Press release

Backbase (Netherlands), EdgeVerve (India), Temenos (Switzerland) and TCS (India) are Leading Players in Digital Banking Platforms Market- Report by MarketsandMarkets™

According to recent research "Digital Banking Platforms Market by Banking Type (Retail Banking and Corporate Banking), Banking Mode (Online Banking and Mobile Banking), Deployment Type (On-Premises and Cloud), and Region - Global Forecast to 2023", The digital banking platforms market is projected to grow from USD 3.3 billion in 2018 to USD 5.7 billion by 2023, at a Compound Annual Growth Rate (CAGR) of 11.2% from 2018 to 2023Browse 34 market data Tables and 40 Figures spread through 111 Pages and in-depth TOC on "Digital Banking Platforms Market"

View detailed Table of Content here - https://www.marketsandmarkets.com/Market-Reports/digital-banking-platforms-market-90744083.html?utm_source=OpenPR

The growing demand among banks to provide customer experience and the increasing adoption of the cloud-based platforms to obtain higher scalability and flexibility are expected to drive the growth of the digital banking platforms market across the globe. The increasing demand for streamlining business processes and the growing adoption of smartphones and tablets are also expected to fuel the growth of the digital banking platform market.

Based on banking types, the retail banking segment is expected to grow at a higher CAGR during forecast period

Based on banking types, the retail banking is estimated to grow at higher CAGR from 2018 to 2023. Retail banking has emerged as an essential enabler in the digital banking platforms market to translate the banking models across the globe. With the increasing number of channels, financial institutions are changing their operating processes to provide customers with premium services and improve their account management. The changing customer expectations and behaviors and the growing digital technologies are contributing to the growth of the retail banking segment.

Based on banking modes, the online banking segment is expected to account for a major market size during the forecast period

Based on banking modes, the online banking segment is expected to account for a major market size during the forecast period. The online banking platforms facilitates banks to offer banking services to end-users over the internet. The online banking requires high level of process automation, web-based services, and Application Programming Interfaces (APIs), and facilitates real-time integration with a bank’s multiple host systems.

Based on deployment types, the cloud segment is expected to grow at a higher CAGR during forecast period

Based on deployment types, the cloud segment is expected to grow at a higher CAGR during the forecast period. The cloud deployment type has become a cost-effective and efficient way to handle all operational processes of insurers, along with data management and governance issues. Cloud-based digital banking platform tools offer several benefits, such as the rapid implementation of tools, reduced set up and operational costs, less maintenance costs, 24/7 data accessibility, security, and ease of use.

Download PDF Brochure@ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=90744083&utm_source=OpenPR

The Asia Pacific (APAC) digital banking platforms market is projected to grow at the highest CAGR during the forecast period

The digital banking platforms market in the APAC region is projected to grow at the highest CAGR during the forecast period. This growth can be attributed to the increased adoption of digital technologies, especially in emerging economies, such as Singapore, Australia, India, China, and Japan. This has made APAC a lucrative market in the IT industry. Strong banking capabilities, including digital offerings, strong financial positions, and digital structures are expected to drive the growth of the digital banking platforms market in the APAC region. Companies in APAC would benefit from the flexible economic conditions, industrialization, globalization-motivated policies of the government, and the expanding digitalization in the region.

Key players operating in the digital banking platforms market include Appway (Switzerland), Backbase (Netherlands), CREALOGIX (Switzerland), ebanklT (England), EdgeVerve (India), Intellect Design Arena (India), Finastra (UK), ieDigital (England), ETRONIKA (Lithuania), Fidor (Germany), Fiserv (US), Halcom (Slovenia), NETinfo (Cyprus), Kony (US), NF Innova (Austria), Oracle (US), SAB (France), SAP (Germany), Sopra (France), Tagit (Singapore), TCS (India), Technisys (US), Temenos (Switzerland), BNY Mellon (US), and Worldline (France).

Backbase (Netherlands) is one of the leading vendors of the digital banking platforms market. Currently, Backbase is working toward enhancing its market share and presence with the help of the growth strategies, such as partnerships and collaborations, in various regions across the globe. In July 2018, Backbase partnered with Jumio, one of the leading Artificial Intelligence (AI)-powered trusted identity-as-a-service providers. This partnership enabled these 2 companies to offer identity verification services to financial institutions and improve the conversion rate, identify frauds, and meet Know Your Customer (KYC), Anti-Money Laundering (AML), and General Data Protection Regulation (GDPR) compliance mandates, while also enhancing the customer experience.

EdgeVerve, an established company in the market and a wholly owned subsidiary of Infosys Ltd has majorly adopted inorganic growth strategies to diversify its product offerings with the help of innovative technologies. In line with its inorganic growth strategies, in September 2018, EdgeVerve partnered with Australian Military Bank (AMB), one of Australia’s longest serving mutual financial institutions, and announced the go-live of the Finacle banking solutions suite to drive AMB’s ambitious digital transformation program. Finacle has enabled AMB with significant operational benefits and cost efficiencies, along with enhanced security and scalability. In October 2018, EdgeVerve Systems, a subsidiary of Infosys, launched Finacle Digital Engagement Suite, an advanced omnichannel solution suite that helps banks onboard, sell, service, and engage customers with tailored experiences.

Request Sample@ https://www.marketsandmarkets.com/requestsampleNew.asp?id=90744083&utm_source=OpenPR

MarketsandMarkets™ provides quantified B2B research on 30,000 high growth niche opportunities/threats which will impact 70% to 80% of worldwide companies’ revenues. Currently servicing 7500 customers worldwide including 80% of global Fortune 1000 companies as clients. Almost 75,000 top officers across eight industries worldwide approach MarketsandMarkets™ for their painpoints around revenues decisions.

