Press release

Insurance Brokerage Market Projected to Experience Major Global Revenue Boost during the Period 2019-2022 | Wells Fargo, National Financial Partners, Meadowbrook, Jardine Lloyd Thompson, BB&T Insurance, Willis

A fresh report has been added to the wide database of Business Industry Reports. The research study is titled “Insurance Brokerage Market” by Manufacturers, Countries, Type and Application, Forecast to 2022 which provides important data about the production, consumption, revenue and company profiles for key industry participants.Global Insurance Brokerage Market Synopsis:

According to Market Analyst, Global Insurance Brokerage Market is projected to grow at a healthy growth rate from 2019 to 2022.

Get Exclusive Sample Study Papers of “Insurance Brokerage Market” @ https://www.businessindustryreports.com/sample-request/108305 .

The global Insurance Brokerage Market is poised for rapid growth between 2019 and 2022. Due to a shift in consumer behavior, insurance brokerage firms are strategizing actuarial models and effective sales strategies to adopt efficient pricing policies. Insurance brokers offer insurance policies that offer multiple benefits to attract and retain customers. Also, as these insurance policies provide security and personalized services, the customers are extensively demanding for insurance products.

The insurance brokers are witnessing growing demand for accidental insurance, life insurance, medical insurance, vehicle insurance, liability insurance, holiday insurance, and property insurance, as the insurance policies offer several advantages such as minimizing financial uncertainties and risks in the future.

Global Insurance Brokerage Market is segmented on the basis of Product Type, Industry and Region. On the Basis of Product Type, The Insurance Brokerage Market has been segmented into Property and casualty insurance policy brokerage, Health and medical insurance brokerage, Life and accident insurance brokerage, Reinsurance brokerage and administration, Annuity brokerage. Based on Industry, Market can be sub segmented into Commercial P&C insurance, Personal P&C insurance, Health and medical insurance, Life and accident insurance, Insurance administration and risk consulting.

Regionally, The Americas will be the major revenue contributor to the commercial insurance brokers market throughout the forecast period.

Complete report on Insurance Brokerage Market spread across 117 Pages and No. of Table of contents. Buy Research at https://www.businessindustryreports.com/buy-now/108305/single .

The Market is segmented and projected on the basis of major key player’s:

1 Wells Fargo Insurance Services

2 National Financial Partners

3 Meadowbrook Insurance Group

4 Jardine Lloyd Thompson Group

5 BB&T Insurance Services

6 Willis Group Holding

7 Marsh & McLennan

8 Arthur J. Gallagher

9 Hub International

Market segment by Regions/Countries, this report covers:

1 North America Country (United States, Canada)

2 South America

3 Asia Country (China, Japan, India, Korea)

4 Europe Country (Germany, UK, France, Italy)

5 Other Country (Middle East, Africa, GCC)

Request a Discount on standard prices of this premium report at https://www.businessindustryreports.com/check-discount/108305 .

The prime objective of this report is to help the user understand the market in terms of its definition, segmentation, market potential, influential trends, and the challenges that the market is facing. Deep researches and analysis were done during the preparation of the report. The readers will find this report very helpful in understanding the market in depth. The facts and data are represented in the report using diagrams, graphs, pie charts, and other pictorial representations. This enhances the visual representation and also helps in understanding the facts much better.

Key Questions Answered in this Report:

1 What are the major market drivers, challenges, and opportunities in the global Insurance Brokerage market?

2 What was the market value of the leading segments and sub-segments of the global Insurance Brokerage market in 2017?

3 What are the influencing factors that may affect the market share of the key players?

4 Who are the key players in Insurance Brokerage Market?

5 How will the industry evolve during the forecast period 2019-2022?

TABLE OF CONTENTS

1 Insurance Brokerage Definition

2 Global Insurance Brokerage Market Major Player Share and Market Overview

3 Major Player Insurance Brokerage Business Introduction

4 Global Insurance Brokerage Market Segmentation (Region Level)

5 Global Insurance Brokerage Market Segmentation (Type Level)

6 Global Insurance Brokerage Market Segmentation (Industry Level)

7 Insurance Brokerage Market Forecast 2018-2022

8 Insurance Brokerage Segmentation Type

9 Insurance Brokerage Segmentation Industry

10 Insurance Brokerage Cost Analysis

11 Conclusion

About us

BusinessindustryReports.com is digital database of comprehensive market reports for global industries. As a market research company, we take pride in equipping our clients with insights and data that holds the power to truly make a difference to their business. Our mission is singular and well-defined – we want to help our clients envisage their business environment so that they are able to make informed, strategic and therefore successful decisions for themselves.

