Press release

CYBER SECURITY INSURANCES MARKET GROWTH AND ANALYSIS BY MAJOR TOP VENDORS ARE XL GROUP LTD., AMERICAN INTERNATIONAL GROUP INC., ZURICH INSURANCE CO. LTD, AON PLC, ALLIANZ GLOBAL CORPORATE & SPECIALTY, MUNICH RE GROUP, CHUBB, HSB, BCS FINANCIAL CORPORATION

Market OverviewCyber security insurances market report for 2018 intends to offer target audience with the fresh outlook on market and fill in the knowledge gaps with the help of processed information and opinions from our industry experts. The cyber security insurances report is a comprehensive business study on the current state of industry which analyses innovative strategies for business growth and describes important factors such as top manufacturers, production value, key regions, and growth rate. Our report proposed the industry growth element coupled with the current scenario and projecting future trends based on historical and comprehensive research with detailed porter's five forces analysis.

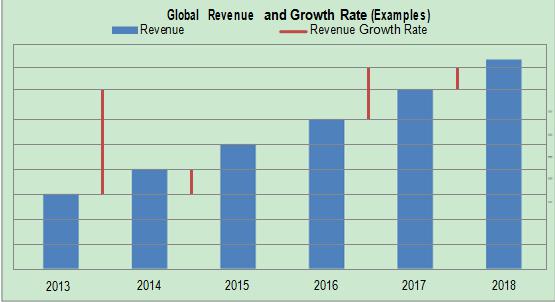

Cyber security insurances market report provides analysis for the period 2016 – 2026, wherein the period from 2018 to 2026 is the forecast period and 2017 is the base year. The report covers all the major trends and technologies playing an influential role in the market’s growth over the forecast period. It also highlights the drivers, restraints, and opportunities for the analysis of market growth during the said period. The study provides a complete perspective on the evolution of the global cyber security insurances market throughout the above mentioned forecast period in terms of revenue (US$ Mn).

Request for Sample of this Report@ https://bit.ly/2SGnESR

The market overview section of the report demonstrates market dynamics such as drivers, restraints, and opportunities that influence the current nature and future status of this market, key market indicators, end-user adoption analysis, and key trends of the market. Further, key market indicators included in the report provide the significant factors which are capable of changing the market scenario. These indicators are expected to define the market position during the forecast period and provide an overview about the global cyber security insurances market.

Scope of the Report

The global market for cyber security insurance is segmented on the basis of service type, enterprise size, industry vertical and geography. On the basis of service type, the market is segmented into risk management, integrity, forefront portfolio, third party liability and others. On the basis of enterprise size, the global cyber security insurance market is bisected into small & medium enterprises and large enterprise. Based on industry vertical, the market is divided into banking and financial services, telecom and IT, government, healthcare, education, manufacturing, travel and hospitality and others. The report covers the analysis of these segments across North America, Europe, Asia Pacific, Middle East & Africa, and Latin America, along with the qualitative analysis for market estimates supplementing the growth of the cyber security insurances market during the forecast period.

The report also highlights the competitive landscape of the global cyber security insurances market, positioning all the major players according to their presence in different regions of the world and recent key developments initiated by them in the industry.

Research Methodology

The research methodology is a perfect combination of primary research, secondary research, and expert panel reviews. Secondary research sources such as annual reports, company websites, broker reports, financial reports, and investor presentations, national government documents, internal and external proprietary databases, statistical databases, relevant patent and regulatory databases, market reports, government publications, World Bank database, and industry white papers are referred.

Primary research involves telephonic interviews, e-mail interactions and face-to-face interviews for detailed and unbiased reviews on the air purifier market across geographies. Primary interviews are usually conducted on an ongoing basis with industry experts and participants in order to get the latest market insights and validate the existing data and analysis. Primary interviews offer firsthand information on important factors such as market trends, market size, competitive landscape, growth trends, and outlook. These factors help to validate and strengthen secondary research findings and also help to develop the analysis team’s expertise and market understanding.

Competitive Dynamics

The global cyber security insurances market report provides company market share analysis of the various key participants. Some of the key players profiled in the report include The global cyber security insurance market includes key players such as XL Group Ltd., American International Group Inc., Zurich Insurance Co. Ltd, AON PLC, Allianz Global Corporate & Specialty, Munich Re Group, Chubb, HSB, BCS financial corporation, Marsh & McLennan Companies, Inc., Markel Corp, Traveler’s group, Hiscox, Beazely Insurance group and others.

