Press release

Flood Insurance Market to Witness Huge Growth (CAGR of 17.6 %) With Key Players: Allianz, Zurich, Allstate, Tokio Marine, Assurant

Flood insurance denotes the specific insurance coverage against property loss from flooding. To determine risk factors for specific properties, insurers will often refer to topographical maps that denote lowlands, floodplains and floodways that are susceptible to flooding.Global Flood Insurance Market peaks the detailed analysis of industry share, growth factors, development trends, size, majors manufacturers and 2023 forecast. The report also analyze innovative business strategies, value added factors and business opportunities. The Flood Insurance Market report introduces market competition situation among the vendors and company profile, revenue, product & services, latest developments and business strategies.

Download PDF Sample Of this Report @ https://www.reporthive.com/enquiry.php?id=1631843&req_type=smpl

Geographically, the global Flood Insurance market has been segmented into USA, Europe, China, Japan, RoA and RoW. The USA held the largest share in the global market, its Premiums of global market exceeds 62% in 2017. The next is Europe.

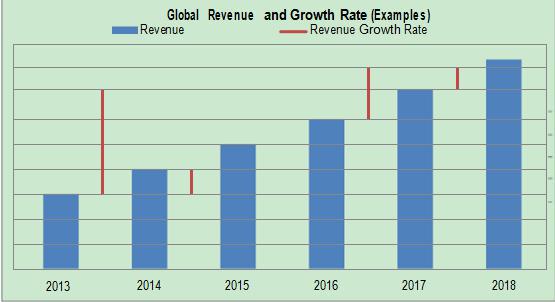

Over the next five years Flood Insurance will register a 17.6% CAGR in terms of revenue, reach US$ 17600 million by 2023, from US$ 6640 million in 2017.

The Key Players Covered in this report:

• Allianz

• Zurich

• Allstate

• Tokio Marine

• Assurant and More....

This report presents a comprehensive overview, market shares and growth opportunities of Flood Insurance market by product type, application, key companies and key regions.

In addition, this report discusses the key drivers influencing market growth, opportunities, the challenges and the risks faced by key players and the market as a whole. It also analyzes key emerging trends and their impact on present and future development.

Segmentation by product type:

• Life Insurance

• Non-Life Insurance

Segmentation by application:

• Commercial

• Residential

• Other

Click Here for Purchase Full Report with Full TOC @ https://www.reporthive.com/enquiry.php?id=1631843&req_type=purch

If you have any special requirements, please let us know and we will offer you the report as you want.

Research objectives

• To study and analyze the global Flood Insurance market size by key regions/countries, product type and application, history data from 2013 to 2017, and forecast to 2023.

• To understand the structure of Flood Insurance market by identifying its various subsegments.

• Focuses on the key global Flood Insurance players, to define, describe and analyze the value, market share, market competition landscape, SWOT analysis and development plans in next few years.

• To analyze the Flood Insurance with respect to individual growth trends, future prospects, and their contribution to the total market.

• To share detailed information about the key factors influencing the growth of the market (growth potential, opportunities, drivers, industry-specific challenges and risks). and More…

We can also provide the customized separate regional or country-level reports, for the following regions:

• Americas

• United States

• Canada

• Mexico

• Brazil

• APAC and many more….

Table of Contents

1 Scope of the Report

1.1 Market Introduction

1.2 Research Objectives

1.3 Years Considered

1.4 Market Research Methodology

1.5 Economic Indicators

1.6 Currency Considered

2 Executive Summary

2.1 World Market Overview

2.1.1 Global Flood Insurance Market Size 2013-2023

2.1.2 Flood Insurance Market Size CAGR by Region

2.2 Flood Insurance Segment by Type

2.2.1 Life Insurance

2.2.2 Non-Life Insurance

2.3 Flood Insurance Market Size by Type

2.3.1 Global Flood Insurance Market Size Market Share by Type (2013-2018)

2.3.2 Global Flood Insurance Market Size Growth Rate by Type (2013-2018)

2.4 Flood Insurance Segment by Application

3 Global Flood Insurance by Players

3.1 Global Flood Insurance Market Size Market Share by Players

3.1.1 Global Flood Insurance Market Size by Players (2016-2018)

3.1.2 Global Flood Insurance Market Size Market Share by Players (2016-2018)

3.2 Global Flood Insurance Key Players Head office and Products Offered

3.3 Market Concentration Rate Analysis

3.3.1 Competition Landscape Analysis

3.3.2 Concentration Ratio (CR3, CR5 and CR10) (2016-2018)

TOC Continued….!

