Press release

Usage-based Insurance Market 2024 By Top Regional Manufacturers - Allianz, Allstate, AXA, Liberty Mutual Insurance, MAPFRE, Nationwide

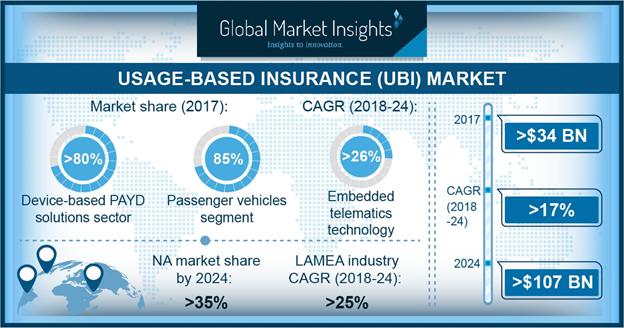

Usage-based Insurance Market will grow at a CAGR of over 17% with USD 107 billion by 2024. One of the major factors driving the UBI market growth is an increase in the production of passenger & commercial vehicles that is embedded with telematics or the use of external tracking systems to capture data about the vehicle’s health & the driving behavior. Car makers and the insurance companies then use telematics data for calculating the insurance premium for clients in accordance with the usage rate of the vehicle. The insurance telematics enables customers to lessen their premium rates by adopting safe driving.Get Sample Copy of This Report @ https://www.gminsights.com/request-sample/detail/3020

The commercial vehicles segment in the usage-based insurance (UBI) market is projected to register an excellent growth rate of over 18% from 2018 to 2024. The commercial vehicles segment is widely deploying telematics solutions to analyze vehicle and driver data to assess the risks and restore profit margins. These solutions are used in commercial fleets to help in integrating capabilities such as traffic updates, roadside assistance, and smart routing and tracking. Telematics insurance data is used by the insurers to review driving behavior and promote safe driving through insurance incentives. The technology is playing a key role in commercial logistics and supply chains as it helps in addressing the challenges related to driver monitoring, insurance, and safety.

The OBD II technology held a major share of over 48% in the UBI market in 2017 and is expected to dominate the market with a share of around xx% in 2024. Vehicles equipped with telematics devices allow insurance companies to get a more precise information to rate a driver’s premium. The traditional UBI programs use OBD II, which allows car owners to manage and remove engine malfunctions and improve vehicle reliability while reducing the fleet operations cost. By implementing OBD II fleet management telematics systems, which track driver performance and allow vehicle utilization, the companies can reduce their fleet insurance premiums.

Company profiled in this report based on Business overview, Financial data, Product landscape, Strategic outlook & SWOT analysis:

1. Allianz SE

2. Allstate Insurance Company

3. AXA

4. Desjardins Group

5. Liberty Mutual Insurance

6. Mapfre, S.A.

7. Nationwide

8. Octo Technology

9. Sierra Wireless

10. UnipolSai Assicurazioni S.p.A.

11. Vodafone Automotive SpA

Make an Inquiry for purchasing this Report @ https://www.gminsights.com/inquiry-before-buying/3020

The North America UBI market is projected to hold a majority market share of over 35% by 2024. The market growth is attributed to the factors such as the growth in the number of connected cars with inbuilt telematics solutions and the adoption of the cloud-based telematics solutions. The region is dominated by the presence of various car insurance companies that are using black box technology to track driving habits. The telematics-based black box devices provide detailed information to car insurance companies and let them calculate insurance risk levels more accurately.

The PHYD segment held a dominant share of over 70% of the UBI market in 2017 as this telematics-driven insurance model takes into consideration how a person drives. The insurance companies can assess the driving skills by installing telematics devices in the car to record the driving habits. PHYD analyzes the habits based on several parameters such as speeding, braking, positioning, and parking to decide premiums. This helps in addressing the unfair practices of motor insurance and considers the factors to ensure that car owners are charged fair premiums.

The insurance companies operating in the usage-based insurance market are entering into strategic partnerships with automakers and other car insurance service providers to jointly offer new insurance telematics solutions to the customers. These solutions also help the companies to improve their individual data capabilities and boost product offerings. The insurance companies are adopting product differentiation strategies and introducing new UBI products and services to stay ahead of their competitors. The program offers qualifying truck drivers a minimum savings of 3% on their commercial auto policy period for signing up and adjusting insurance rates based on the ELD data.

