Press release

Automotive suppliers rate Toyota as best carmaker to work with, but losing ground to its rivals.

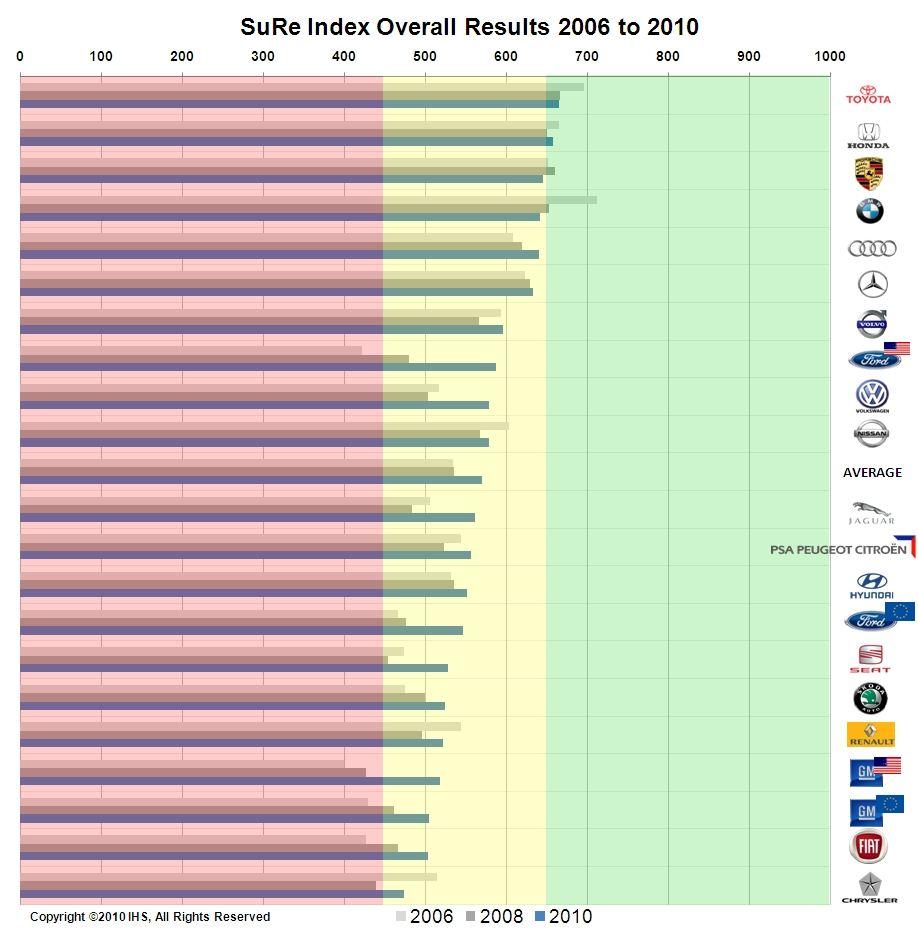

LONDON (August 25, 2010) - Toyota is the preferred automaker to work with according to automotive suppliers in 2010, although its advantage over other carmakers is shrinking. Ford North America, GM and Volkswagen are recording the most significant improvements in the suppliers’ rating of OEMs as measured by the SuRe (Supplier Relationship) index, a survey-based tool introduced by the SupplierBusiness team at IHS Automotive. The SuRe index measures how carmakers perform in managing their supply base, rather than how popular they are according to suppliers.Suppliers’ executives rate automakers with which they are currently in business on 28 relational, organisational and commercial aspects, allocated in five categories. The study leverages on the OEM supplier relations survey, which is in its fifth edition. In 2010, 192 respondents participated in the study, representing 2,900 current supply contracts.

Toyota’s pole position is challenged by another Japanese OEM, Honda, while Porsche occupies the third spot in the 2010 SuRe index. Ford North America is the outlier in a ranking which has been traditionally tiered in four areas with the Japanese carmakers dominating it, followed by German premium OEMs, European mass carmakers and the Big Three at the bottom. Ford now occupies the eighth spot, representing a substantial improvement over last place in the 2006 edition of the study. Volkswagen chases Ford for the eighth position.

GM is also encountering increasing favour in the supplier community, although this is not translating into a fundamental gain of positions in the SuRe index ranking. Similarly to GM, the two partners Fiat and Chrysler are also improving, but not enough to move away from the lowest positions of the ranking.

“Treating suppliers more fairly is no longer the prerogative of Japanese carmakers. Both European and North American mass carmakers are working on fixing their relationships with the supply base, but the Detroit Three are definitely the most active in this field with a number of initiatives, Ford earlier than others,” says Matteo Fini, lead researcher of the SupplierBusiness team. “Toyota remains the benchmark model for supplier relationships, but the pedal storm and tighter price policies have partly tarnished its attractiveness as a customer.”

