Press release

Credit Insurance Market will Surpass US$ 10.77 Billion in Terms of Value by the End of 2025 | Emerging Technology, Potential, Forthcoming Outlook and Top Key Players Like

The Credit Insurance Market is anticipated accounted to US$ 8.64 Bn in 2017 and is expected to grow at a CAGR of 2.9% during the forecast period 2018 – 2025, to account to US$ 10.77 Bn by 2025. Growth in the recent five years is primarily driven by two major factors, unstable macroeconomic factors that are influencing the growth of credit insurance, and improving sales & accounts receivable support benefits to accentuate the demand for credit insurance. The scope of the research study includes different types of insurance players as global players, regional players as well as niche and local players operating in the credit insurance market. The study also provides market insights and analysis of the credit insurance market, highlighting the market technological trends, adoption rate, industry dynamics, and competitive analysis of major players in the industry.Request for Sample Report @ http://bit.ly/2SA83Ed

Leading Credit Insurance Market Players:

1. Euler Hermes

2. Atradius N.V.

3. Coface SA

4. American Internation Group, Inc.

5. Credendo

6. QBE Insurance Group Ltd.

7. Zurich Insurance Group

8. China Export & Credit Insurance Corporation

9. CESCE

10. Export Development Canada

The global credit insurance market is experiencing good growth with regards to the investments, and stringent regulations being laid out in different countries in the current scenario and are anticipated to rise in the coming years. The market for credit insurance consists of various established players across the globe, which invest high amounts in order to deliver the most advanced service to the customers. Due to medium entry barrier to the market, several tier 2 companies are upcoming in the market across the globe, increasing the competitiveness of the market over the years. Majority of the companies operating in the global market are based out of Europe, and North America. However, the market is penetrating at a higher growth rate in the Asia Pacific and the Middle East regions owing to the increasing export business in the regions. China is one of the prominent countries in Asia Pacific regions with China Export and Credit Insurance Corporation holding the majority of the market share in China.

The market for credit insurance globally has been segmented on the basis of components into two major segments including products and services. The companies operating in the global credit insurance market design and innovate robust products and services depending upon the requirements of the customers or clients. The global credit insurance market is further bifurcated on basis of enterprise size as small & medium enterprises (SMEs) and large enterprises. The large enterprises capture a significant market share in the global credit insurance market over the years. The different types of applications of credit insurance include domestic trading market and export trading market.

The export segment in the application is much more prominent and the demand for credit insurance products and services are gaining importance in the domestic market in the current years. The global market for credit insurance is categorized on basis of five strategic regions namely; North America, Europe, Asia Pacific, Middle East, and Africa, and South America. Geographically, the two most dominant region in the current market scenario accounted for Europe and North America.

Inquire about Discount on this Report @ http://bit.ly/2CWDMu5

Reason to Buy:

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the Global Credit Insurance Market

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the Credit Insurance Market, thereby allowing players to develop effective long term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth global market trends and outlook coupled with the factors driving the market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to products, segmentation and industry verticals.

About Us:

The Insight Partners is a one stop industry research provider of actionable intelligence. We help our clients in getting solutions to their research requirements through our syndicated and consulting research services. We are a specialist in Technology, Healthcare, Manufacturing, Automotive and Defense.

Contact Us:

The Insight Partners

533, 5th Floor, Amanora Chambers,

Amanora Township, East Block,

Kharadi Road, Hadapsar, Pune-411028

Phone: +1-646-491-9876

Email: sales@theinsightpartners.com

Website: http://www.theinsightpartners.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Credit Insurance Market will Surpass US$ 10.77 Billion in Terms of Value by the End of 2025 | Emerging Technology, Potential, Forthcoming Outlook and Top Key Players Like here

News-ID: 1399693 • Views: …

More Releases from The Insight Partners

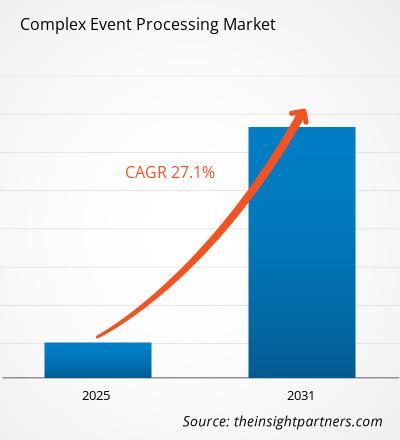

Real-Time Analytics Driving Strong Growth in the Complex Event Processing Market

The report is segmented by Deployment Mode (Cloud, On-Premise); Service Type (Consulting, Installation and Maintenance, Training and Support, Managed Services); Application (Algorithmic Trading, Electronic Transaction Monitoring, Dynamic Pre-Trade Analytics, Data Enrichment, Fraud Detection, Governance, Risk and Compliance, Asset Management and Predictive Scheduling, Geo-fencing and Geospatial Analysis, Others).

The global analysis is further broken down at the regional level and across major countries. The report offers the market value in USD for…

![A Complete Guide to Air Purification Industry [PDF E-Book]](https://cdn.open-pr.com/L/1/L115168461_g.jpg)

A Complete Guide to Air Purification Industry [PDF E-Book]

The increase in airborne diseases owing to the rise in air pollution is a key factor attributed to the market's growth. Furthermore, growing awareness among the consumer about using air purifiers, a rise in disposable income, and an improved standard of living are the prominent factors boosting the market growth. The growing trend toward adopting portable and smart air purifiers is further propelling the market dynamics over the forecast period.…

![A Complete Guide to Rain Gutter Industry [PDF E-Book]](https://cdn.open-pr.com/L/1/L115746839_g.jpg)

A Complete Guide to Rain Gutter Industry [PDF E-Book]

The increasing demand for replacement and renovation construction activities because of the bad weather conditions is driving the rain gutter market. The increase in the number of re-roofing projects, including gutter replacement, resulting from unpredictable weather conditions in various European countries, propels the market growth. In addition, increasing residential and commercial construction activities and rising need for rainwater harvesting are expected to fuel the rain gutter market's growth in the…

Leading Innovations in Aircraft Nacelle Systems Propel Sustainable Aviation Forw …

New York January 15, 2026

Aerospace Dynamics Innovations today announced groundbreaking advancements in aircraft nacelle systems, designed to enhance fuel efficiency and reduce environmental impact in commercial and general aviation. These next-generation nacelle systems incorporate lightweight composite materials and advanced aerodynamic designs, setting new benchmarks for performance in the rapidly evolving aircraft nacelle systems market. The development comes at a pivotal time for the aviation industry, where aircraft nacelle systems…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…