Press release

Fraud Detection and Prevention Market Will Reach USD 63.18 Bn by 2025 | IBM, DELL EMC, EXPERIAN, BAE SYSTEMS, Nice, ACI WORLDWIDE, FAIR ISAAC CORPORATION (FICO), SAS Institure

Globally, the Fraud Detection and Prevention Market Size expected to reach USD 63.18 billion by the end of 2025 and this market estimated to be growing at an impressive CAGR of 19.23% from 2018 to 2023, which presents ample opportunities to the industry players. These players shift their focus to differentiate their technology and demonstrate their technical skills through innovative fraud detection and prevention development techniques. Established market players such as IBM, SAS Institute, and FICO are innovating new software tools by using advanced analytics technologies such as machine learning and artificial intelligence. These technologies are widely adopted by several cybersecurity firms as it detects fraud from complex big data in minimum time. Companies, such as Ravelin have a high focus on using machine learning technology to detect and prevent fraud using logistic regression, decision tree approach.Browse details of 211 pages research report developed on Global Fraud Detection and Prevention Market @ https://www.researchcosmos.com/reports/fraud-detection-and-prevention-market-by-solution-fraud-analytics-authentication-grc-vertical-bfsi-retail-healthcare-real-estate-manufacturing-application-service-and/93962079

These solutions are important pertaining to the augmented public awareness coupled with technological advancements in the fraud detection and prevention market. Rise in e-commerce market with extensively low fraud detection and prevention awareness in some emerging economies, such as India and South Africa, the introduction of novel solutions, and software tools to detect fraud, and government support for cybersecurity are the major factors expected to propel the demand.

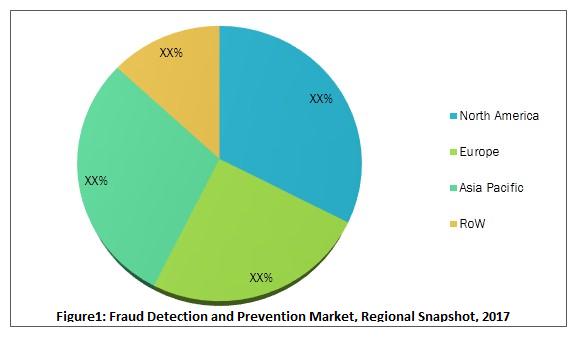

North America to remain dominant in fraud detection and prevention market over the forecast period

Geographically, North America is considered the largest market for fraud detection and prevention accounted for the largest share in 2017. The increase in cybercrime among the organizations in the region, due to the adoption of advanced payment technology has fueled the growth of the fraud detection and prevention market. The USA is expected to witness an exponential growth rate over the forecast period, due to the well-established sectors such as healthcare, financial institutions, and retail industries; this contributed to the highest share in the fraud detection and prevention market. Mexico is considered the second largest country followed by Canada, which is anticipated to show a below average growth rate.

However, Asia-Pacific is expected to witness the highest growth rate from 2018 to 2025. This region experienced the highest rate of cybercrime and money laundering issues within the companies, due to the increased use of IP-based service.

Ask Sample Brochure of the report to evaluate report usefulness, Get a Copy @ https://www.researchcosmos.com/request/fraud-detection-and-prevention-market-by-solution-fraud-ana/93962079

Fraud analytics segment to lead fraud detection and prevention market by 2025

The fraud detection and prevention market by the solution is segmented into fraud analytics, authentication, governance, risk, and compliance (GRC) solution, and others. The fraud analytics is further classified into subsegments such as predictive, customer, social media, big data, and behavioral. Similarly, the authentication segment is also further bifurcated into two subsegments, such as single-factor and multi-factor authentication.

Fraud analytics solution is considered to be the largest segment due to the demand for big data analytics among the organizations to detect fraud insights in minimum time. The use of various fraud analytics solutions such as big data, predictive, and others are expected to obstruct fraudulent activities and provide cognitive solutions to the end users. Big data analytics is a type of fraud analytics solutions, which are mostly used by the vendors of fraud detection and prevention market; as a result, the growth is fueled rapidly. Globally, the high growth for fraud analytics is mainly from the Asia-Pacific region, followed by ROW.

However, authentication solutions are anticipated to witness an exponential growth rate on the backdrop of stringent cybersecurity regulations. These solutions involve a lower cost of development and manufacture, which allows for a lesser selling cost compared to fraud analytics solutions. SMEs are among the major buyers of authentication solutions. Single-factor authentication (SFA) and multi-factor authentication (MFA) are the two subsegments of the authentication solution in the fraud detection and prevention market. North America is projected to account for the largest market share throughout the forecast period, followed by Asia-Pacific.

Inquire more about the report @ https://www.researchcosmos.com/inquire/fraud-detection-and-prevention-market-by-solution-fraud-ana/93962079

About Us:

Research Cosmos is a provider of standard and customized market research, business intelligence and consulting services across more than 100 domains in different industries of the world. We host the trending market reports of the world’s top-notch publishing companies, offering services to a wide range of customers from students to fortune 500 companies and discloses the hidden opportunities in every leading industry of the world.

