Press release

How to Win Customers with Global Life Re-Insurance Market and Inspired with Growth | Munich Re, Swiss Re, Hannover Re, SCOR SE, Lloyd’s, Berkshire Hathaway, Great-West Lifeco, RGA, China RE, First Capital Insurance Limited

Reinsurance is insurance that is acquired by an insurance agency. In the great case, reinsurance permits insurance agencies to stay dissolvable after real cases occasions, for example, real fiascos like tropical storms and rapidly spreading fires. In Life Re-Insurance market Notwithstanding its essential job in hazard the board, reinsurance is some of the time utilized for assessment alleviation and different reasons. The organization that buys the reinsurance approach is known as a "surrendering organization" or "cedent" or "cedant" under generally game plans. The organization issuing the reinsurance strategy is alluded just as the "reinsurer".Global Life Re-Insurance market is expected to grow at a CAGR of +8% during the forecast period 2019-2025.

This market report offers an exhaustive examination of the worldwide Life Re-Insurance Market. This report concentrated on Life Re-Insurance advertise over a wide span of time development internationally. Besides, each segment in this report incorporates master bits of knowledge that will address the issue territories experienced in inventory network issues. To make the report straightforward, the examination highlights designs, diagrams, and infographics.

Request for Sample Copy of this report:

https://www.theresearchinsights.com/request_sample.php?id=3952

Top Key Vendors:

Bupa, DKV, Swiss Re, Pacific Prime, Benefit Management, Inc (BMI), Gen Re, Fubon, Seoul Guarantee Insurance (SGI), First Capital Insurance Limited, Munich Re, Hannover Re

Product Type Coverage

• P&C Reinsurance

• Life Reinsurance

Demand Coverage

• Direct Writing

• Broker

The key provincial areas of the market are Asia Pacific, Europe, North America, and Rest of the World (RoW). A definite assessment of the key patterns that are forming these local markets is referenced in the exploration think about. Area insightful market estimate, income share, volume share, conjectures are shrouded in the report. Besides, the best income creating organizations overwhelming these provincial markets are depicted in the Life Re-Insurance Market report.

Enquiry before Buying:

https://www.theresearchinsights.com/enquiry_before_buying.php?id=3952

After the flood of combinations in the course of the most recent decade, examiners trust this pattern in the life re-insurance market has run its course and don't expect any noteworthy developments in the close to medium term. With the main five reinsurers presently representing more than of reinsurance volume, the market is very focused and rivalry is hardened.

Some Key Points Covered:

• Overview of Life Re-Insurance Market

• Manufacturing Cost Structure Analysis

• Technical Data and Manufacturing Plants Analysis

• Life Re-Insurance Market Regional Analysis

• Major Manufacturers Analysis

• Development Trend of Analysis of Market

• Life Re Insurance Industry Type Analysis

• Conclusion of the Global Life Re-Insurance Market Professional Survey Report 2019

Ask For Discount:

https://www.theresearchinsights.com/ask_for_discount.php?id=3952

About us

The Research Insights – A global leader in analytics, research and advisory that can assist you to renovate your business and modify your approach. With us, you will learn to take decisions intrepidly. We make sense of drawbacks, opportunities, circumstances, estimations and information using our experienced skills and verified methodologies. Our research reports will give you an exceptional experience of innovative solutions and outcomes. We have effectively steered businesses all over the world with our market research reports and are outstandingly positioned to lead digital transformations. Thus, we craft greater value for clients by presenting advanced opportunities in the global market.

Contact us

Robin

Sales manager

+91-996-067-0000

sales@theresearchinsights.com

www.theresearchinsights.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release How to Win Customers with Global Life Re-Insurance Market and Inspired with Growth | Munich Re, Swiss Re, Hannover Re, SCOR SE, Lloyd’s, Berkshire Hathaway, Great-West Lifeco, RGA, China RE, First Capital Insurance Limited here

News-ID: 1496900 • Views: …

More Releases from The Research Insights

Latest Research Report on Travel Services Market by Forecast to 2032

The Global Travel Services Market has experienced substantial growth, driven by increasing globalization, rising disposable incomes, technological advancements, and growing consumer preference for experiential travel. The market encompasses a wide range of services, including travel planning, transportation, accommodation, and tourism activities. This article provides a detailed analysis of the market size, share, trends, and growth prospects, highlighting the factors shaping the industry's future through 2032.

