Press release

Cyber Insurance Market - Global Demand Analysis & Opportunity Outlook 2026

The global cyber insurance market is expected to gain momentum owing to the significant importance that cyber risk has gained within the period of just a few years. Since technology has made its way into business as an important part of organizations that includes virtual reality, augmented reality, artificial intelligence, robotics, and also the internet of things (IoT). New levels of smart cities, e-monility, smart buildings, and automation are generated due to this. The insurance industry is also trying to catch-up with the cyber-risks and its rapid rise in todays fast developing generation.Request a PDF Brochure with Future Analysis @ https://www.transparencymarketresearch.com/sample/sample.php?flag=B&rep_id=48276

There are different variations in the market for cyber insurance market on the basis of vertical and enterprise size. On the basis of vertical, the market is categorized into education, government, health care, utilities, e-commerce and retail, transportation, entertainment and media, IT and telecom, Banking Financial Services and Insurance (BFSI). The industries that rely on digital technologies like logistics, manufacturing and telecommunications or those that deal with a large volume of personal data like healthcare and retail are most likely to acquire cyber insurance in the years to come. With respect to enterprise size, the market can be classified into large enterprises and SMEs.

The report presented here is a complete evaluation of the global cyber insurance market with large focus on market dynamics. It includes the market drivers, restraints, and trends and opportunities. It also offers geographical and other segmentation studies of the market.

Global Cyber Insurance Market: Trends and Opportunities

In the recent past, there has been instances of computer breaches like Democratic National Committee and Twitter and this has also increased the requirement for insurance in resistance to cyber threats. There is also a surging interest in the energy and utilities financial organizations and transport sectors as well. The rising threats posed by interconnectivity is driving such interests, therefore contributing to the revenue generation of the cyber insurance market.

Browse Market Research Report @ https://www.transparencymarketresearch.com/cyber-insurance-market.html

Cyber-attacks are on a constant rise and differ from one another depending on the sector. To site an example, the BFSI sector is being a focus of organized cyber-crimes while the retail sector is being targeted continuously. Technology has adapted the way banking is regulated that is, starting from cloud data storage to online servicing for customers. Ransomware attacks and distributed denial-of-service (DDoS) are used increasingly against businesses like healthcare and media and entertainment. On the other hand, the public and telecommunications sectors are liable to intelligent-focused cyber-attacks.

About TMR

Transparency Market Research (TMR) is a global market intelligence company providing business information reports and services. The company’s exclusive blend of quantitative forecasting and trend analysis provides forward-looking insight for thousands of decision makers. TMR’s experienced team of analysts, researchers, and consultants use proprietary data sources and various tools and techniques to gather and analyze information.

Contact TMR

90 State Street, Suite 700

Albany, NY 12207

Tel: +1-518-618-1030

USA - Canada Toll Free: 866-552-3453

Email: sales@transparencymarketresearch.com

Website: https://www.transparencymarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Cyber Insurance Market - Global Demand Analysis & Opportunity Outlook 2026 here

News-ID: 1449917 • Views: …

More Releases from Transparency Market Research

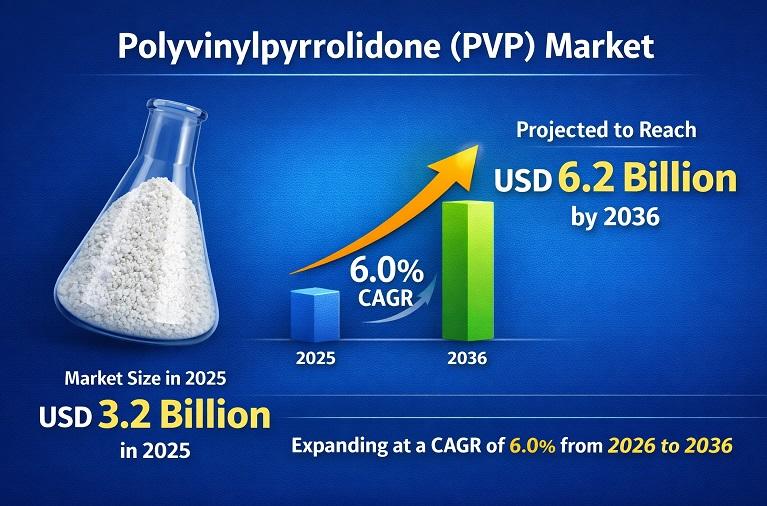

Polyvinylpyrrolidone (PVP) Market to Reach USD 6.2 Billion by 2036 Driven by Pha …

