Press release

Property and Casualty Insurance Providers Market 2019: Global Growth, Share, Size, Revenue, Regional Outlook and 2025 Forecast | Top Companies: Allstate, Berkshire Hathaway, Liberty Mutual, Travelers Companies

Property and Casualty Insurance Providers Market Research Report 2019 presents a thorough assessment of the market key segments and its relative market share, the latest trends, and business strategies used in Property and Casualty Insurance Providers industry. The research study examines the Property and Casualty Insurance Providers market with aid of a number of criteria, such as the product type, application, and its geographical expansion.Get Sample Copy at https://www.orianresearch.com/request-sample/729862

Global insurers are using big data analytics to enhance their performance. Big data is being used in claim management, pricing, underwriting and risk selection among others. This growth is mainly driven by increasing points of contact including social media, which provides a bulk of data that can be transformed into insights and leveraged by insurers to efficiently execute the settlement process. Big data consists of high-volume, high-variety and high-velocity information, and benefits insurers in multiple ways such as faster identification and reporting of events, automatic claim assessment and calculation of loss reserves.

According to a recent survey by Wills Towers Watson, more than 40% of property & casualty insurance firms are already using big data and is expected to increase to 80% in the next two years.

No. of Pages: 93

Key Companies Analyzed in this Report are:

• Allstate

• Berkshire Hathaway

• Liberty Mutual

• Travelers Companies

• ...

Inquire more or share questions if any before the purchase on this report @ https://www.orianresearch.com/enquiry-before-buying/729862

The report reflects on various elements to inspect the international Property and Casualty Insurance Providers Market to 2025, inclusive of evolution in concern with Property and Casualty Insurance Providers Market products; technology growth in this sector; accounts of pioneering market competitors and providers; current evolving activities in the Property and Casualty Insurance Providers Market. Additionally, it also provided information related to international Property and Casualty Insurance Providers Market actual drivers, prudence, provocations, arising markets, pricing framework, current trends and industrial strategies around the world that will influence this particular market business in upcoming days.

The scope of the Property and Casualty Insurance Providers market report is as follows:

• The report provides information on growth segments and opportunities for investment and Benchmark performance against key competitors.

• The research of emerging Property and Casualty Insurance Providers market provides the segments, and the existing market segments will help the investors or new business entrants in planning the business strategies accordingly.

• The report provides key details related to Property and Casualty Insurance Providers industry like the product definition, cost, variety of applications, demand and supply statistics are covered in this research report.

Order a copy of Global Property and Casualty Insurance Providers Market Report 2019 @

https://www.orianresearch.com/checkout/729862

Market segment by Type, the product can be split into

• Automobile Insurance Carriers

• Malpractice/Indemnity Insurance Carriers

• Fidelity Insurance Carriers

• Mortgage Guaranty Insurance Carriers

• Homeowners Insurance Carriers

• Surety Insurance Carriers

• Liability Insurance Carriers

Market segment by Application, split into

• Intermediary

• Direct Selling

Regional Outlook for the Property and Casualty Insurance Providers Market Research Report:

• North America: US, Canada, Mexico

• Europe: Germany, UK, Italy, France, Spain, Rest of Europe

• Asia Pacific: Japan, China, India, Australia, New Zealand, South Korea, Rest of Asia Pacific

• South America: Argentina, Brazil, Chile, Rest of South America

• Middle East & Africa: Saudi Arabia, UAE, Qatar, South Africa, Rest of Middle East & Africa

Major Points Covered in Table of Contents:

1 Study Coverage

2 Executive Summary

3 Market Size by Manufacturers

4 Property and Casualty Insurance Providers Production by Regions

5 Property and Casualty Insurance Providers Consumption by Regions

6 Market Size by Type

7 Market Size by Application

8 Manufacturers Profiles

9 Production Forecasts

10 Consumption Forecast

11 Upstream, Industry Chain and Downstream Customers Analysis

12 Opportunities & Challenges, Threat and Affecting Factors

13 Key Findings

14 Appendix

About Us

Orian Research is one of the most comprehensive collections of market intelligence reports on the World Wide Web. Our reports repository boasts of over 500000+ industry and country research reports from over 100 top publishers. We continuously update our repository so as to provide our clients easy access to the world's most complete and current database of expert insights on global industries, companies, and products. We also specialize in custom research in situations where our syndicate research offerings do not meet the specific requirements of our esteemed clients.

Contact Us

Ruwin Mendez

Vice President – Global Sales & Partner Relations

Orian Research Consultants

US +1 (415) 830-3727 | UK +44 020 8144-71-27

Email: info@orianresearch.com

Website: www.orianresearch.com/

Follow Us on LinkedIn: https://www.linkedin.com/company-beta/13281002/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Property and Casualty Insurance Providers Market 2019: Global Growth, Share, Size, Revenue, Regional Outlook and 2025 Forecast | Top Companies: Allstate, Berkshire Hathaway, Liberty Mutual, Travelers Companies here

