Press release

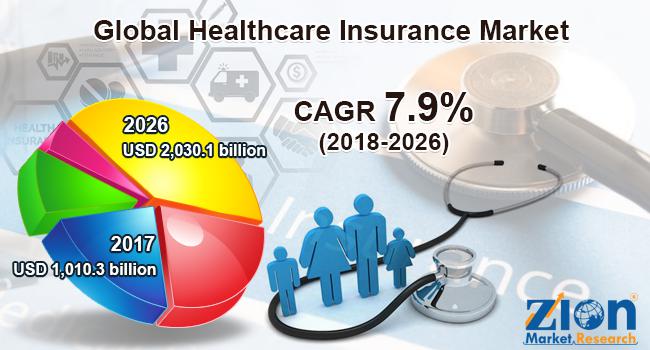

Global Healthcare Insurance Market Is Expected To Grow At ~7.9% CAGR During The Forecast Period

Zion Market Research has published a new report titled “Healthcare Insurance Market by Provider (Private Providers and Public Providers), by Product (Disease Insurance, Medical Insurance, and Income Protection Insurance), by Provider Network (Preferred Provider Organizations (PPOs), Point Of Service (POS), Health Maintenance Organizations (HMOs), and Exclusive Provider Organizations (EPOs)), by Type (Lifetime Coverage and Term Coverage), and by Demographics (Minors, Adults, and Senior Citizens): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2018–2026”. According to the report, the global healthcare insurance market was valued at approximately USD 1,010.3 billion in 2017 and is expected to generate revenue of around USD 2,030.1 billion by the end of 2026, growing at a CAGR of around 7.9% between 2018 and 2026.Medical spending makes poor often vulnerable and results in huge amounts of household spending. Health insurance eliminates or reduces out-of-pocket spending on healthcare solutions and ensures financial risk protection. Government plays a prominent role in deciding the healthcare policies of a country, which directly affects the development of the healthcare insurance market. Supportive government policies is invading the prominent growth of healthcare insurance market, whereas, affordable access to quality treatment and essential medicines depends on several factors, such as provision and use of medicines, sound policies on selection and pricing, efficient regulation by the government and ruling authorities, functioning health infrastructure, a qualified health workforce, good governance, and information systems. Most of the low- and middle-income countries struggle to meet these criteria and fail to provide prominent healthcare services to their population.

Request Free Sample Report of Healthcare Insurance Market Report @ https://goo.gl/RL5UBS

However, the GDP growth has accelerated the expansion of the healthcare insurance market. Healthcare insurance companies are growing mainly due to the emergence of the middle class, rising disposable income, and increasing per capita income globally. The healthcare status of the population is directly linked with the economic development of a country. According to the World Bank, the global healthcare expenditure as a percentage of GDP rose from 9.52% in 2010 to 9.9% in 2015.

The global healthcare insurance market is categorized into a provider, product, provider network, type, and demographics. Based on the provider, this market is bifurcated into private providers and public providers. The private provider segment is likely to grow significantly, owing to less waiting time in hospitals and claim money back on non-medicare health services. By product, this market is fragmented into disease insurance, medical insurance, and income protection insurance. By provider network, this market is divided into preferred provider organizations (PPOs), the point of service (POS), health maintenance organizations (HMOs), and exclusive provider organizations (EPOs). The EPOs segment is expected to grow significantly in the global healthcare insurance market. By type, this market is categorized into lifetime coverage and term coverage. The demographic segment is classified into minors, adults, and senior citizens. The adult segment holds the largest share in the health insurance market. Rising disease awareness and health concerns is a vital factor responsible for the augmentation of the global healthcare insurance market globally.

Download Free PDF Report Brochure @ https://goo.gl/3mDdQt

North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa are major regional segments of the global healthcare insurance market. The North American region is anticipated to remain the leading region over the forecast time period. The Asia Pacific region is anticipated to grow remarkably due to the thriving healthcare sector and favorable government policies pertaining to healthcare insurance, increasing the prevalence of diseases, and growing awareness about insurances regarding health issues. Developing nations, such as China and India, are the most prominent markets healthcare insurance, owing to the rapid growth potential for market players involved in the expansion and promotion of automated solutions for the healthcare industry.

Some key players in the global healthcare insurance market are Apollo Munich Health Insurance Company Ltd., Aetna Inc., AIA Group Limited, Allianz, Anthem, Inc., ASSICURAZIONI GENERALI S.P.A., Japan Post Holding Co., Ltd., Express Scripts Holding Company, Aviva, AXA, Berkshire Hathaway Inc., China Life Insurance (Group) Company, Cigna, International Medical Group Inc., Kaiser Foundation Health Plan, Inc., Munich Re Group, Prudential Financial, Inc., UnitedHealth Group, and Zurich Insurance Group Ltd.

Inquire more about this report @ https://goo.gl/ctNgxh

This report segments the global healthcare insurance market as follows:

Global Healthcare Insurance Market: Provider Segment Analysis

Private Providers

Public Providers

Global Healthcare Insurance Market: Product Segment Analysis

Disease Insurance

Medical Insurance

Income Protection Insurance

Global Healthcare Insurance Market: Type Segment Analysis

Lifetime Coverage

Term Coverage

Global Healthcare Insurance Market: Provider Network Segment Analysis

Preferred Provider Organizations (PPOs)

Point Of Service (POS)

Health Maintenance Organizations (HMOs)

Exclusive Provider Organizations (EPOs)

Global Healthcare Insurance Market: Demographics Segment Analysis

Minors

Adults

Senior Citizens

Global Healthcare Insurance Market: Regional Segment Analysis

North America

The U.S.

