Press release

ONLINE PAYMENTS SERVICES MARKET INSIGHTS, TRENDS, KEY MANUFACTURE AND FORECAST BY 2018-2025

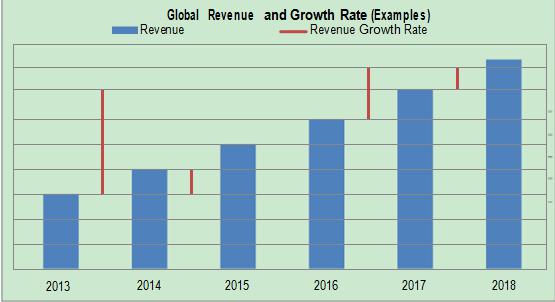

The Online Payments Services Market Research Report highlights the potential growth opportunities within the returning years, whereas additionally reviewing the expansion indicators, challenges, market dynamics, competitive landscape, and different key aspects with relevance international Online Payments Services market.In 2017, the global Online Payments Services market size was million US$ and it is expected to reach million US$ by the end of 2025, with a CAGR of during 2018-2025.

Request for PDF Sample of this Report@ http://www.supplydemandmarketresearch.com/home/contact/57889?ref=Sample-and-Brochure&toccode=SDMRSE57889

This report focuses on the global Online Payments Services status, future forecast, growth opportunity, key market and key players. The study objectives are to present the Online Payments Services development in United States, Europe and China.

The key players covered in this study

• Alipay

• Tencent

• Apple Pay

• PayPal

• WorldPay

• Paydollar

• Amazon Pay

• Adyen

• Creditcall

• Klarna

• OFX (company)

• Paysafe Group

• Square

• Yandex.Money

• Stripe

• Fortumo

• Creditcall

• Trustly

• Wirecard

• Creditcall

• BitPay.

Market segment by Type, the product can be split into

• Type I

• Type II

Market segment by Application, split into

• Online Payment

• Mobile Payment

• Bitcoin Payment

• Other

Request for Discount on this report@ http://www.supplydemandmarketresearch.com/home/contact/57889?ref=Discount&toccode=SDMRSE57889

Market segment by Regions/Countries, this report covers

• United States

• Europe

• China

• Japan

• Southeast Asia

• India

• Central & South America

The study Online Payments Services of this report are:

• To analyze global Online Payments Services status, future forecast, growth opportunity, key market and key players.

• To present the Online Payments Services development in United States, Europe and China.

• To strategically profile the key players and comprehensively analyze their development plan and strategies.

• To define, describe and forecast the market by product type, market and key regions.

In this study, the years considered to estimate the market size of Secure Email Services are as follows:

History Year: 2013-2017

Base Year: 2017

Estimated Year: 2018

Forecast Year 2018 to 2025

Table of Content

Chapter One: Report Overview

Chapter Two: Global Growth Trends

Chapter Three: Market Share by Key Players

Chapter Four: Breakdown Data by Type and Application

Chapter Five: United States

Chapter Six: Europe

Chapter Seven: China

Chapter Eight: Japan

Chapter Nine: Southeast Asia

List of Tables and Figures

• Table Online Payments Services Key Market Segments

• Table Key Players Online Payments Services Covered

• Table Global Online Payments Services Market Size Growth Rate by Type 2013-2025 (Million US$)

• Figure Global Online Payments Services Market Size Market Share by Type 2013-2025

• Figure Type I Figures

• Table Key Players of Type I

• Figure Type II Figures

• Table Key Players of Type II

• Table Global Online Payments Services Market Size Growth by Application 2013-2025 (Million US$)

• Figure Online Payment Case Studies

• Figure Mobile Payment Case Studies

• Figure Bitcoin Payment Case Studies

• Figure Other Case Studies

Access full research report@ http://www.supplydemandmarketresearch.com/home/toc_publisher/57889?code=SDMRSE57889

Contact Us

info@supplydemandmarketresearch.com

http://supplydemandmarketresearch.com

Phone Number: +918208285935

About Supply Demand Market Research(SDMR)

We have a strong network of high powered and experienced global consultants who have about 10+ years of experience in the specific industry to deliver quality research and analysis.

Having such an experienced network, our services not only cater to the client who wants the basic reference of market numbers and related high growth areas in the demand side, but also we provide detailed and granular information using which the client can definitely plan the strategies with respect to both supply and demand side.

302-20 Misssisauga Valley, Missisauga, L5A 3S1

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release ONLINE PAYMENTS SERVICES MARKET INSIGHTS, TRENDS, KEY MANUFACTURE AND FORECAST BY 2018-2025 here

News-ID: 1378616 • Views: …

More Releases from Supply Demand Market Research

Germany Waste Heat Recovery Systems is anticipated to reach USD 2150 Million by …

The Germany Waste Heat Recovery Systems (WHRS) is anticipated to reach USD 2150 million by 2030 growing at a CAGR of 5.7% from 2024-2030. Continued expansion post-2026 aligns with Germany's decarbonization trajectory, as operators increasingly prioritize heat-recovery to reduce fuel consumption and comply with tightening carbon-intensity expectations.

By technology, the exchange waste heat recovery boilers market size is anticipated to reach USD 710 million by 2030. Exchange/WH Boilers and SRC (Steam…

South Korea Flounder Market Anticipated to grow at a CAGR of 8% from 2023-2030

The South Korea flounder is anticipated to grow at a CAGR% of 8.0% from 2022-2030. The factors contributing towards the high growth are flounders such as halibut and turbot high-protein and low-calorie food, helps to re-solve the nutritional imbalance from diet because of its rich minerals, carbohydrates and vitamins despite low-calorie. They also offer medical benefits as liver of halibut contains lots of vitamin B1 and B2, which is effective…

Global Flounder Market Anticipated to reach USD 56 Billion by 2030

The global flounder market is anticipated to reach USD 56 Billion by 2030, growing at a CAGR% of 8.0% from 2022-2030. The factors contributing towards the high growth are flounders such as halibut and turbot high-protein and low-calorie food, helps to re-solve the nutritional imbalance from diet because of its rich minerals, carbohydrates and vitamins despite low-calorie. They also offer medical benefits as liver of halibut contains lots of vitamin…

Global Seafood Market Anticipated to reach USD 730 Billion by 2030

The global seafood market is anticipated to reach USD 730 Billion by 2030, growing at a CAGR% of 8.9% from 2022-2030. The factors contributing towards the high growth are increased disposable income, awareness of fish being used as an ingredient in healthy food is growing. USA the government plans to sanction illegal fishing activities, actively promote fair trade, and promote strategies to promote the fishing industry through detailed strategies such…

More Releases for Pay

Digital Wallets Market to See Thriving Worldwide | PayPal • Apple Pay • Goog …

The latest study by Coherent Market Insights, titled "Digital Wallets Market Size, Share & Trends Forecast 2026-2033," offers an in-depth analysis of the global and regional dynamics shaping this rapidly evolving industry. This comprehensive report highlights the competitive landscape, key market segments, value chain analysis, and emerging technological and regulatory trends expected between 2026 and 2033. The report provides actionable insights for business leaders, policymakers, investors, and new market entrants…

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…