Press release

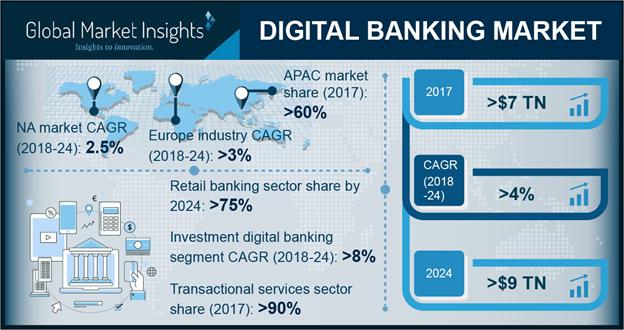

Fiserv, Intellect Design Arena, Kony profiled in Digital Banking Market to grow at 4% CAGR to 2024|By Key Vendors: Oracle, SAP SE, Temenos, Backbase, BNY Mellon, Finastra

The North American digital banking market is anticipated to grow at a CAGR of 2.5% during the forecast period. The market is driven by the early adoption of digital solutions among the banking institutes. The high penetration of internet and smartphone users is also augmenting the demand for digital banking solutions. Large volumes of credit card and debit card transactions in the region also promote the digital banking market.Request for a sample of this research report @

https://www.gminsights.com/request-sample/detail/2651

The increasing venture capital investment in fintech sector is propelling the digital banking market. Over the past five years, fintech has emerged as the most lucrative sector and the venture capitalists are investing billions in the sector to make profits. In 2017, approximately USD 16.5 billion investment was witnessed in the fintech companies, increasing from USD 3.7 billion in 2013. Acknowledging the rise of fintech players, banks are looking to boost their investments in technology. While some banks are collaborating or investing in the fintech companies to develop more customer-centric products, others are acquiring the fintech players to acquire technical expertise and expand their product portfolio.

Company profiled in this report based on Business overview, Financial data, Product landscape, Strategic outlook & SWOT analysis:

• Appway

• Backbase

• BNY Mellon

• CREALOGIX

• ebanklT

• ETRONIKA

• Fidor Solutions

• Finastra

• Fiserv

• Halcom D.D.

• ieDigital

• Intellect Design Arena

• Kony

• NETinfo

• NF Innova

• Oracle

• SAB

• SAP SE

• Sopra

• TCS

• Technisys

• Temenos

• Worldline

The supportive government initiatives & policies for the promotion of digital banking services is also driving the digital banking market. Governments across the globe are constantly working on accelerating the adoption of digital banking services. The demonetization activities and digitalization policies adopted by the government are encouraging the adoption of digital payment solutions. Moreover, governments are also offering tax incentives and subsidies to the fintech players to encourage the adoption of digital solutions.

Browse Full Report: https://www.gminsights.com/industry-analysis/digital-banking-market

Corporate banking held over 13% share in the digital banking market in 2017. The emergence of the fintech players is the primary factor accelerating the adoption of digitalization among the corporate banks. The corporate banks are experiencing tough competition from the fintech companies that are offering standalone products at low costs. This is encouraging corporate banks to embrace the technologies to provide a better experience to their customers. Moreover, the integration of the advanced technologies into the banking platforms, such as artificial intelligence, blockchain, big data analytics, is also augmenting the demand for digital solutions among the corporate banking sector to analyze the customer behavior and meet their requirements.

Non-transaction services in the digital banking market are anticipated to grow at a CAGR of 14% during the projected timeline. The increasing need to provide enhanced customer experience is driving the adoption of non-transaction digital services among the banking institutes. The digital disruption and generational shift cause fundamental changes in customer behavior that are rapidly influencing customer expectations from banks. Over a third of the millennials (population aged between 16 to 34) believe they will be able to live a bank-free existence in the future. Customers, especially the younger population who are digitally savvy, hyper-connected, and choice conscious have an inclination toward tech-oriented services as their preferences are changing. These customers are accustomed to digital experiences offered by online retailers and expect the same or perhaps a richer experience from the banks.

Make an inquiry for purchasing this report @

https://www.gminsights.com/inquiry-before-buying/2651

The key players in the digital banking market space are Appway, Backbase, BNY Mellon, Crealogix, ebanklT, EdgeVerve Systems, ETRONIKA, Fidor, Finastra, Fiserv, Halcom, IE Digital, Intellect Design Arena, Kony, NETinfo, NF Innova, Oracle, SAB, SAP, Sopra, Tagit, TCS, Technisys, Temenos, and Worldline.

Browse Related Report:

Mobile Mapping Market Size, By Component (Hardware [Imaging Device, Laser Ranging Device & Scanning Device, Positioning Device], Software [Mapping Data Extraction, Data Processing], Service [Consulting, Integration & Maintenance, Managed Service]), By Application (Road & Railway Survey, GIS Data Collection, Vehicle Control & Guidance, Asset Management), By End-User (Agriculture, BFSI, Government & Public Sector, Real Estate, Retail, Mining, Telecommunication, Transport & Logistics), Industry Analysis Report, Regional Outlook (U.S., Canada, UK, Germany, France, Italy, Spain, Australia & NZ, China, India, Japan, South Korea, Brazil, Mexico, Argentina, GCC, Israel, South Africa), Growth Potential, Competitive Market Share & Forecast, 2018 – 2024

https://www.openpr.com/news/1346530/Mobile-Mapping-Market-to-grow-at-15-CAGR-to-2024-By-Key-Vendors-Apple-Autonavi-Baidu-Inc-Black-Veatch-Google-Inc-Land-Surveys-Leica-Geosystems-Inc-Microsoft-Mitsubishi-Electric-Corporation-Topcon-Positioning-Systems-Inc-Trimble-Inc.html

About Global Market Insights:

Global Market Insights, Inc., headquartered in Delaware, U.S., is a global market research and consulting service provider; offering syndicated and custom research reports along with growth consulting services. Our business intelligence and industry research reports offer clients with penetrative insights and actionable market data specially designed and presented to aid strategic decision making. These exhaustive reports are designed via a proprietary research methodology and are available for key industries such as chemicals, advanced materials, technology, renewable energy and biotechnology.