Europe

UK

France

Germany

Asia Pacific

China

Japan

India

Latin America

Brazil

The Middle East and Africa

Read Detailed Index of full Research Study at: https://goo.gl/9sQph3

About Us:

Zion Market Research is an obligated company. We create futuristic, cutting-edge, informative reports ranging from industry reports, the company reports to country reports. We provide our clients not only with market statistics unveiled by avowed private publishers and public organizations but also with vogue and newest industry reports along with pre-eminent and niche company profiles. Our database of market research reports comprises a wide variety of reports from cardinal industries. Our database is been updated constantly in order to fulfill our clients with prompt and direct online access to our database. Keeping in mind the client’s needs, we have included expert insights on global industries, products, and market trends in this database. Last but not the least, we make it our duty to ensure the success of clients connected to us—after all—if you do well, a little of the light shines on us.

Contact Us:

Zion Market Research

244 Fifth Avenue, Suite N202

New York, 10001, United States

Tel: +49-322 210 92714

USA/Canada Toll-Free No.1-855-465-4651

Email: sales@zionmarketresearch.com

Website: https://www.zionmarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Healthcare Insurance Market Is Expected To Grow At ~7.9% CAGR During The Forecast Period here

News-ID: 1483481 • Views: …

More Releases from zion market research

Halal Food Market to Reach USD 16.84 Billion by 2034, Expanding at 18.04% CAGR

The global halal food market, valued at USD 3.21 billion in 2024, is projected to reach USD 16.84 billion by 2034 at a robust CAGR of 18.04%. This extraordinary growth is fueled by a rapidly rising global Muslim population, increasing demand for certified halal-compliant food, expanding global halal trade networks, and the emergence of halal as a trusted, premium, ethical, and hygienic food label even for non-Muslim consumers.

Key Market Highlights

Metrics Insight

2024…

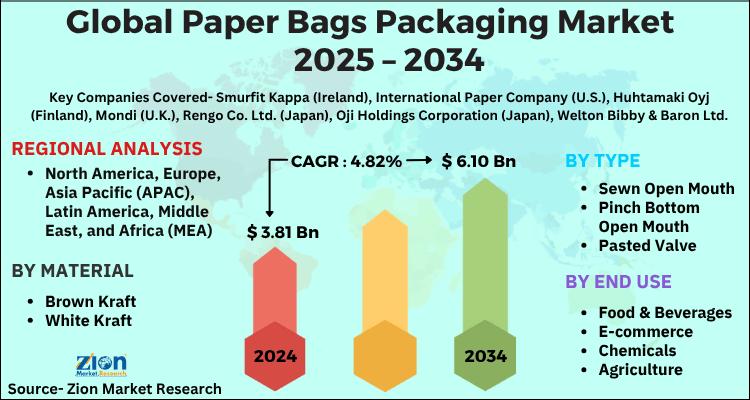

Paper Bags Packaging Market to Reach USD 6.10 Billion by 2034, Expanding at 4.82 …

The global paper bags packaging market, valued at USD 3.81 billion in 2024, is projected to reach USD 6.10 billion by 2034, growing at a 4.82% CAGR between 2025 and 2034. The market is gaining momentum on the back of sustainability mandates, stringent global regulations against single-use plastic, rising consumer environmental consciousness, and the rapid expansion of e-commerce and foodservice industries adopting recyclable packaging.

Key Market Highlights

Indicator Insight

2024 Market Value USD 3.81 Billion

2034…

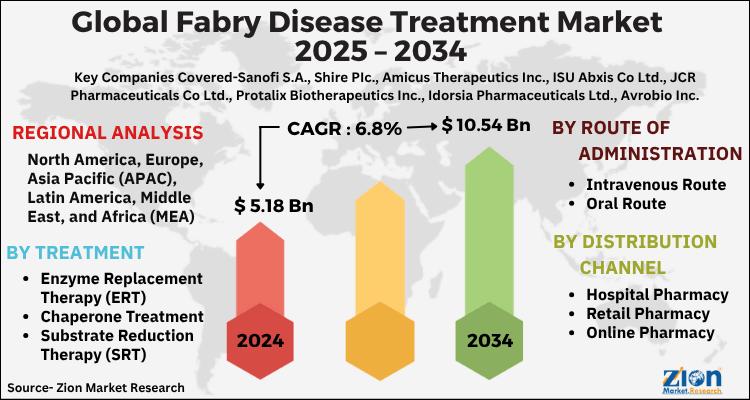

Fabry Disease Treatment Market to Reach USD 10.54 Billion by 2034, Expanding at …

The global Fabry disease treatment market, valued at USD 5.18 billion in 2024, is projected to reach USD 10.54 billion by 2034, growing at a 6.8% CAGR (2025-2034). Market momentum is driven by rising disease awareness and diagnosis, expanding enzyme replacement therapy (ERT) utilization, progress in chaperone and substrate reduction therapies (SRT), and an advancing pipeline in gene and next-generation ERTs. Persistent unmet need-stemming from organ involvement (renal, cardiac, cerebrovascular),…

Snow Sports Apparel Market to Reach USD 5.37 Billion by 2034, Expanding at 7.3% …

The global snow sports apparel market, valued at USD 2.65 billion in 2024, is projected to reach USD 5.37 billion by 2034, growing at a 7.3% CAGR (2025-2034). Growth is driven by the rising popularity of winter sports and outdoor recreation, fabric and garment-tech innovations (breathability, waterproofing, thermal regulation), and the accelerating role of e-commerce, social media, and athlete-led branding in discovery and conversion.

Strategic Market Insights & Key Performance Indicators

2024…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…