Press release

Internet of Things in Banking Market 2018 | High Growth at a CAGR of 18.49% along with NFC RING, MASTER CARD, INFOSYS LIMITED, IBM, MICROSOFT, TEMENOS GROUP AG, ALLERIN TECHNOLOGIES till 2023

Industry Highlights:The Internet of things in banking market is expected to register a CAGR of 18.49%, during the forecast period (2018-2023). The scope of the report is limited to products for Real-Time Streaming Analytics, Security, Data Management, and Remote Monitoring. While the application segments considered in the scope of the report include Cyber Security, Customer Relationship Management, Logistics, Product management and planning, and marketing.

Detailed Sample Copy of Updated Analysis @ https://marketprognosis.com/sample-request/16431

Note: “If this link doesn’t work in Internet Explorer, kindly try copy pasting it in other browsers”.

Internet of things in banking has been growing in recent times owing to the growth of technology adoption in every possible industry. Many trends, such as the deployment of sensors in ATM and the use of IoT in banking has enriched the consumer experience. Banks can anticipate the needs of customers through the data collected and offer solutions and advice that can help the consumers take a better decision owing to such trends internet of things has become a powerful facilitator in growing the business in banking sector.

The privacy and risk of data exposure is one primary factor of concern in the implementation of data analytics. Any data breaches from the bank end could lead to various complicated repercussions for banks. Many countries have also imposed heavy fines on data breaches, which increases the risk factor for banks.

Key Developments in the Market

• February 2018 - Trackopolis, an IoT company has acquired a USD 3.5 million credit facility from Silicon Valley Bank. This can result in a new product portfolio for the company

• February 2018 - Many countries, such as India have been reliant of latest technology such as AI and block chain to grow the banking industry. Internet of things is among the key technologies that are to be implemented in the country

The major players include –

NFC RING, MASTER CARD, INFOSYS LIMITED, IBM CORPORATION, MICROSOFT CORPORATION, TEMENOS GROUP AG, ALLERIN TECHNOLOGIES, and EDGEVERVE, amongst others.

Request Discount on this repots @ https://marketprognosis.com/discount-request/16431

Note: “If this link doesn’t work in Internet Explorer, kindly try copy pasting it in other browsers”.

Growth of Connected Devices has Demanded the Need for Implementation of IoT Technologies in Banking

It is estimated that about there will be about 25 billion smartphones, wearable and other connected devices by 2020. This growth of connected devices has enabled in the ease of various activities in the banking sector. The use of IoT in banking lead to enriched consumer experience, better product offers towards customers and better marketing practices owing to the targeted accuracy in the type of service being provided.

Banking industry has been experiencing a growth in wearable technology and the many banks have been providing applications, which enable in easier transactions. Applications have been provided to popular brands, such as companies, like Apple Watch and FitPay, which are already in collaboration with the Bank of America to enable in such functions. Some of the banks have invested more in this trend and have launched their own devices. Banks such as Caixa Bank, Hellenic Bank and Australia’s Westpac (with PayWear) and other wearable bands coming from Barclay's unveiling bPay wearable contactless payment solutions are some of the products owned by banks.

Owing to the Scope for Unconventional Applications Remote Monitoring is Expected to Have High Growth in the Future

Many unconventional applications for remote monitoring technology in the banking sector enable in better loan and insurance deployments. Applications such as the use of sensors in warehouses to track the inventory level can aid the banks to deduce the account balance and inventory debt that can be paid when the inventory is sold. Financial institutions, such as auto loan and insurance companies can deploy sensors in vehicles for which there are disbursed loans. These sensors can track the vehicle and alert the banks in case of theft or robbery from the banks. Deployment of farming loans can also be eased as the sensors detect the climatic conditions in the area and base those conditions as a factor for the amount of loan to be given.

North America Is Expected To Have A High Adoption Rate Owing To The Presence Of Major Players

North America has many of the largest banks, which has a major effect to drive the market for IoT in banking. Banks, such as Bank of America have been collaborating with apple to increase the usage of IoT in the industry. Owing to such collaborations the banking industry in the company is expected to have a high adoption rate for banking. Presence of banks, such as JP Morgan, Wells Fargo, Goldman Sachs, Royal Bank of Scotland is expected to further grow the market in the region.