The five concepts in which the 28 questions are categorised are: Profit potential, Organisation, Trust, Pursuit of Excellence and Long-term Outlook. These are then summarised in a numeric value in a 0 to 1,000 scale, which forms the SuRe index. The questions cover all the different phases in which the two parties interact, from RFQ (Request for Quotation) through development to warranty liability management.

The SuRe index is based on SupplierBusiness’ well-established surveys of the supply industry, which started in 2005. From its inception, the survey has seen the participation of more than a thousand senior to middle managers working at automotive suppliers and directly interfacing with OEMs' personnel. In 2010, 50% of respondents were based in North America, 41% in Europe, 9% from other regions. The survey includes 25 of the world’s top 60 automotive suppliers, 58 of the top 100, 53 medium sized suppliers with turnover between $100 million and $1 billion and 81 small suppliers (turnover lower than $100 million).

A variety of suppliers’ organisational functions are surveyed in order to include the different perspectives on the business relations and practices of OEMs. Most respondents belong to Marketing and Sales, Engineering, Program Management, R&D, Quality and Manufacturing. The 28 questions have been organised in five patterns and cover the entire period of the supplier’s interface and involvement with the OEM - from RFQ to warranty liability management. These result in a numeric value, ranging from 0 to 1,000 indicating the rating of suppliers.

For an executive summary of the survey results, please go to www.supplierbusiness.com/sureindex

##

About SupplierBusiness (www.supplierbusiness.com)

SupplierBusiness is a team within IHS Automotive focused on automotive supply base issues, providing the most comprehensive coverage of issues facing the global automotive supplier community. Thorough analysis of the purchasing and product development strategies at OEMs are combined with the supplier viewpoint on those same processes through regular surveys of leading automotive suppliers.

Matteo Fini

133 Houndsditch

EC3A 7BX London

+44 203159 3478 begin_of_the_skype_highlighting +44 203159 3478 end_of_the_skype_highlighting

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Automotive suppliers rate Toyota as best carmaker to work with, but losing ground to its rivals. here

News-ID: 142671 • Views: …

More Releases for OEM

Revolutionizing OEM Coatings With Sustainable Solutions Trend: A Crucial Influen …

Which drivers are expected to have the greatest impact on the over the oem coatings market's growth?

The surge in requirements from final consumer industries is forecasted to boost the expansion of the OEM coatings market. These coatings, referred to as OEM, are utilized during the integration of other firms' products into the substrate process or application. They prove to be beneficial for a variety of end-user sectors, including automotive and…

OEM Technology Partnerships Launches Brokerage Specializing in 100+ OEM Technolo …

San Francisco, California, USA - February 13, 2025 - OEM Technology Partnerships is thrilled to announce the launch of its specialized brokerage focused on connecting businesses with a comprehensive portfolio of over 100 Original Equipment Manufacturer (OEM) technologies. This new venture is poised to revolutionize how companies access and implement cutting-edge solutions across diverse industries.

Leveraging deep industry expertise and a vast network of OEM partners, OEM Technology Partnerships offers a…

OEM or ODM Watches? What's the Difference?

When searching for a watch manufacturer for your store or watch brand, you may come across the terms OEM and ODM. But do you truly understand the difference between them? In this article, we will delve into the distinctions between OEM and ODM watches to help you better grasp and choose the manufacturing service that suits your needs.

Image: https://www.naviforce.com/uploads/15a6ba3911.png

What's OEM / ODM Watches [https://www.naviforce.com/products/]

OEM (Original Equipment Manufacturer) watches are produced…

OEM Partnership with Extreme Networks

ComputerVault announces an OEM partnership with Extreme Networks and has certified its switches for use with ComputerVault enterprise software to deliver virtual desktop infrastructure (VDI).

Extreme Networks industry leading switches deliver ComputerVault Virtual Desktops at faster than PC speeds in the LAN and WAN.

“ComputerVault is very excited to work with Extreme Networks. Not only are their switches very reliable, but their exceptional performance guarantees a great user experience”, said Marc…

Humidity Measurement Module for OEM Applications

The EE1900 humidity module from E+E Elektronik is optimised for the measurement of relative humidity (RH) or dew point temperature (Td) in climate and test chambers. With outstanding temperature compensation across the working range from -70 °C to 180 °C (-94 °F to 356 °F) and the choice of stainless steel and plastic probes, the module is suitable for a wide range of applications.

High Accuracy in Harsh Environment

The excellent…

Industrial Fasteners Market for Machinery OEM, Automotive OEM and Construction A …

The global industrial fasteners market is gaining momentum on the account of the rise in construction and maintenance activities across the globe. Increase in the demand for automobiles, specifically in emerging economies such as Brazil, China, and India is a significant factor contributing towards the growth of the global industrial fasteners market. The research report provides a complete picture of the global industrial fasteners market, analyzing all the crucial market…