause and effect of this episode.

Cause:

Ethereum is an open-source, public, blockchain-based platform for dApps and Ripple is a real-time gross settlement system, currency exchange, and remittance network…

More Releases for STO

IWS FinTech Expand Security Token Offering (STO) Services into Different Milesto …

Singapore (15 March 2022) - IWS FinTech, an award winning and fast-growing start-up specialising in disruptive technologies such as blockchain and fintech, recently expanded one of their services into different milestones, demonstrating their commitment to innovation.

Security Token Offerings (STOs) are a new approach for start-ups and established businesses to raise funding. They are more secure than traditional initial coin offerings (ICOs) due to lower costs, improved security, more liquidity, and…

Commercial Cladding System Market Boosting the Growth Worldwide | Dryvit Systems …

Advance Market Analytics published a new research publication on “Commercial Cladding System Market Insights, to 2026″ with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Commercial Cladding System Market was mainly driven by the increasing R&D spending across the world.

Some of the key players…

E-Commerce in Parcel Delivery Market Next Big Thing | STO Express, DHL, LSO

The Global E-Commerce in Parcel Delivery Market Report assesses developments relevant to the insurance industry and identifies key risks and vulnerabilities for the E-Commerce in Parcel Delivery Industry to make stakeholders aware with current and future scenarios. To derive complete assessment and market estimates a wide list of Insurers, aggregators, agency were considered in the coverage; Some of the top players profiled are OnTrac, Spee Dee Delivery Service, JD.com, STO…

KEEPP announces blockchain based equity-token crowdfunding (STO)

Keepp – a share company, registered in Latvia is announcing plans for equity crowdfunding campaign assisted by technology and compliance provider Fintelum (https://fintelum.com). In the unprecedented fundraise, Keepp will be issuing a security token on the Ethereum blockchain, representing the share ownership

The EU-based business Keepp (keepp.eu) aims to scale market-proven network of short- and long-term self-service storage facilities. In the first phase, the project plans to develop across Riga, Latvia.…

VINX Coin STO Launch

Vinito Capital Management releases VINX, its first fine wine and vineyard backed STO coin

A fine wine and vineyard investment company launches an asset backed Ethereum cryptocurrency token.

Monte Carlo; Today, Vinito Capital Management (VCM), a fine wine and vineyard investment company, is announcing the release of its first Security Token Offering (STO) coin called VINX, backed by assets worth EUR32 million. With this coin, investors can now purchase VCM shares on…

Future Currency of Health, HIT Foundation STO Begins 19th June 2019

18th June 2019, Switzerland – Following a venture round funding which raised over $500K CHF, HIT Foundation have announced details of their STO event commencing 19th June 2019, 00:00 CEST. Aiming to provide a decentralized platform for matching information seekers with individual and unlock the $536 billions worth of digital health market in 2025, HIT Foundation uses NEM blockchain technology and smart contracts to empower the individual to take back…