Press release

Cyber Insurance Market Size, Share, Growth| Mojar Key Players Company American International, Chubb, Zurich Insurance, XL Group, Berkshire Hathaway, Allianz Global Corporate & Specialty, Munich Re, Lloyds

Cyber Insurance Market Report, published by Allied Market Research, forecasts that the global market is expected to garner $14 billion by 2022, registering a CAGR of nearly 28% during the period forecast 2022. North America constituted the largest cyber insurance market share in 2015 and it would continue to dominate the market during the forecast period. Growth in the region is supplemented by enforcement of data protection regulations in U.S. Moreover, increase in levels of liability and legislative developments accelerate the market growth.Access Full Report Summary: https://www.alliedmarketresearch.com/cyber-insurance-market?utm_source=OpenPR

Increase in awareness about cyber risks from boardroom to data centers owing to the rising number of cyber-attacks in the past 23 years is the prime factor that drives the market. However, complex and changing nature of cyber risks limits cyber insurance market growth. Low market penetration of cyber insurance policies in developing countries offers promising business opportunity for market players.

The global cyber insurance market is segmented based on industry verticals, company size, and geography. Based on industry verticals, the market is segmented into healthcare, retail, financial services (BFSI), information technology and services, others (utilities, energy, manufacturing, construction, and transportation). BFSI and information technology sector were the early adopters of cyber liability insurance policies to protect their data. Although, as per the study, Healthcare vertical generates around one-third of the premium as these companies possess huge third-party data such as personal details of consumers, employment details and cyber criminals can easily misuse this data to make money. For instance, in U.S., around 78% of hospitals are secured under cyber insurance.

Based on revenue generated by companies, cyber insurance market is categorized as very small-sized (2.5 million to 99 million), small-sized (100 million-299 million), medium-sized (300 million to 1billion), and large companies (1 billion and above). Despite the fact that cyber security and cyber risks are acknowledged as serious threat, several companies do not purchase cyber insurance policies. However, the market has witnessed a change in the scenario. Companies of all sizes tend to purchase cyber insurance policies, owing to legal developments. Large companies contribute significantly, i.e., around 70% of the overall cyber insurance market in 2015, as loss of any kind of data has negative repercussions on their businesses.

North America dominates the cyber insurance market and accounts for around 87% of the overall cyber insurance market in 2015. Mandatory legislation regarding cyber security in several U.S. states has led to higher penetration of cyber liability insurance policies. The U.S. cyber insurance industry has become mature, and growth of the cyber insurance industry is projected to decrease owing to rising adoption of cyber liability insurance policies. Europe has very less penetration of cyber insurance liability policies as compared to that of the U.S. The European council has recently passed regulations regarding data protection and security, which are projected to be brought into effect in 2018. These regulations would oblige companies to purchase cyber insurance policies. Though Asia-Pacific accounts for negligible percentage share, it is expected to grow at a significant CAGR during the forecast period owing to a significant increase in ransomware attacks.

Download Sample Copy Here: https://www.alliedmarketresearch.com/request-sample/1705?utm_source=OpenPR

Key Findings of the Cyber Insurance Market:

•North America generated highest revenue in 2015 and will continue to lead the market during the forecast period.

•Europe is projected to grow at the highest rate.

•Large companies contribute significantly in generation of cyber insurance premium.

•Healthcare industry was the major buyer of cyber insurance policies in 2015 and will continue to lead the market during the forecast period.

Key companies profiled in the report are American International Group, Inc. (U.S.), The Chubb Corporation (U.S.), Zurich Insurance Co. Ltd (Switzerland), XL Group Ltd (Republic of Ireland), Berkshire Hathaway (U.S.), Allianz Global Corporate & Specialty (Germany), Munich Re Group (Germany), Lloyds (U.K.), Lockton Companies, Inc. (U.S.), and AON PLC (U.K.).

Enquiry Report: https://www.alliedmarketresearch.com/purchase-enquiry/1705?utm_source=OpenPR

Allied Market Research, a market research and advisory company of Allied Analytics LLP, provides business insights and market research reports to large as well as small & medium enterprises. The company assists its clients to strategize business policies and achieve sustainable growth in their respective market domain.