Tables And Figures

• Table Product Specifications of Flood Insurance

• Figure Flood Insurance Report Years Considered

• Figure Market Research Methodology

• Figure Global Flood Insurance Market Size Growth Rate 2013-2023 ($ Millions)

• Table Flood Insurance Market Size CAGR by Region 2013-2023 ($ Millions)

• Table Major Players of Life Insurance

• Table Major Players of Non-Life Insurance

• Table Market Size by Type (2013-2018) ($ Millions)

• Table Global Flood Insurance Market Size Market Share by Type (2013-2018)

• Figure Global Flood Insurance Market Size Market Share by Type (2013-2018)

• Figure Global Life Insurance Market Size Growth Rate

• Figure Global Non-Life Insurance Market Size Growth Rate and More….

About Report Hive Research

Report Hive Research delivers strategic market research reports, statistical survey, and Industry analysis & forecast data on products & services, markets and companies. Our clientele ranges mix of global Business Leaders, Government Organizations, SME’s, Individual & Start-ups, Management Consulting Firms, and Universities etc. Our library of 600,000+ market reports covers industries like Chemical, Healthcare, IT, Telecom, Semiconductor, etc. in the USA, Europe Middle East, Africa, Asia Pacific. We help in business decision-making on aspects such as market entry strategies, market sizing, market share analysis, sales & revenue, technology trends, competitive analysis, product portfolio & application analysis etc.

500, North Michigan Avenue,

Suite 6014

Chicago, IL - 60611

United States

Contact Us

Mike Ross

Marketing Manager

sales@reporthive.com

https://www.reporthive.com

Phone Number: +1-312 604 7084

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Flood Insurance Market to Witness Huge Growth (CAGR of 17.6 %) With Key Players: Allianz, Zurich, Allstate, Tokio Marine, Assurant here

News-ID: 1347006 • Views: …

More Releases from Report Hive Research

Oryzenin Market 2022 scope and Research methodology | Axiom Foods, Inc., AIDP

The global Oryzenin market is expected to reach an estimated USD 561.1 Million by 2030 with a CAGR of 14.2% from 2022 to 2030.

The Global Oryzenin market 2022 research provides a overview of the industry including definitions, classifications, applications and industry chain structure. The Global Oryzenin market report is provided for the US, EU, APAC, as well as development trends, competitive landscape analysis, and key regions development status. Development policies…

Polymer Emulsions Market SWOT Analysis, Competitive Landscape and Massive Growth …

The global Polymer Emulsions market was estimated at USD 27.3 billion in 2021 and is projected to expand at a CAGR of 7.5% from 2022 to 2030.

The Report Hive Research has added a new statistical market report to its repository titled as, Polymer Emulsions Market. It provides the industry overview with market growth analysis with a historical & futuristic perspective for the following parameters; cost, revenue, demands, and supply data…

Glufosinate Market Future Set to Significant Growth with High CAGR value 2022 | …

The global Glufosinate market is expected to reach an estimated USD 4.12 billion by 2030 with a CAGR of 8.68% from 2022 to 2030.

The Glufosinate market report provides a detailed analysis of global market size, regional and country-level market size, segmentation market growth, market share, competitive Landscape, sales analysis, impact of domestic and global market players, value chain optimization, trade regulations, recent developments, opportunities analysis, strategic market growth analysis, product…

Glass Filled Nylon Market 2022 scope and Research methodology | DowDuPont, BASF, …

The global Glass Filled Nylon market is projected to register an average CAGR of 5.6% during the forecast period 2022-2030.

The Global Glass Filled Nylon market 2022 research provides a overview of the industry including definitions, classifications, applications and industry chain structure. The Global Glass Filled Nylon market report is provided for the US, EU, APAC, as well as development trends, competitive landscape analysis, and key regions development status. Development policies…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…