Browse Report Summery @ https://www.gminsights.com/industry-analysis/usage-based-insurance-ubi-market

Some of the major players of the operating in the UBI market are Progressive, Allstate, State Farm, AXA, Allianz, Liberty Mutual, Nationwide, Vodafone Automotive, UnipolSai, Generali, Octo, Metromile, TomTom, Insure The Box, Mapfre S.A, Zubie, Desjardins Group, Sierra Wireless, IMS, Cambridge Mobile Telematics, and Danlaw.

About Global Market Insights:

Global Market Insights, Inc., headquartered in Delaware, U.S., is a global market research and consulting service provider; offering syndicated and custom research reports along with growth consulting services. Our business intelligence and industry research reports offer clients with penetrative insights and actionable market data specially designed and presented to aid strategic decision making. These exhaustive reports are designed via a proprietary research methodology and are available for key industries such as chemicals, advanced materials, technology, renewable energy and biotechnology.

Contact Us:

Arun Hegde

Corporate Sales, USA

Global Market Insights, Inc.

Phone:1-302-846-7766

Toll Free: 1-888-689-0688

Email: sales@gminsights.com

Web: www.gminsights.com/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Usage-based Insurance Market 2024 By Top Regional Manufacturers - Allianz, Allstate, AXA, Liberty Mutual Insurance, MAPFRE, Nationwide here

News-ID: 1496791 • Views: …

More Releases from Automotive Industry

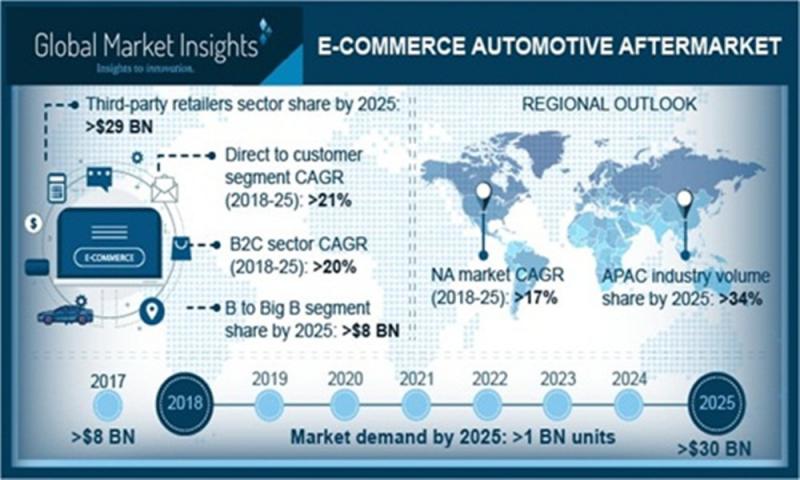

E-commerce Automotive Aftermarket Industry Analysis Players - Flipkart, eBay, Au …

Global Market Insights added Most up-to-date research on “E-commerce Automotive AfterMarket: Global Industry Size, Share, Trends and Forecast, 2019 – 2025″ to its huge collection of research reports.

This Research study on the Global E-commerce Automotive AfterMarket offers detailed and insightful information on major regional markets and related sub-markets.

Online platforms have gained traction among the e-commerce automotive aftermarket participants for launching their product portfolio. The component manufacturers are continuously launching their…

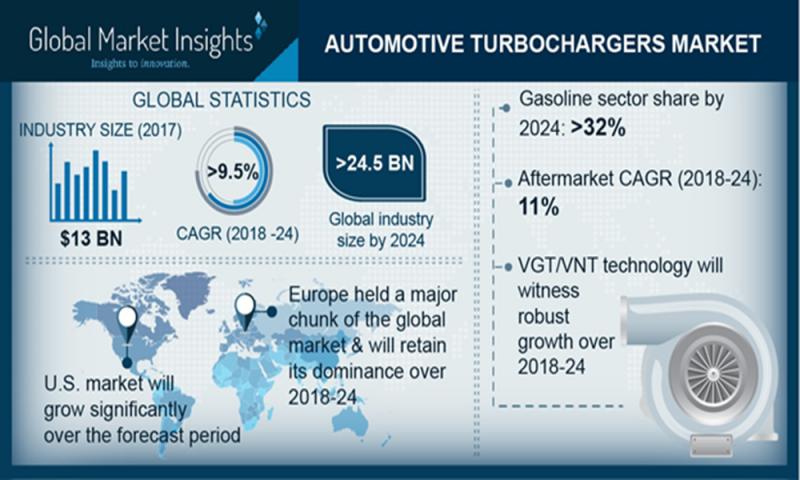

Automotive Turbocharger Market include BorgWarner, Cummins, Federal-Mogul, Honey …

Global Market Insights added Most up-to-date research on “Automotive Turbocharger Market: Global Industry Size, Share, Trends and Forecast, 2019 – 2024″ to its huge collection of research reports.