𝐂𝐥𝐢𝐜𝐤 𝐭𝐡𝐞 𝐥𝐢𝐧𝐤 𝐭𝐨 𝐠𝐞𝐭 𝐚…

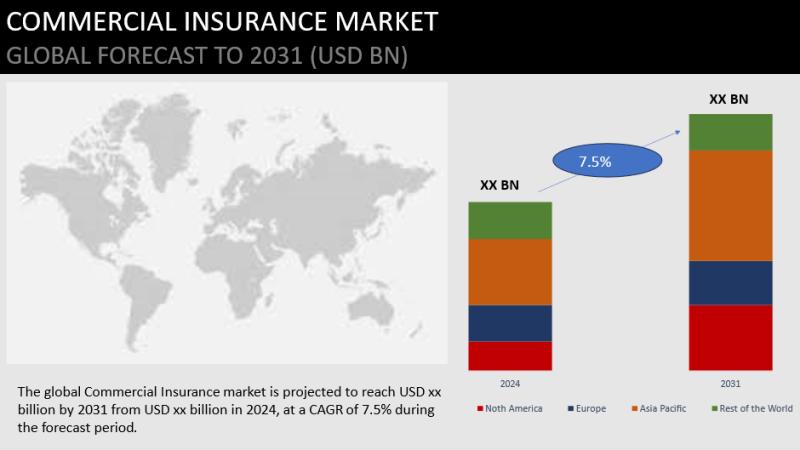

Commercial Insurance Market is Expected to Grow at a CAGR 2024 - 2031

The Commercial Insurance Insights of 2024 is a thorough analysis that offers a thorough look at the market's size, revenues, market shares, various categories, drivers, and other pertinent factors in addition to trends and possible new developments. Aside from the 2031 forecast period, the research study discusses market restraints and regional industrial presence that may impact market growth patterns. In PDF version, the Commercial Insurance Market study comprises an extensive…

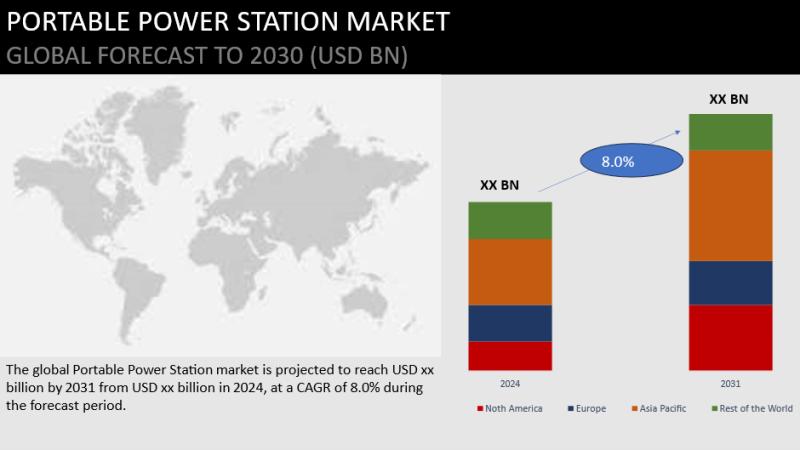

Portable Power Station Market Forecast 2024-2031 - 46.6% CAGR Growth by 2031

The Portable Power Station Insights of 2024 is a thorough analysis that offers a thorough look at the market's size, revenues, market shares, various categories, drivers, and other pertinent factors in addition to trends and possible new developments. Aside from the 2031 forecast period, the research study discusses market restraints and regional industrial presence that may impact market growth patterns. In PDF version, the Portable Power Station Market study comprises…

Portable Power Station Market To Grow at a Stayed CAGR from 2024 to 2031

The Portable Power Station Insights of 2024 is a thorough analysis that offers a thorough look at the market's size, revenues, market shares, various categories, drivers, and other pertinent factors in addition to trends and possible new developments. Aside from the 2031 forecast period, the research study discusses market restraints and regional industrial presence that may impact market growth patterns. In PDF version, the Portable Power Station Market study comprises…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…