Contact Us:

Arun Hegde

Corporate Sales, USA

Global Market Insights, Inc.

Phone: 1-302-846-7766

Toll Free: 1-888-689-0688

Email: sales@gminsights.com

Web: https://www.gminsights.com

Blog: http://algosonline.com/news

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Fiserv, Intellect Design Arena, Kony profiled in Digital Banking Market to grow at 4% CAGR to 2024|By Key Vendors: Oracle, SAP SE, Temenos, Backbase, BNY Mellon, Finastra here

News-ID: 1496104 • Views: …

More Releases from Global Market Insights Inc.

Latest Research Report On Agricultural Adjuvants Market 2021. Major Players Incl …

The agricultural adjuvants market is expected to observe noteworthy growth on account of increasing demand for high-quality crops. Adjuvants commonly act as an additive in pesticides that increase its effectiveness and smoothen its mixing application.

The demand for plant protection products in countries like Bangladesh, India, and Vietnam has surged considerably in recent years. Ever-increasing population across developing economies has forced farmers to produce large quantities of high-quality yields. Citing…

U.S. Minoxidil Market 2021 Growth Opportunities and Competitive Landscape 2027 - …

The U.S. minoxidil industry has been impacted by the COVID-19 pandemic in the form of increased stress amid job losses and health issues, creating rising incidences of hair fall and associated problems. The industry is expected to gain commendable proceeds on account of an upsurge in research studies concerned with the effectiveness of minoxidil.

Citing one such instance, in January 2021, a study published in the Dermatologic Therapy supported the efficacy…

Global Sulfosuccinate Market 2021 Future Growth With Technology and Current Tren …

Owing to these factors, estimates have revealed that the global sulfosuccinate market size will exceed USD 475.7 million in annual estimation by 2024.

Increasing adoption of high-performance materials that meet application-specific requirements across various industries, including pharmaceuticals will stimulate the need for sulfosuccinate compounds. The surging disposable incomes of consumers mainly across the developing nations have also fueled their spending capacities on household and personal care.

Sulfosuccinates are mainly a mild type…

By 2026, Graphene Market will register over 35% CAGR | Applied Nanotech, Inc, an …

The global Graphene Market is slated to gain significant momentum over the forthcoming years, as a result of the growing product consumption in the electronics sector, particularly in developing countries. This high consumption can be attributed to its superior qualities such as high electrical conductivity, durability, and toughness.

Request a sample of this research report @

https://www.gminsights.com/request-sample/detail/233

Top Key Players in The Market are:

Graphenea S.A., Applied Graphene Materials plc, ACS…

More Releases for Fiserv

Payment Terminal Market is Booming Worldwide | Fiserv, Elavon, Verifone

The Latest published market study on Global Payment Terminal Market provides an overview of the current market dynamics in the Payment Terminal, as well as what our survey respondents all outsourcing decision-makers predict the market will look like in 2032. The study breaks the market by revenue and volume (wherever applicable) and price history to estimate the size and trend analysis and identify gaps and opportunities. Some of the players…

Anti-fraud Solutions Market Regaining Its Glory: IBM, Capgemini, Fiserv

According to HTF Market Intelligence, the Global Anti-fraud Solutions market to witness a CAGR of % during the forecast period (2023-2029). The Latest Released Anti-fraud Solutions Market Research assesses the future growth potential of the Anti-fraud Solutions market and provides information and useful statistics on market structure and size. This report aims to provide market intelligence and strategic insights to help decision-makers make sound investment decisions and identify potential gaps…

Commercial Banking Market Is Booming Worldwide | Fiserv, Wells Fargo, Oracle

Advance Market Analytics published a new research publication on "Commercial Banking Market Insights, to 2028" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Commercial Banking market was mainly driven by the increasing R&D spending across the world.

Get Free Exclusive PDF Sample Copy of…

Fiserv Market: Ready To Fly on high Growth Trends

Fiserv - Competitor Profile is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The influencing Factors of growth and regulations with respect to the usage of the information, availability of highly reliable products in the market, and increase in operational efficiency of Fiserv - Competitor Players. The study provides information on market trends and development,…

Hadoop Distribution market future prospects 2026 | IBM, Pivotal, Fiserv

A new statistical surveying study titled Hadoop Distribution Market investigates a few critical features identified with Hadoop Distribution Market covering industry condition, division examination, and focused scene. Down to earth ideas of the market are referenced in a straightforward and unassuming way in this report. A far-reaching and exhaustive essential investigation report features various actualities, for example, improvement factors, business upgrade systems, measurable development, monetary benefit or misfortune to support…

Mobile Banking Market Worth Observing Growth | CR2, SAB, Fiserv

Global Mobile Banking Market Size, Status and Forecast 2019-2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Mobile Banking Market. Some of the key players profiled in the study are CR2, SAB Group,…