This Research study on the Global Automotive Turbocharger Market offers detailed and insightful information on major regional markets and related sub-markets.

Automotive turbocharger market from PCVs are likely to capture highest revenue share, surpassing 60% by the end of 2024. Rising production of these…

Railway Management System Market set for years of strong growth By Huawei Techno …

Global Market Insights added Most up-to-date research on “Automotive Turbocharger Market: Global Industry Size, Share, Trends and Forecast, 2019 – 2024″ to its huge collection of research reports.

This Research study on the Global Automotive Turbocharger Market offers detailed and insightful information on major regional markets and related sub-markets.

Railway Management System Market will grow at a CAGR of over 10% with USD 64 billion by 2024. The cloud deployment model is…

Where Will The Automotive Communication Technology Market Be In 2024? Industry P …

The Europe automotive communication technology market held over 26% of the market share in 2017. The growth in this region is attributed to the rising awareness regarding automotive safety among citizens and stringent government regulations. The region is also the home for leading automotive semiconductor providers such as Elmos Semiconductor, NXP Semiconductor, STMicroelectronics, and Vector Informatik, which contributes to the market growth in this region. Poland is one of the…

More Releases for UBI

Usage Based Insurance (Ubi) Market: A Comprehensive Overview

The Usage-Based Insurance (UBI) Market was valued at USD 43.38 billion in 2023 and is expected to grow to approximately USD 87.0 billion by 2033, reflecting a CAGR of about 7.2% from 2024 to 2033.

Usage Based Insurance (Ubi) Market Overview

The Usage-Based Insurance (UBI) Market is experiencing significant growth, driven by advancements in telematics and the increasing adoption of connected vehicles. UBI models, such as Pay-As-You-Drive (PAYD) and Pay-How-You-Drive (PHYD), utilize…

Usage Based Insurance (Ubi) Market Size Unlocking New Opportunities for Success

The global Usage-Based Insurance (UBI) Market was valued at approximately USD 33.27 billion in 2023 and is projected to reach around USD 232.94 billion by 2032, growing at a compound annual growth rate (CAGR) of 24.14% from 2024 to 2032.

Usage Based Insurance (Ubi) Market Overview

Usage-Based Insurance (UBI) is an innovative auto insurance model that determines premiums based on individual driving behaviors, such as distance traveled, speed, braking patterns, and time…

Usage-based Insurance (UBI) Market Revenue Sizing Outlook Appears Bright

Global Usage-based Insurance (UBI) Market Report from Market Insights Report highlights deep analysis on market characteristics, sizing, estimates and growth by segmentation, regional breakdowns & country along with competitive landscape, player's market shares, and strategies that are key in the market. The exploration provides a 360° view and insights, highlighting major outcomes of the industry. These insights help the business decision-makers to formulate better business plans and make informed decisions…

Usage-based Insurance (UBI) Market Will Generate Record Revenue by 2029

The global UBI market is anticipated to grow at a CAGR of 27.9% during the forecast period. Due to the increasing demand for usage-based insurance for automotive continues, along with the strong ecosystem is getting created around connected automotive services. This ecosystem involves participants such as automotive IoT and insurance platform providers, data platform and analytics companies, automotive insurance black box and telematics providers, big data companies, and cloud service providers. For…

Usage-based Insurance (UBI) Market to Witness Growth Acceleration by 2029

The global UBI market is anticipated to grow at a CAGR of 27.9% during the forecast period. Due to the increasing demand for usage-based insurance for automotive continues, along with the strong ecosystem is getting created around connected automotive services. This ecosystem involves participants such as automotive IoT and insurance platform providers, data platform and analytics companies, automotive insurance black box and telematics providers, big data companies, and cloud service providers. For…

Usage-Based Insurance (UBI) Market by Policy Type [Pay-As-You-Drive Insurance (P …

UBI Market Size

The global usage-based insurance market size was valued at $28.7 billion in 2019, and is projected to reach $149.2 billion by 2027, growing at a CAGR of 25.1% from 2020 to 2027. Usage-based insurance is expected to grow rapidly in the coming years. Key drivers of the usage-based insurance market include the growing adoption of telematics technology in the automotive insurance space.

Download Free Sample: https://reports.valuates.com/request/sample/ALLI-Auto-0U87/Usage_Based_Insurance

Trends Influencing the Global…