Press release

Growth prospect of Blockchain in Retail Banking Market including major key vendors like Microsoft, Royal Bank of Canada (RBC), Emirates Islamic Bank, State Bank of India (SBI), Mizuho, JPMorgan and BBVA and others

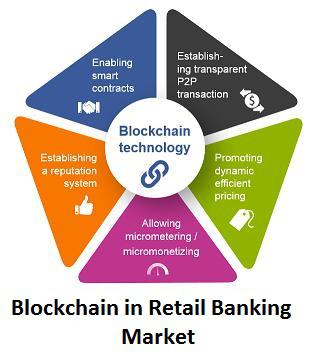

Blockchain in Retail Banking Market is expected to grow at a CAGR of +39 % during the forecast period. The key factors driving the growth of the market are increase in demand for transparency related to product origin or processes and rise in need to reduce duplicative record keeping. While the lack of awareness related to blockchain technology is hampering the markets growthThe research report analyzes the global Blockchain in Retail Banking market in a thorough way by clarifying the key characteristics of the market which are predicted to have a measureable impact on its evolving prospects over the forecast period. It offers an in-depth vision into the key drivers, restraints and futuristic opportunities. Latest technological advancements and edge-cutting competitive landscape have also been identified as they form the most important pillars for understanding the current state of the market. Also the major players operating in the market are mentioned with details in this report

Get Sample Copy of this Report @

http://qyreports.com/request-sample?report-id=94774

Top key players:

Accenture, Cognizant, Credit China FinTech, Goldman Sachs, IBM, Microsoft, Ping An, Santander, Axoni, BitFury, Digital Asset Holdings, Filament, LO3 Energy, R3, Ripple, Slock.it, Royal Bank of Canada (RBC), Emirates Islamic Bank, State Bank of India (SBI), Mizuho, JPMorgan and BBVA

Competitive Analysis serves as the bridge between manufacturers and other participants available in global market. To understand the competitive scenario among the manufacturers, the report estimates the Blockchain in Retail Banking market share and revenue of some of the leading companies. The report also discusses the strategies implemented by the key companies to maintain their hold on the industry. The business overview and financial overview of each of the companies also have been analyzed.

The research report segments the Global Blockchain in Retail Banking Market based on its Type, Application and Geography. On the basis of type the market is segmented into Public, Private and Hybrid. By application the market is categorized into Exchange, Payment, Documentation and Others.On the basis of topography, the worldwide market is separated into North America, China, Europe, Japan, India, and Southeast Asia. The research report witnesses that North America will be a key territorial market in the general market.

Thus, the report presents a widespread synopsis of the Blockchain in Retail Banking market based factors that are expected to have a substantial and determinate influence on the market’s growth prospects over the forecast period.

For more Information:

http://qyreports.com/enquiry-before-buying?report-id=94774

Table of Content:

Global Blockchain in Retail Banking Market Research Report 2018-2023

Chapter 1: Industry Overview

Chapter 2: Blockchain in Retail Banking International and China Market Analysis

Chapter 3: Environment Analysis of Blockchain in Retail Banking market

Chapter 4: Analysis of Revenue by Classifications

Chapter 5: Analysis of Revenue by Regions and Applications

Chapter 6: Analysis of Global Blockchain in Retail Banking Market Revenue Status.

Chapter 7: Analysis of Global Blockchain in Retail Banking Industry Key Manufacturers

Chapter 8: Sales Price and Gross Margin Analysis

Chapter 9: Marketing Trader or Distributor Analysis of Global Blockchain in Retail Banking

Chapter 10: Development Trend of Blockchain in Retail Banking Industry 2017-2023

Chapter 11: Industry Chain Suppliers of Global Blockchain in Retail Banking market with Contact Information

Chapter 12: New Project Investment Feasibility Analysis of Blockchain in Retail Banking

Chapter 13: Conclusion of the Blockchain in Retail Banking Market Research Report

Ask for discount@

http://qyreports.com/ask-for-discount?report-id=94774

About QYReports:

We at, QYReports, a leading market research report published accommodate more than 4,000 celebrated clients worldwide putting them at advantage in today’s competitive world with our understanding of research. Our list of customers includes prestigious Chinese companies, multinational companies, SME’s and private equity firms whom we have helped grow and sustain with our fact-based research. Our business study covers a market size of over 30 industries offering unfailing insights into the analysis to reimagine your business. We specialize in forecasts needed for investing in a new project, to revolutionize your business, to become more customer centric and improve the quality of output.

Contact:

QYReports

Jones John

(Sales Manager)

+91-9764607607

sales@qyreports.com

www.qyreports.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Growth prospect of Blockchain in Retail Banking Market including major key vendors like Microsoft, Royal Bank of Canada (RBC), Emirates Islamic Bank, State Bank of India (SBI), Mizuho, JPMorgan and BBVA and others here

News-ID: 1394752 • Views: …

More Releases from qyreports

Insurance Chatbot Market 2021 Global Demand and Emerging Trends by 2028- ICICI L …

Global Insurance Chatbot Market Report is a believable source for gaining the market research that will exponentially accelerate your business. SWOT and Porter's five analysis are also effectively discussed to analyse informative data such as cost, prices, revenue, and end-users. The research report has been evaluated on the basis of various attributes such as manufacturing base, products or services and raw material to understand the requirements of the businesses. The…

Global Cloud based Repository Services Market Assessment 2021-2028| Industry Siz …

The Global Cloud based Repository Services Market Report is a study of prevailing drivers, trends, forecast, and restraints in the global landscape. The report is the latest addition to the vast data repository of QY Reports known for their original, trustworthy, and unique business acumen. The report is another addition to the vast landscape of the keyword market, as it expands into new regions. As you undertake this new journey,…

Cloud Services Policy Controller Solutions Market is Thriving Worldwide with San …

The research report on the Global Cloud Services Policy Controller Solutions Market published by QY Reports covers all the market details for the forecast period. Primarily, the report considers some essential factors that account for the growth and development of the market. The Cloud Services Policy Controller Solutions market report sheds light on the major interferences and challenges. The market report provides a recent overview of the future market scope…

Source-to-Pay (S2P) Outsourcing Market Next Big Thing | Major Giants Capgemini, …

The comprehensive research report provides genuine information of the Global Source-to-Pay (S2P) Outsourcing Market. Its scope study expands from market situation to comparative pricing among the chief players, expense of the specific market areas and profits. It represents a comprehensive and in-brief analysis report of the prime competitor and the pricing statistics with a view to aid the beginners establish their place and survive in the market. Furthermore, it also…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…