By Service Type

• Risk management

• Integrity

• Forefront Portfolio

• Third Party liability

• Others

By Enterprise Size

• Small & Medium Enterprises (SMEs)

• Large Enterprises

By Industry Vertical

• Banking, Financials

• Telecom and IT

• Government

• Healthcare

• Education

• Manufacturing

• Travel and hospitality

• Others

TABLE OF CONTENTS

Chapter One: Preface

Chapter Two: Executive Summary : Global Cyber Security Insurance Market

Chapter Three: Market Overview

Chapter Four: Global Cyber Security Insurance Market Analysis and Forecast, By Service Type

Chapter Five: Global Cyber Security Insurance Market Analysis and Forecast, By Enterprise Size

Chapter Six: Global Cyber Security Insurance Market Analysis and Forecast, By Industry Vertical

Chapter Seven: Global Cyber Security Insurance Market Analysis and Forecast, by Region

Chapter Eight: North America Cyber Security Insurance Market Analysis and Forecast

Chapter Nine: Europe Cyber Security Insurance Market Analysis and Forecast

List of figures

Figure 1 Global Cyber Security Insurance Market Share in 2018, By Service Type

Figure 2 Global Cyber Security Insurance Market Share in 2018, By Enterprise Size

Figure 3 Global Cyber Security Insurance Market Share in 2018, By Industry Vertical

Figure 4 Global Cyber Security Insurance Market Share in 2018, By Region

Figure 5 Global Cyber Security Insurance Market Share in 2026, By Service Type

Figure 6 Global Cyber Security Insurance Market Share in 2026, By Enterprise Size

List of Tables

Table 1 Global Cyber Security Insurance Market Size (US$ Mn) Forecast, by Service Type 2016(H)-2026(F)

Table 2 Global Cyber Security Insurance Market Size (US$ Mn) Forecast, by Enterprise Size 2016(H)-2026(F)

Table 3 Global Cyber Security Insurance Market Size (US$ Mn) Forecast, by Industry Vertical 2016(H)-2026(F)

Table 4 Global Cyber Security Insurance Market Size (US$ Mn) Forecast, by Region 2016(H)-2026(F)

Table 5 North America Cyber Security Insurance Market Size (US$ Mn) Forecast, by Service Type 2016(H)-2026(F)

Table 6 North America Cyber Security Insurance Market Size (US$ Mn) Forecast, by Enterprise Size 2016(H)-2026(F)

Browse full Research Report@ https://www.blueweaveconsulting.com/cyber-security-insurances/

Contact Us:

info@blueweaveconsulting.com

https://www.blueweaveconsulting.com

Phone Number: 18666586826

About BlueWeave Consulting & Research Pvt Ltd. (BWC)

BlueWeave Consulting provides a full scope of business intelligence solution for solving your toughest challenges. BWC is an emerging global expert & pioneer in the market research and provision of exclusive market INTEL. We optimize your decision making by equipping your industry with an accurate & better market research according to your industry demands through our professionally designed qualitative & quantitative research methods. Our trendy & efficient sample collection methods, integrated data solutions as well as methodologies certainly make us a better partner that you can rely on. With collective experience in the varied fields of retail, market research and reporting, we provide the business insight and business practices that would give the required impetus for your company’s growth.

GD-69, Sector G, East Kolkata Twp

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release CYBER SECURITY INSURANCES MARKET GROWTH AND ANALYSIS BY MAJOR TOP VENDORS ARE XL GROUP LTD., AMERICAN INTERNATIONAL GROUP INC., ZURICH INSURANCE CO. LTD, AON PLC, ALLIANZ GLOBAL CORPORATE & SPECIALTY, MUNICH RE GROUP, CHUBB, HSB, BCS FINANCIAL CORPORATION here

News-ID: 1374856 • Views: …

More Releases from BlueWeave Consulting & Research Pvt Ltd.

United States Enhanced Water Market Size, Share Growth is Projected to Growing a …

The United States enhanced water market is growing at high rate because of the rising health awareness and the need for additional nutritional supplements in the body due to a busy lifestyle....

