Press release

Global Digital Banking Platforms Industry 2019 Market Trends, Size, Share, Top Key Players: Appway, Oracle, Finserv, SAP, TCS, BNY Mellon and Forecast 2025

Global Digital Banking Platforms Industry 2019 research report provide the details about industry overview and analysis about size, share, growth, trend, demand, outlook, classification revenue details, competitive scenario, industry analysis, markets forecast, manufacturers with development trends and forecasts 2025.For Sample Copy of this Report Visit @ https://www.orianresearch.com/request-sample/696908

Growing adoption of cloud-based platforms to obtain higher scalability is having a positive effect on Digital Banking Platforms market. Moreover, rising adoption of smartphones and tablets and increasing demand for streamlining business processes are further boosting the growth of Digital Banking Platforms market.

Difficulty in integrating digital banking platforms with legacy systems and increasing security concerns can be considered as some of the restraining factors for the growth of Digital Banking Platforms market. However, recent advancements in AI, and growing need to meet the compliance requirements of new data laws and regulations are propelling the Digital Banking Platforms market growth.

North America is expected to record the fastest growth over the forecast period owing to rapid adoption of new technologies.

Under the Banking Types of Digital Banking Platforms, retail banking is expected to witness significant adoption owing to the need to meet retail customers’ elevated expectations of personalization and align these expectations in line with the growing multiplication of channels.

Some of the key players operating in this market include Appway, Oracle, Finserv, SAP, TCS, BNY Mellon and Others.

Global Digital Banking Platforms Industry is spread across 121 pages, profiling 06 companies and supported with tables and figures.

Inquire more or share a question if any before the purchase on this report @ https://www.orianresearch.com/enquiry-before-buying/696908 .

Key Benefits of the Report:

* Global, Regional, Country, Banking Type and Banking Mode Market Size and Forecast from 2014-2025

* Detailed market dynamics, industry outlook with market specific PESTLE, Value Chain, Supply Chain, and SWOT Analysis to better understand the market and build strategies

* Identification of key companies that can influence this market on a global and regional scale

* Expert interviews and their insights on market shift, current and future outlook and factors impacting vendors short term and long term strategies

* Detailed insights on emerging regions, Banking Type, Banking Mode, and competitive landscape with qualitative and quantitative information and facts

Target Audience:

* Digital Banking Platforms providers

* Traders, Importer and Exporter

* Raw material suppliers and distributors

* Research and consulting firms

* Government and research organizations

* Associations and industry bodies

Order a copy of Global Digital Banking Platforms Market Report 2018 @ https://www.orianresearch.com/checkout/696908 .

Research Methodology

The market is derived through extensive use of secondary, primary, in-house research followed by expert validation and third party perspective like analyst report of investment banks. The secondary research forms the base of our study where we conducted extensive data mining, referring to verified data sources such as white papers government and regulatory published materials, technical journals, trade magazines, and paid data sources.

For forecasting, regional demand & supply factor, investment, market dynamics including technical scenario, consumer behavior, and end use industry trends and dynamics , capacity production, spending were taken into consideration.

We have assigned weights to these parameters and quantified their market impacts using the weighted average analysis to derive the expected market growth rate.

The market estimates and forecasts have been verified through exhaustive primary research with the Key Industry Participants (KIPs) which typically include:

* Original Equipment Manufacturer,

* Component Supplier,

* Distributors,

* Government Body & Associations, and

* Research Institute

TABLE OF CONTENT

1 Executive Summary

2 Methodology And Market Scope

3 Digital Banking Platforms Market — Industry Outlook

4 Digital Banking Platforms Market Banking Type Outlook

5 Digital Banking Platforms Market Banking Mode Outlook

6 Digital Banking Platforms Market Regional Outlook

7 Competitive Landscape

End of the report

Disclaimer

About Us

Orian Research is one of the most comprehensive collections of market intelligence reports on the World Wide Web. Our reports repository boasts of over 500000+ industry and country research reports from over 100 top publishers. We continuously update our repository so as to provide our clients easy access to the world's most complete and current database of expert insights on global industries, companies, and products. We also specialize in custom research in situations where our syndicate research offerings do not meet the specific requirements of our esteemed clients.