Allied Market Research provides one stop solution from the beginning of data collection to investment advice. The analysts at Allied Market Research dig out factors that help clients to understand the significance and impact of market dynamics. The company amplies client’s insight on the factors, such as strategies, future estimations, growth or fall forecasting, opportunity analysis, and consumer surveys among others. As follows, the company offers consistent business intelligent support to aid the clients to turn into prominent business firm.

Contact:

David Correa

5933 NE Win Sivers Drive

#205, Portland, OR 97220

United States

Toll Free (USA/Canada):

+1-800-792-5285, +1-503-894-6022, +1-503-446-1141

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1⟨855⟩550-5975

help@alliedmarketresearch.com

Web: https://www.alliedmarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Cyber Insurance Market Size, Share, Growth| Mojar Key Players Company American International, Chubb, Zurich Insurance, XL Group, Berkshire Hathaway, Allianz Global Corporate & Specialty, Munich Re, Lloyds here

News-ID: 1394330 • Views: …

More Releases from Allied Market Research

Emerging Technologies in Structural Steel Tube Market in Glob: Innovations and F …

According to the report, "the structural steel tube market" was valued at $105.3 billion in 2023, and is estimated to reach $167.5 billion by 2033, growing at a CAGR of 4.8% from 2024 to 2033.

Allied Market Research published a report, titled, "Structural Steel Tube Market By Type (Hot-Rolled Steel and Cold-Rolled Steel), Material (Stainless Steel Tube, Carbon Steel Tube, Alloy Steel Tube, and Others), Sales Type (Direct,…

Costume Jewelry Market Size Worth USD 86.8 billion by 2033 | Growth Rate (CAGR) …

According to a new report published by Allied Market Research, titled, "costume jewelry market" was valued at $45.2 billion in 2023, and is projected to reach $86.8 billion by 2033, growing at a CAGR of 6.8% from 2024 to 2033.

Get Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/2093

Costume jewelry refers to decorative pieces made of inexpensive materials such as base metals, glass, plastic, or synthetic stones, often adorned with…

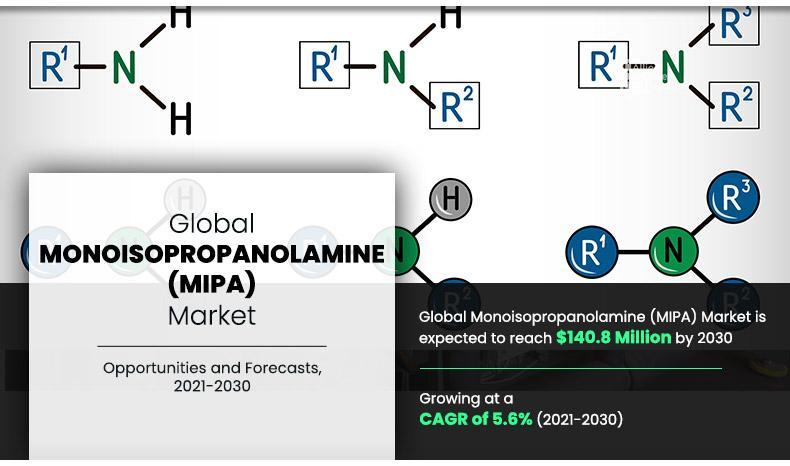

Monoisopropanolamine Market: A Comprehensive Analysis of Trends, Growth and Oppo …

The global Monoisopropanolamine (MIPA) Market was pegged at $82.2 million in 2020, and is expected to reach $140.8 million by 2030, growing at a CAGR of 5.6% from 2021 to 2030.

Allied Market Research recently published a report, titled, Monoisopropanolamine (MIPA) Market by End-use Industry (Chemical Industry, Personal Care, Agrochemical, Pharmaceuticals, Metalworking, and Others): Global Opportunity Analysis and Industry Forecast, 2021-2030".

Download Sample Report with Statistical Info: https://www.alliedmarketresearch.com/request-sample/16048…

Treadmill Market Navigating Business with CAGR of 5.1% with Revenue of $5,932.0 …

The global treadmill market size was valued at $3,284.8 million in 2020, and is projected to reach $5,932.0 million by 2030, registering a CAGR of 5.1%.

Request The Sample PDF Of This Report @ https://www.alliedmarketresearch.com/request-sample/4286

Treadmill is widely used for physical fitness equipment for weight management and improving body stamina & muscular strength. Mostly used treadmills are motorized or electronic, owing to advance features offered to users. Rise in…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…