News-ID: 1493019 • Views: …

More Releases from Orian Research

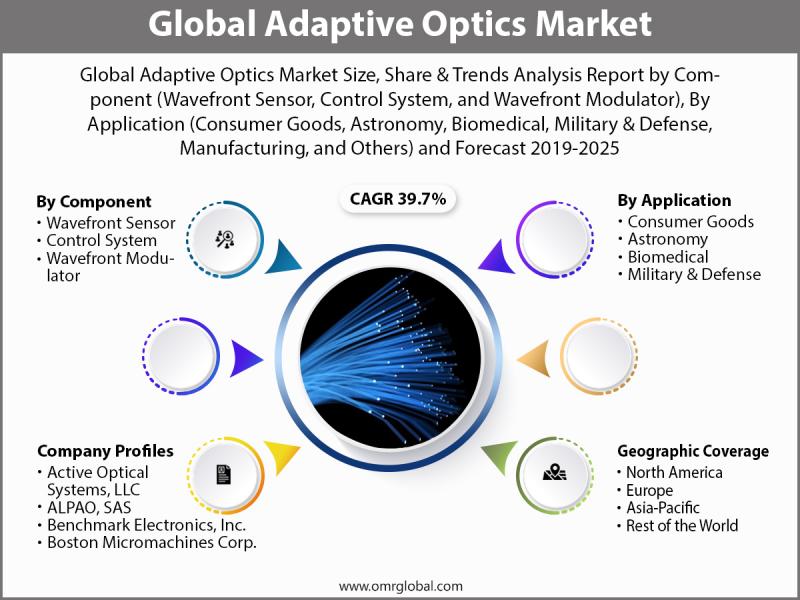

Adaptive Optics Market Size, Competitive Analysis, Share, Forecast- 2019-2025

The global adaptive optics market is projected to grow at a significant CAGR of 39.7% during the forecast period owing to the increasing application of adaptive optics in retinal imaging and ophthalmology to reduce the optical aberrations. The integration of adaptive optics converts an ophthalmoscope into a microscope, allowing visualization of and optical access to individual retinal cells in living human eyes.

To learn more about this report request a…

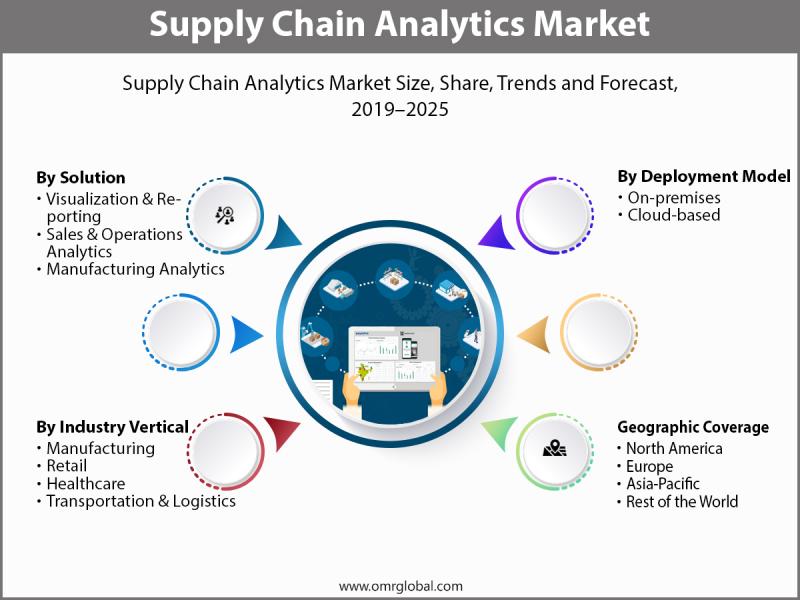

Supply Chain Analytics Market Size, Competitive Analysis, Share, Forecast- 2019- …

The Global Supply Chain Analytics Market is estimated to grow at a significant CAGR during the forecast period 2019- 2025. The impact of e-commerce on retailers and manufacturers is driving a revolution in many sectors and business organization. This has led to the introduction of supply chain analytics solution, which offers mathematics, statistics, predictive modeling and machine-learning techniques to find meaningful patterns and knowledge regarding order, shipment and transactional data.…

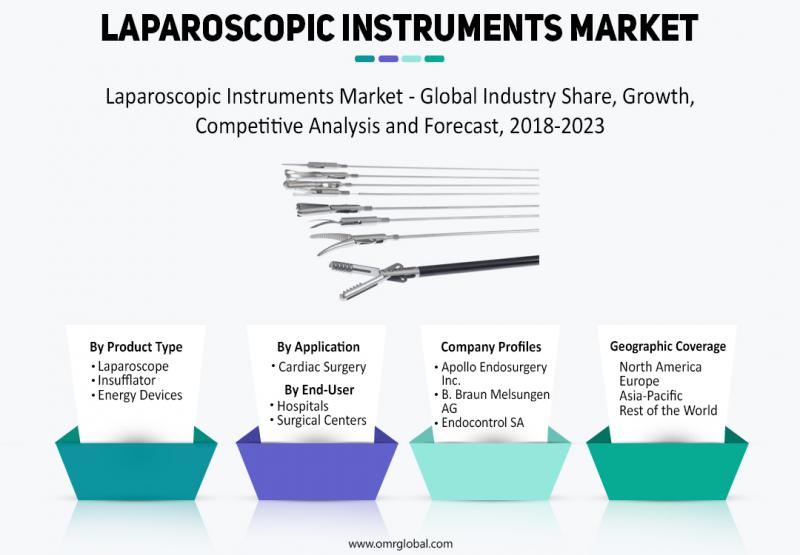

Laparoscopic Instruments Market Size, Competitive Analysis, Share, Forecast- 201 …

The laparoscopic or minimally invasive surgery uses a special surgical instrument known as laparoscope to look inside the body and carry out certain procedures. The laparoscopic instruments market is projected to witness a steady growth rate during the forecast period 2018-2023. The rise in preference of minimal invasive method over invasive surgeries, the high prevalence of lifestyle-oriented diseases, high global expenditure on the laparoscopic market, increasing healthcare market in emerging…

Fertility Drug Market Size, Competitive Analysis, Share, Forecast- 2018-2023

Infertility is one of the major issue now a day due to change in life style & cultural shift. There are various fertility drugs available in market for infertility related problems. Fertility drugs enhance the reproductive ability by improving quality of egg or sperms by increasing the levels of certain hormones in human body. The major factors that are responsible for the growth of fertility drug market are Change in…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…