Press release

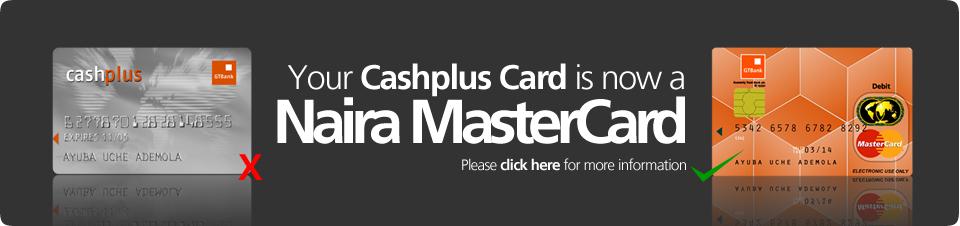

GTbank phases out Magnetic stripe cards... Introduces Naira MasterCard

As part of efforts to continuously conform to the highest international standards and in keeping with its promise to continually offer customers security of transactions and accounts, Guaranty Trust Bank has phased out its Old Magnetic Stripe Debit and Credit cards for more secure and internationally accepted Chip & Pin alternatives. The cards to be affected under this scheme are the CashPlus Naira Debit cards and the Magnetic stripe Dollar denominated MasterCard Classic cards.Speaking on this development, Ronke Kuye, General Manager and Head of Card Services at GTBank stressed the need for customers to collect the replacement cards at their branches saying that the cards not just offer enhanced security to the user but also, conveniently provide the user with greater flexibility in withdrawals and payments than the magnetic stripe cards. Customers were therefore urged to ensure that they collect their replacement cards by August 1, 2010 as the old cards would cease to work from that period

The ‘Naira MasterCard’ from GTBank made history upon its introduction as the first Naira denominated debit MasterCard card in the world. It can be used on all ATMs with the MasterCard sign and employs a dual Chip and Pin technology for the utmost protection and security of accounts and transactions. Meanwhile, all old magnetic stripe GTBank dollar denominated MasterCard cards will be disabled from the 1st of July 2009 and replacements issued to the customers at a fee. Customers should therefore request for ‘Chip and Pin’ MasterCard Dollar and Visa Card Dollar cards from the Bank.

Established in 1990, Guaranty Trust Bank grown consistently to become one Africa’s leading e-business and financial services providers with significant presence in all countries of Anglophone West Africa (Nigeria, Ghana, Gambia, Sierra Leone, Liberia) and the United Kingdom. The bank is soon set to expand its operations into Francophone West Africa

GTBank

Plot 1669, Oyin Jolayemi Street, Victoria Island, Lagos

+234 1 2714580

Femi Adeniran

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release GTbank phases out Magnetic stripe cards... Introduces Naira MasterCard here

News-ID: 139495 • Views: …

More Releases for GTBank

Payments Landscape in Nigeria: Opportunities and Risks to 2022

ReportsWeb.com has announced the addition of the “ Payments Landscape in Nigeria” The report provides detailed analysis of market trends in the Nigerian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including cards, credit transfers, direct debits, and cheques during the review-period.

This report provides top-level market analysis, information and insights into the Nigerian cards and payments industry, including -…

Payments Landscape in Nigeria Market 2022 Infrastructure & Regulation by FirstBa …

GlobalData’s "Payments Landscape in Nigeria: Opportunities and Risks to 2022", report provides detailed analysis of market trends in the Nigerian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including cards, credit transfers, direct debits, and cheques during the review-period (2014-18e).

The report also analyzes various payment card markets operating in the industry and provides detailed information on the number of…

“Advances in AI will start a new wave of re-shoring & localization”

The 8th Edition of New Age Banking Summit, Nigeria brought together top thought leaders and industry experts who shared the best and next practices that make use of latest technologies, case studies and strategies, thus providing the opportunity to discuss and deliberate on the solutions and opportunities that exist in this new and cognitive age of banking. It was attended by over 200 banking professionals & Fintech leaders.

…

Clickatell Transact and Kwesé iflix partner to provide streaming for all in Nig …

KWESE IFLIX AND CLICKATELL TRANSACT ESTABLISH A PARTNERSHIP TO EXPAND MOBILE STREAMING ENTERTAINMENT IN NIGERIA

LAGOS, NIGERIA – September 2018 - Clickatell Transact , Kwesé iflix (Africa’s game-changing digital entertainment platform) , together with GT Bank and some of the most prominent banks in Nigeria, have partnered to offer the freshest line-up of sports, news and entertainment, available to millions of Nigerians, via the Kwesé iflix platform.

The Kwesé iflix service…

GT Bank Pioneers Social Banking in Nigeria

Foremost Nigerian financial institution, Guaranty Trust Bank plc has once again raised the service bar for Nigerian banks with the unveil of its ‘Social Banking’ service on Facebook. The new offering which is the first of its kind by any Nigerian Bank allows GTBank Social Account holders transfer money, purchase airtime, pay bills, and confirm their account balance on Facebook.

Speaking about the innovation, Managing Director/CEO of Guaranty Trust Bank…

AAA Welcomes News of Private Equity Investment in Africa

Alternative Asset Analysis (AAA) has welcomed a new report from alternative asset research firm Pregin, which has found that private equity investment is helping to develop economies in Africa.

Boston, MA, April 20, 2011 -- Alternative Asset Analysis (AAA) has welcomed a new report from alternative asset research firm Pregin, which has found that private equity investment is helping to develop economies in Africa.

The alternative investment analysis organization supports all forms…