Contact Us:

Ruwin Mendez

Vice President – Global Sales & Partner Relations

Orian Research Consultants

US +1 (415) 830-3727| UK +44 020 8144-71-27

Email: info@orianresearch.com

Website: www.orianresearch.com/

Follow Us on LinkedIn: https://www.linkedin.com/company-beta/13281002/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Digital Banking Platforms Industry 2019 Market Trends, Size, Share, Top Key Players: Appway, Oracle, Finserv, SAP, TCS, BNY Mellon and Forecast 2025 here

News-ID: 1481671 • Views: …

More Releases from Orian Research

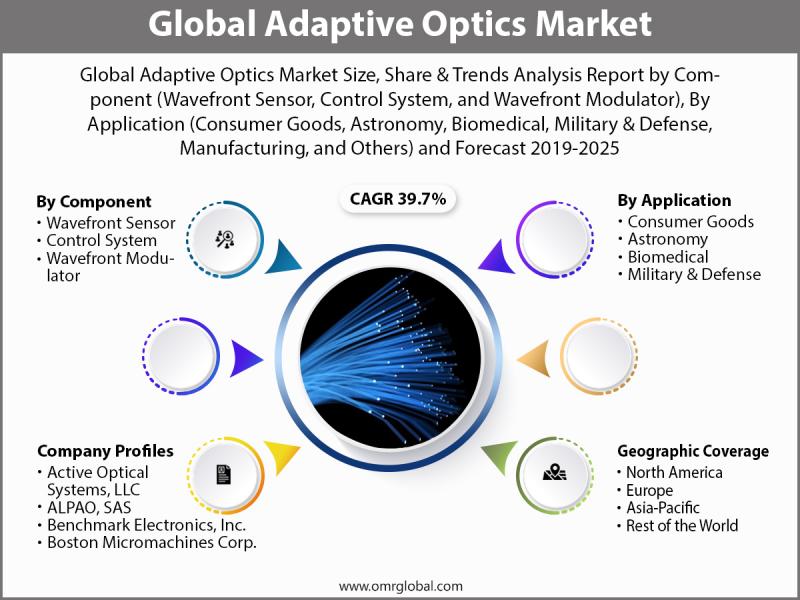

Adaptive Optics Market Size, Competitive Analysis, Share, Forecast- 2019-2025

The global adaptive optics market is projected to grow at a significant CAGR of 39.7% during the forecast period owing to the increasing application of adaptive optics in retinal imaging and ophthalmology to reduce the optical aberrations. The integration of adaptive optics converts an ophthalmoscope into a microscope, allowing visualization of and optical access to individual retinal cells in living human eyes.

To learn more about this report request a…

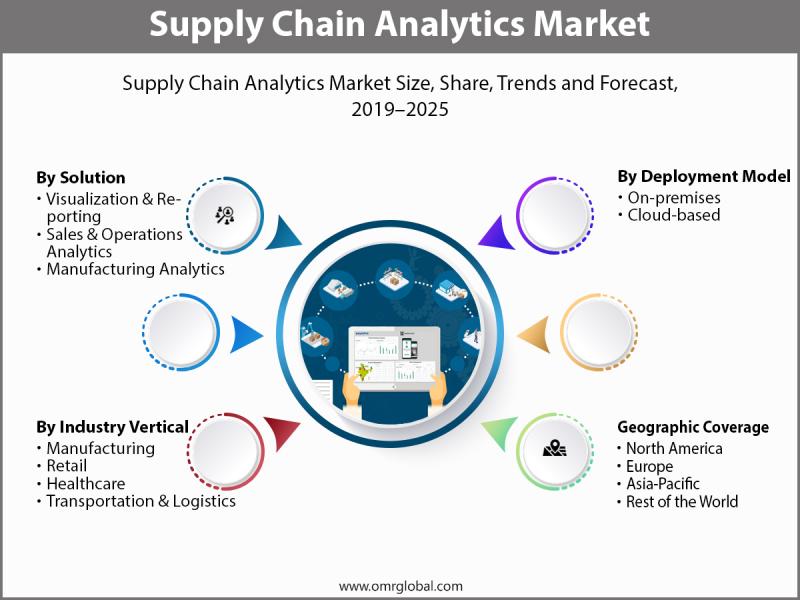

Supply Chain Analytics Market Size, Competitive Analysis, Share, Forecast- 2019- …