Contact Us:

Kevin Stewart

Global Sales Manager

Research Cosmos

www.researchcosmos.com

Blog: acutemarketinsights.com

Blog: marketreportsweb.com/

kevin@researchcosmos.com

+1 888 709 8757

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Fraud Detection and Prevention Market Will Reach USD 63.18 Bn by 2025 | IBM, DELL EMC, EXPERIAN, BAE SYSTEMS, Nice, ACI WORLDWIDE, FAIR ISAAC CORPORATION (FICO), SAS Institure here

News-ID: 1239441 • Views: …

More Releases from Research Cosmos

Mobile Phone Insurance Market Size to Reach USD 32.24 Bn By 2025

The size of the Global mobile phone insurance market is estimated to reach USD 32.24 billion by 2025, growing at a CAGR of 12.5%, as per the recently published report by Research Cosmos. It is worth to claim insurance for mobile phones as we are spending a lot of money on purchasing. The policies include accidental damage, water damage, and screen cracking.

Browse details of the report @ https://www.researchcosmos.com/reports/mobile-phone-insurance-market/199557834

Growing utilization…

Social Employee Recognition Systems Market Predicted to grow at a CAGR of xx By …

Social Employee Recognition Systems Market Analysis Size, Growth rate and Overview:

Social Employee Recognition Systems Market was valued at USD xx million in 2018 and is expected to reach almost USD xx million by the end of 2025, growing at a CAGR of around xx% over the predicted period.

Throughout the world, social employee recognition systems have expanded dramatically to address the need to move away from traditional methods and programs of…

More Releases for Fraud

GrayCat PI Joins Global Effort to Spotlight Fraud During International Fraud Awa …

Image: https://www.abnewswire.com/upload/2025/11/dc16cdb8496c72daf00c6802941e27f3.jpg

International Fraud Awareness Week runs November 19-22, 2025 worldwide Oaxaca, Oaxaca, Mexico. $3.1 billion lost to fraud. That figure comes from Occupational Fraud 2024: A Report to the Nations, the latest study from the Association of Certified Fraud Examiners (ACFE), based on 1,921 occupational fraud cases worldwide. The report is available at https://legacy.acfe.com/report-to-the-nations/2024/.

Because fraud remains a persistent and costly threat, GrayCat PI has joined International Fraud Awareness Week [https://graycatpi.com/fraud-week-mexico-2025/],…

New York City Fraud Attorney Russ Kofman Releases Insightful Guide on Welfare Fr …

New York City fraud attorney Russ Kofman (https://www.lebedinkofman.com/are-you-being-investigated-for-welfare-fraud-in-nyc/) of Lebedin Kofman LLP has recently published an enlightening article addressing the complexities surrounding welfare fraud investigations in New York City. The article, aimed at individuals who may be under investigation for welfare fraud, offers crucial legal insight and guidance for navigating this challenging process.

Welfare fraud is no minor offense. It comprises various fraudulent acts to unlawfully obtain public assistance benefits. This…

Fraud Increased by 3% in 2021 - Says Shufti Pro's Global ID Fraud Report

AI-powered digital identity verification solution provider, Shufti Pro, revealed new data in its Global ID Fraud Report 2021 which shows insights from ample research of 11 months of verification. The report highlights the changing fraudulent activities and advanced manipulation techniques that the company faced in 2021. Experts from Shufti Pro have also made fraud predictions that will threaten the corporate sector in 2022.

The ceaseless increase in ID and…

IPTEGO Launching PALLADION Fraud Detection and Prevention for a Real-Time Protec …

IPTEGO presents PALLADION Fraud Detection & Prevention, an innovative protection for CSPs and their customers against toll fraud.

Berlin, Germany, February 08, 2012 -- IPTEGO presents PALLADION Fraud Detection & Prevention, an innovative protection for CSPs and their customers against toll fraud.

With PALLADION Fraud Detection & Prevention, IPTEGO provides an answer to a growing demand for more network security when it comes to toll fraud. Today’s Communication Service Providers (CSPs) are…

Online Fraud Prevention – Sentropi

Are security nightmares causing you sleepless nights? Are you worried about how secure your I.T infrastructure is? Sentropi aims to address these ever present security concerns with its uniquely different identification and tracking solution. Sentropi's innovative technology allows you to identify your users with pinpoint accuracy and lets you track fraudsters on any platform, any browser, any time and any where! Hunt down fraudsters by tracking down their computers rather…

Fight Private Placement Program Fraud - PPP Fraud!

Stand up to private placement program fraud!

To set an undertone for the following summary; logic begets logic. No trading platforms nor programs, whether public or private have the freedom of complete exclusion from regulatory oversight, licensing, and governance.

Our firm has significant interest in a few platforms, as principals. There are indeed private financial offerings which have historically delivered very significant performance using "Institutional Leverage, Traders, Risk Management, Clearing & Execution"…