The Polyvinylpyrrolidone (PVP) Market was valued at around US$ 3.2 billion in 2025 and is projected to reach approximately US$ 6.2 billion by 2036, expanding at a steady CAGR of about 6.0% during the forecast period. This growth is primarily driven by rising demand from the pharmaceutical industry, where PVP is widely used as a tablet binder, solubilizer, and stabilizer, along with increasing consumption in cosmetics and personal care products…

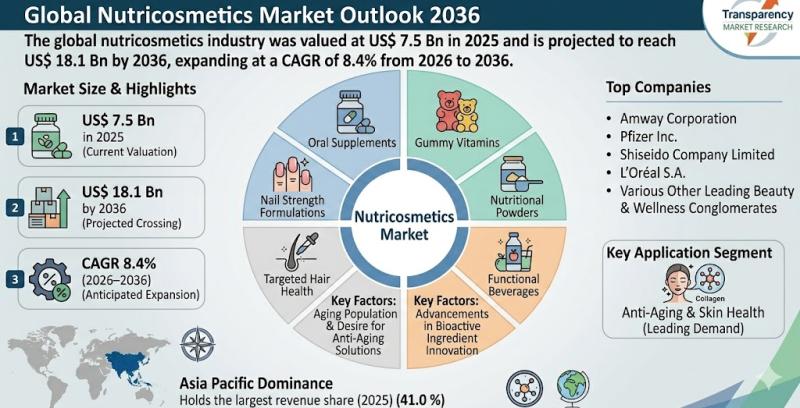

Nutricosmetics Market to Reach US$ 18.1 Bn by 2036, Expanding at 8.4% CAGR Drive …

The global nutricosmetics market was valued at US$ 7.5 Bn in 2025 and is projected to reach US$ 18.1 Bn by 2036, expanding at a robust CAGR of 8.4% from 2026 to 2036. Nutricosmetics-nutritional supplements and functional products designed to enhance skin, hair, and nail health from within-are gaining substantial traction worldwide. The growing consumer shift toward holistic wellness, preventive healthcare, and clean-label beauty solutions is significantly driving market expansion.

Nutricosmetics…

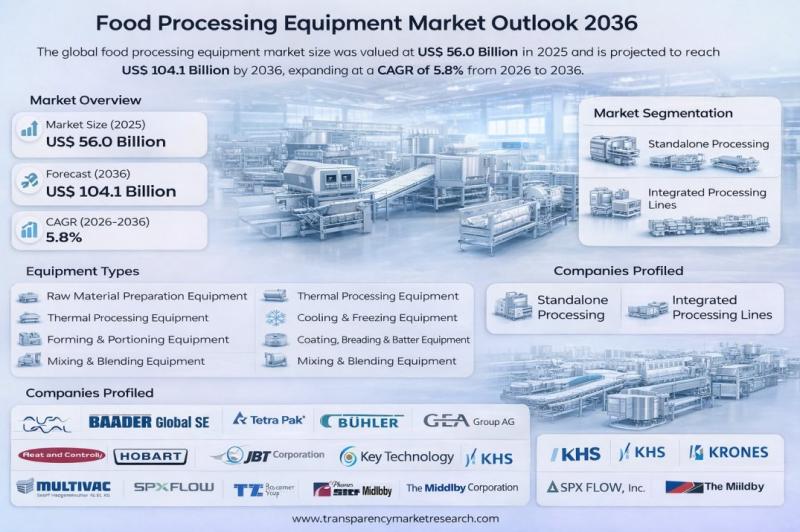

Food Processing Equipment Market to Reach US$ 104.1 Billion by 2036, Driven by A …

The global food processing equipment market was valued at US$ 56.0 Billion in 2025 and is projected to reach US$ 104.1 Billion by 2036, expanding at a CAGR of 5.8% from 2026 to 2036. Market expansion is being driven by rising demand for processed and convenience foods, expanding urbanization, increasing automation in food manufacturing, stringent food safety regulations, growing meat and dairy consumption, technological advancements, adoption of energy-efficient machinery, industrialization…

Global Household Cooking Appliances Market to Reach USD 160.3 Billion by 2036, D …

The global household cooking appliances market is poised for robust growth over the next decade. Valued at US$ 88.3 billion in 2025, the market is projected to reach US$ 160.3 billion by 2036, expanding at a steady CAGR of 5.5% from 2026 to 2036. The market outlook remains highly positive as rapid urbanization, rising disposable incomes, and evolving consumer lifestyles continue to reshape global kitchen environments.

Household cooking appliances include gas-…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…