The Global Supply Chain Analytics Market is estimated to grow at a significant CAGR during the forecast period 2019- 2025. The impact of e-commerce on retailers and manufacturers is driving a revolution in many sectors and business organization. This has led to the introduction of supply chain analytics solution, which offers mathematics, statistics, predictive modeling and machine-learning techniques to find meaningful patterns and knowledge regarding order, shipment and transactional data.…

Laparoscopic Instruments Market Size, Competitive Analysis, Share, Forecast- 201 …

The laparoscopic or minimally invasive surgery uses a special surgical instrument known as laparoscope to look inside the body and carry out certain procedures. The laparoscopic instruments market is projected to witness a steady growth rate during the forecast period 2018-2023. The rise in preference of minimal invasive method over invasive surgeries, the high prevalence of lifestyle-oriented diseases, high global expenditure on the laparoscopic market, increasing healthcare market in emerging…

Fertility Drug Market Size, Competitive Analysis, Share, Forecast- 2018-2023

Infertility is one of the major issue now a day due to change in life style & cultural shift. There are various fertility drugs available in market for infertility related problems. Fertility drugs enhance the reproductive ability by improving quality of egg or sperms by increasing the levels of certain hormones in human body. The major factors that are responsible for the growth of fertility drug market are Change in…

More Releases for Banking

Banking ERP Software Market: A Catalyst for Banking Excellence

The Banking ERP Software Market is at the forefront of a financial revolution, poised to redefine the way banking institutions operate in the digital age. As the industry grapples with evolving customer expectations, regulatory demands, and technological advancements, ERP software solutions have emerged as indispensable tools for financial institutions. These systems streamline operations, enhance data management, and empower banks to deliver more efficient and customer-centric services. In an era where…

Digital Banking Market Report, Worth, Size, Share, Trends, Segmented by Applicat …

Digital Banking Market Size:

In 2018, the global Digital Banking market size was 5.180 Billion USD and it is expected to reach 16.200 Billion US$ by the end of 2025, with a CAGR of 15.3% during 2019-2025.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-4N473/Global_Digital_Banking

Digital Banking Market Share:

• In 2017, North America's economy accounted for about 48.73% of the global Digital Banking market share, while Europe and Asia-Pacific accounted for about 30.22%, 16.54%, respectively.

• European countries such…

Online Banking Market by Banking Type - Retail Banking, Corporate Banking, and I …

The Online Banking Market size is expected to reach $29,976 million in 2023 from $7,305 million in 2016, growing at a CAGR of 22.6% from 2017 to 2023. Digital banking includes all kinds of online/internet transactions done for various purposes. It is the incorporation of new technologies, to deliver enhanced customer services.

Customer convenience, higher interest rates, and technologically advanced interface majorly drive the market. High security risk of customer’s data…

Explore Mobile Banking Market with Top Players like Barclays, BOC, SBI, HSBC Mob …

Mobile Banking allow various users to avail banking and financial services through any telecommunication devices. Different kind of services include both information and monetary transaction. Increase in the use of number of smart phones and mobile phones mobile Banking Market has gained its popularity. It is preferable and comfortable by the users than any other means of transaction.

Global Mobile Banking Market anticipated to grow at a CAGR of +35% over…

Mobile Banking Market Is Booming Worldwide | HSBC Mobile Banking, ICICI Bank Mob …

HTF MI recently introduced Global Mobile Banking Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are HSBC Mobile Banking, ICICI Bank Mobile Banking, U.S. Bank, Santander Mobile…

Online Banking Market Report 2018: Segmentation by Banking Type (Retail Banking, …

Global Online Banking market research report provides company profile for ACI Worldwide (U.S.), Microsoft Corporation (U.S.), Fiserv, Inc. (U.S.), Tata Consultancy Services (India), Cor Financial Solutions Ltd. (UK), Oracle Corporation (U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for…