Press release

Investment Banking Market 2019: By Barclays, JP Morgan, Goldman Sachs, Bank Of America Merrill Lynch, Morgan Stanley, Deutsche Bank, Credit Suisse

The investment banking market comprises establishments primarily engaged in undergoing capital risk in the process of underwriting securities. This market excludes companies acting as agents and/or brokers between buyers and sellers of securities and commodities. These establishments primarily involve in underwriting, originating, and/or maintaining markets for issue of securities.The Investment Banking Market Report offers a comprehensive evaluation of the market. It does so via in-depth insights, understanding market evolution by tracking historical developments, and analysing the present scenario and future projections based on optimistic and likely scenarios. Each research report serves as a repository of analysis and information for every facet of the market.

Top Key Players Covered in this market Report:

Barclays

JP Morgan

Goldman Sachs

Bank Of America Merrill Lynch

Morgan Stanley

Deutsche Bank

Credit Suisse

...

Get Sample PDF Of This Report @ https://www.supplydemandmarketresearch.com/home/contact/119488?ref=Sample-and-Brochure&toccode=SDMRSE119488

Investment banks across the globe are moving towards businesses requiring less regulatory capital. In this regard, major investment banks from around the world such as Barclays, Deutsche Bank and Credit Suisse have announced their plans to move from traditional underwriting business to other activities such as mergers and acquisitions advisory and fundraising. This shift is primarily due to regulatory changes that made some investment banking activities more expensive than the others. Although the regulations have restricted the range of some banks, forcing them to specialize, some investment bankers, such as Citibank and JPMorgan have continued offering a complete range of investment banking services.

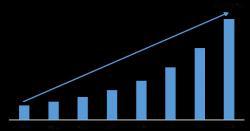

In 2018, the global Investment Banking market size was xx million US$ and it is expected to reach xx million US$ by the end of 2025, with a CAGR of xx% during 2019-2025.

This report focuses on the global Investment Banking status, future forecast, growth opportunity, key market and key players. The study objectives are to present the Investment Banking development in United States, Europe and China.

Market segment by Type, the product can be split into

Mergers And Acquisitions Advisory

Debt Capital Markets Underwriting

Equity Capital Markets Underwriting

Financial Sponsor/ Syndicated Loans

Market segment by Application, split into

Bank

Investment Banking Companies

Securities Company

Table of Content:

1 Report Overview

1.1 Study Scope

1.2 Key Market Segments

1.3 Players Covered

1.4 Market Analysis by Type

1.4.1 Global Investment Banking Market Size Growth Rate by Type (2014-2025)

1.4.2 Mergers And Acquisitions Advisory

1.4.3 Debt Capital Markets Underwriting

1.4.4 Equity Capital Markets Underwriting

1.4.5 Financial Sponsor/ Syndicated Loans

1.5 Market by Application

1.5.1 Global Investment Banking Market Share by Application (2014-2025)

1.5.2 Bank

1.5.3 Investment Banking Companies

1.5.4 Securities Company

1.6 Study Objectives

1.7 Years Considered

TOC Continued……!

Click Here To Buy Full Report With Full TOC@ https://www.supplydemandmarketresearch.com/home/purchase?code=SDMRSE119488

About us:

SupplyDemandMarketResearch.com have a strong network of high powered and experienced global consultants who have about 10+ years of experience in the specific industry to deliver quality research and analysis.

Having such an experienced network, our services not only cater to the client who wants the basic reference of market numbers and related high growth areas in the demand side, but also we provide detailed and granular information using which the client can definitely plan the strategies with respect to both supply and demand side.

Canada Office:

302-20 Misssisauga Valley, Missisauga,

L5A 3S1, Toronto

Email- info@supplydemandmarketresearch.com

Global- +919960204545

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Investment Banking Market 2019: By Barclays, JP Morgan, Goldman Sachs, Bank Of America Merrill Lynch, Morgan Stanley, Deutsche Bank, Credit Suisse here

News-ID: 1535099 • Views: …

More Releases from Supply Demand Market Research

Germany Waste Heat Recovery Systems is anticipated to reach USD 2150 Million by …

The Germany Waste Heat Recovery Systems (WHRS) is anticipated to reach USD 2150 million by 2030 growing at a CAGR of 5.7% from 2024-2030. Continued expansion post-2026 aligns with Germany's decarbonization trajectory, as operators increasingly prioritize heat-recovery to reduce fuel consumption and comply with tightening carbon-intensity expectations.

By technology, the exchange waste heat recovery boilers market size is anticipated to reach USD 710 million by 2030. Exchange/WH Boilers and SRC (Steam…

South Korea Flounder Market Anticipated to grow at a CAGR of 8% from 2023-2030

The South Korea flounder is anticipated to grow at a CAGR% of 8.0% from 2022-2030. The factors contributing towards the high growth are flounders such as halibut and turbot high-protein and low-calorie food, helps to re-solve the nutritional imbalance from diet because of its rich minerals, carbohydrates and vitamins despite low-calorie. They also offer medical benefits as liver of halibut contains lots of vitamin B1 and B2, which is effective…

Global Flounder Market Anticipated to reach USD 56 Billion by 2030

The global flounder market is anticipated to reach USD 56 Billion by 2030, growing at a CAGR% of 8.0% from 2022-2030. The factors contributing towards the high growth are flounders such as halibut and turbot high-protein and low-calorie food, helps to re-solve the nutritional imbalance from diet because of its rich minerals, carbohydrates and vitamins despite low-calorie. They also offer medical benefits as liver of halibut contains lots of vitamin…

Global Seafood Market Anticipated to reach USD 730 Billion by 2030

The global seafood market is anticipated to reach USD 730 Billion by 2030, growing at a CAGR% of 8.9% from 2022-2030. The factors contributing towards the high growth are increased disposable income, awareness of fish being used as an ingredient in healthy food is growing. USA the government plans to sanction illegal fishing activities, actively promote fair trade, and promote strategies to promote the fishing industry through detailed strategies such…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…