A recent study conducted by the strategic consulting and market research firm BlueWeave Consulting revealed that the US enhanced water market was worth USD 2,131.0 million in the year 2020. The data yielded by the study reveals that the…

Global Electronic Bill Presentment and Payment (EBPP) Market Size & Share is Gro …

Electronic bill presentment and payment (EBPP) market is being driven by factors such as globalization, businesses expanding overseas, and consumers increasingly using plastic money. Market growth is also driven by the use of high-speed internet access on smart phones...

A recent study conducted by the strategic consulting and market research firm BlueWeave Consulting revealed that the global electronic bill presentment and payment (EBPP) market was worth 18.5 number of bills in…

Global Fatty Alcohol Market Size & Share is Predicted to Garner USD 8.4 Billion …

The global fatty alcohol market is growing at a high CAGR because of the increasing demand for bio-based renewable products to promote sustainability and control dependence on non-renewable products such as petrochemicals...

A recent study conducted by the strategic consulting and market research firm BlueWeave Consulting revealed that the global fatty alcohol market was worth USD 5.5 billion in the year 2020. The market is estimated to grow at a CAGR…

Global Medical Goggle Market Size, Share & Growth is Projected to Grow at a CAGR …

The global medical goggle market is growing at a high CAGR because of the increasing demand for surgical procedures and prevalence of infectious diseases and stringent regulations regarding the safety of healthcare workers...

A recent study conducted by the strategic consulting and market research firm BlueWeave Consulting revealed that the global medical goggle market was worth USD 443.4 million in the year 2020. The data generated by the study reveals that…

More Releases for Cyber

Cyber Insurance Market to Expand Rapidly, Fueled by Cyber Threats

According to the latest market research study published by P&S Intelligence, the global cyber insurance market is expected to witness significant growth, with a projected rise from USD 16.1 billion in 2024 to USD 65.2 billion by 2032, expanding at a robust CAGR of 19.3%.

This growth is driven by the increasing frequency of cyberattacks, such as data breaches and ransomware incidents, coupled with rising regulatory pressures on businesses to adopt…

Express your Cyber Attitude with Zeelool Cyber Punk Glasses

Zeelool follows the trend of fashion and launches a series of new and unique cyberpunk glasses, its unique futuristic design concept and sense of technology, perfectly interpreting the aesthetic connotation of cyberpunk culture, the frame uses neon transparent material and black lines intertwined, as if with the digital world constructed in cyberpunk novels, awakening the infinite reverie of people for the virtual reality and holographic technology.

Highlights of Cyberpunk Glasses:

…

Cyber Security Market Research Reports, Cyber Security Market Revenue, Issues an …

The Cyber security, also denoted to as IT security, emphasizes on maintenance computers, programs, networks, and data from unrestrained or spontaneous admittance. It contains network security, application security, endpoint security, identity administration, data security, cloud security, and infrastructure security. As the cyber threats have augmented at an alarming rate, security solutions have been achievement traction, worldwide. Solutions such as antivirus software and firewalls have grown-up in involvedness and recognized to…

Cyber Security Market Research Reports | Cyber Security Market Revenue | Future …

The Cyber security, also mentioned to as IT security, emphasizes on maintenance computers, programs, networks, and data from unrestrained or spontaneous admittance. It contains network security, application security, endpoint security, distinctiveness management, data security, cloud security, and infrastructure safekeeping. As cyber threats have augmented at an alarming rate, security solutions have been purchase traction, globally. Solutions such as antivirus software and firewalls have grown up in complexity and demonstrated to…

Market Research Reports Of Cyber Security | Cyber Security Market Growth Analysi …

Cyber security market is very fragmented & highly competitive market that comprises several global & regional players. Cyber Security is a key concern that helps the organizations to monitor, detect, report, and contradict cyber threats for maintaining data confidentiality. As the innovation is developing and new applications are coming into market, programmers are finding the new escape clauses and taking the significant & secret information's from the servers and selling…

Cyber Institute receives Best Cyber Security Education Initiative - USA

The Cyber Institute received the 2019 US Business News Best Cyber Security Education Initiative - USA for their programs to help reduce barriers into cybersecurity and STEM related careers by advancing traditional and non-traditional pathways; for women and minorities in particular. By increasing access to education, employment, and workforce development, we believe they will have greater opportunities for self-determination and self-reliance.

The Cyber Institute received the prestigious international US Business News…