Enquiry Before Buying @ https://marketprognosis.com/enquiry/16431

Note: “If this link doesn’t work in Internet Explorer, kindly try copy pasting it in other browsers”.

About Market Prognosis

We at Market Prognosis believe in giving a crystal clear view of market dynamics for achieving success in today’s complex and competitive marketplace through our quantitative & qualitative research methods.

We help our clients identify the best market insights and analysis required for their business thus enabling them to take strategic and intelligent decision.

We believe in delivering actionable insights for your business growth and success.

Contact us:

ProgMark Pvt Ltd,

Thane - 421501

India.

Contact No: +1 973 241 5193

Email: sales@marketprognosis.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Internet of Things in Banking Market 2018 | High Growth at a CAGR of 18.49% along with NFC RING, MASTER CARD, INFOSYS LIMITED, IBM, MICROSOFT, TEMENOS GROUP AG, ALLERIN TECHNOLOGIES till 2023 here

News-ID: 1237142 • Views: …

More Releases from Market Prognosis

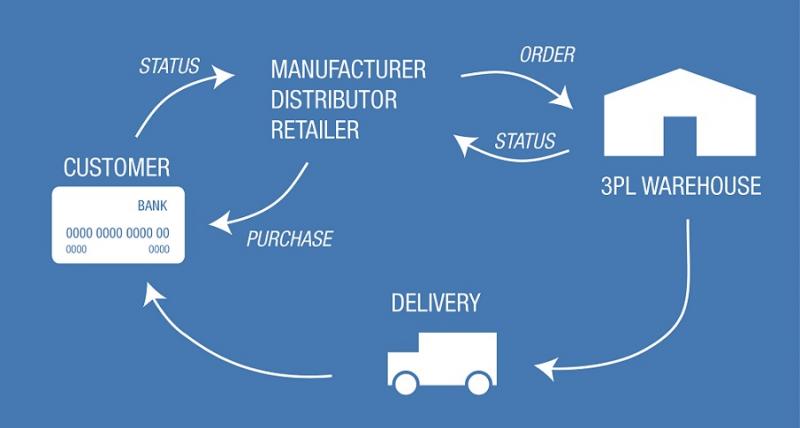

Third-Party Logistics (3PL) Market Latest Study Focuses On Current, Future Innov …

The report covers a forecast and an analysis of the Third-Party Logistics (3PL) Market on a global and regional level. The study provides historical data for 2018, 2019, and 2020 along with a forecast from 2019 to 2026 based on revenue and volume.

Overview of the Global Third-Party Logistics (3PL) Market:

The report spread across 90 pages is an overview of the Global Third-Party Logistics (3PL) Market. These report study based on the Third-Party…

Ride-Hailing Market: An Insight on the Important Factors and Trends Influencing …

The report covers a forecast and an analysis of the Ride-Hailing Market on a global and regional level. The study provides historical data for 2018, 2019, and 2020 along with a forecast from 2019 to 2026 based on revenue and volume.

Overview of the Global Ride-Hailing Market:

The report spread across 90 pages is an overview of the Global Ride-Hailing Market. These report study based on the Ride-Hailing Market. It is a complete overview…

COVID-19 Impact on Professional Indemnity Insurance Market 2021-2026: Industry I …

The report covers a forecast and an analysis of the Professional Indemnity Insurance Market on a global and regional level. The study provides historical data for 2018, 2019, and 2020 along with a forecast from 2019 to 2026 based on revenue and volume.

Overview of the Global Professional Indemnity Insurance Market:

The report spread across 90 pages is an overview of the Global Professional Indemnity Insurance Market. These report study based on the Professional…

Modular Construction Market Future Growth Explored in Latest Research Report by …

The report covers a forecast and an analysis of the Modular Construction Market on a global and regional level. The study provides historical data for 2018, 2019, and 2020 along with a forecast from 2019 to 2026 based on revenue and volume.

Overview of the Global Modular Construction Market:

The report spread across 90 pages is an overview of the Global Modular Construction Market. These report study based on the Modular Construction Market. It…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…