Media Contact

Business Industry Reports

Pune – India

sales@businessindustryreports.com

+19376349940

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Insurance Brokerage Market Projected to Experience Major Global Revenue Boost during the Period 2019-2022 | Wells Fargo, National Financial Partners, Meadowbrook, Jardine Lloyd Thompson, BB&T Insurance, Willis here

News-ID: 1491235 • Views: …

More Releases from Business Industry Reports

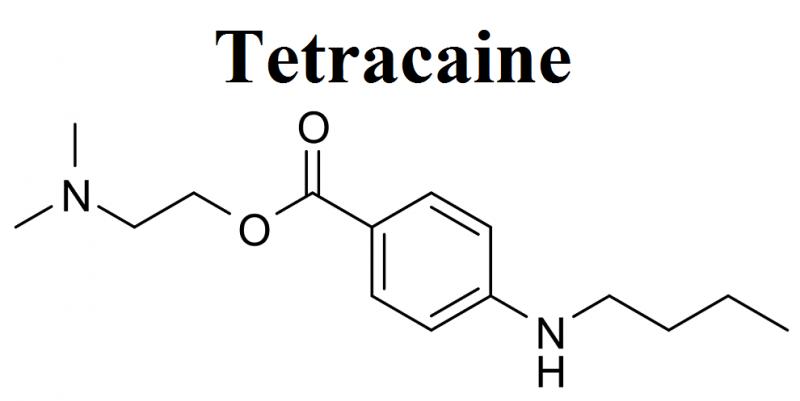

Tetracaine Market Exhibits a Lucrative Growth Potential during 2021-2025 | Endo …

BusinessIndustryReports has recently broadcasted a new study to its broad research portfolio, which is titled as “Global Tetracaine Market” Research Report 2021 provides an in-depth analysis of the Tetracaine with the forecast of market size and growth. The analysis includes addressable market, market by volume, market share by business type and by segment (external and in-house). The research study examines the Tetracaine on the basis of a number of criteria,…

Cyber Warfare Market Evenly Poised To Reach A Market Value of US$ By Share, Size …

Overview of Global Cyber Warfare Market:

This report provides in-depth study of “Global Cyber Warfare Market 2021” using SWOT analysis i.e. Strength, Weakness, Opportunities, and Threat to the organization. The Cyber Warfare Market report also provides an in-depth survey of key players in the market organization.

According to the market research study, the Cyber Warfare is virtual conflict between state, organization, or country by the use of computer technology to disrupt activities…

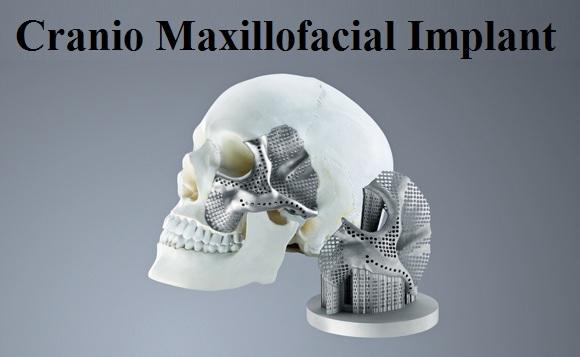

Covid-19 Impact on Cranio Maxillofacial Implant Market 2021-2025: Business Growt …

Overview of Global Cranio Maxillofacial Implant Market:

This report provides in-depth study of “Global Cranio Maxillofacial Implant Market 2021” using SWOT analysis i.e. Strength, Weakness, Opportunities, and Threat to the organization. The Cranio Maxillofacial Implant Market report also provides an in-depth survey of key players in the market organization.

According to the market research study, Craniomaxillofacial Implants are medical implants used in surgeries of maxillofacial region such as, head, face, neck, oral,…

Beginning of the bloom: The Rise of the Biohacking Market 2021-2025 | Global Key …

Global Biohacking Market Synopsis:

The report covers a forecast and an analysis of the Biohacking Market on a global and regional level. The study provides historical data for 2015, 2016, 2017 and 2018 along with a forecast from 2020 to 2025 based on revenue (USD Million) and volume (Kilotons). The study includes drivers and restraints of the Biohacking Market along with the impact they have on the demand over the forecast…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…