Our 850 fulltime analyst and SMEs at MarketsandMarkets™ are tracking global high growth markets following the "Growth Engagement Model – GEM". The GEM aims at proactive collaboration with the clients to identify new opportunities, identify most important customers, write "Attack, avoid and defend" strategies, identify sources of incremental revenues for both the company and its competitors. MarketsandMarkets™ now coming up with 1,500 MicroQuadrants (Positioning top players across leaders, emerging companies, innovators, strategic players) annually in high growth emerging segments. MarketsandMarkets™ is determined to benefit more than 10,000 companies this year for their revenue planning and help them take their innovations/disruptions early to the market by providing them research ahead of the curve.

MarketsandMarkets’s flagship competitive intelligence and market research platform, "Knowledgestore" connects over 200,000 markets and entire value chains for deeper understanding of the unmet insights along with market sizing and forecasts of niche markets

Mr. Shelly Singh

MarketsandMarkets™ INC.

630 Dundee Road

Suite 430

Northbrook, IL 60062

USA : 1-888-600-6441

newsletter@marketsandmarkets.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Backbase (Netherlands), EdgeVerve (India), Temenos (Switzerland) and TCS (India) are Leading Players in Digital Banking Platforms Market- Report by MarketsandMarkets™ here

News-ID: 1394928 • Views: …

More Releases from MarketsandMarkets

Top Ultrasound Market Trends Driving Growth in 2025 and Beyond | Philips Healthc …

The global ultrasound market is entering a transformative phase in 2025. Once primarily associated with pregnancy scans and basic imaging, ultrasound has now evolved into a powerful, multipurpose diagnostic tool with applications across cardiology, oncology, musculoskeletal care, emergency medicine, and beyond.

As healthcare systems worldwide shift towards non-invasive, affordable, and portable imaging solutions, ultrasound is becoming central to modern diagnostics. According to market insights, the ultrasound industry is poised for steady…

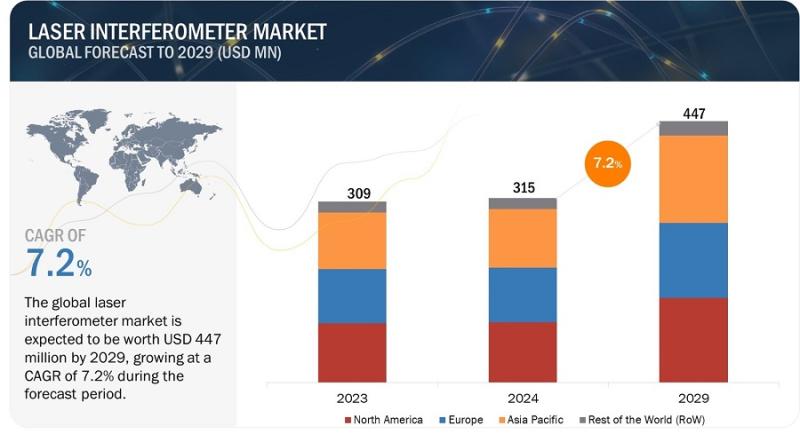

Laser Interferometer Market Set to Grow at the Fastest Rate- Time to Grow your R …

The global laser interferometer market is expected to be valued at 315 million in 2024 and is projected to reach USD 447 million by 2029, at a CAGR of 7.2% from 2024 to 2029. Emerging applications in industries push the market's growth due to the growing demand for precision in the manufacturing sector. However, challenges such as higher initial investments and maintenance costs cause problems. Despite these, opportunities arise for…

With 19.6% CAGR, Battery Testing, Inspection, and Certification Market Growth to …

The battery testing, inspection, and certification market is projected to reach USD 36.7 billion by 2029 from USD 14.9 billion in 2024 at a CAGR of 19.6% during the forecast period. Increasing adoption of EVs and energy storage systems, rising enforcement of stringent standards to ensure battery safety, thriving portable electronics industry, and rapid advances in battery technology are the major factors contributing to the market growth.

Download PDF Brochure @…

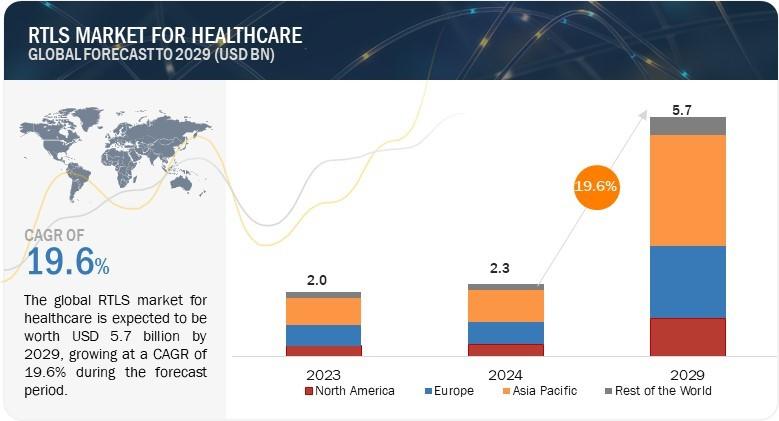

Real-Time Location Systems Revolutionize Healthcare: Insights from MarketsandMar …

The global RTLS market for healthcare is projected to grow from USD 2.3 billion in 2024 to USD 5.7 billion by 2029, at a compound annual growth rate of 19.6% from 2024 to 2029. As it attracts more and more players who enter this market with innovative RTLS features for customers, the market for RTLS technology is rapidly increasing. Top companies in this market focus on healthcare, retail, and manufacturing…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…