Press release

Should You Buy Gold Now?

Gold, gold, gold. It seems like that’s all people ever want to talk about these days is gold. I remember a song that Elvis Presley and Willie Nelson used to sing. I don’t know if it was their song, but the title of it was “You Were Always on My Mind,” and I remember singing this song as a duet in college with my guitar to many of the students at Georgia Tech. And now here I am, 13 years after graduating from Georgia Tech, and I feel like singing that song again, “Gold Is Always on My Mind,” when it comes to the topic of investing.Last month, I wrote that September has typically been the best and strongest month for gold, and gold certainly didn’t disappoint by increasing in 4.78% in September, while gold stocks were up 4.33%. October is a little bit different than September. In fact, it’s the exact opposite. October is typically a volatile month for gold. I expect gold to continue to go up through the mid part of October, and then somewhere around mid-October, through the rest of the month, we’ve seen that as the most bearish time for gold. Gold has fallen 21 out of the past 31 years during the time period from October 13 to November 1. So October is the weakest period of the year for gold prices. However, even though that two week period is a weak period for gold, historically, we are still in a strong range from gold which goes from September sometimes through January. However, that two week period is typically a tough time for gold.

As we continue to look at prospects of gold in the future, there are so many studies and there’s so many things that are being said that point to this bull market not being over yet for gold. I do believe that this bull market will continue. I do not have any projections as to how high gold will go.

However, one of the biggest concerns that I have for gold, based on what I’ve learned in the past with other asset classes, is the big drop that I believe is coming in the price of gold. It may not come, and it probably won’t come, this year. It probably won’t come next year or even the year after that, but at some point I do believe that it’s going to come. I remember back during the real estate craze the over repeated phrase, “Buy more land. They’re not making any more of it.” I remember talking with people in 2004, 2005, and 2006 and everybody wanted to get into real estate. Everybody was getting real estate licenses. People were getting into flipping homes, and the idea was that real estate always goes up. Well, we know now that real estate doesn’t always go up.

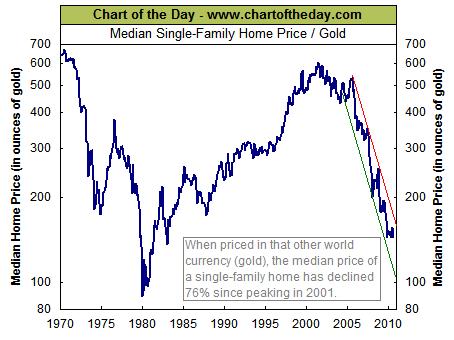

From Chart of the Day: “The chart presents the median single-family home price divided by the price of one ounce of gold. This results in the home/gold ratio or the cost of the median single-family home in ounces of gold. For example, it currently takes 144 ounces of gold to buy the median single-family home. This is considerably less than the 601 ounces it took back in 2001. When priced in gold, the median single-family home is down 76% from its 2001 peak (to a level last seen in January 1983) and remains well within the confines of its six-year accelerated downtrend.”

If home prices can drop, then we certainly can understand that gold prices can drop. Back in 1980, we’ve already seen this happen to gold. So just remember, as any type of investment that you’re getting into, there’s no bad investment (that’s legal, ethical, and moral). There are only bad times to be in them, and that’s something that they actually teach in the Crown Financial Bible Study course at so many churches across the country. As we continue to enjoy this gold rally and this gold bull market, let’s keep our eyes on the horizon and remember that we must have an exit strategy. That is something that I certainly do have, is an exit strategy, to get my clients out of gold when the time looks right. And although I don’t think the time is close right now I do think that I need to take my emotions out of it and have a set system that will get my clients out so I can lock in their profits and move on to another possibly more undervalued asset class.

It would appear, at least from the above chart that real estate may be becoming a good asset to move into. Of course those of you in the Real Return strategy and TDP® have been real estate stocks since November 12th and seen great results!

Eleven Two Fund Management gives investment advice that is different because it uses true or proper diversification with active management. Much of the financial planning advice we give is always right, never changes, and is relevant because it is based on Biblical principles.

Eleven Two Fund Management, Inc.

3162 Johnson Ferry Road #260-27

Marietta, GA 30062

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Should You Buy Gold Now? here

News-ID: 149040 • Views: …

More Releases for October

Dogecoin Price Prediction In October

Dogecoin Price Prediction is on the radar this October as investors monitor whether the meme cryptocurrency can sustain its bullish formation in light of broader market volatilities. With rising interest in utility-driven assets and renewed optimism around strong community tokens, Dogecoin remains one of the top cryptocurrencies to consider right now.

While Dogecoin was conceived as a meme coin, it has grown into a legitimate market force with strong liquidity, a…

October Headlining Shows In Vegas

Upcoming Headlining Shows In Las Vegas

OCTOBER 2024

now - 10/27

Sistahs! The Hocus Pocus Parody

now - 10/19

Earth, Wind and Fire

now - 10/19

Eagles

now - 10/26

Carrie Underwood: REFLECTION

now - 10/19

Barry Manilow: The Hits Come Home

10/18

When We Were Young Sideshow:

The Used and Taking Back Sunday

10/18

Tommy James & The Shondells

10/18 - 10/19

Toni Braxton and Cedric The Entertainer

10/18 - 10/19

Brad Paisley

10/18 - 10/26

Lenny Kravitz

10/19

Porter Robinson

10/19

Parker McCollum

10/19 - 10/20

When We Were Young Festival

10/19 - 10/20

Nick Swardson

10/20

Jeff Dunham: Still…

The Second Line Film Festival enters its 2nd year October 14 – October 18

New Orleans, La ( October 15, 2020) The Second Line Film Festival is an exciting virtual event produced by Gloried Media, LLC, the producers of the South Carolina Cultural Film Festival and the Charlotte Black Film Festival. After participating in the New Orleans cultural scene and serving as a producer for the Real Caregivers of New Orleans Mr. Nichols president of Glorified Media, LLC. fell in love with the people…

ProviNET Solutions exhibits at Leading Age Dallas on October 27 – October 30

A Leading Provider of Healthcare IT Solutions Participates in Leading Age Dallas Annual Meeting and Expo

Tinley Park, IL (September, 2013) ProviNET Solutions is a full-service IT company that offers a comprehensive spectrum of technology products and services for senior living facilities throughout the United States. Born from a long-term care provider, ProviNET is familiar with the strict demands and urgent needs of the industry. ProviNET focuses on ways to…

October Trade Show Triathlon

A high-intensity program of three events for rational motion and TM4 in Germany.

Cologne, October 9, 2012

October is marathon month for rational motion and partner enterprise TM4. With three events following close on one another, the two companies are on tour for electric powertrains and vehicle integration throughout the month. The grand finale will be a joint booth at the eCarTec in Munich. Though the three events differ greatly, they all…

Florida: October is "Guardianship Month"

Florida Governor Charlie Crist has declared October as “Guardianship Month.”

NASGA would point Governor Crist’s attention to the fact that the original intent of guardianship/conservatorship law - “guard,” “protect” and “conserve” - is no longer being complied with in a frightening and growing number of cases involving court-appointed fiduciaries. Wards' estates, instead of being conserved, are being plundered in the guise of fiduciary fee billings for "services," either not…